- The traditional broker model has become vulnerable to procurement software sales directly to small businesses, and larger enterprises are gravitating toward more comprehensive solutions.

- Traditional print-on-paper has become commoditized, and growth has shifted to more dynamic applications like promotional collateral, signage, and point-of-sale displays.

- Technological innovations as well as product and sourcing sustainability are important factors that are driving market expansion.

By Will Morgan and Colin McMahon

Introduction: Market Dynamics

Sometimes known as “marketing execution services,” “brand deployment,” and “marketing print management,” the print management market is a slice of the broader customer communications ecosystem that sees enterprise clients outsourcing print and related spending to a third-party provider (also known as a distributor or broker) who leverages a network of manufacturers to procure the company’s printed marketing materials and promotional products. Through consolidated purchasing, print management providers offer cost savings and upgraded efficiencies that in-plants struggle to match, as well as a wider array of products, applications, and expertise than a single print manufacturer can manage.

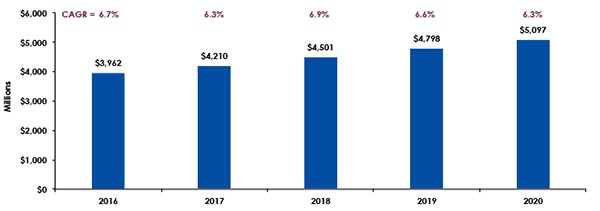

In its latest financial review of the print management space, Keypoint Intelligence – InfoTrends projected that the print management sector would expand by 6.5% CAGR between 2016 and 2020, driven by expanded services and applications beyond traditional print on paper as enterprises continue to push providers toward end-to-end global solutions. These assumptions remain in keeping with more recent data and the insights of industry stakeholders. As the COO of a print and marketing logistics company explained, “The average client’s needs have become much more complex, forcing providers to move toward more sophisticated web technology, to get more creative in sourcing, and tighter in their integration with the client.”

Figure 1. Print Management Market Growth in the U.S.

Source: U.S. Document Outsourcing Market Forecast: 2015-2020, Keypoint Intelligence – InfoTrends, 2016

As a result, the traditional broker model has become vulnerable to intrusion from procurement software sales directly to small businesses. Meanwhile, larger enterprises are gravitating toward more comprehensive solutions. The CEO of an American end-to-end marketing execution provider cautions, “There is a great distinction between pure procurement brokers and companies providing full, end-to-end marketing execution partnerships. The brokership model is now small and in jeopardy.”

Growth Through Innovation

In both the print management market and the industry at large, traditional print-on-paper has become commoditized, dropping in price and production volume. Growth has shifted to more dynamic applications like promotional collateral, signage, and point-of-sale (POS) displays. “Promo is expanding rapidly,” one industry veteran explained. “Two or three years ago, it only made up 20% or 30% of a distributor’s business, but this has climbed to 50% or 60% now. Clients are also looking for broader services and an expanded suite of products in POS and signage.Providers offering a broader range of services to larger clients naturally have a more significant portion of their business tied up in POS than smaller brokers serving the traditional print market.”

“POS has grown into more refined work,” the VP of Strategy & Digital Solutions for a European company’s print management division in the U.S. declared.“Everyone is either looking for differentiation through digital engagement and interaction or they are looking to bring costs down while remaining competitive. There is therefore a wide range of quality in the space, from pure digital interactive displays to simple commodities.” On the cutting edge, interactive features like compliance monitoring and electronic footfall tracking are gaining ground in POS, helping marketers get a more complete picture of a campaign’s ROI without endangering data privacy.The integration of augmented reality into POS can generate positive buzz for a brand through good word of mouth.

Beyond technological innovation, product and sourcing sustainability is another important factor driving market expansion. Companies (especially larger enterprises with well-known brands) care about improving their public image and promoting sustainable sourcing throughout the whole supply chain, particularly when dealing with highly-visible collateral like POS.“Clients in the U.S. are beginning to demand diversity in the supply chain like their European and Australian counterparts,” the CEO of a global procurement software company observed. “That means more indigenous sourcing and minority- or woman-owned providers are now required in the chain.”

Logistically, warehousing arrangements, whether they are handled by the provider or a third party, are most directly influenced by the needs (and size) of the client. “We see POS increasingly moving toward print-on-demand,” another CEO explained. “Whenever possible, suppliers produce what they need for an auto-shipment and make items available for re-order [via an] online [system]. Kitting is an important part of POS. Materials often need to be kitted in individual boxes for shipment to multiple locations. If warehousing is required, a central location is selected to minimize freight expense and transit times. Integration with a storefront or print purchasing system is essential to the efficient management of inventory.”

The Bottom Line: The Size of the Opportunity

Providers that are offering a broader range of services to larger clients will naturally have a more significant portion of their business tied up in POS than smaller brokers serving the traditional print market. According to the CEO of an end-to-end marketing execution provider, “The corporate world has really embraced third-party support, and because of that, the marketing execution services market in the U.S. has seen steady growth, going from $200 million in 2002 to somewhere between $8 to $10 billion today…and 60% of that is POS! That is the future. That’s what stays around.” Another interviewee, this one the CEO of a global procurement software company, agrees. “A total market sizing of about $8 to 10 billion in the U.S. sounds about right, but if anything, the opportunity is bigger when you throw in promo and all of the front-loaded creative costs that the big guys try to take. In the U.S., I would say that about 10 companies are controlling $10 billion worth of print.”

It should be noted that these bullish claims exceed the expectations projected by InfoTrends and other data analysts, which estimate that the print management market will only be valued at around $5 billion by 2020. While some may see this incongruity as a troubling disconnect, we believe it may be sign that there is, as one CEO suggested, hidden opportunity not fully aggregated in current projection models. Regardless, one thing is clear: the print management market is growing and, in a landscape of rapidly developing technology and evolving marketing strategy, operators in the space may be poised for real advancement.

Will Morgan is a Senior Research Analyst at Keypoint Intelligence – InfoTrends. In this role, he supports market research and analysis in the Customer Communications market, interacts with service clients, and assists with consulting engagements as well as company deliverables. Prior to joining Keypoint Intelligence, Mr. Morgan spent ten years conducting research and analysis at the Mississippi Department of Archives and History.

Colin McMahon is a Research Analyst at Keypoint Intelligence – InfoTrends. He primarily supports the Business Development Strategies and Customer Communications services. In this role, he creates and refines much of InfoTrends’ written content, including forecasts, industry analysis, and research/multi-client studies. He also assists with the editing and formatting processes for many types of deliverables.

Discussion

By Vincent Mallardi on Mar 21, 2019

As the Chair of the Printing Brokerage Buyers Association, and as an economist, I found the Print Management article interesting but not informative. First, the volume of print reselling at end-use-value exceeds US$ 14 Billion, about 2.3-times that forecast in the story. Also, there are 75, not 10 companies that constitute the bulk of the business while the remaining market is shared by some 13,000 or more brokers, distributors, group buying services and manufacturers' reps. The increasing demand comes from the lack of marketing prowess on the part of production printing companies and the plain fact that a good salesperson can make more money NOT working for a plant. Most end-use customers, too, don't like dealing with unpleasant printing companies. The only factor that could reverse the trend toward 3P arrangements is dishonesty. The print management provider can't burn both ends of the candle by accepting fees, gain-shares, rebates, etc. from both users and subcontractors, misrepresent themselves as owners or partners in plants and equipment, and use accounting methods that pretend revenues at 100% though being pass-throughs or capitalize at present value the future returns of long-term contract that may never materialize. Buying business at the C-level through front-ending and similar gimmicks is a ploy that the accounting standards board and the antitrust administrators should examine.