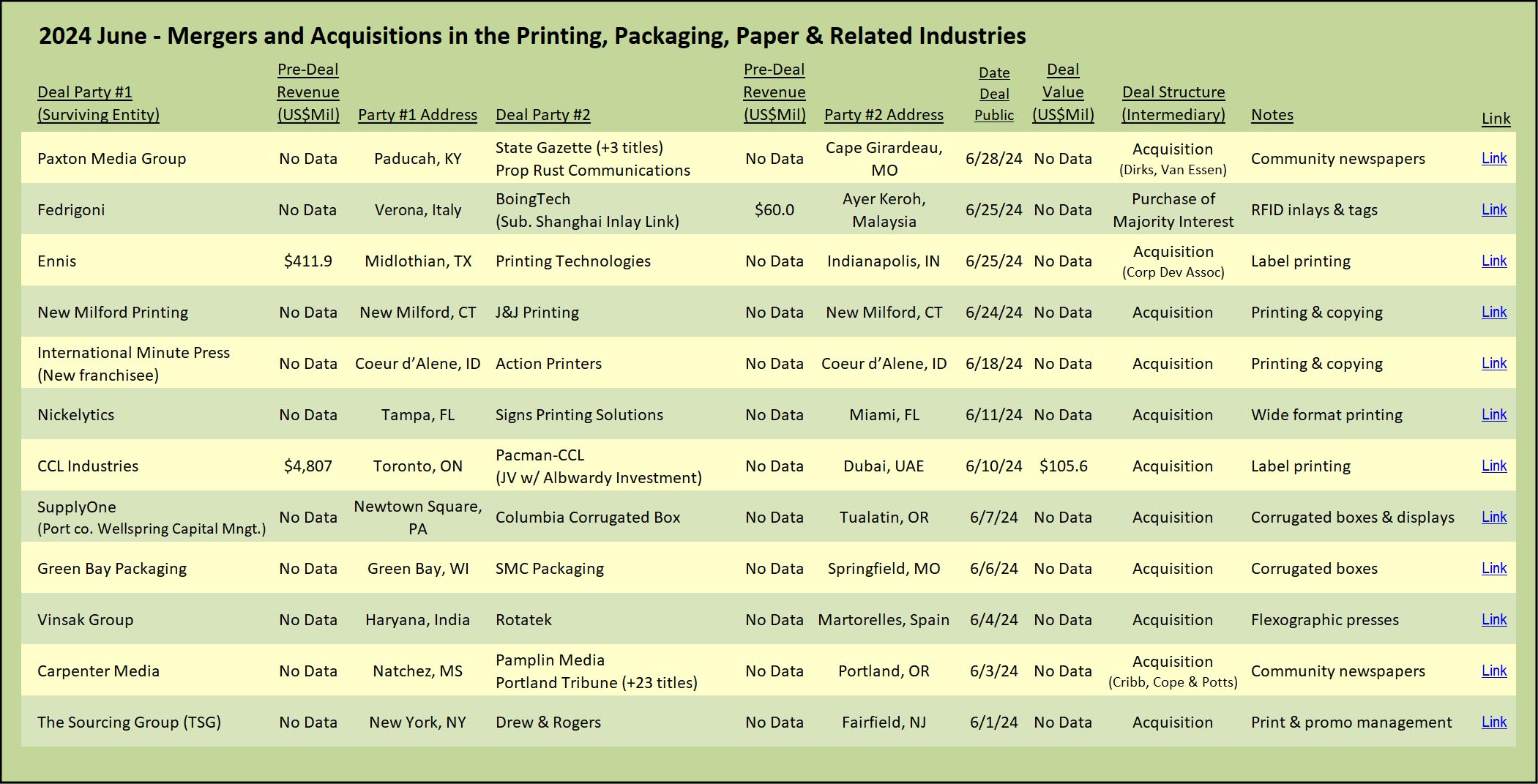

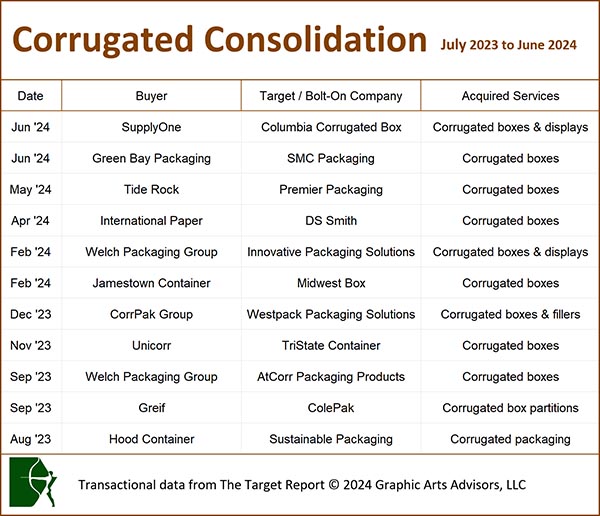

There has been a steady uptick in the number of acquisitions over the past twelve months of companies focused on the production of corrugated cartons. Recent deal activity involving the corrugating, printing, and converting of corrugated box products now exceeds that of any of the prior five years, including the number of deals we logged in the corrugated segment during 2019, the benchmark year before Covid disrupted everything.

From the largest players, such as International Paper, to the midsize integrated companies including Hood Container and Green Bay Packaging, to Welch Packaging, which is rolling up smaller companies, interest in fiber-based corrugated box businesses is keen and shows no sign of letting up. However, unlike the private equity-induced fever-pitch pace of deals in the label and flexible packaging segments that occurred prior to the COVID shutdown and continued apace up to the first quarter of 2023, transactions in the corrugated business have been, to date, driven primarily by buyers that are themselves steady-as-you-go family businesses.

We began to see an increased interest in the box, of all types, as 2023 began, concurrent with the decline in the number of deals in labels and flexible packaging. It appeared, at least to us, that the purchase price multiples in the label and flexible packaging businesses had reached unsustainable levels, coinciding with a dearth of suitable acquisition candidates; many of the best already having been cherry-picked by the surfeit of private equity funds vying to snag the next label or flexible packaging deal. (For more, see: The Target Report: The Box is Back – January 2023.)

Vertical Integration Enables M&A Scale

Green Bay Packaging announced the acquisition of SMC Packaging Group, a corrugated box manufacturer based in Springfield, Missouri. Originally founded in 1972 as Southern Missouri Containers, the company expanded via acquisitions and now operates in four locations in Missouri, Arkansas, and Oklahoma. With over 550 full-time employees, the acquired company was an early adopter of the employee-ownership structure, converting to an ESOP structure in 1978, only four years after the roll-out of the formal ESOP model that was defined and encouraged with the passage in 1974 of the federal Employee Retirement Security Act (ERISA).

SMC Packaging’s capabilities include a corrugator that produces a wide range of corrugated flute profiles, including B, C, E, and combinations of these. Printing is up to four colors over two colors in one pass, with capability to mount preprinted top sheets for higher level graphics. The company provides design and inventory management. In addition to boxes, SMC manufactures retail displays that use corrugated substrates.

While SMC Packaging’s capabilities are impressive, the merger into Green Bay Packaging brings the vertical integration to a completely different level. Starting with the company’s management of several hundred thousand acres of forestland, Green Bay Packaging harvests and reforests approximately 5,500 acres per year, planting 5,000,000 pine trees annually. The Green Bay Mill division, in Wisconsin, produces recycled content containerboard. The Arkansas Mill division, with multiple locations along the Arkansas River, produces containerboard with a mix of recycled and virgin fibers, along with lumber, and waste products used for energy production.

Further down the corrugating production sequence, Green Bay Packaging has 30 corrugated converting operations, mostly in the Midwest. There is a folding carton division a short distance up the Fox River from the Green Bay Mill location, and eight locations that produce paper and film pressure-sensitive label stock, bringing the total to over 40 operations.

Founded in 1933, Green Bay Packaging is still family-owned, led by the third-generation, operates in 16 states, and employs more than 4,500 people. With the scale and vertical integration of its operations, the company was well positioned to take on the smaller, but still sizeable, SMC Packaging Group.

Combining Manufacturing with Outsourced Production

SupplyOne, which touts its advantage as being “equal parts manufacturer, distributor, and service provider,” announced the acquisition of Columbia Corrugated Box Company, a manufacturer of corrugated boxes. The company uses flexo technology to print up to six colors plus UV coating directly onto corrugated. High-level graphics are achieved by laminating digitally or offset-printed top sheets onto the corrugated substrates. As is common in the corrugated box business, retail display production and inventory management are offered.

Based in Newtown Square, Pennsylvania, SupplyOne claims to be “the largest independent supplier of corrugated and value-added packaging products, equipment, and services in North America.” Founded 25 years ago as a packaging management company that relied on an outsourced network of manufacturers, the company has grown to include both internal manufacturing capabilities and distribution, in addition to the outsourced production model.

SupplyOne’s growth has been fueled by a steady program of acquisitions; the purchase of Columbia Corrugated Box is the company’s 41st addition. Based in the northwest, Columbia represents a significant geographic expansion for SupplyOne. While many of the companies in the corrugated segment remain family-owned, SupplyOne is an exception and is owned by private equity firm Wellspring Capital Management.

Focused on Family-Based Corrugated

Welch Packaging Group, based in Elkhart, Indiana, rolled up two more acquisitions of family-owned corrugated box companies in the past year. Most recently, Welch acquired Innovative Packaging Solutions, a corrugated box and retail display manufacture based in York, Pennsylvania. The transaction stays within Welch’s laser-focused lane, the corrugated box business, however the expansion is a significant leap outside Welch’s traditional geographic focus on businesses in the Midwest and Midsouth regions.

Within the past year, Welch also acquired AtCorr Packaging Products, a family-owned manufacturer of corrugated boxes located in Glasgow, Kentucky. The sellers noted that Welch’s twenty-plus locations and its network of sheet plants would support their ability to service existing customers and expand their business on a going-forward basis. The retention of the acquired business operation is consistent with Welch’s strategy that reflects the local nature of much corrugated production and delivery to end users. (For more, see: The Target Report: Catching the Wave in Corrugated Cartons – February 2020.)

View The Target Report online, complete with deal logs and source links for June 2024