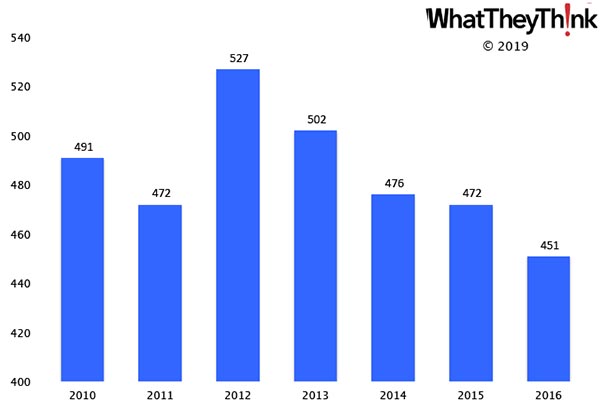

In our ongoing, semi-weekly look at establishment and employee counts of graphic arts businesses, we have been looking at packaging/paper converting establishments. Back in August, we looked at NAICS 322212 (Folding Paperboard Box Manufacturing, specifically, the number of establishments by employee size in 2016, the most recent year for which County Business Patterns has data. This week, we take a historical look at 322212. In 2010, there were 491 establishments in NAICS 322212, but by 2016, that number had declined -8% to 451, although there had been a jump in establishments from 2011 to 2012. However, bear in mind that there are so few manufacturers in this category that an 8% drop translates to only 50 establishments.

Some of the factors driving this market segment include:

- Increased digital printing of cartons to handle shorter runs.

- Ecommerce is driving the demand for different kinds of cartons with different graphic requirements (i.e., less emphasis on packaging needing to stand out on a retail shelf).

- “Smart packaging” incorporates electronic functionality (such as temperature change sensors for foods and pharmaceuticals) or interactive elements such as QR codes for inventory tracking.

- Specialty enhancements such as 3D, lenticular imaging, or digital embellishments for retail-ready cartons are appearing ion cartons with greater frequency.

NAICS 3222 comprises some widely disparate sub-categories:

- 32221 Paperboard Container Manufacturing

- 322211 Corrugated and Solid Fiber Box Manufacturing

- 322212 Folding Paperboard Box Manufacturing

- 322219 Other Paperboard Container Manufacturing

- 32222 Paper Bag and Coated and Treated Paper Manufacturing

- 322220 Paper Bag and Coated and Treated Paper Manufacturing

- 32223 Stationery Product Manufacturing

- 322230 Stationery Product Manufacturing

- 32229 Other Converted Paper Product Manufacturing

- 322291 Sanitary Paper Product Manufacturing

- 322299 All Other Converted Paper Product Manufacturing

These different sub-categories have different market dynamics—corrugated and folding cartons vs. things like stationery—but if there is one constant across each of these categories it is consolidation. Especially in the period during and following the Great Recession (the first half of the decade), we saw no small amount of consolidation in all corners of the paper, converting, and printing industries.

As we dig deeper into the sub-categories in upcoming weeks, we can better identify the factors driving establishment growth and/or decline.

These establishment counts are based on data from the Census Bureau’s County Business Patterns. These data, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.