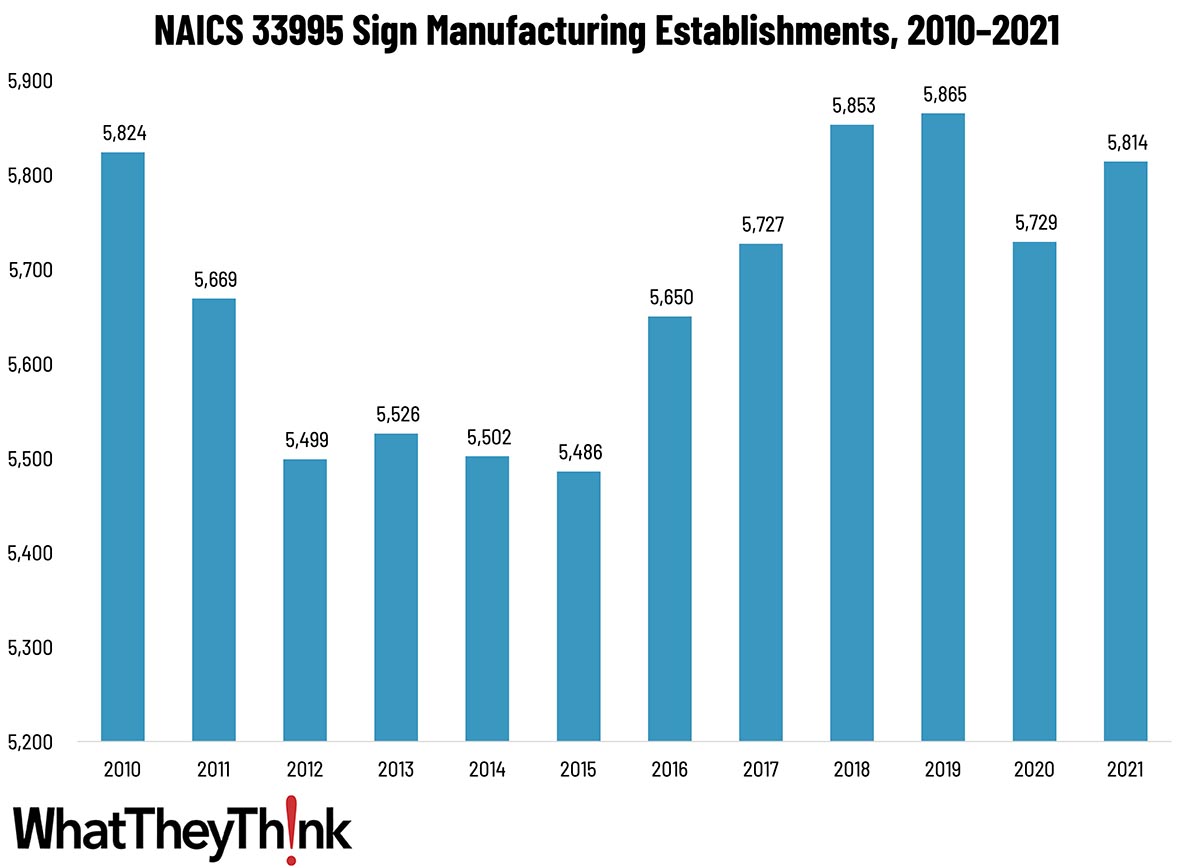

According to County Business Patterns, in 2010, there were 5,824 establishments in NAICS 33995 (Sign Manufacturing). Establishments in this NAICS category declined in the wake of the Great Recession, ultimately climbing back up to 5,865 establishments in 2019, dropping in 2020, and then climbing back up to 5,814 in 2021.

The Bureau of the Census definition for this business classification:

This industry comprises establishments primarily engaged in manufacturing signs and related displays of all materials (except printing paper and paperboard signs, notices, displays).

During and in the immediate aftermath of the Great Recession, there was decreased demand for signage, which didn’t reverse itself until new business began forming as the economy improved, and existing companies underwent a rebrand. By the end of the decade, rebrand cycles were shorter, while at the same time consolidation in verticals such as healthcare and banking drove up the demand for new signage projects. The years preceding the pandemic saw a lot of business expansion, with chains opening new locations. All these trends drove up the demand for signage, which in turn drove up the number of providers of signage.

The way the Census Bureau captures establishment counts means that any sign manufacturing business that existed at all in 2020 was included—which means that the drop in establishments was not due to the COVID pandemic; indeed, the climb in 2021 represents the net change in establishments due to COVID. Signage and display graphics were growth areas during the pandemic.

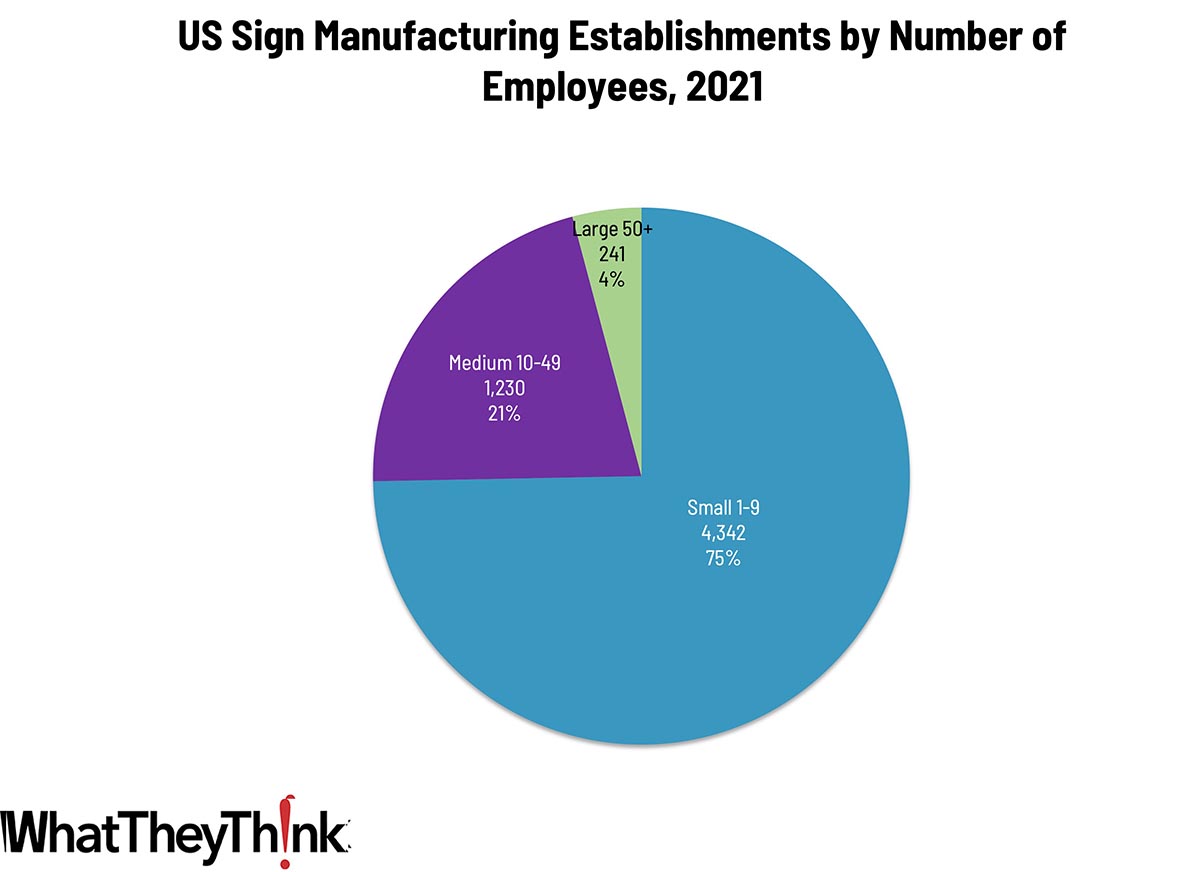

Establishments in this category are concentrated at the small end, with 75% having 1–9 employees, 21% having 10–49 employees, and only 4% having more than 50 employees.

Next up in our data slice’n’dice series:

- NAICS 541850 Display/Outdoor Advertising

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment

Yesterday, in the third estimate of Q2 GDP, the Bureau of Economic Analysis left growth unrevised at 3.0%, and revised up Q1 GDP from 1.4% to 1.6%. Q3 is nearly over, and as of September 18 the Atlanta Fed’s GDPNow is forecasting growth of 2.9%.

Meanwhile, the Bureau of Labor Statistics released their Annual Consumer Expenditures for 2023.

Average annual expenditures for all consumer units in 2023 were $77,280, a 5.9-percent increase from 2022, the U.S. Bureau of Labor Statistics (BLS) reported today. During the same period, the Consumer Price Index for All Urban Consumers (CPI-U) rose 4.1 percent, and average income before taxes increased 8.3 percent.

So things are still looking pretty good economy-wise.