The number of transaction statement in-plant printers has been in decline for some time, due mainly to a decline in print volumes caused by suppression and more recently the effect of electronic bill presentment, which has become a default option for many who open a new financial or insurance account. The demise has affected mostly small and medium-size in-plants, ones with a handful of production cut-sheet printers, where a 30% drop in volume often makes the cost of producing statements internally no longer cost effective. Larger in-plants still have sufficient volumes to thrive even if their volumes reduce by another 30%, as they typically have the option to reduce the number of in-plant sites from multiple locations to a handful or less. But they too face significant challenges, a circle of problems with few easy answers.

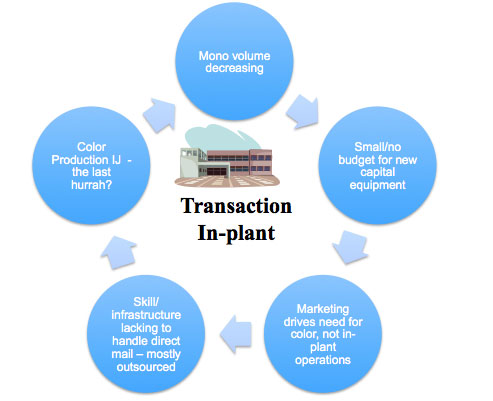

Figure 1: The Transaction In-Plant Production Conundrum

Capacity Utilization: What Are You Doing to Maintain Print Volumes?

In transaction printing, there is often a burst period that may consume five days of peak production, followed by lots of idle time during the rest of the month. While some of the in-plant providers are ultra-efficient and can balance these irregular volume demands due to 20+ years experience and provide print services to their firms at lower costs than independent transaction service bureaus (implying they have little pressure to fill the excess capacity), others are under pressure to keep the machines filled. This challenge has been exacerbated by the consolidation of financial/insurance firms, where through acquisition, many have found themselves with even more excess capacity then before.

What can be done to fill this excess capacity to keep overall unit piece costs low and competitive in the market place? For those in-plants not running seven days per week times 24 hours per day, and those who are not prohibited from taking on outside work during idle times, some are turning to outside print brokers to have them find jobs that are unpredictable in frequency, and that can be printed within the excess capacity time window allotted.

For most, it is difficult to take on other print application work that the parent company requires such as direct mail because they don’t necessarily have the right equipment or skills. Many do not yet have either enough digital color presses to handle the volumes required (and very few have continuous-feed color production printers), and have little budget access to invest in new production color equipment that provides color page volume capacity in excess of potential future need.

A second challenge is that, unlike independent direct mail printing shops, in-plants tend to lack the infrastructure to provide guidance on design/help track response rates. This is not critical for relatively simple and smaller size direct mail campaigns, but it is a challenge for higher-volume efforts.

In some case, like credit card offers, the print volumes are so large (one firm commissioned one billion pages per month) that it is not cost effective to have to buy new production printers to serve that need already handled well by outside independent print providers.

The bottom line is that it is not easy to fill the excess capacity on what are mainly monochrome production printers, and with business shrinking it becomes even more challenging for many to obtain budget to re-invest in new production color printing equipment.

One area where most in-plants are very cost-competitive is cut-sheet digital production color for mainly direct mail-related pieces. This is because the profit margin at independent providers remains high. Several in-plants have grown their print volumes internally by word-of-mouth based upon their ability to produce color print for 25–30% less cost than currently paid by departments that are outsourcing digital color production printing. Once those departments using in-plant color production services realized that by encouraging other departments to in-source color print that their costs would go down as economies of scale improved, they started “shaming” those other departments that were still outsourcing to use the in-plant operation.

Cost Containment: The Daily Battle

In-plant managers are rewarded upon reducing the cost per piece printed, with little credit given for innovation, and no credit for driving up cost. For many in-plant managers, color print is down the bottom of the list of immediate daily concerns.

The most immediate concern is postage cost. Depending on the volumes of the in-plant, postage can represent anywhere from 50–70% of the cost of getting a statement in the hands of the customer. This cost can be somewhat reduced by co-mingling communication with the customer in a single envelope, by using more duplex printing to reduce the number of pages (and weight) inserted into an envelope, and by taking advantage of postal discounts such as the Intelligent Mail Barcode and pre-sorting. One would think that pre-sorting can be easily done electronically before printing the jobs, but many in-plants are dealing with multiple legacy data software formats that cannot be easily synchronized since little money is available to re-write the computer codes. Many therefore send out the windowed envelopes with inserted statements to a third-party sorting house, whose expertise is in maintaining the mechanical sorters needed to sort the mail in order to receive the highest postal discount. Few are able to secure resources to upgrade their computer systems or bring the mechanical sorting in-house.

The second biggest cost issue faced by in-plants is labor cost. Because the volume of print fluctuates dramatically for most firms, many have moved to using a combination of own staff for those functions that require high-knowledge and low-cost temporary service workers for jobs that only take a few days to learn (such as handling inserters). In-plants can have up to 500 temporary employees during peak weeks during the month. The challenge with temporary employees is that legally one cannot use a temporary employee for more than 12 to 18 months, after which time they are legally considered full-time employees. Some in-plants are moving to new employment agreements where they are hiring the temporary employees as “on-call” employees with an agreement that increases their hourly rate above what they earned as temporary workers in exchange for the ability of the company to only pay them when they are needed. Other plants have moved to using “silver bullet” employees, retirees of the company who are highly skilled and who are willing to work at nominal rates during peak times in the month. They often do it for camaraderie reasons, the ability to catch up with old friends, to stay active, and make a little pocket money. The most reliable workers are said to be vocational rehabilitation workers, ones with special needs who once skilled in a task become highly loyal and efficient.

Other areas of cost containment focus are reduction of waste and a movement towards standardization within a firm of size/format. For example, several in-plants cited they are required by their internal customers to handle a specific size/shape envelopes, resulting in a cumulative need of up to 500 different types of envelopes. Rationalizing standard size/shape envelopes provides an immediate savings impact.

This has become even more important with the downturn effects of the recession, as many envelope manufacturers have scaled back their production capabilities, resulting in price increases in envelopes. When buying 100 million envelopes or more of a wide range of shapes and sizes these incremental cost increases matter.

Typically last on the list of cost containment concerns is printing hardware. Most have a good understanding of their costs per printed piece, mailed piece, etc., but few have a detailed awareness of the implication of certain costs associated with printing. For example, one in-plant had recently acquired a continuous-feed color electrophotographic printer whose electricity demands for fusing caused a very high increase in the utility bill. By the time it was installed and up and running, it was too late to control this cost. In looking at hardware, a key concern for in-plants these days is the up-front acquisition cost. Some lease, some purchase, some require a ROI of 18 months, some amortize anything purchased over $250 and others anything over $1 million. These factors greatly depend upon the philosophy and state of business of each respective company. The key finding is that most err in favor of having less capacity when acquiring new hardware rather than acquiring more than they need, but might grow into. This puts many of the inkjet production printer specifications beyond the need of current in-plant desires.

Conclusion

While one might draw the conclusion that there is little hope for moving transaction in-plant printers to production continuous feed color printers, this is not correct. While print volumes at in-plants appear to be on a systemic downward decline, there is great saving to be gained for many by consolidating cut-sheet and monochrome continuous feed electrophotographic printers with production ink jet printers for the simple reason of a reduction in the amount of hardware that needs to be maintained and the productivity benefit that allows for lower cost of consumables.

The hurdle for many is the upfront cost required to switch out their legacy systems, the anticipated ramp up time to move their internal customers to color (which may not matter since they can print lower-cost monochrome output on ink jet printers than electrophotographic printers), and the difficulty in securing any capital budget for equipment as their volumes continue to decrease due to suppression and the impact of electronic communication alternatives.

However, competitive pressure between the various marketing departments of these financial and insurance providers will gradually make color a default requirement. The digital printer manufacturer who is able to provide a duplex color production continuous ink jet system with a real life print volume sweet spot of under five million pages per month with an acquisition cost below $1 million will serve transaction in-plant printers well, enabling them to re-define the value that they provide to their internal customers. There is a need for color, but this need is in a form that has to be accessible to the current state of in-plants.

Discussion

By Bob Neubauer on Dec 19, 2013

Where is your supporting data to back up statements like "The number of transaction statement in-plant printers has been in decline for some time" along with many other contentions in this piece? While many of your points are insightful, your assessment of the in-plant market seems to rely on the general popular feeling about in-plants rather than actual research. (I'm not saying you didn't do any, but this piece does not refer to any.)

Also, your statement that "This puts many of the inkjet production printer specifications beyond the need of current in-plant desires" seems to overlook several recent installations of production inkjet presses at in-plants.

By Marco Boer on Jan 02, 2014

Hi Bob,

You are right that we can't statistically prove the actual number of in-plant printing operations that have been outsourced, but based upon the hundreds of interviews we conduct we know that the large transaction print service providers are taking on ever more customers while their page volumes remain flat. What is happening is that the large print service providers are seeing their large customer print volumes decline, but they are able to keep print volumes level by taking on more and more smaller customers (the in-plants). Collaborating this is that we're seeing more and more outsourcing by local/regional banks in particular to the large transaction print service providers as those banks are reluctant to re-invest in new printing equipment as their print volumes too decline.

Marco Boer