The future of print will increasingly be individually customized with the images we want, delivered wherever we want, printed on demand when we want, and applied to whatever products we choose – The Target Report, May 2021.

This inexorable trend has accelerated in the Covid and post-Covid periods. Initially, social distancing and the ease of online ordering was a factor, as was the desire to spruce up our personal at-home spaces with personalized décor. Going online first to order unique items is now often the go-to first response, picking up the phone and engaging in personal interaction a comparative nuisance. Ordering many types of printed items is no exception.

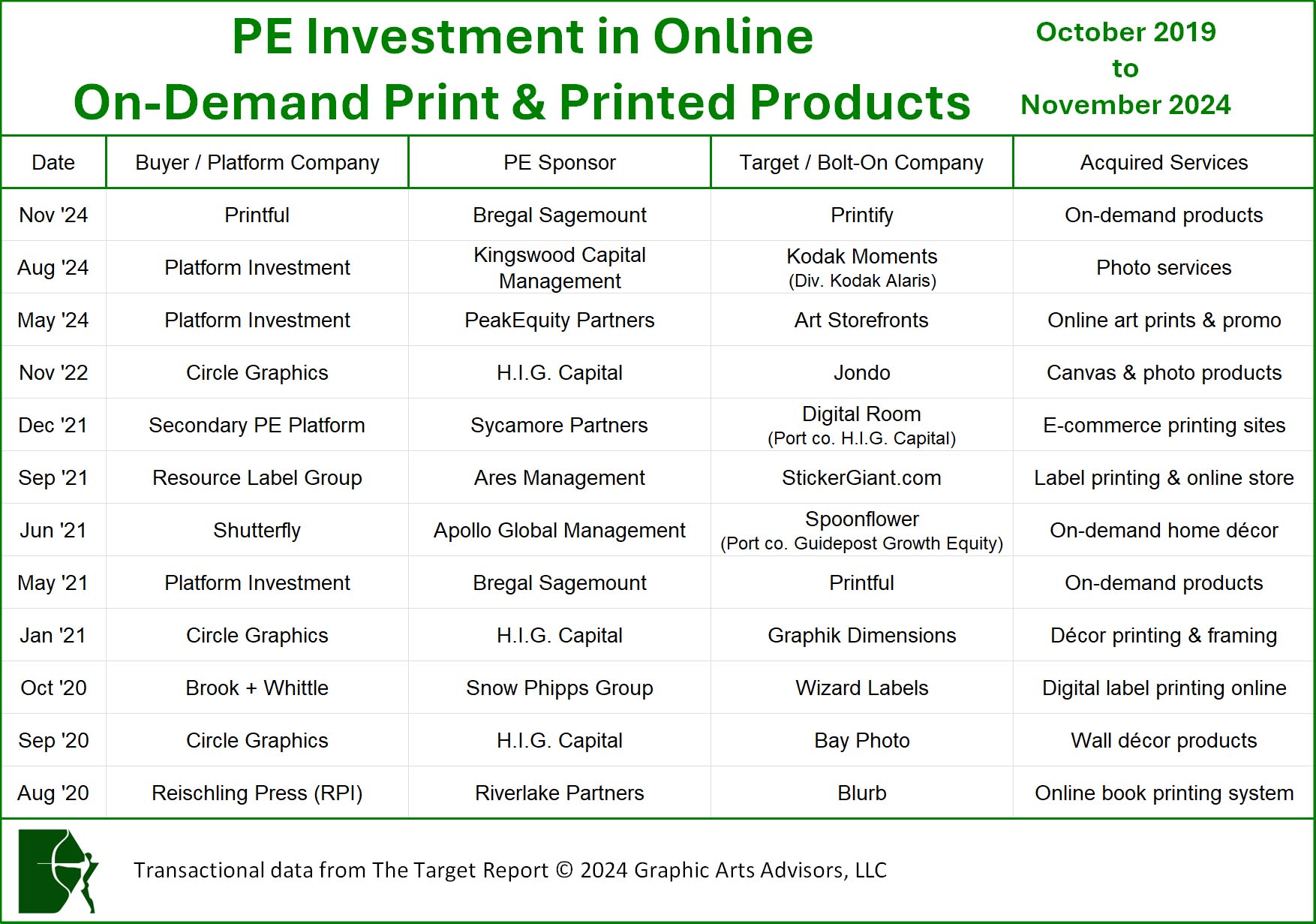

Building a robust and efficient online system has increasingly been accomplished with the support of well-heeled private equity funds seeking the higher margins possible with the scale and automation obtainable in an online environment.

Two Online Print Businesses Merge, Different Models Remain

Printful and Printify announced on November 5th that the companies will merge in what is being billed as a merger of equals. By the 20th of the month, the shareholders and regulatory authorities had indicated final approval of the transaction, and the new executive team positions were announced. The Printful CEO will be the new CEO of the merged company, taking the top position, while the Printify CEO is now the President and Head of Platform. The two brands will continue to operate separately, at least for now, with the name of the holding company still undetermined.

Both companies are providing what is known as white-label services to hundreds of thousands of independent resellers of on-demand printed products. In a white-label business, the manufacturer produces products that can be sold under the reseller’s brand. Designers offer unique products under their own name, logo, and brand identity, never revealing that the product was made by others. With the white-label strategy, the two sites support a thriving network of online designers and retailers, many of which self-identify as being part of the “Print-On-Demand Community.”

When the merger was announced, the influencers on YouTube that act as self-appointed print-on-demand consultants were all in a dither about the merger, but they quickly coalesced in a near unanimous and positive opinion that the merger was good for the Community.

There are several major categories that are the primary driver of revenue on both systems. Apparel is the number one featured category. Personalization is available on a multitude of wearable items, from the expected tee?shirts, hoodies, hats, and jackets, to more unique items such as swim trunks and sports bras, all of which can be individualized with print. Other categories include home and office décor, drinkware, stationery, and customized gift items. The merged company can now offer in excess of one thousand distinct products.

Theirs is a tale of two business models that are fundamentally different. Printful, founded in 2013, is an online print-on-demand service that owns and manages its production facilities, and with fulfillment centers in North America and Europe. Printing technology utilized by Printful in its manufacturing sites includes Kornit Digital fabric printers and the Coloreel embroidery system. (For more on Coloreel, see: The Target Report: Troubled Times for Graphic Machinery Innovators – July 2024.)

On the other hand, Printify, founded in 2015, is purely a technology company that acts as an intermediary, connecting its creator community to 85 third-party pre-qualified suppliers. Based on this asset-light model, Printify is able to offer a much broader product range and wider geographic footprint, including manufacturing partners in China, Australia, the US, and multiple countries in Europe. If you want to offer customized dog collars, Printify is the way to go.

As one Reddit user put it: “Printful makes stuff. Printify lists products made by different manufacturers.” In both cases, the companies have prospered by serving the print-on-demand community in the new diversified universe of design-driven retailers, sometimes dubbed the “creator economy.”

Institutional Investors Provided the Capital to Fuel the Growth

In May of 2021, Bregal Sagemount, a private equity fund based in New York City, invested $130 million in Printful. Based on the percentage of equity acquired, the investment implied that the enterprise value of Printful exceeded $1 billion, giving the company the right to claim “unicorn” status, a first for any company that was originally based in Latvia. (See The Target Report: On Demand Everything – May 2021).

Printify, also originally based in Latvia, obtained a $45 million venture capital investment from Index Ventures, among other early investors, to fund the company’s growth during its startup phase. In a heartfelt congratulatory posting, a principal investor at Index Ventures has this to say about the merger: “While the two companies share cultural DNA, their journeys affirm that there’s no single blueprint for building a high-growth startup. Their different paths—one building manufacturing capacity, the other a marketplace; one expanding to the US early, the other doubling down on European talent – prove that companies can take different routes to the same summit.”

Reading between the lines, TechCrunch, a technology news website, opined that the recent announcement “underscores the struggles that startups in the on-demand manufacturing space, and the creator economy, are facing as stand-alone companies. Funding for later-stage startups has been especially challenging in Europe over the last several years, and it looks like 2025 will be no exception.” With that understanding as a backdrop, we can see that the use of a merger transaction enables these two companies that serve a common market to build scale without the need for an extensive recapitalization or sale to a bigger private equity firm in a secondary buyout. At least not yet.

The Money is Betting on Print On Demand

Over the past five years, we have identified 315 investments by private equity funds in companies in the printing, packaging, and related industries. While the number of investments in print-on-demand businesses is a sliver of the total, in the world of online print these transactions are significant. These investments provide the capital needed to scale, automate, and transform print business models. Investors are keen on businesses that harness digital solutions to streamline order intake, optimize production, and enhance customer experience.

Customizable product platforms like those offered by Printful and Printify have set new benchmarks for ease of use, increased the variety of printable items offered, and enabled the ability to personalize at the level of one. Private equity firms are investing in companies that can offer these services at scale, and that hold out the promise for future growth. While the two companies featured in our commentary this month principally print on apparel and promotional items, the same dynamics are at play in the commercial printing market segment with companies such as Digital Room and Circle Graphics. Traditional printing companies that ignore these trends risk obsolescence and increased competitive pressure from online printing companies of all sorts.

View The Target Report online, complete with deal logs and source links for November 2024