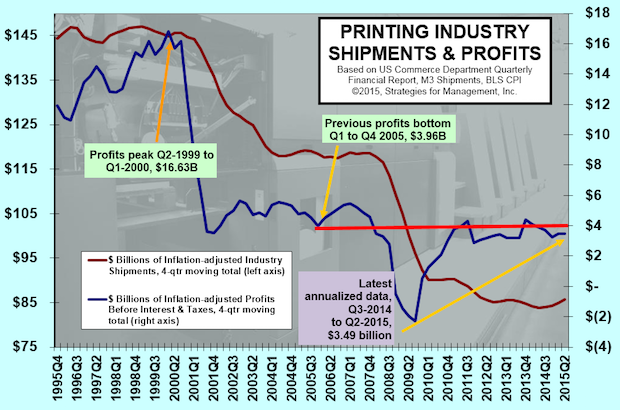

The 4-quarter moving total of inflation-adjusted US commercial printing shipments have been increasing, but unfortunately profits have not. Q2-2015 four-quarter shipments are up +2.3%, but profits are unfortunately down for the last four quarters -10.8%.

This is may be part of the explanation why total employment has been declining sales have been moving in the opposite direction. There is also intense downward pressure on printing prices as the cost of digital media competitors are decreasing. That squeeze leads to short run length jobs that have a high fixed cost per unit. That means the print business ends up moving backwards on the economies of scale curve.

Remember, these are total industry profits. We know that the profit leaders (top 25% of establishments) historically gather almost all of the industry's profits meaning that the average of other firms is slightly above breakeven and sometimes less.

These data imply that the forces of consolidation (know your ABCs: acqusition, bankruptcy, closure) and strategic re-visioning (content creation, communications logistics, agency models) are all in play. Benefits of cost reductions and process improvements are only temporary in competitive markets when client demands are changing as their media priorities change. The industry is more dynamic than it appears.