In our January/February 2023 print edition, we are launching a new series called “Tales from the Database,” drawing on six years’ worth of Print Business Outlook surveys. These surveys form the basis of our annual Printing Outlook reports, the most recent of which (2023) is now available. In every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities, and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

This is the software issue, so we rounded up a few software-related challenges, opportunities, and investments. Let’s see what the historical data can tell us.

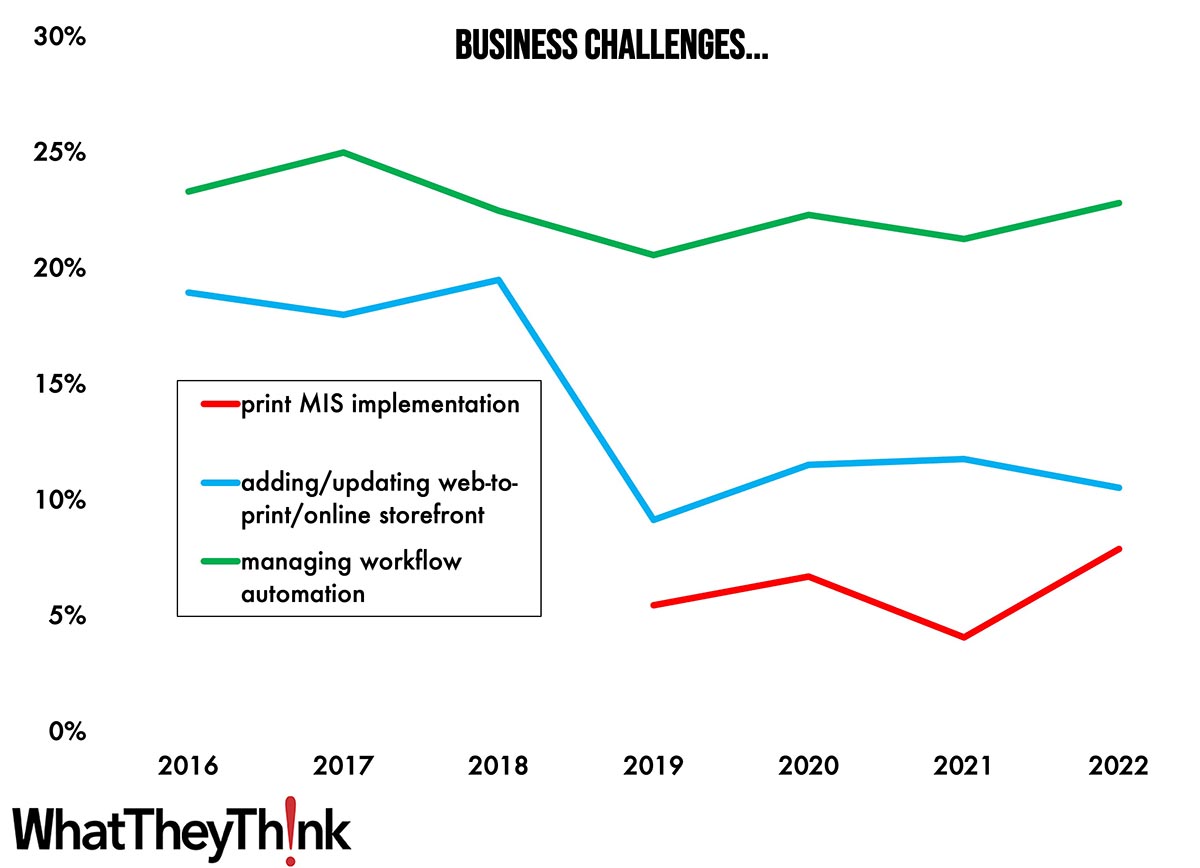

Business Challenges

A perennial top 10 (or even top 5) challenge throughout the history of our survey has been “managing workflow automation”—Figure 1 shows, it peaked as a challenge in 2017 at 25% of our survey respondents, but has never been lower than 21%. A big part of “managing” automation is understanding what comprises it. In 2018, “adding/updating web-to-print/online storefront” peaked as a challenge at 20%, and then dropped dramatically and has stayed fairly low since. Is that because everyone installed/updated their online storefront in 2019, or did it just fall out of the public consciousness? Elsewhere (see below), one gets the sense that it was a little bit of both.

We also added “print MIS implementation” to our list of challenges in 2019 and while it debuted down at 5%, it peaked in our most recent survey at 8%. Again, does this mean that print businesses are not challenged because it’s not a challenging process? Or is it because a MIS implementation is not on their radars? Or have they already done it?

Figure 1: Software- and automation-related challenges.

New Business Opportunities

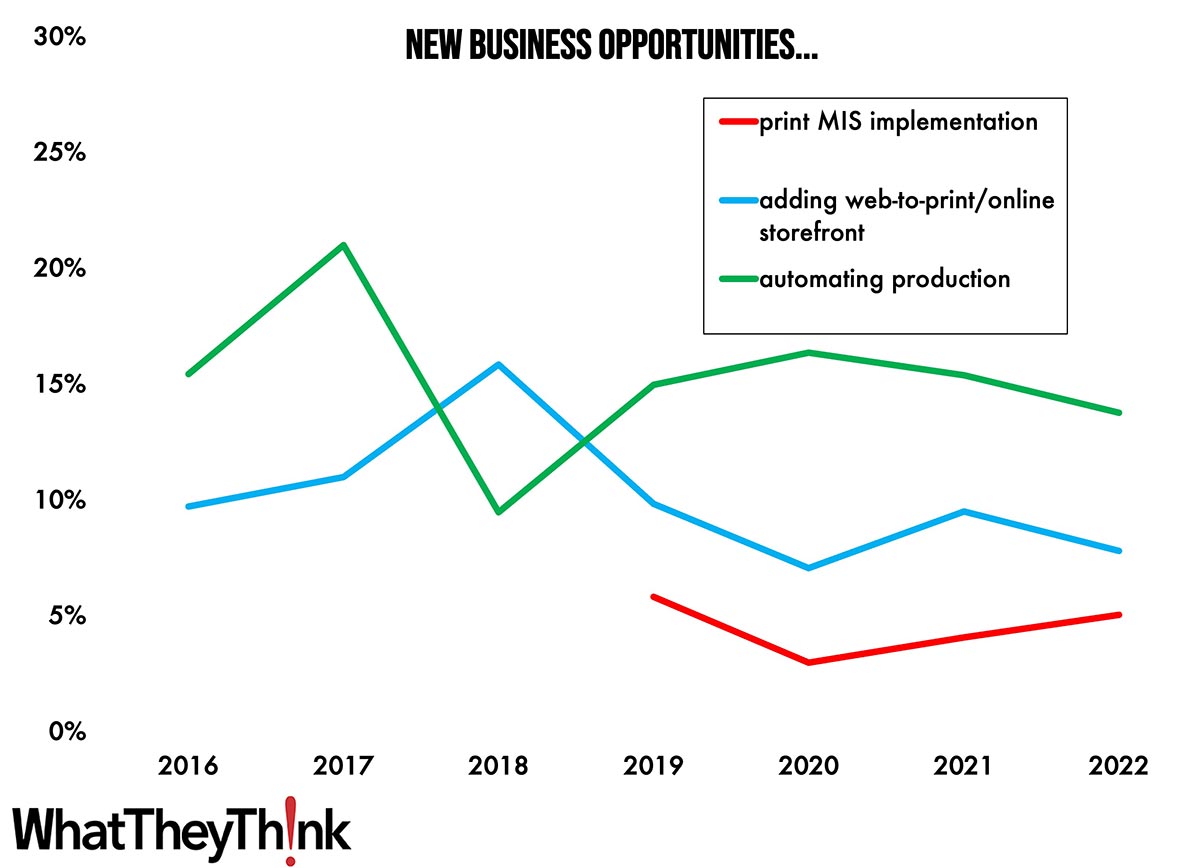

Then there is the question of whether print businesses feel that print software can provide a business opportunity. This is a key point. After all, printers usually buy things—equipment mostly—based on the extent to which they feel it will bring more business in the door. It’s not always easy to see software in the same way one sees a new press, for example. So, do print businesses see business opportunities in software? As you can see in Figure 2, not at especially high levels. “Automating production” was an opportunity for 15% of print businesses in 2016, topped out at 22% a year later, then plummeted in 2018 before rebounding slightly toward the turn of the decade. “Adding web-to-print/online storefront” peaked in 2018 and then declined in the following years. It’s likely that the mid-2010s saw the majority of print businesses building out their online storefronts; the surge in 2020–2021 was likely due to a pandemic-generated spike in using web-to-print during the pandemic lockdowns, as well as to sell COVID-related products. “Print MIS implementation” was seen as a business opportunity by 6% of print businesses when we added it to our survey in 2019; it subsequently dropped, but is back up to 5% in 2022.

Figure 2: Software- and automation-related business opportunities.

Planned Investments

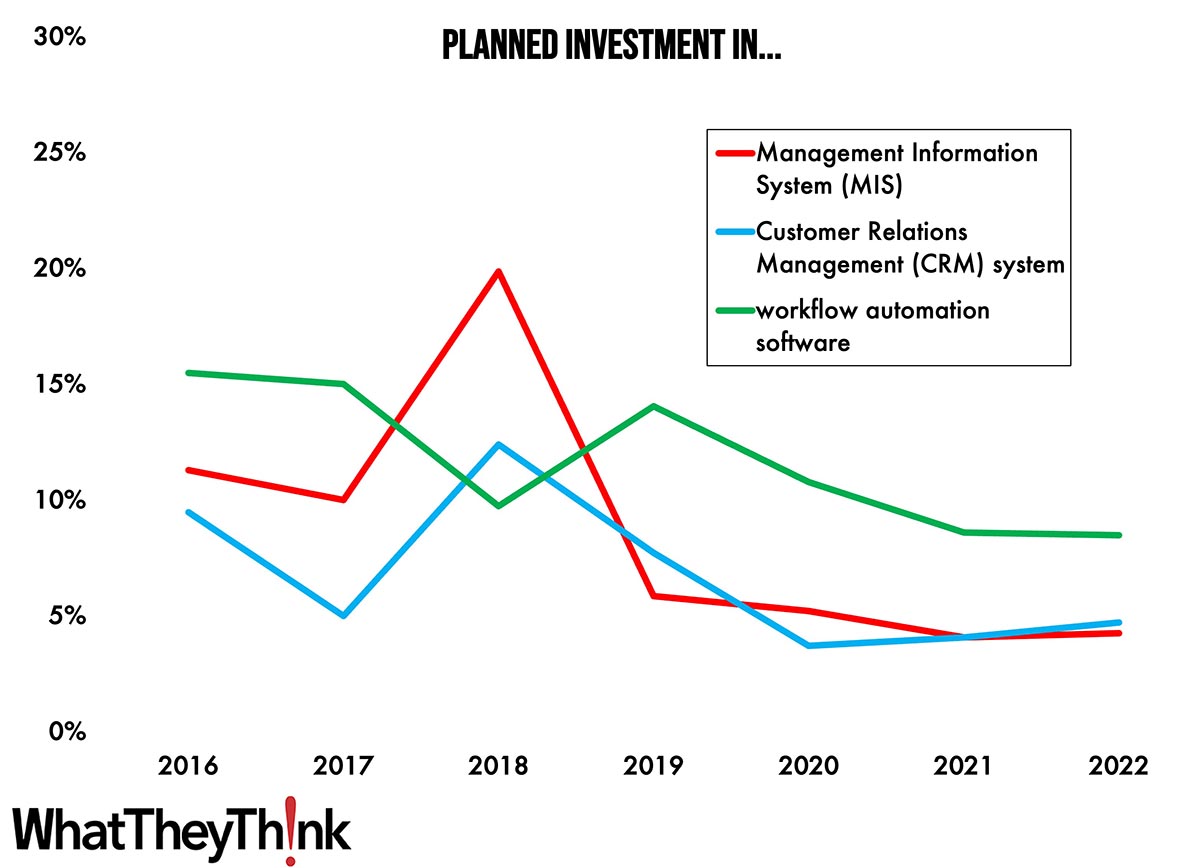

Finally, what have print businesses been buying? In 2018, planned investment in a Management Information System (MIS) peaked at 20%, but has been on the wane ever since—and notice how the decline in planned investment in MIS tracks the decline in the perception of implementing an MIS as a business opportunity. It’s perception as a challenge rather than an opportunity reflects the sense that an MIS is a “necessary evil” and not necessarily something that can make or save money—again, the tendency to think of software in a different way than equipment. Investment in a CRM is also fairly low although has been on the rise post-pandemic. “Workflow automation software” has also been on a general downward trend as an investment—or probably as an investment category unto itself. As more people understand what is meant by “automation,” it’s more likely that they are liable to look for automation features in other kinds of software (like a RIP/DFE, etc.) rather than some dedicated “automation” solution.

Figure 3: Software- and automation-related planned investments.

Top investments are almost predominantly equipment-based; capital equipment does require a more formal budgeting process than software, although a MIS implementation should not be the kind of thing one does willy-nilly. But it does also reflect the sense we get that software is not necessarily perceived as something that is a money-maker per se, or at least not in the way that, say a digital press is. This is understandable, but the key will be to change that perception—software can play a very large role in both saving and making a company money.

Breaking this data down by size of shop is also illustrative, and is a topic for further research.