Change continues to rock the book manufacturing business. Contracts for book printing and bindery services have declined as publishers pull back on new orders and work off the excess inventory that built up in response to demand during the Covid years. Print-on-demand book technologies are placing further downward pressure on traditional book manufacturing. Although there is widespread confidence that the printed book will survive the digital onslaught better than many other forms of print, there are shifts and cracks in the book printing world.

Consolidators are buying companies with long histories and respected pedigrees that have served and continue to sell to the trade and educational publishers. At the same time, others are closing down huge manufacturing facilities as overall volumes decline in certain segments. On-demand digital ordering, prepress, and printing technologies, driven primarily by the plethora of installed highly productive continuous form inkjet printing devices, has reduced the need for publishers to order long runs and keep large inventories.

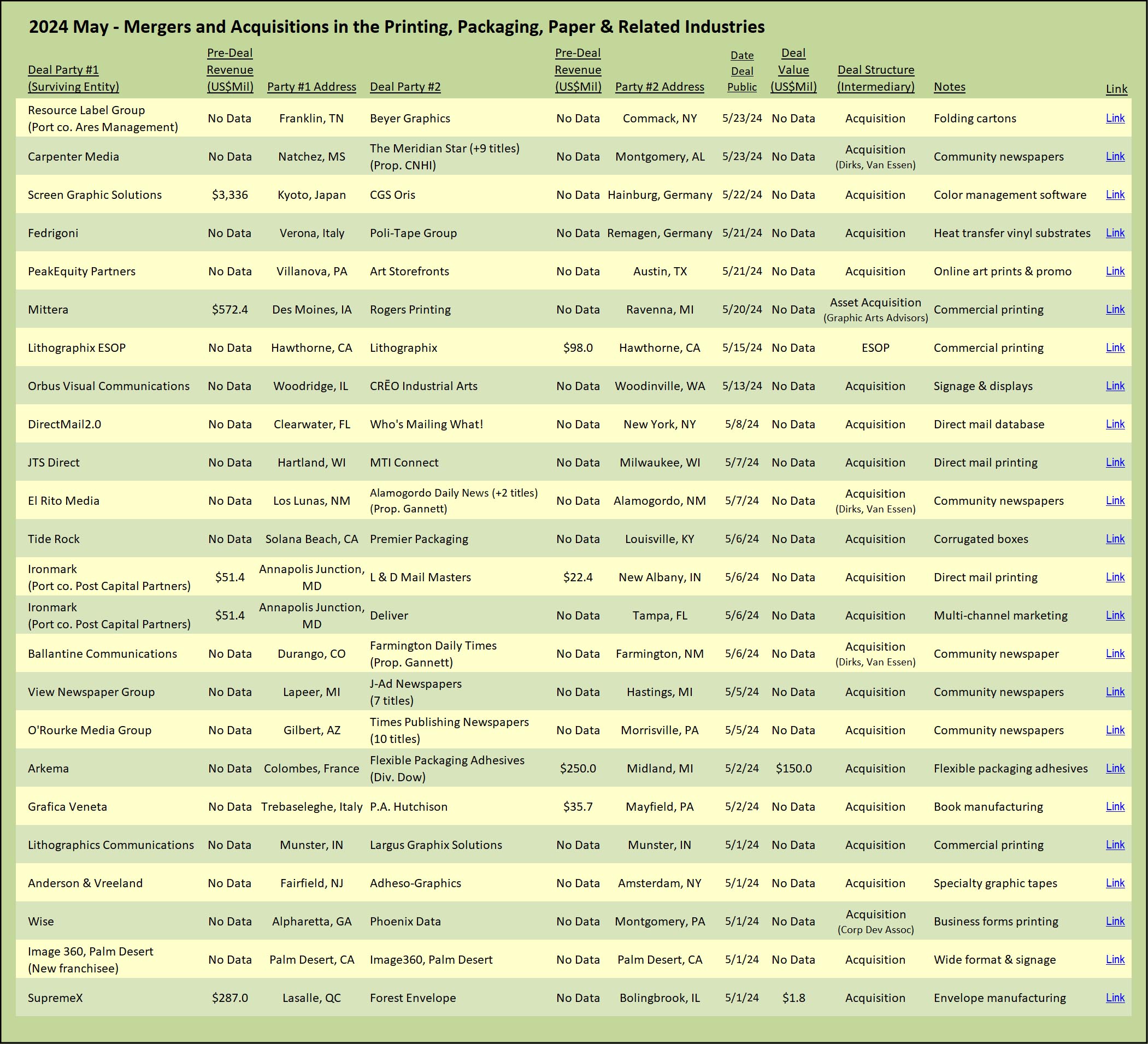

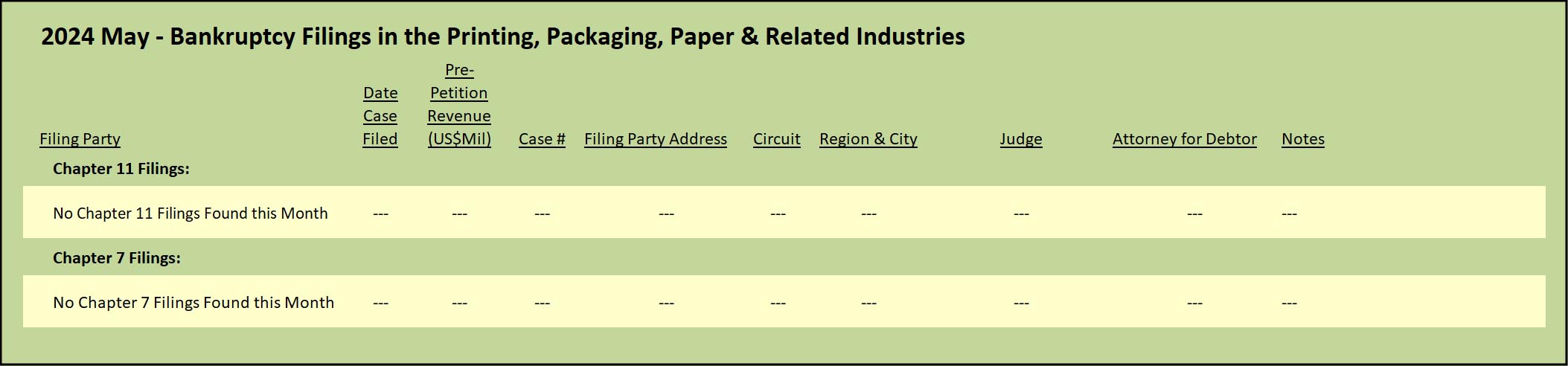

Robust Acquisition Activity in Book Manufacturing

Grafica Veneta (the GV Group), based in Trebaseleghe, Italy, acquired P.A. Hutchison, a traditional book manufacturing company with an annual production capacity of 50 million books. The acquired Pennsylvania company is over one hundred years old and focuses on the production of textbooks and other educational materials. GV group announced plans to install four-color web printing capability at the plant and increase annual capacity to over 100 million books. Left unsaid is whether the web printing technology will be high-volume traditional offset or be based on more nimble digital color print engines.

This is GV Group’s second foray into the US market, a follow up to its purchase in February 2021 of Lake Book Manufacturing in Melrose Park, Illinois. That acquisition was a huge first step into the US market for the Italian printing company. That deal brought 300 employees and in excess of $117 million in revenue to GV Group. Lake Book served the publishing trade with capability to produce one- to four-color hardcover and softcover books. At the time, GV Group reported that the acquisition increased the combined company’s annual production capacity to 300 million books. (For more, see: The Target Report: So Many Books, So Little Time – February 2021.)

Other companies continue to have faith in and invest in the book manufacturing business. CJK Group, a printing industry roll-up based in Brainerd, Minnesota, placed another bet on its core interest in book and journal printing with the acquisition in September 2023 of Worzalla in Stevens Point, Wisconsin. Prior to the acquisition, Worzalla was one of the largest remaining independent book-printing companies in the US, in business for over 130 years. With 365,000 square feet of manufacturing, and approximately 340 employees, the company primarily served the children’s book and trade publishing market. The acquisition was a straight-down-the-middle strategic move for CJK, totally about books.

CJK Group has built a mammoth business with a core focus on book manufacturing. We first reported on the CJK Group in 2013, when it was known as Bang Printing. The company had just completed a Section 363 asset purchase in the Chapter 11 bankruptcy proceeding of Hess Print Solutions. (For more on CJK’s early acquisitions, see: The Target Report: CJK Group Opens Next Chapter with Loan-to-Own Strategy – March 2019.)

In June 2023, Lakeside Book, the scion of the original R.R. Donnelley & Sons Company, and the largest US printing company focused primarily on book manufacturing, acquired Marquis Book Printing, ending the independence of another significant book printing company. With several plants in Canada, the Marquis company dates back to 1937, and had approximately 600 employees.

It has been a topsy-turvy journey for Lakeside Book. Originally the book printing division of R.R. Donnelley, it was spun out in the ill-fated three-way split of the company in 2015. The divested division was rebranded as LSC Communications, with a nod to the original name (hence the LS in LSC). After a dizzying array of acquisitions, LSC Communications succumbed to the weight of all the incurred debt and filed for Chapter 11 bankruptcy protection in April 2020. Later that year, in September, private equity firm Atlas Holdings emerged as the stalking horse bidder for LSC Communications. Under Atlas’ guidance, LSC spun out the book printing division and rebranded it Lakeside Book (not to be confused with the aforementioned Lake Book acquired by GV Group). Further rationalization occurred earlier this year when LSC divested its magazine and catalog printing operating units, as well as its rebranded marketing execution division, Kodi Collective. Oddly, the buyer of these disparate operations was CJK Group, which with this acquisition appears to have veered off its well-defined path paved with books.

With the consolidation of book manufacturing, many of the independent trade binderies serving smaller book printers ceased operations. An exception has been BindTech, a roll-up of trade binderies that serve printers, publishers, and marketing agencies. Earlier this year, BindTech added to its network of specialized binderies with the acquisition of Eckhart & Co., a supplier of hardcover, softcover, and mechanical binding services. Other specialized services offered by BindTech include Smyth sewing, gilding, leather covers, gold stamped embossed ornamentation, ribbon markers, hub spines, hand crafted endsheets, and other book bindery arcana.

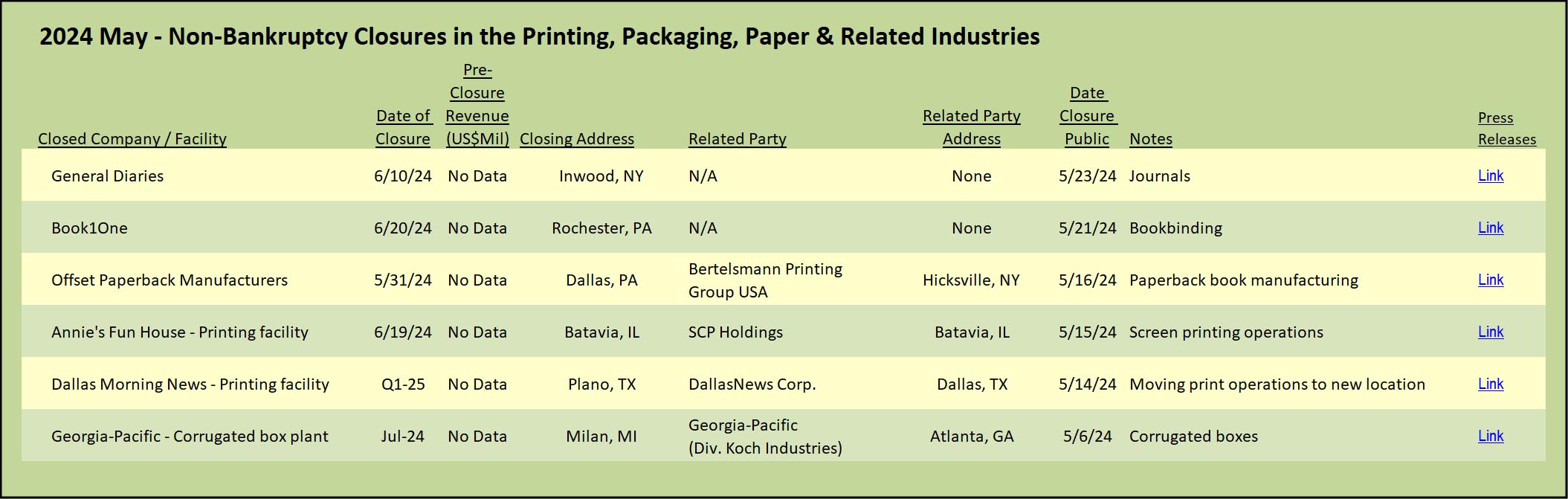

Out of Print

Bertelsmann Printing Group USA, a division of the German global publishing and printing powerhouse, announced the closure of the Offset Paperback Manufacturers (OPM) plant in Dallas, Pennsylvania. At one time, the plant was the second largest paperback manufacturing facility in the world, with about 1,000 unionized employees, running 24 hours a day, seven days a week, with annual output of more than 250 million books. According to the WARN notice filed with the Pennsylvania Department of Labor & Industry, employment at the factory had dwindled to approximately 100 employees. Book production has declined to about one million books per month. Reportedly, the company had deferred any capital improvements at the facility for quite some time, with the result that productivity slumped, accelerating the cycle of decline. The company cited a rapid decrease in the market demand for mass-market and digest format books, the exact type produced at this plant.

It has not been all acquisitions for CJK Group. Earlier this year in February, the company announced that it was closing its plant in Madison, Wisconsin. The company cited the decline in demand for book production which has followed publishers’ post-covid buildup in inventory combined with the continued shift to digital publishing in the education sector which the plant specialized in. The plant was scheduled to cease all production and close completely by the end of this month. The facility was formerly known as Webcrafters, and before that as Democrat Printing, which had begun, as had many printing companies, in the 1800s as a newspaper publisher.

The final edition is set for the Book1One on-demand book printing and bindery services company in Rochester, New York. All the equipment will be auctioned off later this month, resulting in the complete closure of the plant. Book1One was founded in 2005 with the mission to provide personalized books, utilizing digital printing technologies, ordered via an online publishing software platform. The company also provided digital book printing and bindery services to smaller independent publishers. Clearly, competition is heating up in the on-demand book printing sector, as well as in the more traditional high-volume trade.

View The Target Report online, complete with deal logs and source links for May 2024