Much has been written about what business owners should do to improve the value of their business. So much so, that when it comes to developing a set of priorities to get ready for a sales or other transfer process, uncertainty and confusion reign supreme. Depending on who you listen to, advice favors improving sales, enhancing profits, cash flow or market potential, picking the right advisor, etc. Everyone seems to have their own opinion. The fact is, they all play a role in the buyer's perception of how value correlates to the quality of an acquisition target.

The problem is every buyer in an arms-length process looks at the situation somewhat differently. But every seller should strive to get his business presented and classified as an A++ investment opportunity. The one factor that trumps all others in achieving this objective is how much risk is inherent in the business for the buyer. Understanding and "de-risking" the business should be the seller's number one priority before entering into a sale process. A low risk opportunity helps to position the business above other options, creates a competitive buyer environment, increases value, enhances negotiations and deal terms and minimizes the time to LOI and close. Too much risk can cause a buyer to reject the entire opportunity in short order.

Generally speaking, there is an inverse relationship between risk and quality. The higher the risk in a deal, the lower its quality. So it follows that an A++ deal will have low risk and will get the seller's business on top of the pile for buyers' review. But where does the risk come from, can it be quantified and controlled, and how does it relate to value?

Identifying risk

Some buyers will think of risk in terms of insurance policies and claims, purchase, credit, supply agreements, leases, etc. But there is far more to building a complete picture of a private company's investment risk profile and its impact on value. Investment and valuation professionals will look at a company's planning, leadership, sales, marketing, people, operations, finance as well as legal (or contract) areas. Some investment models take these 8 categories break them down into 45 areas and over 365 factors. They all contain elements of risk; every one of which can be benchmarked against that A++ opportunity. Some are solely under the control of the seller, some are not. Its this benchmarking process that connects the risk profile to valuation and investment quality.

While there are many ways to establish the value of a privately held business, some professional buyers will connect risk to the cost of equity in a projected discounted cash flow (DCF) assessment. In this case, the higher the

risk, the greater the discount rate. Other private equity firms prefer using a hurdle rate that is derived from their commitments to their funding partners to establish a valuation and then try to assess the chances of achieving that return. No matter what approach is employed, risk is a major consideration in the valuation process.

Reducing risk

So, how does an owner go about "de-risking" his business? It starts with a deep and comprehensive dive into all the elements of the business and an objective assessment of where the business stands relative to companies that perform "best in class". From this, a complete risk and quality profile can be developed and tied to a discount rate or cost of equity to establish a valuation in a DCF assessment, investment hurdle rate, or other value calculation. Areas where there is considerable risk that can easily be fixed should be addressed first.

Others that have less impact but also easily fixed can be next and still others that take longer to enhance can be planned out to show improvement over time. In this way, a complete roadmap for improvement can be developed. The whole process can take as long as 2-3 years to reach a high level of performance and low state of risk but the effort will reap huge dividends in terms of value.

Risk vs. Sales vs. Margins

At this point, an owner might ask; "How do you know what's more important; increasing sales, profits or reducing risk?" An illustration might be most helpful is providing direction for the answer.

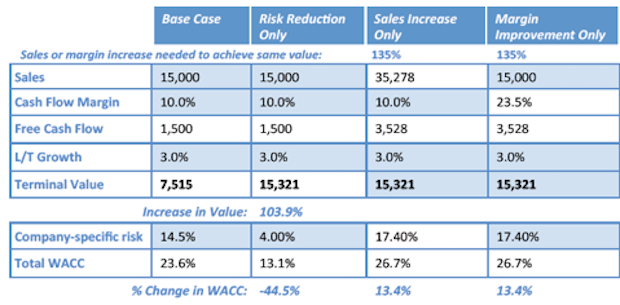

Let's say you have a company with $15 Million in Sales and a 10% Cash Flow Margin. Let's also assume that after analysis, your Company's specific risk (the risk you can control) is 14.5% and your uncontrollable risk is 15% giving you a cost of equity of 29.5% and a total Weighted Average Cost of Capital (WACC) of 23.6%. The terminal value of your company with a 3% long term growth rate would be $7.5 Million. (See Table I below.) It is conceivable for a program that focuses on risk reduction to get controllable risk down to 4% with a resulting 13.1% WACC.

Sensitivity of Risk, Sales and Margin to Valuation. Source Corporate Value Metrics

Accomplishing that could increase the value of your company to $15 Million. That's double the value!

Trying to achieve that same valuation by only growing the top line (with the same cash flow margin) would require annual sales to more than double to $35 Million and your efforts would likely increase the controllable risk and WACC. Similarly, it would take margin of 23.5% to generate the same value. And again, that would not be possible without a likely increase in risk to the business. Now consider a combination.

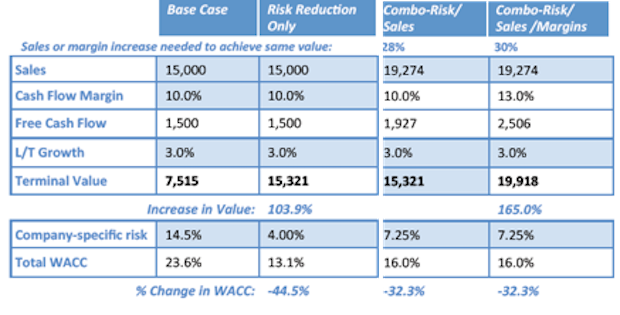

Table II shows the value of the business when combining improvements in risk with sales and risk with both sales and margin. Working on all three and achieving modest goals in each area has a significant impact on value.

Sensitivity of Combining Risk, Sales and Margin. Source Corporate Value Metrics

Structuring the de-risking process

The message here is that risk is critical to a buyer's assessment of an acquisition and de-risking the business is more sensitive to value creation than either increasing sales or improving profits. Attempting to significantly increase sales, or expand margins, without first reducing risk will likely increase risk (and decrease value).

Combining a risk reduction program, as a first step, with subsequent strategies to increase sales and expand margins will achieve a leveraged impact on value due to a lower discount rate applied to higher cash flow. But be aware, this is a process that takes time to implement.

How do you accomplish this? It's not rocket science but it does require a structured process, a solid financial model, knowledge of all the moving parts and an honest, independent assessment of the business. If you are an owner, its the one thing you can do to create a significant return on your investment in your business before entering into a sale process. Chances are, if you haven't done it so far, it won't happen in the future unless you get some professional help. After all, you still have a business to run. Many owners are reluctant to engage professional help because they feel it costs too much. If you are someone who thinks its too expensive to hire a professional, wait until you try doing it yourself or choose to not do it at all.

Discussion

Only verified members can comment.