Like all industries, packaging is under tremendous pressure and undergoing radical change. Although many of these changes can be credited to the pandemic, these changes, including e-commerce, shorter runs, and co-packing, have been in the works for a while.

Last month’s WhatTheyThink webinar “Labels and Packaging Are Transforming,” part of the Technology Outlook Week LunchNLearn Webinar Series, looked at key drivers of this transformation. The archive for this webinar is available here.

First, the Numbers…

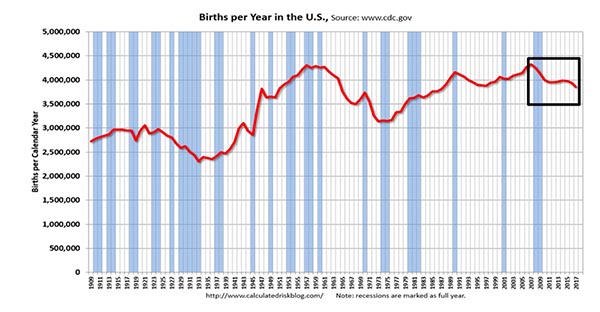

First and most importantly, packaging is growing.

|

Labels |

13.41% |

2022 – 2027 |

|

Folding Carton |

14.38% |

2022 – 2027 |

|

Flexible Packaging |

17.80% |

2022 – 2027 |

|

Corrugated |

13.79% |

2022 - 2027 |

Source: Zwang & Co.

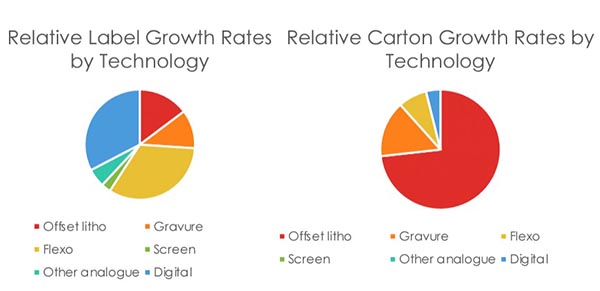

David Zwang of Zwang & Co., who served as the presenter for the webinar, points to growth in the flexible packaging market, in particular—growth that is being driven by Asia and the Pacific Rim and that is now moving into the Western markets. We are seeing strong growth in labels and folding cartons, as well as corrugated and corrugated pre-print thanks to an explosion of e-commerce and a drive toward sustainability.

Source: Zwang & Co.

Source: Zwang & Co.

The fastest growing segment of each market? Digital, which is growing at 11% CAGR between 2020 and 2027. Most of this growth, Zwang points out, is coming from digital folding cartons, a market that is forecast to grow at 32% CAGR in that same period.

The sub-market to watch? EP folding cartons.

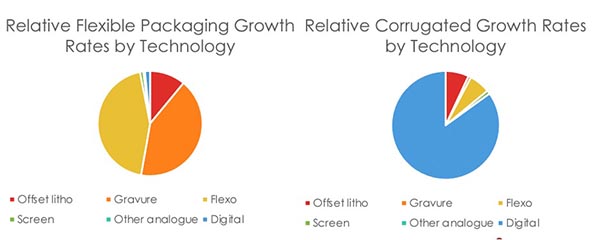

What about digital flexible packaging? At 63% CAGR, the numbers are truly impressive. However, Zwang points out that this growth is starting from a very small base, and as a market, flexible packaging has its challenges. “The issue is sustainability,” he explains. “We’re seeing increased growth in flexible packaging for food, and now you have to worry about food contact, both direct and indirect, plus all the additional finishing.”

Technology to the Rescue

Here, however, it is technology to the rescue. Companies like Miyakoshi, Screen, Xeikon, Fujijfilm, and HP are driving innovations to address these challenges, both in the short- and long-terms.

But while growth rates for the various markets are impressive, don’t get overly excited about them, Zwang cautions. Not only are these high growth percentages are starting from a much lower baseline than analog, but analog processes just keep getting better, too.

“Digital may eventually overtake analog processes, but not in my lifetime,” Zwang explains. “There are certain costs and economies of scale when you start looking at some of these analog technologies, especially as they get digitalized.”

Watch for Innovations

Currently, the fastest growth is in EP flexible packaging, but watch for introduction of new technologies here, as well, specifically on the inkjet side. These introductions are designed to address many of the challenges faced by digital flexible packaging, including the lack of labor.

Speaking of digitalization of analog processes, it’s important to remember that, despite the hype and “sexy” discussion around fully digital presses, companies like Heidelberg, KBA, and Komori are adding levels of innovation to analog presses that are keeping them highly competitive against the digital space.

“You look at these players, and all of their presses have been digitalized to the point where, in some cases, it's almost hands-free,” says Zwang. “You have automatic plate loading and pretty much automated makereadies at rates of 22,000 sheets an hour. It’s hard to keep up with that in a digital environment. Plus, you have a notably lower cost of ink.”

Omet, Mark Andy, Uteco, Edale and Soma are digitalizing their flexo devices, as well.

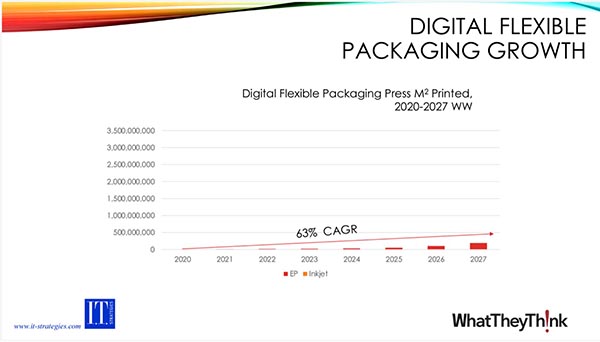

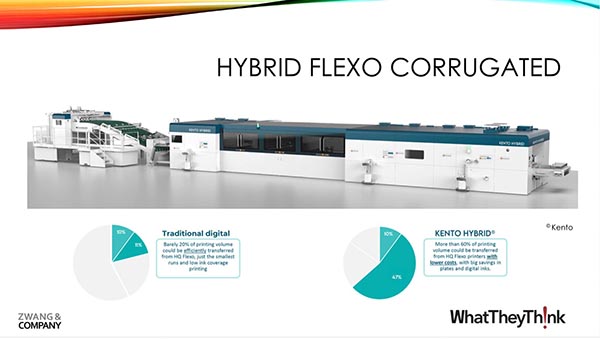

Don’t Overlook Hybrids

Then there are hybrid all-in-one label devices like the Kento. “In this case, hybrid means there's flexo and inkjet,” says Zwang. “You can potentially even add converting equipment to the line, as well, so you can make it an application-based solution. We're starting to see a lot more of these applications-based solutions out there.”

Lest you be like a hound dog with its nose to the ground in your search for presses, be aware that China is introducing its own solutions, as well. (Which makes sense, since many of these same companies are supplying parts for the traditional U.S. brand names.) Zwang notes that about 25% of the equipment shown at Label Expo was from China.

For a full list of equipment in each of the packaging markets, see the full webinar here.

Who’s Running the Presses?

Of course, there are other factors impacting the packaging market—e-commerce, sustainability, regional conflicts, energy costs—but the big one, notes Zwang, is labor, and it’s not going to get better any time soon. Not only are fewer people seeing the printing industry as a viable career option, but there are fewer people coming into the job market altogether.

Source: Zwang & Co.

Blame, in part, the drop in global fertility rate. “The global fertility rate has more than halved over the past 70 years, from around five children for each female in 1950 to 2.2 children in 2021,” he says. “Over half of all countries and territories (110 of 204) are below the population replacement level of 2.1 births per female as of 2021.”

Add to this the industry’s competition with higher-wage jobs like Amazon, which pays up to $30 per hour, and the packaging industry is facing not just a labor shortage, but a long-term one.

Fortunately, the digitalization of analog processes makes these presses much more productive, faster, with less makeready, allowing the industry to address some of these concerns. “This level of automation is making that much easier for new people coming into the industry so that that skill level is becoming less of a factor,” says Zwang.

“It Ain’t Finished ’Til It’s Finished”

As the old saying goes, “It ain't finished until it’s finished,” so Zwang rounded out the session with a discussion of converting equipment designed to handle quick turns, quick makereadies, and shorter runs. Specifically, solutions from Rollem and Kolbus, as well as production die-cutters, automated folder-gluers, and embellishers.

No discussion about the future would be complete without robots, cobots, and mobots—from the likes of HP Indigo, Heidelberg and Konica-Minolta—as well as the connected supply chain. Too much to cover in a WhatTheyThink article, but fortunately, there are replays!

Looking over the entirety of the data set and equipment options, Zwang concludes: “There's an evolution that's happening here that is very exciting. These are the types of technologies that are going to allow the industry to keep up with the growth rates we’re seeing.”

When people come up to him, asking about which press to purchase, Zwang always gives them the same answer: Start with the application. “You may not need 12,000 sheets an hour. You may not need 22,000 sheets an hour,” he says. “Depending on the market you're supplying and what your real needs are, you’ve got an incredible range of options now, and that range is continually being enhanced.”

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free