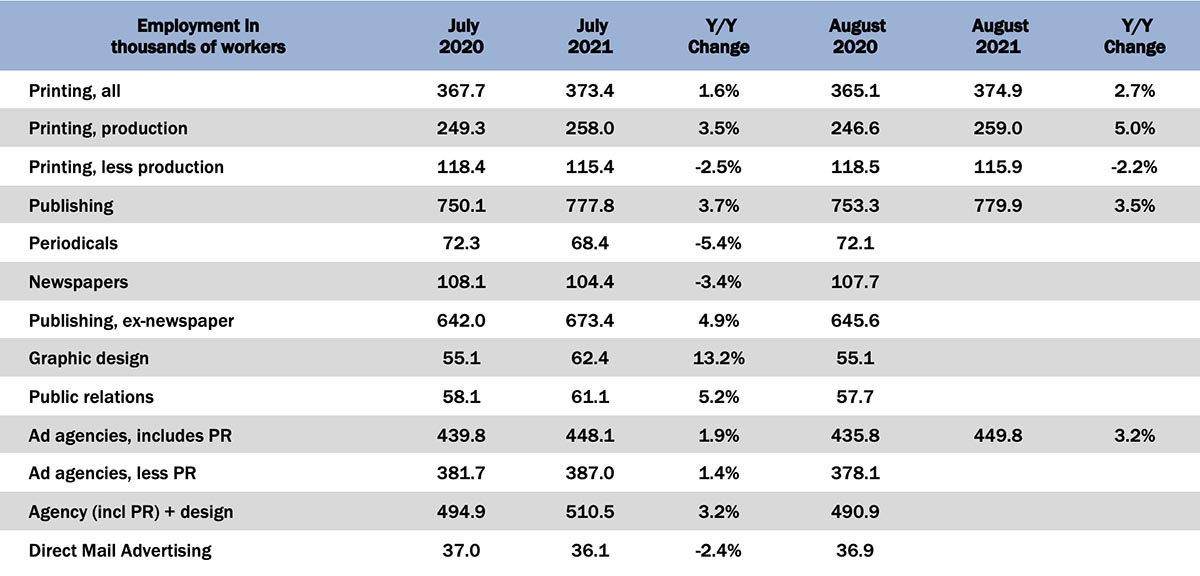

Last month, we remarked that July saw an end to the upward trend in employment, and in August we seem to be very much in a holding pattern. Overall printing employment was up +0.4% from July, production employment up +0.4%, and non-production printing employment was also up +0.4%. If you look at the year-over-year changes, early 2021 saw a return of the workers that had been shed or furloughed during the pandemic, so that summer employment was a little slow should not be that much of a surprise.

Publishing employment is also generally flat; general publishing employment was up +0.3% from July. Digging into the specific publishing segments (the reporting of which lags a month), from June to July, periodical publishing employment grew +0.3% while newspaper publishing employment was down -0.9%.

The creative markets fared about the same. Graphic design employment was up +0.4% from June to July, ad agencies (less PR) were up +0.7%, and PR was the star of the show this month, with July employment +1.3% above June. Direct mail advertising employment was up +0.7%—well below the +2.8% increase we had seen from April to May.

In the general August employment report, said the BLS:

Total nonfarm payroll employment rose by 235,000 in August, and the unemployment rate declined by 0.2 percentage point to 5.2 percent, the U.S. Bureau of Labor Statistics reported today. So far this year, monthly job growth has averaged 586,000. In August, notable job gains occurred in professional and business services, transportation and warehousing, private education, manufacturing, and other services. Employment in retail trade declined over the month.

Meanwhile, “The change in total nonfarm payroll employment for June was revised up by 24,000, from +938,000 to +962,000, and the change for July was revised up by 110,000, from +943,000 to +1,053,000. With these revisions, employment in June and July combined is 134,000 higher than previously reported.”

Some other quick hits from the July report:

- The labor force participation rate was unchanged at 61.7%.

- The employment-to-population ratio increased from 58.4% to 58.5%.

- The number of persons working part time for economic reasons decreased from 4.483 million to 4.469 million, close to the pre-pandemic level of 4.4 million.

- The 25 to 54 participation rate was unchanged at 81.8%.

Calculated Risk adds, “there are still 5.3 million fewer jobs than prior to the recession, and overall this was a disappointing report, probably due to the sharp increase in COVID cases.”