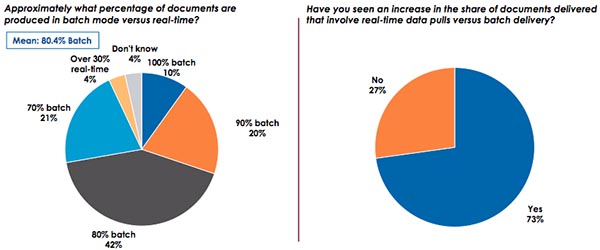

- While batch-based delivery of data remains predominant, real-time pull volumes represent a sizable and growing minority.

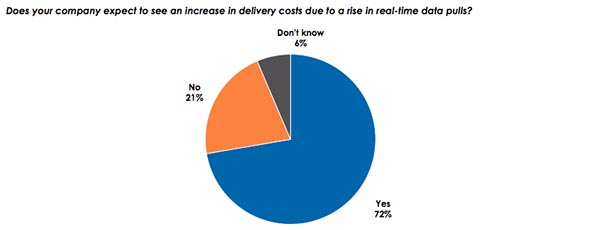

- Although clients seem reluctant to pay extra for real-time delivery, 72% of enterprise respondents expect to see an increase in delivery costs due to the rise in real-time data pulls.

- As the demand for real-time data delivery rises, it will increase the complexity of pricing agreements between enterprises and their third-party print or communication service providers.

By Will Morgan

Introduction

There is no denying that the customer communications landscape is changing. As part of its coverage of the customer communications market, Keypoint Intelligence – InfoTrends conducts annual research of enterprises and consumers. Each year, we also ask our industry contacts about what they are seeing in the market, what people are talking about, what questions we can address, and how we can improve our research to stay on top of industry trends. This article provides a brief overview of top-level survey findings and also highlights the findings that will be uncovered in upcoming research.

A Shift Toward Real-Time Data Pulls

Batch delivery—which involves collecting and processing data in a group while input, management, and output are all maintained as separate processes and executed as a “batch”—has long been considered the most efficient way of managing large amounts of data and handling requests for access to it. In contrast, real-time data delivery requires a continual process of input, management, and output. Because each request is handled individually, it is not as efficient as batch delivery. As its name implies, however, real-time delivery is more immediate.

In December 2017, InfoTrends published a study entitled Pricing for Digital: Exploring New Models for Transactional Communications Delivery. This study confirmed that while batch delivery remains predominant, real-time volumes represent a sizable and growing minority. Although about 80% of documents in North America were currently produced in batch mode, nearly three-quarters of businesses had seen an increase in the share of documents delivered involving real-time data pulls.

Figure 1. Batch vs. real-time delivery

N = 202 Business Respondents in North America that outsource traditional document printing to a third party.

Source: Pricing for Digital: Exploring New Models for Transactional Communications Delivery, InfoTrends 2017.

In a follow-up to its Pricing for Digital research, InfoTrends surveyed 22 mid-sized print service providers in North America about their enterprise clients’ interest in real-time communications. One interviewee stated, “Batch is acceptable for simple communications, but clients want transactional communications to be as real-time as possible.” At the same time, however, another reported that most systems were not currently set up to handle real-time communication channels. While more than one respondent reported that clients are very interested in real-time communication channels, another reported, “some of our clients are requesting real-time delivery, but none of them have been willing to pay the additional cost to provide this service thus far.” Although clients seem reluctant to pay extra for real-time delivery, 72% of enterprise respondents expect to see an increase in delivery costs due to the rise in real-time data pulls.

Figure 2. Delivery costs are expected to increase due to real-time data pulls

N = 202 Business Respondents in North America that outsource traditional document printing to a third party.

Source: Pricing for Digital: Exploring New Models for Transactional Communications Delivery, InfoTrends 2017

An Eye to the Future

InfoTrends’ Pricing for Digital research concluded that as the demand for real-time data delivery rises, it will increase the complexity of pricing agreements between enterprises and their third-party print or communication service providers. Based on this conclusion, we are working to stay ahead of evolving market demands. To this end, InfoTrends is conducting its Annual State of Transactional Communications research, with business and consumer survey findings scheduled to publish later this year. Each year, this research is updated and modified to reflect ongoing market shifts. Topics that are being further explored in this year’s survey results include:

- Color vs. black and white: This year’s consumer research includes additional questions about the effectiveness of color in transactional communications. In addition to being asked if transactional communications printed in color were easier to read and understand than those in black & white, consumer respondents were also asked if the inclusion of color prompted them to take action or pay their bills faster. We also hope to determine if color communications might improve comprehension and reduce the amount of time that consumer spend contacting customer help lines. Customers who have needed to contact their providers will be asked which channel(s) they used and what motivated them to reach out. On the business side of our research, enterprise respondents will be asked to estimate the share of their digital and print-based communications that require customer care.

- The customer experience: Although previous renditions of our transactional communications research primarily focused on where responsibility for the customer experience rests on an executive level, the questions in this year’s survey have been broadened to include any business units that play a role across the entire customer journey. We’re also working to further differentiate between categories of digital communications to gain insight into consumer adoption of transactional communications through mobile apps and expectations around digital archives. Correspondingly, business respondents will be asked how quickly their customers can access their archives and for how long.

- Data management: Although data management has been a perennial topic in our business surveys, our 2019 research will ask enterprises specifically about their plans to improve data management and analytics by addressing data silos. In adding these questions, we hope to better understand what enterprises are doing to achieve a single view of customer by sharing consumer data across various business units, communication channels, and workflows. Ultimately, this will help us uncover specific strategies that can help enterprises make the most of their resources by calibrating every action for maximum impact.

- The role of social media: This year’s research will place a special emphasis on the growing role of social media in transactional communications. Are enterprises working to increase the visibility of their brand story on social media platforms? How much importance do clients place on social media delivery and personal cloud storage? To find out, enterprise respondents will be asked how they manage the application of social media in customer communications. Those who use software tools (e.g., Hootsuite, Social Media Jukebox) obviously see potential in social media, but they may not be fully capitalizing on the opportunity.

The Bottom Line

InfoTrends’ ongoing research on the transactional communications market continues, and the consumer surveys are currently in the field for North America and Western Europe. Our corresponding business surveys will soon follow. The changes that we make with each iteration of our research enable us to provide the market with the most up-to-date information on the changing customer communications landscape. To learn more about our upcoming research, please email Deanna Flanick at [email protected] today!

Will Morgan is a Senior Research Analyst at Keypoint Intelligence – InfoTrends. In this role, he supports market research and analysis in the Customer Communications market, interacts with service clients, and assists with consulting engagements as well as company deliverables. Prior to joining Keypoint Intelligence, Mr. Morgan spent 10 years conducting research and analysis at the Mississippi Department of Archives and History.