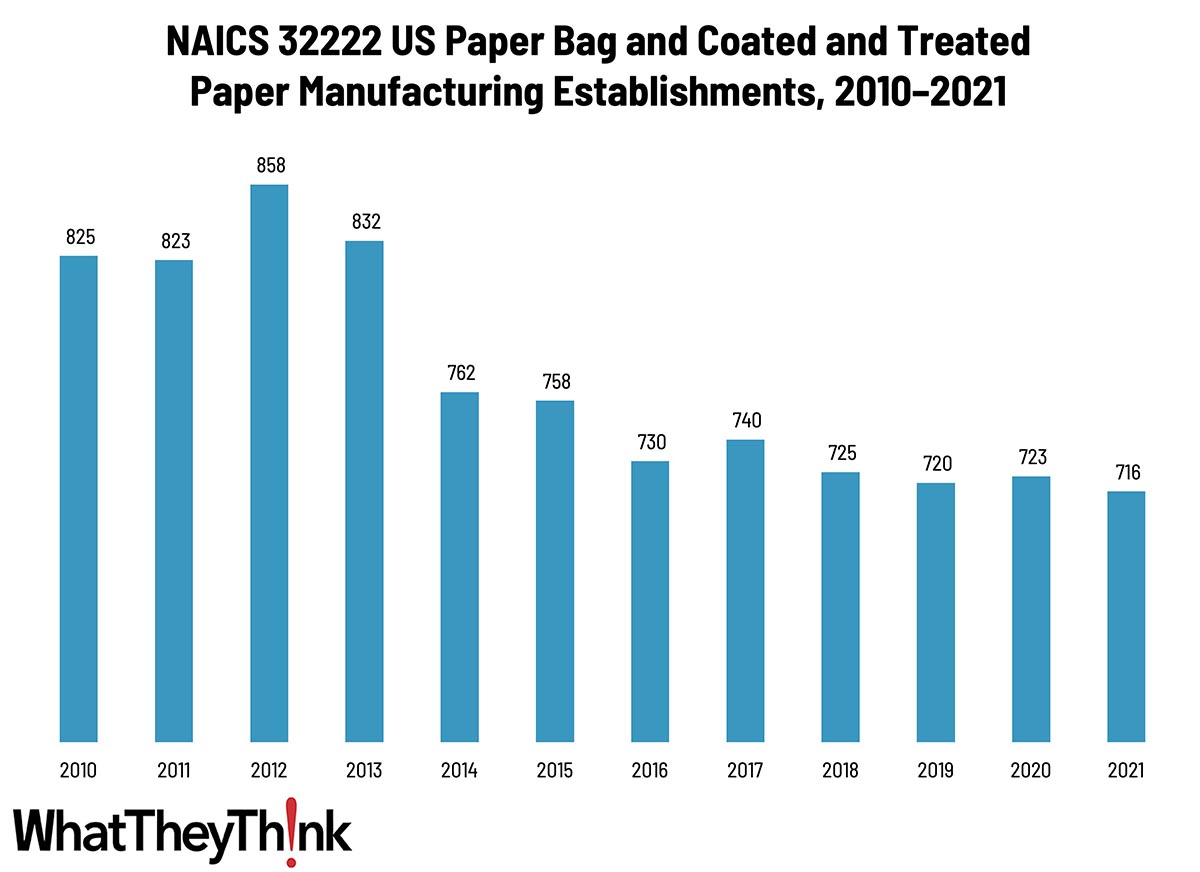

According to County Business Patterns, in 2021, there were 716 establishments in NAICS 32222 (Paper Bag and Coated and Treated Paper Manufacturing establishments). This NAICS category peaked in 2013, but has declined slowly over the rest of the decade.

The Bureau of the Census definition for this business classification:

This industry comprises establishments primarily engaged in one or more of the following: (1) cutting and coating paper and paperboard; (2) cutting and laminating paper, paperboard, and other flexible materials (except plastics film to plastics film); (3) manufacturing bags, multiwall bags, sacks of paper, metal foil, coated paper, laminates, or coated combinations of paper and foil with plastics film; (4) manufacturing laminated aluminum and other converted metal foils from purchased foils; and (5) surface coating paper or paperboard.

Towards the end of the last decade (pre-pandemic), “paper vs. plastic” considerations anecdotally worked in paper bags’ favor, as more and more municipalities had been banning or adding surcharges to plastic bags, and paper bags are easily recycled. At the same time, the growth and popularity of reusable bags have been making this conversation moot. Trends in retail can trickle down to affect bag demand, and there is still demand for niche/boutique bags. Digital printing can eliminate the “blank bag,” and laminates and other types of coatings—plastics, foils, embellishments, etc.—increase strength, aesthetic appeal, etc., but may adversely impact recyclability.

This NAICS tended to lose establishments in the under-100-employee categories, but gained establishments in the 100+-employee categories, in large part the result of consolidation. But it also reflects growing demand for products produced by establishments in this category.

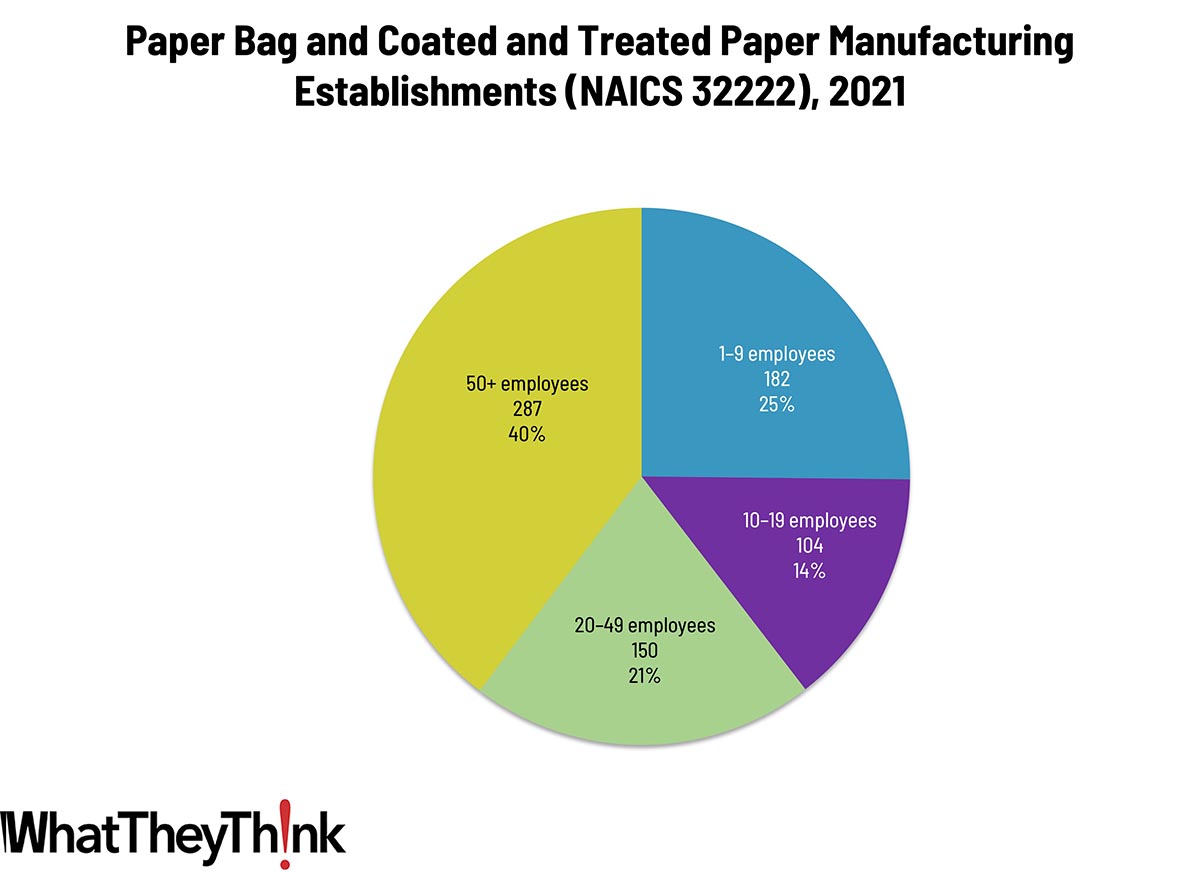

Establishments in this category are larger than we usually see in the printing and publishing industries. Small paperboard container manufacturers (1 to 9 employees) account for 25% of all establishments, while large manufacturers (50+ employees) account for 40% of establishments. Mid-size establishments account for 35%.

These counts are based on data from the Census Bureau’s County Business Patterns. Every other week, we update these data series with the latest figures. These counts are broken down by printing business classification (based on NAICS, the North American Industrial Classification System).

Next up, we’ll continue through the converting NAICS categories:

- 32223 Stationery Product Manufacturing

- 32229 Other Converted Paper Product Manufacturing

- 322291 Sanitary Paper Product Manufacturing

- 322299 All Other Converted Paper Product Manufacturing

To clarify what is included in the 2021 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2021 CBP.

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

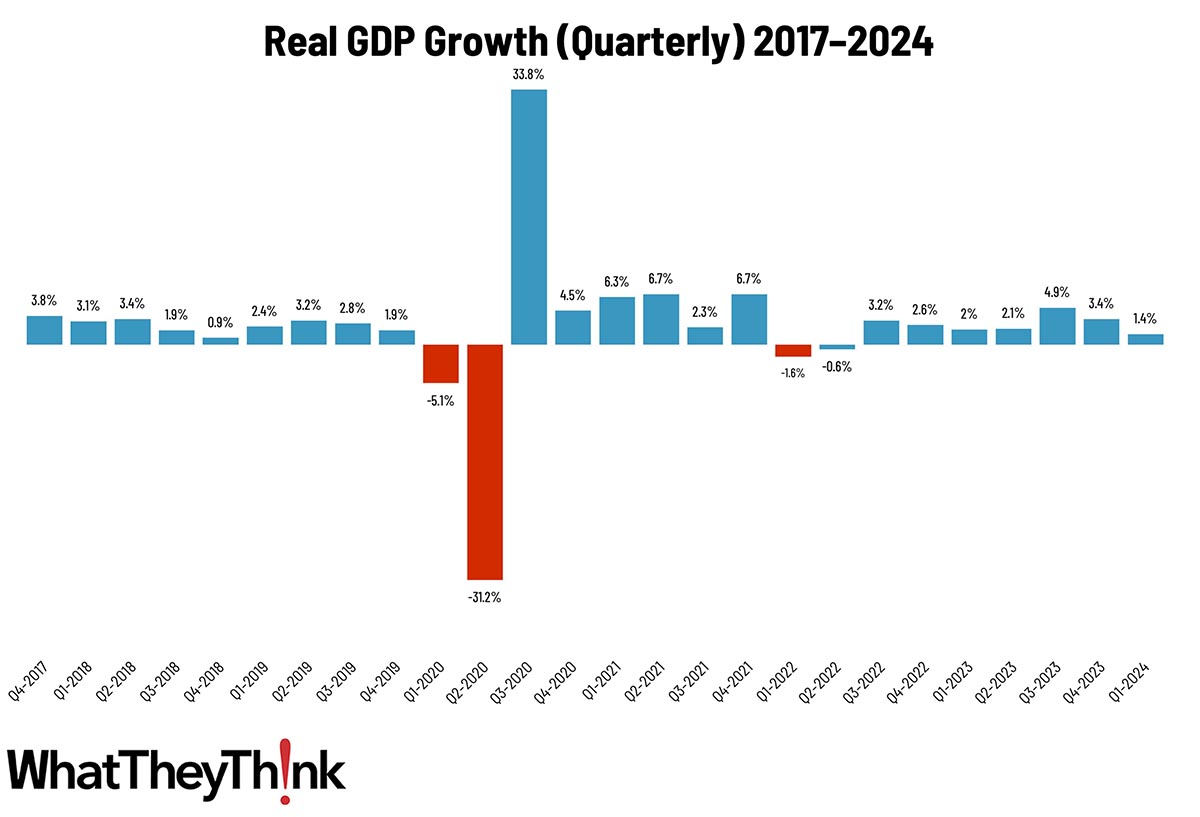

The Bureau of Economic Analysis released its third estimate of Q1 GDP and it was revised up to 1.4%. You may recall, the initial. Advance estimate back in April was 1.6%, which was pretty anemic. Then it was revised down in the second estimate, to 1.3%, which was even more anemic. Now, yesterday, it was revised up to a slightly less anemic 1.4%.

The upward revision primarily reflected a downward revision to imports, which are a subtraction in the calculation of GDP, and upward revisions to nonresidential fixed investment and government spending. These revisions were partly offset by a downward revision to consumer spending.

Forecasts of Q2 GDP growth are looking a bit rosier, hovering in the 2.5–3.0% range.