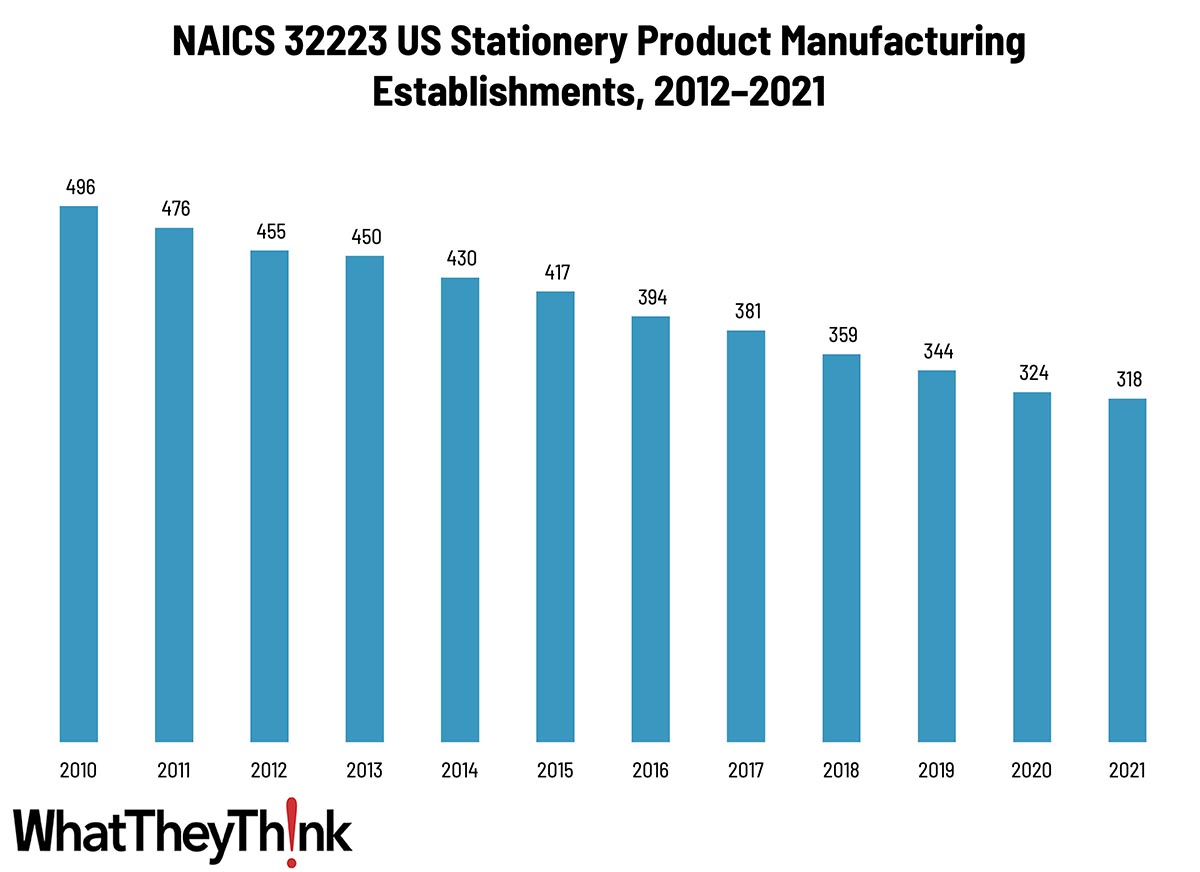

According to County Business Patterns, in 2021, there were 318 establishments in NAICS 32223 (Stationery Product Manufacturing). This NAICS category has declined steadily over the course of the decade.

The Bureau of the Census definition for this business classification:

This industry comprises establishments primarily engaged in converting paper or paperboard into products used for writing, filing, art work, and similar applications.

Think about how much stationery you use these days and you can probably explain much of the decline in this category. Still, it was circa 2016 that industry watchers had been noting a renewed interest in stationery and related products. Said Stationery Trends magazine in 2016: “There is a strong resurgence in consumers’ passion for stationery and specialty paper products. From journals to cards to prints, the written word and personal sentiments are returning stronger than ever—and in new ways.” Christmas and other holiday cards are increasingly customized/personalized, featuring the sender’s family and printed via digital print services such as Shutterfly. “Hand-crafted,” often using letterpress, is often the operative term in much of this product category, although many of these “makers” may not be reflected in Census data, as they tend to be individual artisans or hobbyists.

(Greeting card publishers are a separate NAICS, but greeting card manufacturing is included here.)

Journals with unique uses also stand out, from blank journals, to travel diaries, self-exploration journals, and journals that track family memories have been trending subjects. For fitness buffs, “workout diaries” (“WODBooks”) are also popular items. The classic Moleskine notebook had a resurgence mid-decade and pictures of note-filled Moleskines are shared on social media.

Although these data points are a few years old (as is typical for CBP), it will be interesting to see next year what the pandemic and forced lockdowns have done to demand for these kinds of items.

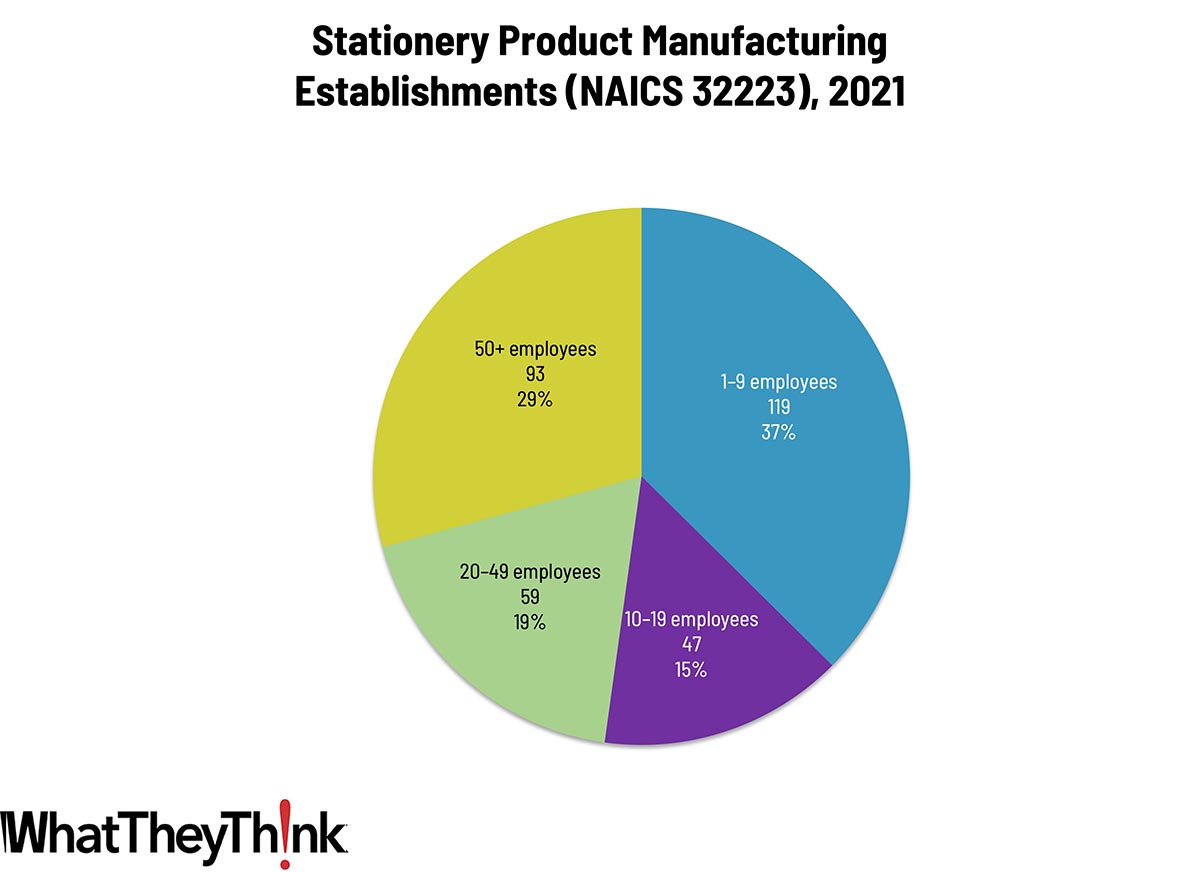

Establishments in this category are pretty evenly distributed. Small stationery product manufacturers (1 to 9 employees) account for 37% of all establishments, large manufacturers (50+ employees) account for 31% of establishments, and mid-size establishments (10–49 employees) account for 33%.

These counts are based on data from the Census Bureau’s County Business Patterns. Every other week, we update these data series with the latest figures. These counts are broken down by printing business classification (based on NAICS, the North American Industrial Classification System).

Next up, we’ll continue through the converting NAICS categories:

- 32229 Other Converted Paper Product Manufacturing

- 322291 Sanitary Paper Product Manufacturing

- 322299 All Other Converted Paper Product Manufacturing

To clarify what is included in the 2021 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2021 CBP. Thus, businesses lost during the COVID pandemic are accounted for in this series.

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

According to the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent on a seasonally adjusted basis, after being unchanged in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.

The index for gasoline fell 3.8 percent in June, after declining 3.6 percent in May, more than offsetting an increase in shelter. The energy index fell 2.0 percent over the month, as it did the preceding month. The index for food increased 0.2 percent in June. The food away from home index rose 0.4 percent over the month, while the food at home index increased 0.1 percent.

The index for all items sans food and energy rose 0.1% in June, after rising 0.2% the preceding month. It’s safe to say, at this point, that inflation is under control. Maybe the Fed should cut interest rates?