Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software, or business trends. This issue is in part devoted to labels and packaging, so we delve into the data to gauge print businesses’ interest in adding packaging capabilities.

These surveys form the basis of our annual Printing Outlook reports. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

Our 2025 Print Business Outlook Survey is in the field and now accepting responses! Take our short questionnaire here.

Labels and Packaging

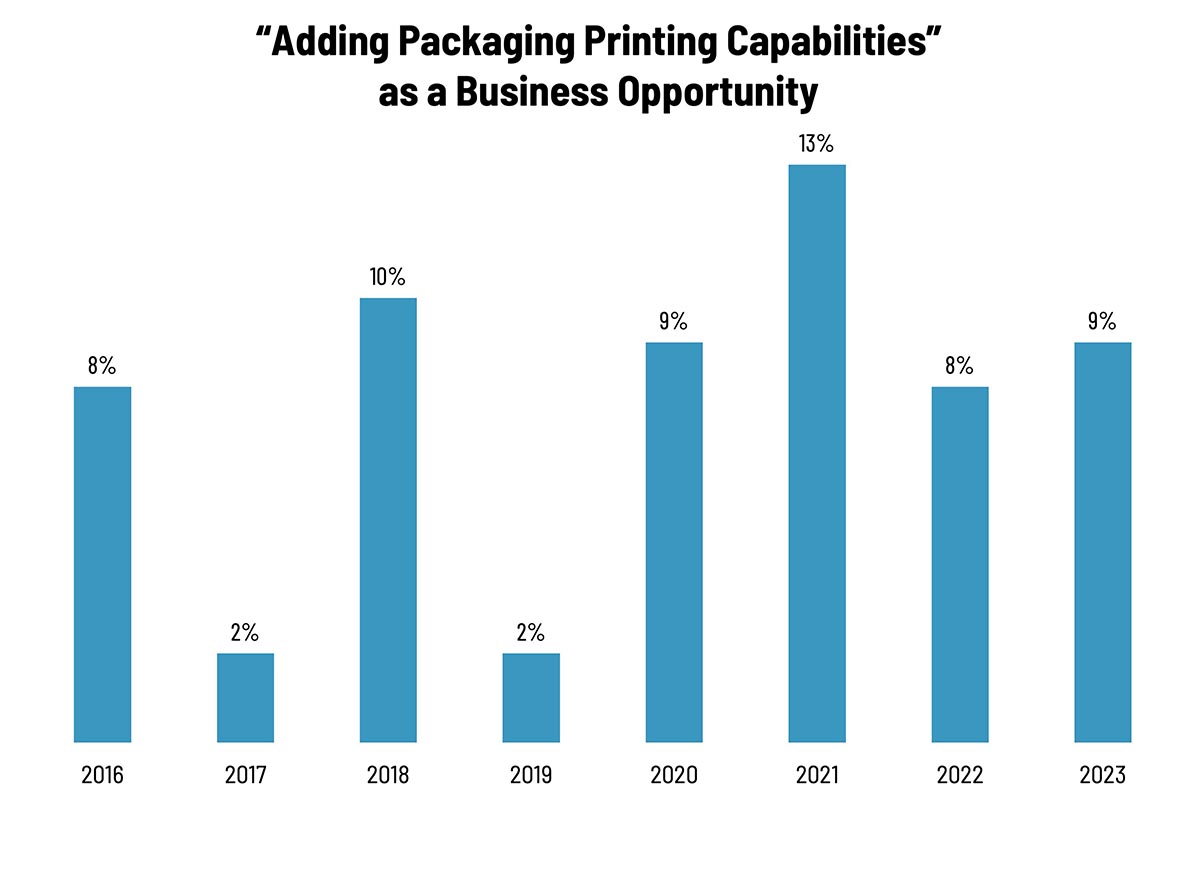

Various pundit types have been saying for a number of years now that packaging is the next big area for commercial printers to expand into. But have our data born that out? Sort of. If we look at “adding packaging capabilities” as a new business opportunity (see Figure 1), there has been some interest in it. It peaked in 2021—remember that the pandemic led a lot of print businesses to look at new areas to expand into. It’s been 8–9% in the two years since. (By way of comparison, at its height, “adding wide-format capabilities” ran close to 20%.) So it is of some, if not overwhelming, interest.

Figure 1: “Adding packaging capabilities” as a new business opportunity.

Source: WhatTheyThink Print Business Outlook surveys, 2016–2023.

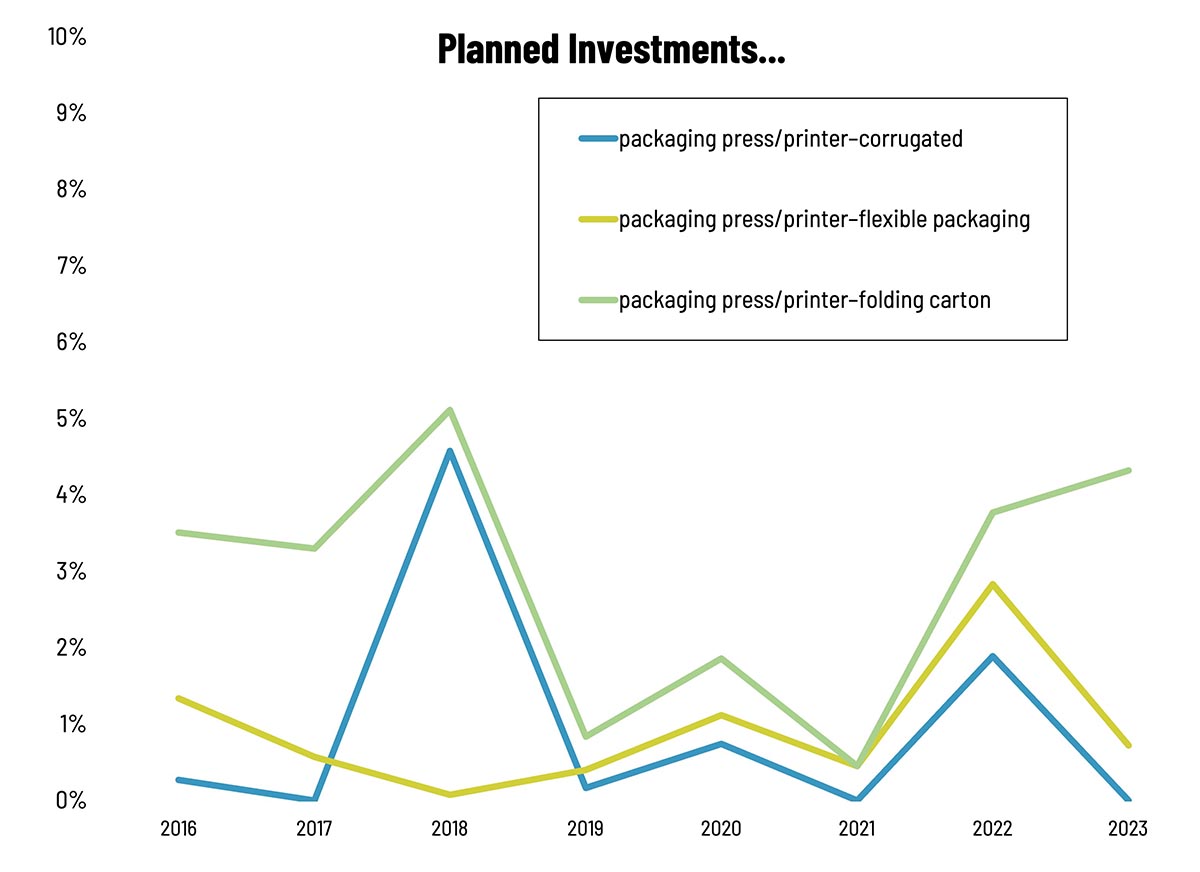

If we look at planned equipment investment by type of packaging (see Figure 2), folding carton printing equipment has led the pack by a slight amount, but even that only ever peaked at 5% of survey respondents. Corrugated equipment spiked in 2018 at just over 4%, but has remained half that level ever since. Flexible packaging had a peak in 2022 at 3%, but has generally been about 2% or under.

Figure 2: Planned investment in assorted packaging equipment.

Source: WhatTheyThink Print Business Outlook surveys, 2016–2023.

Every few surveys, we try to gauge the extent to which print service providers are branching out into new product and service areas, if they had already added those new products/services, and, if not, if they had a time frame for adding them—or if they were even on their radars at all. How did packaging fare? We asked about corrugated, folding carton, and flexible packaging.

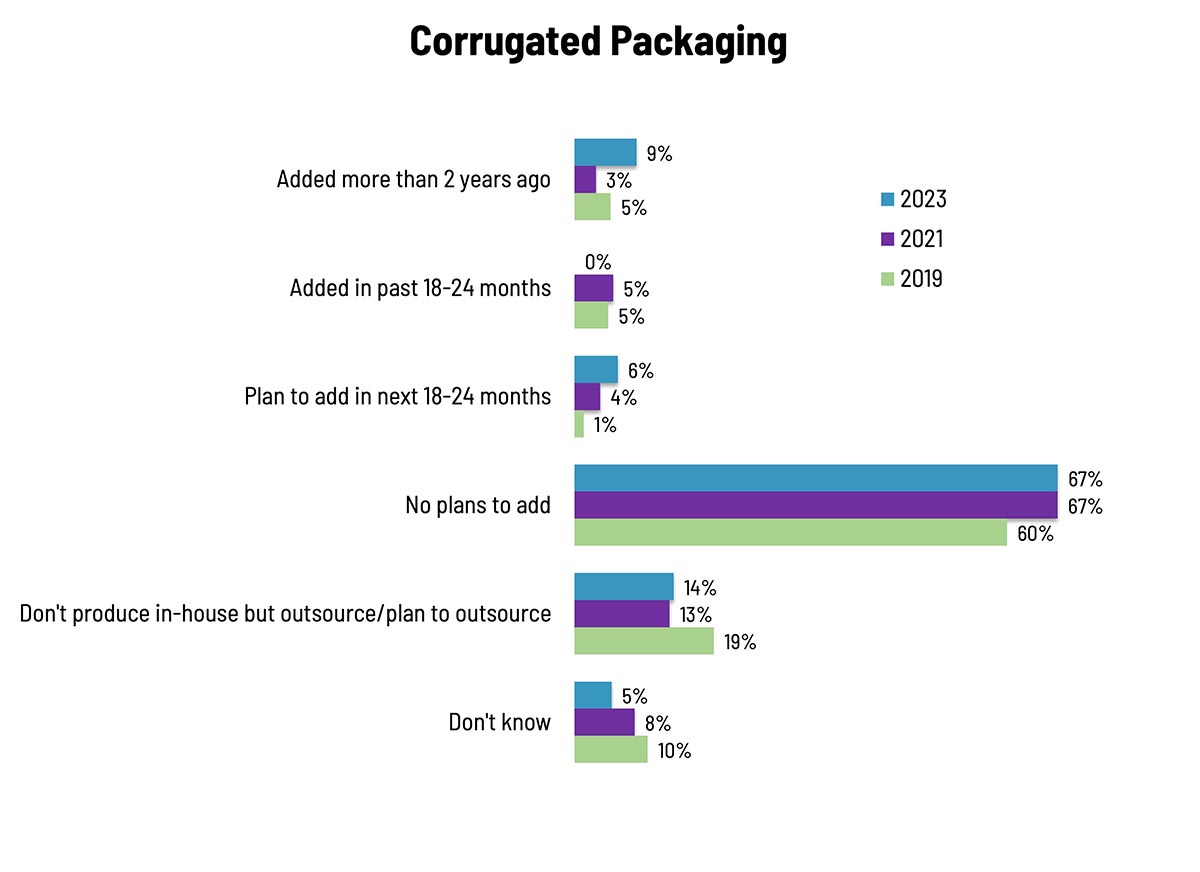

For corrugated packaging (see Figure 3), in 2023, 9% said they had added it more than two years ago, with another 6% planning to add it in the next 18–24 months. Twelve percent added it in the mid to late 2010s, and 10% added it in the mid 2010s. Two-thirds have no plans to add corrugated packaging capabilities.

Figure 3: Interest in corrugated packaging.

Source: WhatTheyThink Print Business Outlook surveys, 2019–2023.

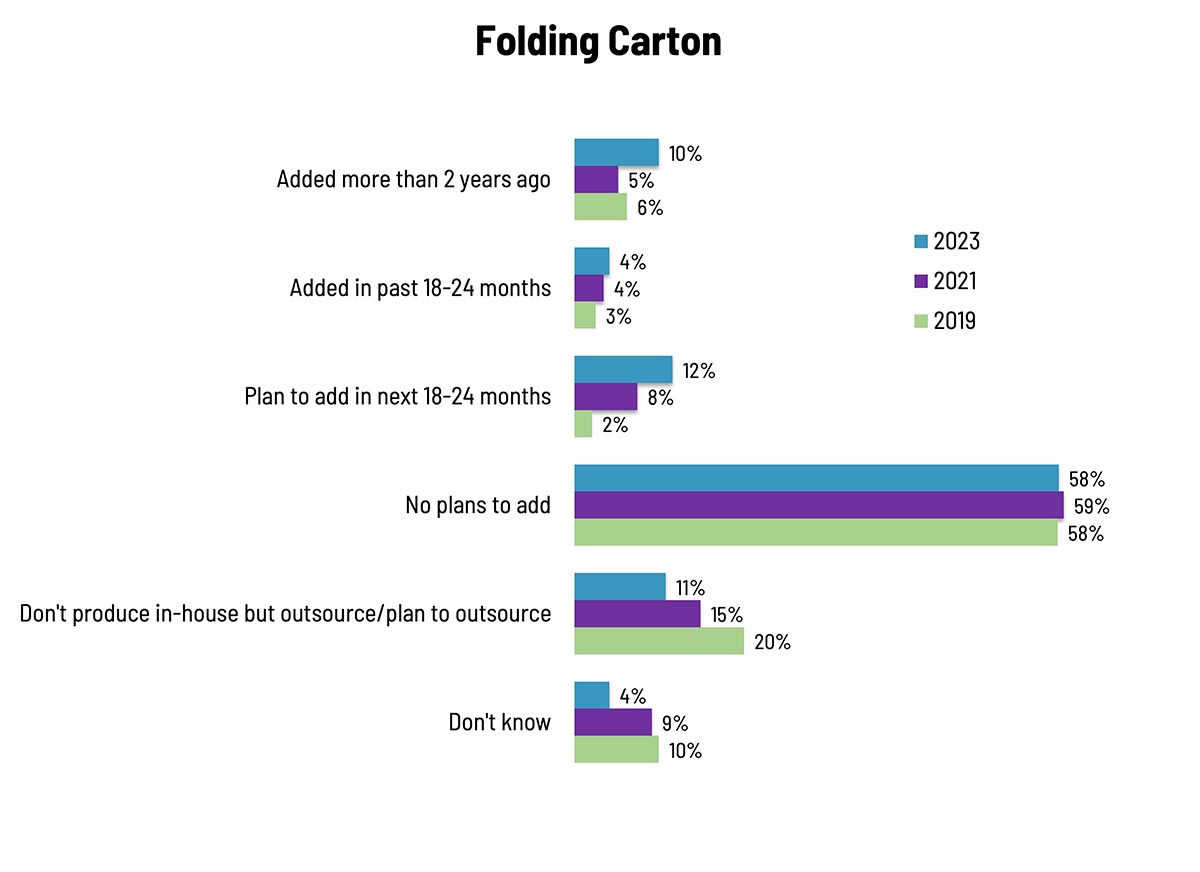

As the investment data suggested, folding carton is of a bit more interest (see Figure 4), with 14% saying in 2023 that they had already added folding carton printing capabilities. (Looking at previous years, 18% added it more than four years ago.) Twelve percent say they plan to add it in the next 18–24 months, and 58% say they have no plans to add it.

Figure 4: Interest in folding cartons.

Source: WhatTheyThink Print Business Outlook surveys, 2019–2023.

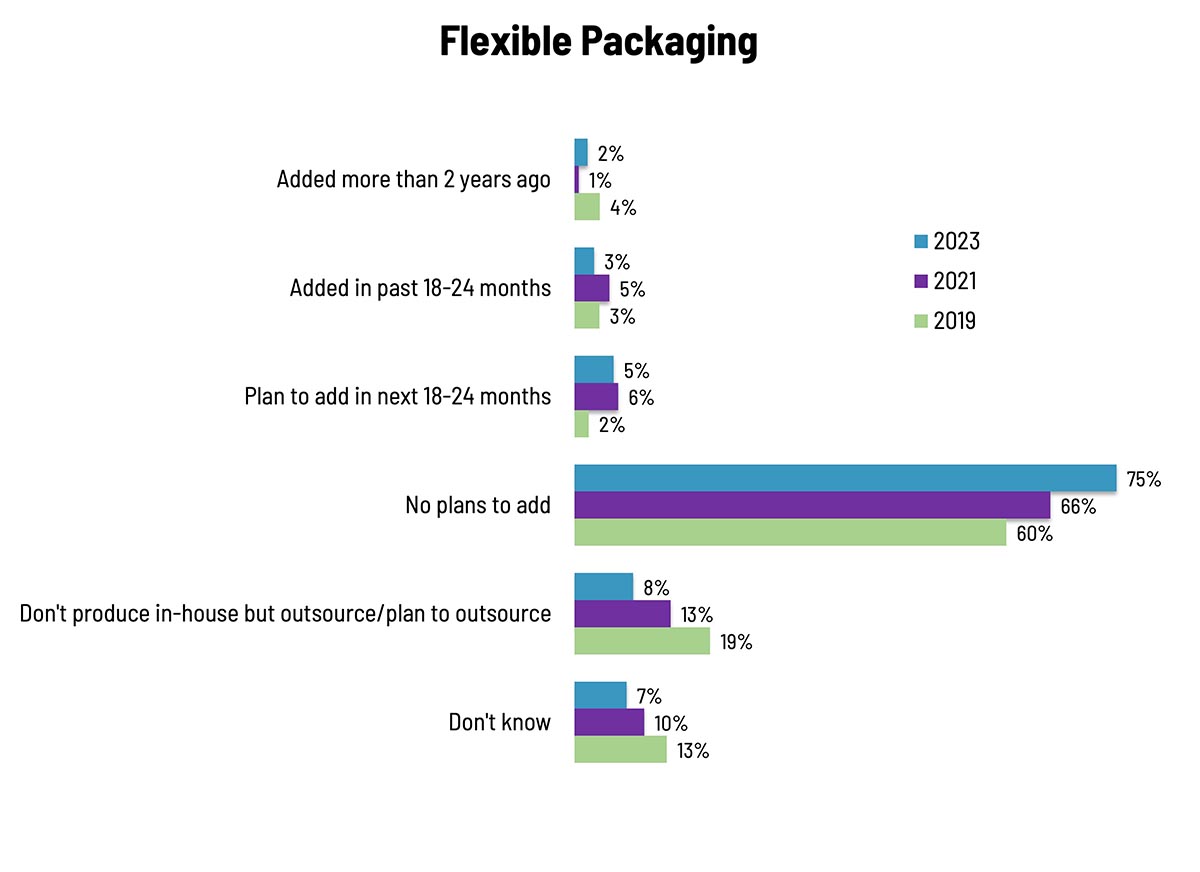

As for flexible packaging (Figure 5), that is the least compelling of the three, with (in 2023) only 5% saying they had ever added it, and 5% say they have any plans to add it. (Thirteen percent added it more than four years ago.) In 2023, a good three-fourths of commercial print businesses had no plans to add flexible packaging printing capabilities.

Figure 5: Interest in flexible packaging.

Source: WhatTheyThink Print Business Outlook surveys, 2019–2023.

Looking Forward

There are reasons why expanding into packaging might not be as compelling a proposition as, say, wide format was back in the day. The big reason is not necessarily technological; at the end of the day, it’s still mostly putting ink on something which is what printers do. It’s usually more a question of getting in the door to those who require packaging. For big consumer brands, their packaging converting processes are almost akin to trade secrets, and as a result they stick with trusted partners. The sweet spot for commercial printers looking to get into packaging are the smaller, local, more boutique brands, who have packaging needs that are far more modest than the P&Gs of the world. Think about the local makers of salsa, hummus, maple syrup, potato chips, etc., who need small numbers of boxes to ship their wares to farmers markets or local grocery stores. And even big regional grocery chains increasingly have a “buy local” section.

Packaging doesn’t need to be some undiscovered country from whose bourn no traveler returns, nor need it puzzle the will. It just requires the will to explore it.