Keypoints:

- In terms of transactional communications strategies, cost reduction topped the list as the most important business objective.

- All told, our interviewees were responsible for the delivery of over 50 billion printed, electronic, and mobile communications in 2016!

- Today’s enterprises are trying to pivot toward a centralized and coordinated communications strategy across all channels, leveraging each interaction to deliver consistent, timely, and relevant messaging with blended transactional and marketing intent.

- Instead of investing in the costly upgrades that are needed to modernize their internal operations, enterprises are increasingly turning to outsourcing providers to produce their print and manage the complexities of data-driven communications.

Introduction

InfoTrends, a division of Keypoint Intelligence, has been tracking the customer communications outsourcing market for over a decade. As analysts, we have found it fascinating to observe—and support—the unique approaches that providers have taken to navigate from a print-focused core competency, reputation, and pricing model to ambitions of true omni-channel offerings. While some are more proactive in expanding their offerings ahead of client demand, most providers are reacting to declining volumes and evolving customer needs.

Transactional Communications Priorities

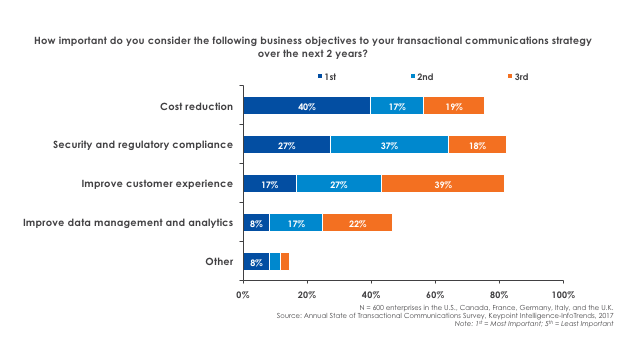

In our latest research, we surveyed 600 enterprises across North America and Western Europe and asked them to rank the importance of common business objectives relative to their transactional communications strategies. Cost reduction topped the list as the most important objective, but security and regulatory compliance accounted for the highest percentage (64%) when the first and second most important objectives were combined. Furthermore, improving the customer experience was nearly as high as security and regulatory compliance when the ranks of first, second, and third were combined.

How important do you consider the following business objectives to your transactional communications strategy over the next 2 years?

These enterprises’ priorities are also driving customer communication outsourcing and prompting service providers to improve and expand their offerings. In an initiative to fully examine these efforts within our Customer Communications Advisory Service, we recently published Enterprise Customer Communications—Trends & Strategies from Around the Globe. This in-depth report provides a review of the insight we garnered from over sixty interviews with leading providers and other market stakeholders. All told, our interviewees were responsible for the delivery of over 50 billion printed, electronic, and mobile communications in 2016!

Customer Communications Insight

To gain a better understanding of the trends that are driving enterprises’ expectations and aspirations for customer communications, we interviewed some of the largest players in the customer communications market—as well as important smaller providers with deep vertical and regional insights.

Sampling of Interview Respondents

During the course of these interviews, we gathered insights on:

- The current state of the customer communications market, business dynamics driving growth, and the obstacles challenging it

- Nuances of outsourcing, electronic delivery adoption, and multi-channel messaging, as well as innovative solutions by geography and vertical market

- How evolving enterprise needs are influencing investment decisions now and in the future

Here are a few of the top trends that are shaping the customer communications market on a global basis:

- Although the desire for cost reduction and containment persists, enterprises are beginning to prioritize personalized, high-quality communications that secure improved response rates, return on investment, and bottom line growth.

- Today’s enterprises are trying to pivot toward a centralized and coordinated communications strategy across all channels, leveraging each interaction to deliver consistent, timely, and relevant messaging with blended transactional and marketing intent.

- Demand for direct mail varies globally, but poor returns from digital campaigns have prompted some companies to reinvest. While many enterprises are investing in direct mail, few are taking advantage of the channel’s potential for increased personalization.

- Although some enterprises may not be ready to adopt emerging technologies like personalized videos and augmented reality, they will want an outsourcing partner with advanced capabilities to future-proof their communications strategies and act as a trusted advisor to help them achieve their business goals.

- Instead of investing in the costly upgrades that are needed to modernize their internal operations, enterprises are increasingly turning to outsourcing providers to produce their print and manage the complexities of data-driven communications.

Recommendations

Based on its research into the customer communications market, InfoTrends offers the following recommendations for outsourcing providers:

- Leverage compliance concerns to build lasting partnerships: Evolving regulations surrounding the delivery of critical communications will help drive enterprises’ desire to outsource the complexities of compliance. Print should be viewed as one piece of a broader, all-inclusive customer communications outsourcing opportunity.

- Solve the data dilemma: Enterprises are sitting on more client and prospect data than they know what to do with. You must become an expert in helping clients maximize the value of that data so they can provide timely and relevant communications to their customers and prospects—with a strong analytics platform in place to review performance.

- Elevate the conversation: Some of today’s most successful outsourcing service providers have elevated the customer communications discussion to an executive level within their clients’ and prospects’ organizations. At that level, the conversation is less about cost savings and more about the bigger picture of customer experience. While your relationships might now exist with operations or procurement managers, now is the time to begin navigating toward the C-suite!

For vendors, InfoTrends suggests the following:

- Assist the mid-market with their mobile communications strategies: Even with significant resources at hand, large enterprises are struggling to grasp the evolving definition of a “document” in today’s mobile world. This challenge is amplified in the mid-market, and your clients are seeking mobile solutions that can drive interaction while improving the end customer experience. Focus on supporting this tier!

- Help make the case for print: While print plays an important role in marketing and transactional communications, enterprises, outsourcing providers, and other market stakeholders struggle to locate strong case studies and other materials highlighting its importance. If you are a vendor with ties to the print world, it is critical to continue socializing real-world examples and data to support this case.

- Provide the platform: With communication needs ranging from print to mobile, static to dynamic, and mass to personalized, enterprises and outsourcing providers will require customer communications technology platforms that can serve as a central management hub for transactional and marketing communications while also scaling with their evolving needs. Ensure that your offering addresses these needs.

The Bottom Line

The customer communications market is evolving rapidly as enterprises strive to improve customer engagement and the overall customer experience. This article provides just a sampling of the insights contained within InfoTrends’ extensive market report. We have embedded dozens of direct quotes throughout the report, drawing our interviewees’ insights into the enterprise dynamics that are shaping the market in greater detail, including insight by region and vertical market. Together, they tell the story of an industry in flux—but with that flux, there are opportunities for vendors and service providers supporting the market!

InfoTrends’ coverage of the customer communications market continues—we are launching additional research initiatives into marketing communications, exploring the ecosystem for personalized video, and reviewing pricing models for digital delivery. We’d love to hear your feedback!