Commercial printers are feeling the love from acquirers as their top line revenues increase, profits return and grow – at least that is true for printing companies that are able to demonstrate a high degree of competence, have specialized capabilities and that serve well-defined vertical markets. Compared to the past several years, there is an unmistakable and positive difference in the market for commercial printers.

A year ago, we advised buyers of commercial printing companies to proceed with caution; we indicated that the road ahead was potentially rough. The environment was still very competitive as many commercial printers scrambled to add services and differentiate their companies. Although the industry is not ready to “party like it’s 1999,” the trend now, and we believe likely to persist for the coming year, in terms of M&A, is that buyers are back in the market for commercial printers. Recent data, as detailed in The Target Report deal logs, indicates that transactional activity in the commercial printing segment has increased substantially, and the nature of completed transactions signifies that buyers are anticipating improved business conditions for commercial printers. Purchase multiples have risen to levels that portend and are likely to stimulate increased M&A activity in the commercial printing segment during the coming year.

Orora, based down-under in Hawthorn, Australia, and publicly listed on the ASX exchange, has placed its second bet on the US commercial printing industry with its acquisition of Clifton, New Jersey-based Register Group. In a bellwether transaction, both in terms of price and structure, Orora paid $44 million for the company, a healthy 5.8 times trailing twelve months $7.6 million EBITDA, a very respectable 18.1% of revenue which was $42 million. Year-over-year top line growth was 5% for the past three years, another indicator that surely drove the value for the sellers. As reported in Orora’s presentation to investors, the $44 million purchase price was paid mostly in cash with only $4 million of the total held back for 18 months, subject to undisclosed parameters for release. As icing on the cake, Orora paid an additional $3 million to reimburse the sellers for recent capital investments that are predicted to drive additional growth, but that have not yet impacted trailing EBITDA, increasing the effective multiple paid to 6.2 times trailing EBITDA, rewarding, not penalizing, the sellers for planning ahead regardless of their interest in selling the company.

It must be noted that although Register operates in the commercial printing segment, it is not a typical commercial printer, rather the company has long been a specialist in large-format offset printing, the “go-to” printer in the New York metro area for oversize offset sheets used primarily in retail displays, with a smaller position in oversize litho sheets used to produce packaging. In addition to Register’s product specialization, Orora was attracted by Register’s industry vertical focus on consumer products, food & beverage, healthcare and technology companies, all consistent users of retail point-of-purchase printing.

The acquisition of the Register Group is consistent with and adjunctive to Orora’s prior acquisition of IntegraColor in March, 2016. Orora reported that they paid 6.9 times trailing EBITDA for IntegraColor. Based in Dallas, Texas, IntegraColor forms the platform company for Orora’s strategic initiative to establish a significant US-based point-of-purchase business. Although the acquired company’s EBITDA of 11.2% was, as a percentage of revenue, less than at Register, IntegraColor was significantly larger in terms of revenues, approximately $100 million, which combined with IntegraColor’s role as the initial US investment in retail display, apparently justified that higher multiple. Consistent with the terms of the Register purchase, Orora paid $70 million of the purchase price in cash at closing, holding back an additional $7 million for up to 18 months against reps and warranties.

In another noteworthy transaction last month, private equity firm ICV Partners acquired SG360°, one of the largest direct mail printers in the US with annual revenues of $300 million. SG360° was majority-owned by the company’s ESOP plan which was refinanced in the transaction, locking in value for the employees in the current favorable market conditions. ICV is not a freshman when it comes to commercial printing companies – the fund has another printing company in its portfolio, OneTouchPoint, a roll-up of commercial printing companies with a go-to-market position as a comprehensive marketing services provider. ICV acquired OneTouchPoint in September 2014 from Huron Capital Partners. OneTouchPoint has itself been an active acquirer of commercial printing companies, standing as one of the few companies active on the national stage executing a roll-up strategy in commercial printing (See The Roll-Up Returns (to Commercial Printing), The Target Report, Sept 2014).

Moore DM Group, a diversified direct mail company serving the non-profit fundraising industry, acquired Vienna, VA-based Production Solutions / PS Digital, adding to the company’s deep penetration into the non-profit direct mail production space. Angstrom Graphics, a diversified commercial printer based in Cleveland, Ohio, acquired list and mailing service company New Channel Direct. The Marek Group continued its evolution towards being a full-fledged marketing services provider, acquiring marketing agency Wunderlich, Pearson & Tetzlaff, both in Wisconsin.

Projections for 2017

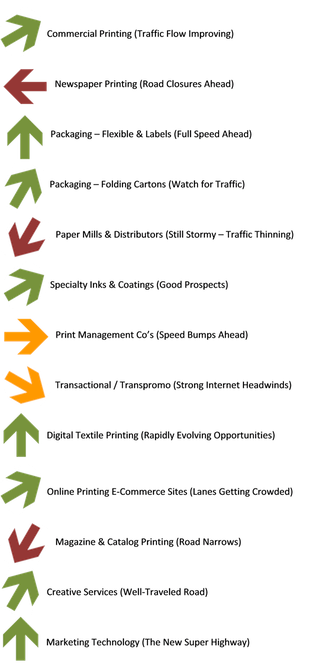

As 2016 wound down, the commercial printing industry segment exhibited renewed strength, both in M&A activity and fewer bankruptcy filings and plant closings. Therefore, we are changing our forward-looking indicator for the commercial printing segment for 2017 from orange to green and now pointed slightly upwards.

For comparison to last year, click here to view GAA’s Projections for 2016.

View the complete M&A report for December 2017

Here’s our projections for the printing and related industries for 2017 by segment, in graphic form: