Rising incomes, growing populations, and rising urbanization are some of the key growth drivers for the global packaging market, according to The Future of Global Packaging to 2024, a new study from Smithers.

In 2019, packaging will reach a total global value of $917 billion with demand growing steadily at 2.8% yearly to reach $1.05 trillion in 2024.

Sustainability, recycling, overpackaging, and bans on single-use plastic packaging are key issues for packaging suppliers in advanced markets, particularly in parts of Western Europe. Growing consumer concern over the environment is driving demand for renewable packaging. Ease of packaging collection and recycling and mounting public pressure to reduce excessive and plastic packaging are becoming more important.

Global and Regional Consumption Trends

World packaging consumption, at current prices, increased from $860,714 million in 2014 to $891,212 million in 2018, a CAGR of 0.9%. It is projected to grow 2.9% to $917,104 million by 2019, and at a CAGR rate of 2.8% to $1,053,706 million through 2024.

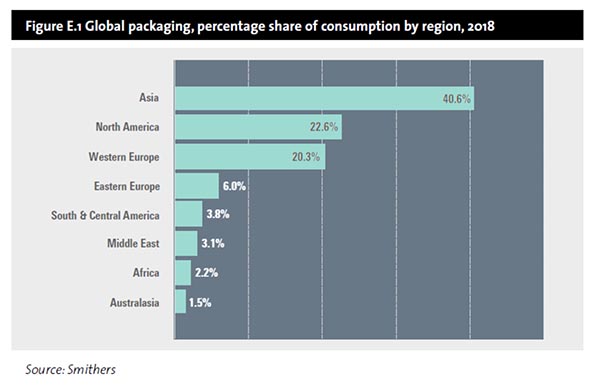

Asia is the largest market, accounting for 40.6% of world packaging consumption in 2018. North America is second, accounting for 22.6%, ahead of Western Europe with 20.3%. The emerging and developing regions of Eastern Europe, South and Central America, the Middle East, and Africa each account for a relatively small share of packaging consumption.

Asia, the Middle East, Africa, and Eastern Europe are forecast to grow packaging consumption faster than the world market average rate over the five years to 2024. The mature markets of North America, Western Europe and Australasia will grow packaging consumption at relatively low rates.

Consumption Trends in Packaging Materials

Board is the largest packaging material accounting for 33.2% of world packaging consumption in 2018, followed by flexible packaging with 25.5%, rigid plastics with 18.7%, and metal with 12.1%. Glass packaging accounted for 5.8% and other packaging for 4.7% of world consumption.

The consumption of flexible plastic is forecast to grow at the fastest rate, followed by rigid plastics and board. Glass, metal, flexible paper, and other packaging are forecast to grow at lower rates than the world market average.

Board and Flexible Packaging

Board is the most used packaging material followed by flexible packaging, rigid plastics, and metal. Flexible plastic is forecast to grow at the fastest rate, followed by rigid plastics and board. Glass, metal, other packaging, and flexible paper are forecast to grow at lower rates than the world market average. Flexible foil consumption is forecast to decline, according to Smithers research. Flexible plastic, which covers plastics, foil, and paper, is by far the largest product type, followed by flexible paper and flexible foil. Flexible plastic packaging consumption is forecast to grow during 2019–24 at the fastest rate.

Flexible packaging is replacing traditional materials for various applications. Retort stand-up pouches, for example, are challenging metal tins and glass jars for a wide range of food products. Flexible packaging compares favorably with rigid pack formats since it is often lower in cost, has a much lower pack weight, offers freight cost savings, and can also provide barrier protection.

Currently, China is the world’s largest flexible packaging consumer, followed by the US and India. Japan and the UK registered the biggest reduction in flexible packaging consumption during 2014–18 in US dollar terms.

Technology in Rigid Plastics

Technology plays an important role in rigid plastics packaging market development. Improved barrier solutions enable the use of rigid plastics packaging in applications such as fruit juices, milk, wine and hot-fill food jars. Resin producers also continue to offer new and improved formulations for rigid plastics packaging. Bio-based plastics, including 100% bio-based PET bottles, are expected to gain market share over the forecast period.

The Flexibility of Foil

Foil is used in food and beverage packaging in laminates, dairy lidding, bags, sachets, pouches, trays, dishes, and bottlenecking foils. It is also used for household foil and in the pharmaceutical sector to manufacture blister packs and sachets. Although aluminum foil is a perfect barrier, it doesn’t seal and has low puncture resistance. It is better used as a laminated barrier in multilayer film structures, in which it is usually bonded to coextruded layers of polyamide, PET, or PP film.

For more information on The Future of Global Packaging to 2024, download the brochure at: https://www.smithers.com/services/market-reports/packaging/future-of-global-packaging-to-2024.