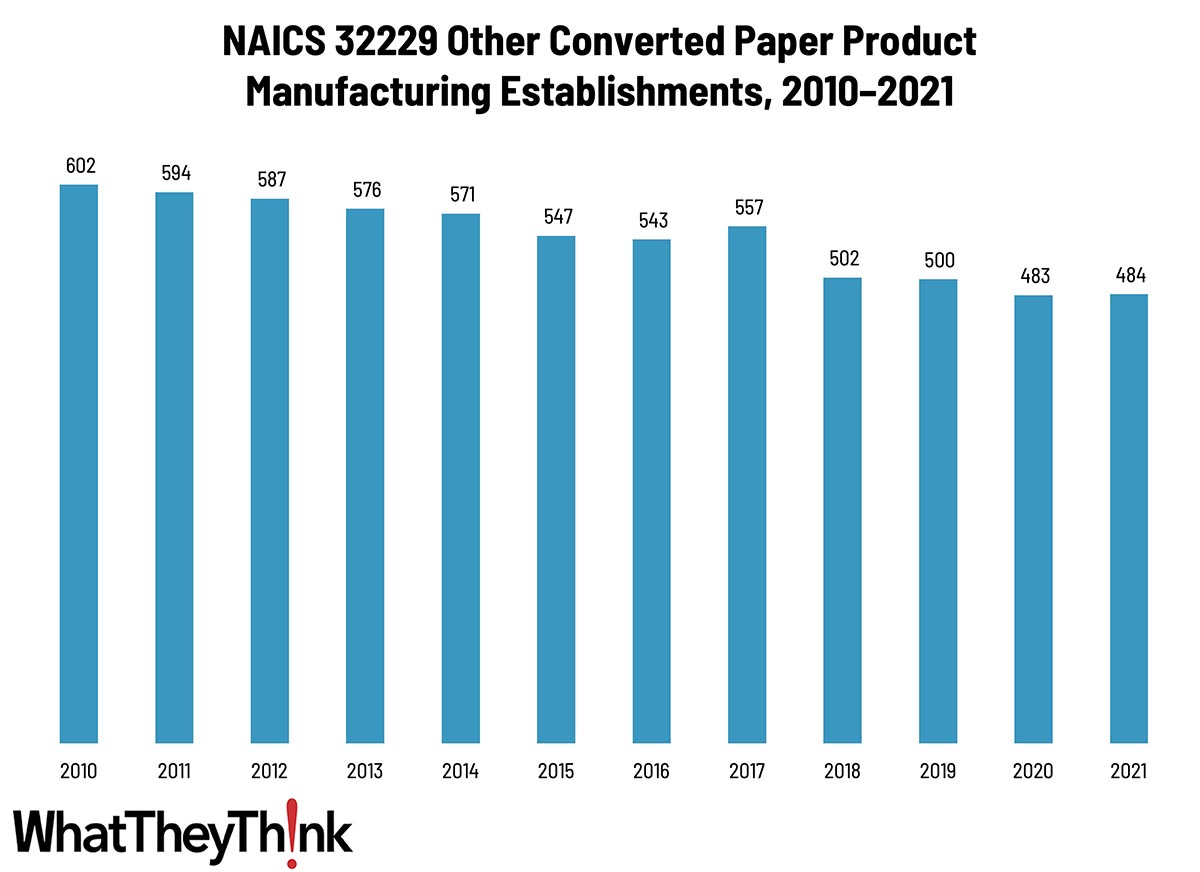

According to County Business Patterns, in 2021, there were 484 establishments in NAICS 32229 (Other Converted Paper Product Manufacturing). This NAICS category has declined steadily over the course of the decade, although has stabilized over the las two years of this time period.

The Bureau of the Census definition for this business classification:

This industry comprises establishments primarily engaged in (1) converting paper and paperboard into products (except containers, bags, coated and treated paper and paperboard, and stationery products) or (2) converting pulp into pulp products, such as disposable diapers, or molded pulp egg cartons, food trays, and dishes. Processes used include laminating or lining purchased paper or paperboard.

Since this product category largely comprises food trays, egg cartons, and a similar hodgepodge of food packaging-related products, trends in this packaging category will depend upon trends in the types of food they contain. For example, starting in 2018, egg consumption had been increasing and creative egg packaging was seen as an “uncracked market,” according to the American Egg Board (waka waka). Competition from foam-based food trays and cartons was and continues to be substantial, and while cushioning, cost-effectiveness, and moisture-impermeability work in foam’s favor, biodegradability/sustainability works in the favor of paper-based trays/cartons. At the time, there was also increased demand for food trays/packaging (take-out, restaurant leftovers, school and cafeteria use, etc., e.g.), but had been moving in foam’s direction. (There was of course a spike in home delivery/take-out during the lockdowns of 2020, which could account for the gain of one establishment from 20290 to 2021.) At the same time, the increasing number of municipal bans on foam takeout containers can work to paper’s advantage.

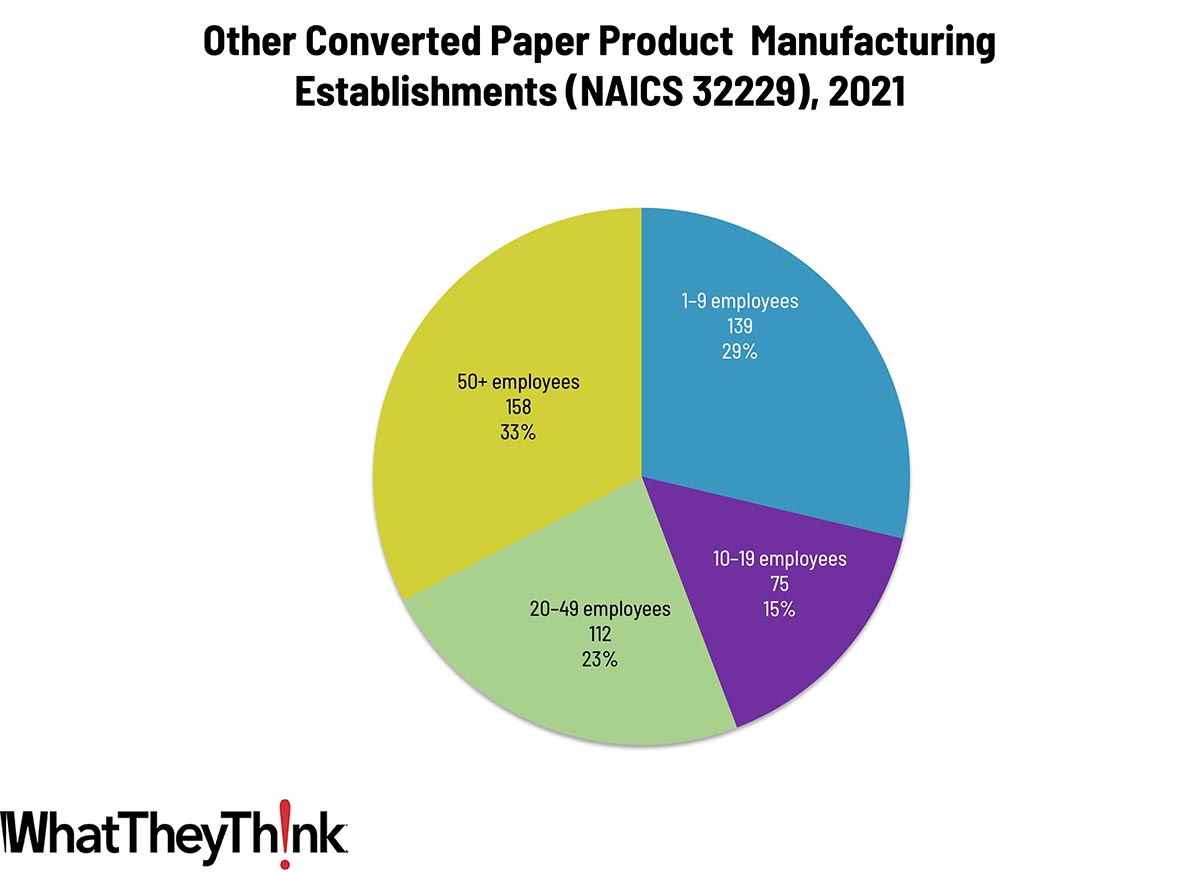

Establishments in this category are pretty evenly distributed. Small converted paper manufacturers (1 to 9 employees) account for 29% of all establishments, large manufacturers (50+ employees) account for 33% of establishments, and mid-size establishments (10–49 employees) account for 38%.

These counts are based on data from the Census Bureau’s County Business Patterns. Every other week, we update these data series with the latest figures. These counts are broken down by printing business classification (based on NAICS, the North American Industrial Classification System).

Next up, we’ll continue through the converting NAICS categories:

- 322291 Sanitary Paper Product Manufacturing

- 322299 All Other Converted Paper Product Manufacturing

To clarify what is included in the 2021 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2021 CBP. Thus, businesses lost (or gained) during the COVID pandemic are accounted for in this series.

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

If you have been following the news, you may have seen that last Friday’s July employment report caused no small amount of consternation, and, as we had anticipated when we wrote up the June jobs report, the one-point rise in the unemployment rate triggered the Sahm Rule suggesting a recession is in the offing. Claudia Sahm herself cautioned that there are nuances in the current employment landscape that render the Sahm Rule less definitive a recession indicator than it has been in the past. (Naturally, the stock market freaked out but quickly corrected itself.) And it is worth mentioning that other economic indicators are still fairly strong. The Atlanta Fed’s GDPNow, for example, as of August 8 was tracking Q3 GDP at +2.9%—the strongest growth all year so far. So keep the doomsayers at bay for now.