The potential of digital print is broadening, and packaging companies are only just beginning to realise the benefits on offer in terms of personalisation, customer engagement and integration with online campaigns.

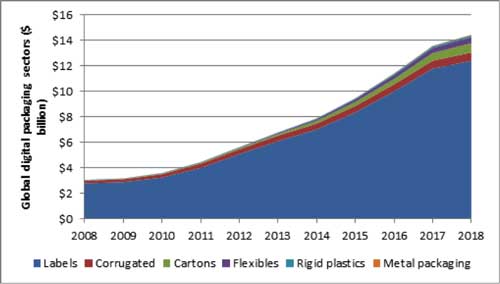

The industry is growing rapidly, and doesn’t show signs of slowing down any time soon. Estimated to be worth $7.3 billion in 2013, the digital print for packaging market is forecast to reach $15.3 billion by 2018 according to The Future of Digital Print for Packaging to 2018, a new market report from Smithers Pira.

So what are the reasons behind this impressive growth rate? Firstly, digital print offers many advantages to packaging companies. It can be a successful method of driving traffic and creating a buzz around a brand, as proven by Coca Cola’s global “Share a Coke With . . .” campaign this summer. Designed to allow customers to ‘share a coke’ with friends, family and loved ones, the initiative featured a number of the world’s most popular names digitally printed onto 375ml and 500ml bottles of Coca Cola.

“Share a Coke” took advantage of the variable data capability of digital presses, and used versioning and personalisation to roll out the campaign in 35 European countries over 750 million packs. Without digital print the project would not have been possible; printing the labels using analogue methods would give the same number of individual bottles, but they would then be labelled and delivered together. Randomly printing names sequentially is the only way to get the right distribution at the point of sale.

As part of their campaign, Coca Cola produced over a billion labels; putting the widespread notion that digital is only suitable for short runs into perspective. The campaign was the largest job on record for Indigo label presses, and increased both social media engagement and sales. And its effect reached way beyond consumers. “Share a Coke” has shown the packaging industry what is possible, created enormous interest, and pushed digital label acceptance forward in companies of all shapes and sizes. In fact, labels account for the bulk of digital printing market share – in 2013, their value will be $6 billion, 89.6% of all digital packaging.

There are a number of other drivers behind the evolution of digital print. One major factor is the ability to produce short print runs economically, as packaging buyers continue to search for ways to engage with customers using innovative methods. Printing on demand means less waste, ensuring that new designs or changes in ingredients don’t result in redundant stock. Technological developments in inkjet and electrophotography are meaning that digital print is becoming increasingly accessible and cost-effective for all kinds of companies, big and small.

There are a number of other drivers behind the evolution of digital print. One major factor is the ability to produce short print runs economically, as packaging buyers continue to search for ways to engage with customers using innovative methods. Printing on demand means less waste, ensuring that new designs or changes in ingredients don’t result in redundant stock. Technological developments in inkjet and electrophotography are meaning that digital print is becoming increasingly accessible and cost-effective for all kinds of companies, big and small.

Despite all of the advantages on offer, there has historically been reluctance in the industry to adopt digital printing processes on a large scale. A general lack of knowledge in the sector coupled with a perception that the process is expensive and difficult to manage has meant digital printing has evolved more slowly in the past. However, after successful campaigns like “Share a Coke”, it seems that more and more companies need to consider digital print to avoid being left behind in this fast-moving market.

All information and data is taken from The Future of Digital Print for Packaging to 2018, a new market report from Smithers Pira. This study provides a detailed explanation of these and other trends to give your business actionable insights into the industry's market over the next five years. Quantitative market sizes and strategic forecasts, broken down by end-use, region and technology, are combined with exclusive tables and in-depth research to provide an extensive informed discussion of factors shaping the future of digital print.

How will this Market Intelligence Report benefit you?

- Gain insight into new print systems and workflows being developed to bring longer print runs within digital packaging's competitive cost structures.

- Up-to-date information on market drivers will ensure you're ready for packaging opportunities arising from new applications and consumer trends in point-of-sale marketing and product personalization.

- Use our industry-wide knowledge of technical developments - a perspective unavailable from equipment vendors and single market reports - to benefit your strategic planning.

For more information about this report, please contact Steve Hill, [email protected].

If you want to learn more about digital print and discuss key issues with other individuals in the industry, why not attend Digital Print for Packaging? Bringing together a range of quality speakers across a broad spectrum of topics, this conference is unmissable whether you’re considering digital print for your business, or would just like to know a little more about the industry. Don’t miss out and book your place now.

Discussion

By Kevin Karstedt on Dec 10, 2013

Steve,

Good points on the desire for digital in packaging overall. In working with both Brand Owners and Packaging Converters (of all types) there truly is a desire for the benefits digital printing can bring them. Those on the Marketing side at Brand Owner are looking for stronger customer engagement, those in Operations are looking for advantages in getting product from raw materials to distribution centers. Converters are looking to get orders filled more effectively, utilizing manufacturing assets more efficiently and getting more orders produced and delivered then they have in the past.

Digital printing holds some promise for meeting these unmet needs. The label sector is positioned to grow as your research indicates. There continues to be innovation in that area as evidenced by the number of exhibitors and followup sales coming out of LabelExpo. What has helped this sector to lead the way is the development of systems enhancing the input and output of the digital systems. This includes MIS and Prepress Workflow on the front end and Finishing of many types on the back end.

The next domino to fall in packaging will be Folding Cartons but there are some issues that need to be addressed before that will happen in ernest. The front end needs in cartons, and the other packaging types as well, can be handled by existing systems with some modifications for digital presses and the increased volume of orders that result. The bottleneck shift to finishing will be the most significant challenge. We have seen an increasing acceptance of the 30 inch format size by carton manufactures and there have been a good number of "half size" analog high productivity presses sold into this market over the past 2-3 years. These presses are being used for orders of 5000 cartons or less on a regular basis. This tells us that converters have found ways to finish short run half size sheets through conventional assets effectively, this also bodes well for the implementation of digital printing systems for cartons.

The next hurtle is less technical and more marketing... digital press manufactures do not really understand where their presses fit in addressing the unmet needs of that sector. Too often we are seeing marketing materials that talk of the marketing benefits of running personalized packaging through digital presses. While that is the "sexy" opportunity and there is a market for it, the real need is for production efficiencies and operational relief in the supply chain. If the personalization programs will yield X dollars over the next 5 years operational relief will yield 100X or even 1000X. My bet is on the down and dirty grunt work that needs to be addressed in the supply chain. The sexy stuff will continue to get all the press while the heavy lifting will get the investment.

Any others want to chime in?

By Andrew Copley on Dec 12, 2013

Indeed, digital printing offers numerous opportunities including regionalization, seasonal, event and affinity customization. There are literally millions of customization opportunities that brand owners can take advantage of as the economics of packaging shift from mass production to mass customization. Now is the time to get acquainted with what digital printing can offer - Xerox discussed this topic in a blog post found here: http://xerox.bz/1kwam2b. – Andrew Copley, Senior Vice President/General Manager, Graphics Communications Business Group, Xerox