By Ed Crowley

Thus far in this series on product strategy we have discussed how a sustainable product strategy is critical to success, regardless of whether you are a multinational manufacturing company or a local printing press. We have also discussed the 7 deadly sins of product strategy. In this article we will discuss the first step in building the product strategy--market scanning and roadmapping.

Market Scanning?

Market scanning is the process of continually and actively monitoring the external environment in order to identify customer needs, anticipate competitive actions, and, identify technological changes which will provide new market opportunities or market disruptions. Note the emphasis on the word active. This is not something that should be done passively or on an exception basis. Companies must constantly be probing and exploring the external environment to identify significant changes and explore competitive activity.

Companies must constantly be probing and exploring the external environment to identify significant changes and explore competitive activity.

So how do you scan the market? Does continually surveying customers and potential customers require a massive marketing research budget? The short answer is 'no'. While market research should be an integral part of any strategy development effort, there are many methods of scanning the market in addition to traditional large scale surveys. Examples include:

- Sales Force Intelligence: Your sales force is always 'in the market'. They are speaking to customers and meeting with prospects. From this unique vantage point, sales people are in a position to learn about competitor's activities, customer requirements, and other market changes. The key is to structure an incentive that makes it worth the salesperson's time to capture this information. It is important to offer an easy method for the salesperson to report this information via an intranet site or email. It is very easy to create a corporate intranet site for capturing the information, and to create a 'contest' for the sales people. The person turning in the best competitive tip being rewarded with a trip or cash.

Structure an incentive that makes it worth the salesperson's time to capture information about a competitor's activities.

- Customer Feedback: Capturing customer feedback is one of the easiest, but most often overlooked methods of capturing market information. Clearly, the first step is to understand how you are doing by capturing customer satisfaction feedback through response cards and online customer feedback forms. But why stop there? Forming customer councils is a great way to understand how customers' needs are changing and to obtain the customers' perspective on ideas for new programs or products. This has an added benefit of increasing customer loyalty by reinforcing the value of their feedback and opinions.

- Purchasing Intelligence: Your purchasing or buying team can be an excellent source of competitive and market intelligence. Suppliers can be an invaluable source of competitive intelligence. Understanding when components or supplies are in high demand can often be a good tip off that competitors are preparing for a major product launch, or provide insight into what products and/or services are selling well for competitors.

Customer councils are a great way to obtain insights into customer's perspectives and how their needs are changing.

- Market Research: I would be remiss if I didn't mention the value and power of traditional research. From quantitative surveys to qualitative focus groups, there are many affordable methodologies for probing the market to understand pricing trends, new product development optimization, and other issues central to defining the product strategy.

Roadmaps

Once you have captured this information, what next? How can the information be used? One of the key tools used in developing product strategy are roadmaps. These roadmaps are simply a projection into the future of how the market will evolve.

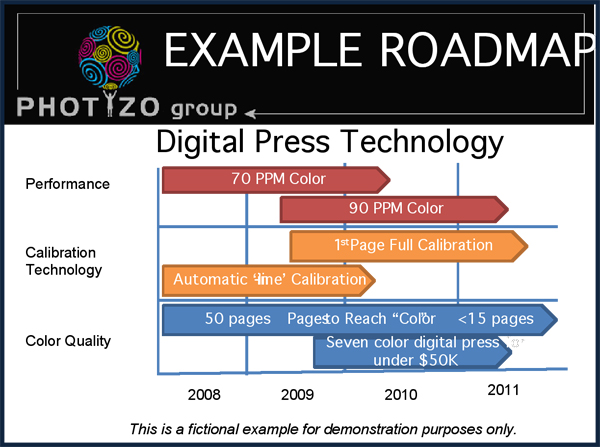

The graphic at right demonstrates a technology roadmap. While roadmaps come in many different shapes and forms, they all contain a timeline, and defined attributes which are meaningful to the strategic assessment.

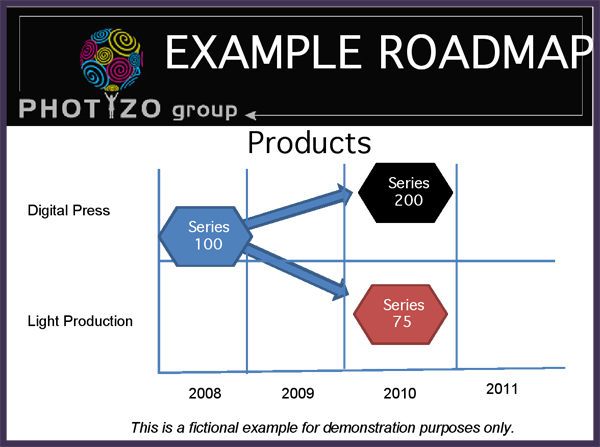

Typical roadmaps will cover the technology landscape, planned products, customer requirements, and even regulatory issues. The second graphic displays an example product roadmap. In order to fully describe the external market, firms may have as many as 20 or 30 roadmaps.

Roadmaps serve several key roles in the strategic planning process:

- They act as a shared repository of market knowledge.

- Developing the roadmap requires collaboration and agreement across the organization. This consensus- driven process is almost as valuable as the roadmap itself. It avoids wasting time arguing about whether a feature or product is needed. In the process of developing the roadmap, the consensus has already been reached.

- It provides a method for quickly communicating the critical issues affecting the strategy, and ultimately represents a method for communicating the product strategy itself across the organization.

One of the important aspects of a successful product strategy process is identifying the process owner. By process owner, I mean the individual who will ensure the process is followed, document the process, and lead post-mortems to make sure the process is updated over time. Note that this process owner does not have final say over the decisions about what goes onto the maps. The decisions about what goes into the maps is a shared decision, the process owner is responsible for ensuring the maps are updated and that the process is followed. This process owner can be a global marketing team, product development team, or corporate strategy group.

One of the important aspects of a successful product strategy process is identifying the process owner.

Smaller organizations with limited staffs may not have the resources to manage this process internally. However, a good marketing consultant should be able to fill this role for a reasonable fee, or at least assist the company in starting the process by developing the initial roadmaps. Once the roadmaps are developed, the time and resource required for maintenance falls considerably, allowing the small firm to bring this function in house. There is no 'one size fits all' approach to creating a strategy process. In order to be successful, the process must be modified to meet the needs of your particular market, organization, and resources.

We have just scratched the surface of market scanning and creating product roadmaps in this article. However, I hope that I have given you enough information to conceptualize the process and think of ways it could benefit your organization. Please feel free to contact me with questions and comments on this crucial topic.