Drawing on six years’ worth of Print Business Outlook surveys, our “Tales from the Database” series looks at historical data to see if we can spot any particular hardware, software or business trends. This issue is our Technology Outlook, so I rounded up some technology outlook-related (or at least adjacent) challenges and investments, as well as our periodic question about the extent to which print businesses are looking to expand into new product areas.

These surveys form the basis of our annual Printing Outlook reports, and in every survey, we ask a broad cross-section of print businesses about business conditions, business challenges, new business opportunities and planned investments. In our Business Outlook reports, we tend to focus (obviously) on the most recent survey data, occasionally looking back a survey or two to see how these items have changed in the short-term. Plumbing the depths of our survey database can give us a better sense of how these trends have changed since the mid-2010s.

Keeping Up with Technology

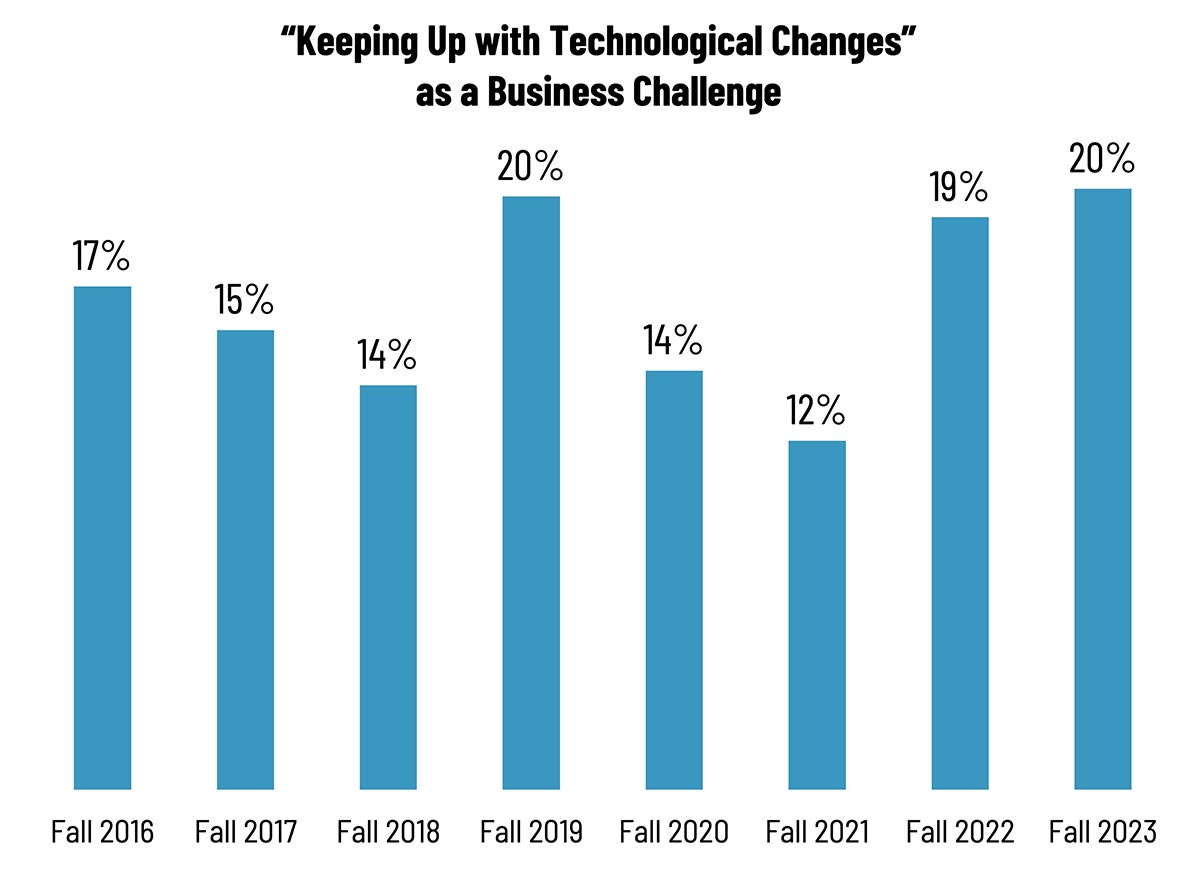

A challenge that has appeared on every survey—and even those going back to the old TrendWatch days—is “keeping up with technology.” Looking at how this challenge has been perceived over the past seven years, we find that it is not a major one (in 2023 it was the number 12 challenge and while it has historically been a top 20 challenge, it’s not a top of mind issue. There was a spike in 2019, likely because our survey was in the field right around PRINTING United, and the run up to the show likely whetted some interest into updating or upgrading some aspects of the plant. The last pre-pandemic year also boasted the best business conditions in recent memory, so shops had all that much more reason to be looking at new technologies. The challenge has peaked in the last two surveys, and we suspect a lot of that is not necessarily hardware-related; 2022 was when DALL-E and ChatGPT emerged, putting AI on everyone’s radar—and if there was one technological change that could be seen a challenge, AI would be it. No one is still entirely certain where it will end up. There other aspects to print business software that could be challenging, as well—such as even just using print business software.

WhatTheyThink Print Business Outlook Surveys, 2016–2023

Planned Investments

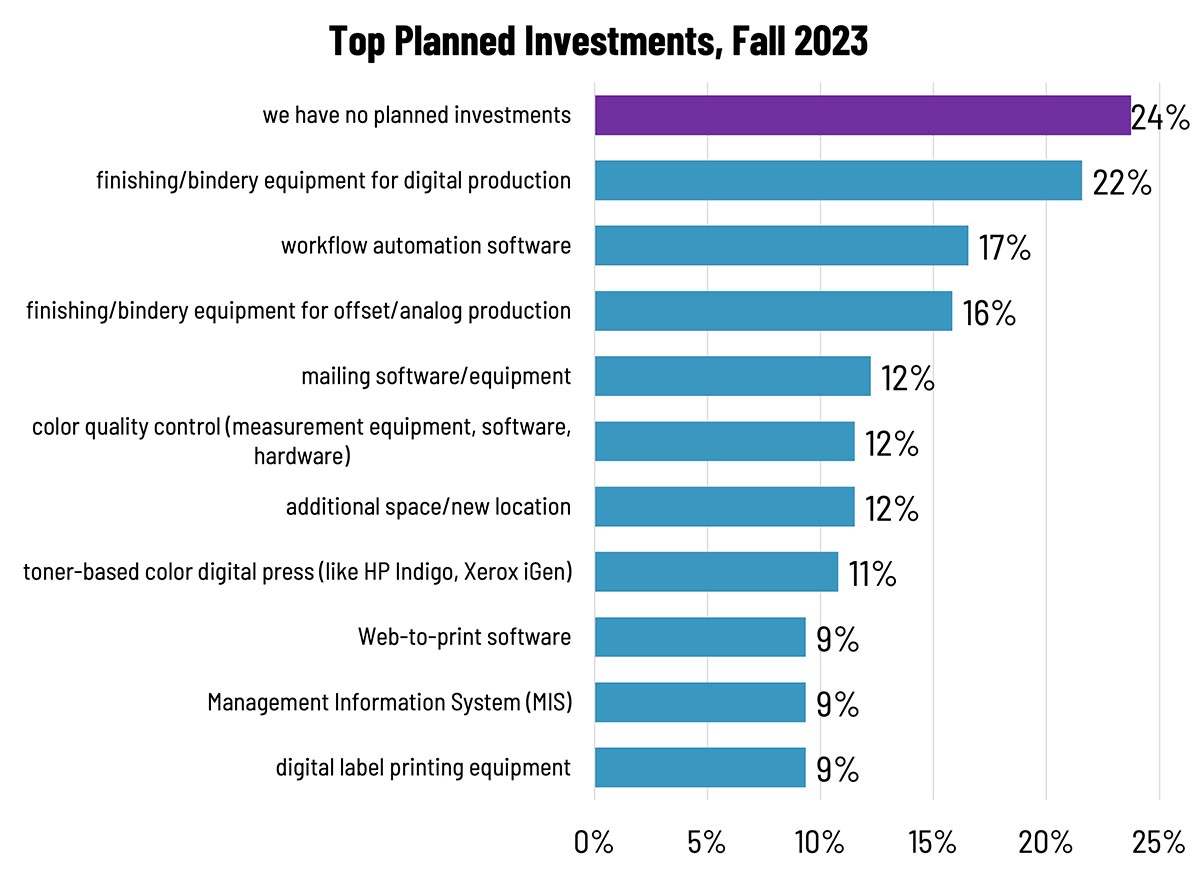

The top planned investments from our most recent survey (Fall 2023) show a great interest in post-printing equipment—binding and finishing (for digital and analog equipment) and mailing—as well as software.

WhatTheyThink Print Business Outlook Survey, 2023

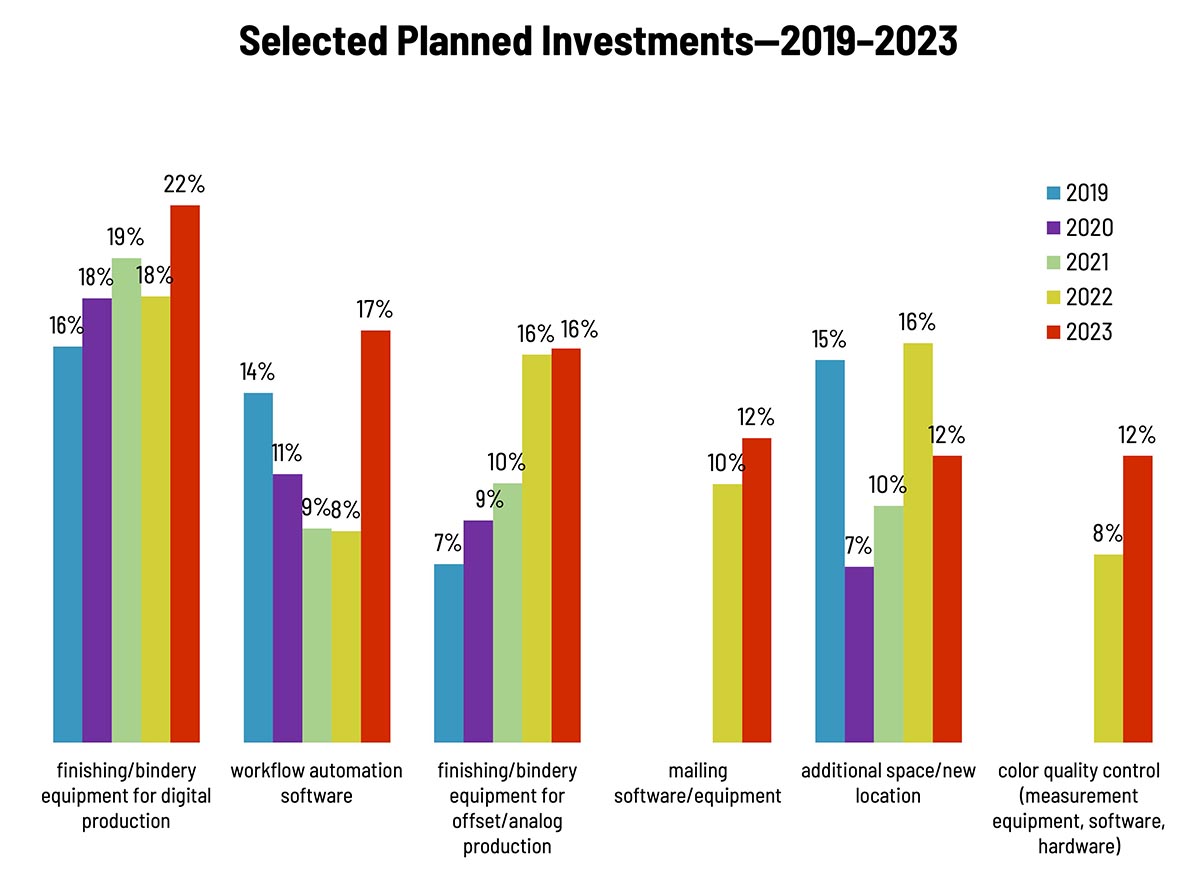

I took the top six items and platted them back to 2019 to see how the product categories ebbed and flowed. (I would have liked to do more but then I would need to output the chart on a wide-format printer.) Finishing equipment for both digital and analog has been a hot area, but finishing for offset/analog had a bit of a growth spurt in 2022; as Patrick Henry points out later in this issue, offset printing is very much alive and well and modern presses have made offset more and more competitive with digital—even production inkjet. Workflow automation software dropped to its lowest ebb in 2022, but spiked to its zenith a year later. We added “mailing software/equipment” in 2022 after noticing it had been a big write-in response in the prior couple of surveys, and it has only become more popular. “Additional space/new location” spiked in 2022—by that point, it was possible to determine if the effect of the pandemic would require a bigger location to expand capacity/capabilities or a smaller location that needed only a shop floor as work from home precluded the need for what Jen Matt used to call “the carpeted areas of the business.”

WhatTheyThink Print Business Outlook Surveys, 2019–2023

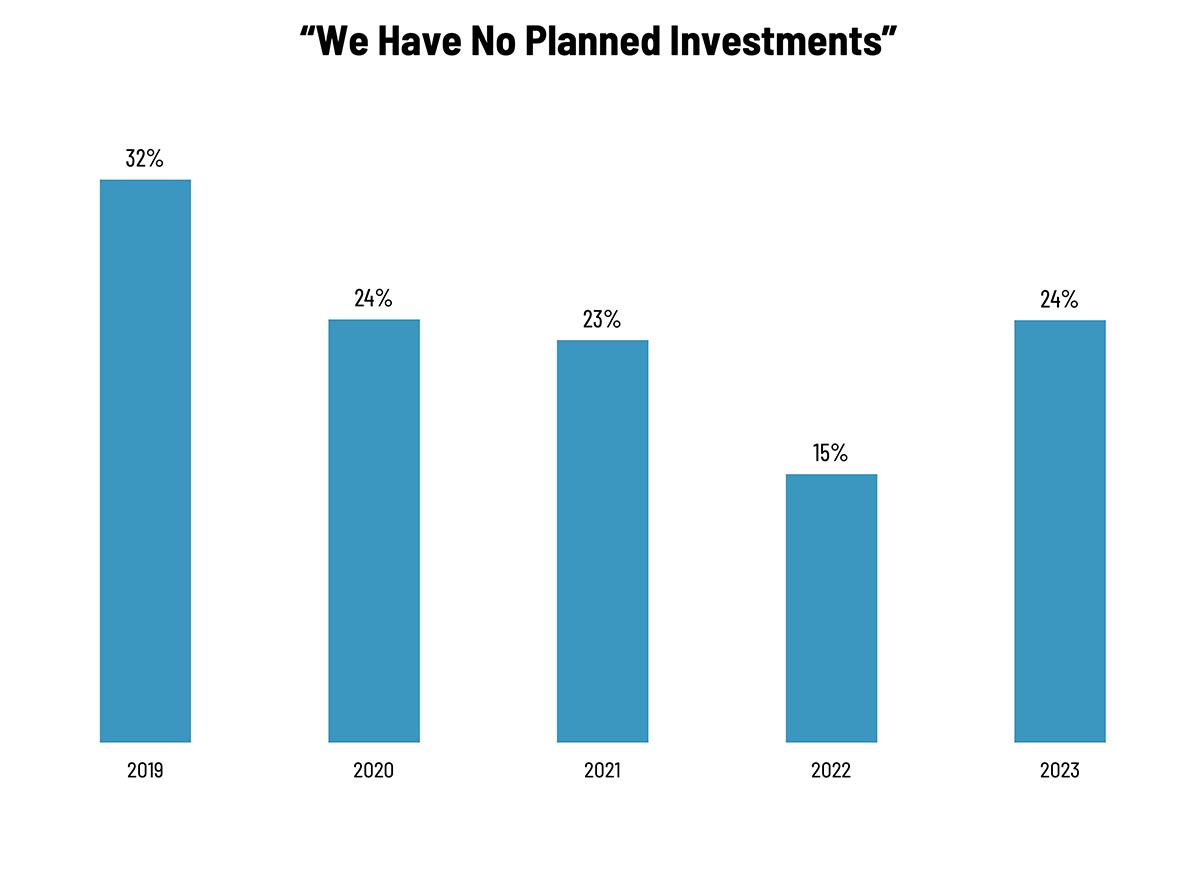

And, yes, I also tracked the “we have no planned investments” responses during this same period:

WhatTheyThink Print Business Outlook Surveys, 2019–2023

“We have no planned investments” was up a bit in 2023, and for a basic reason: 2023 was a lousy year for capital investment as high interest rates made any financing costs prohibitive, or at least worth putting off until rates come down (we can tell because “financing costs of our equipment” came in at an all-time high in the Business Challenges question). Naturally, this doesn’t apply to things like software, but any major equipment purchases will likely be put off until rates come down unless it’s an emergency.

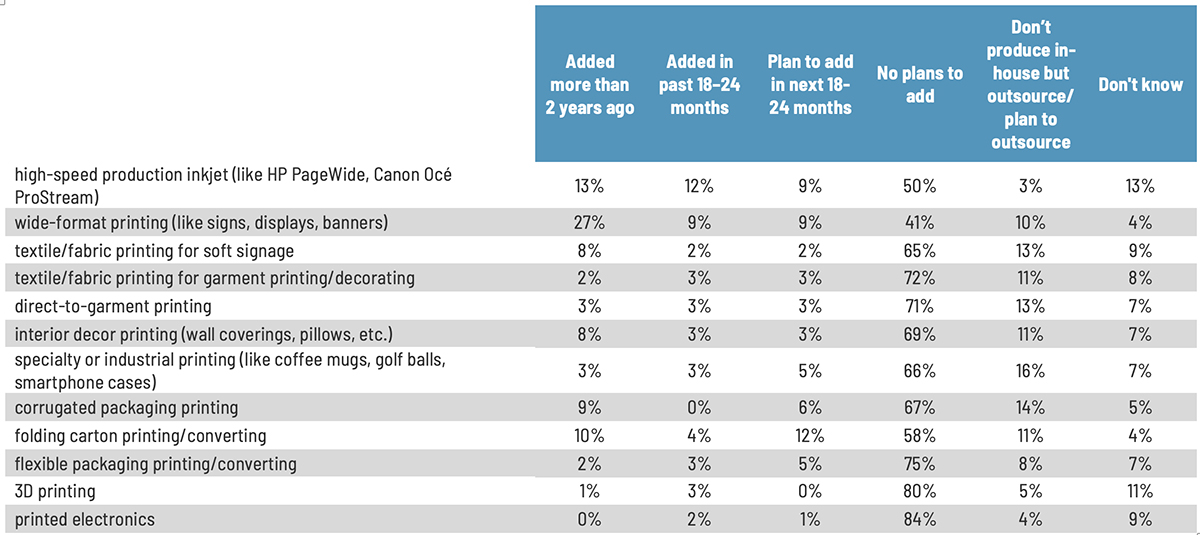

New Capabilities

Every few surveys, we try to gauge the extent to which print service providers are branching out into new product and service areas, if they had already added those new products/services, and, if not, if they had a time frame for adding them—or if they were even on their radars at all.

So where do print businesses see their growth areas? Production inkjet and folding carton printing (and the two are not mutually exclusive) appear to be the areas in which printers look to be expanding. Display graphics had been the hot application area 10 years ago, but everyone who was ever likely to get into display graphics has already done so. Textile and other specialty printing—especially décor—have been touted as hot growth areas, but they have not turned up in our survey data, or at least not yet.

Looking Forward

Dr. Joe Webb used to say that printers ignore a new technology until they start losing business to it. I’m not sure that’s the case anymore, and printers across the board have come to realize that diversification is a major strategic plan in today’s industry.

But technology doesn’t just mean adding new printing capabilities, but also modernizing the business in general. And that more often than not means software. Which means keeping up with technology—or perhaps catching up with technology when it becomes necessary.