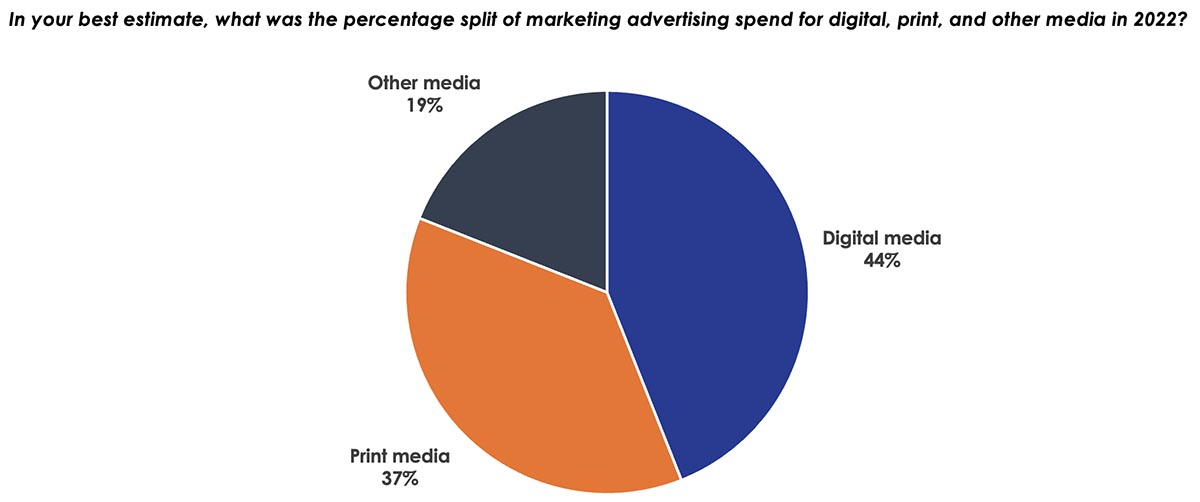

- Digital media accounted for roughly 44% of marketing advertising spend in 2022.

- Nearly three-quarters of respondents agreed that they were increasing the use of print marketing because digital marketing alone does not always produce sufficient response rates.

- 90% of businesses considered printing marketing collateral to be very or somewhat important to their sales and marketing efforts.

By Eve Padula

Introduction

In late 2023, Keypoint Intelligence completed a comprehensive multi-client study to gain a better understanding of how print demand is changing in key vertical industries. This survey serves as an update to similar vertical market research that was conducted in 2020. The vertical industries that we covered in depth include education, finance/banking, healthcare, hospitality, insurance, manufacturing, retail, and publishing.

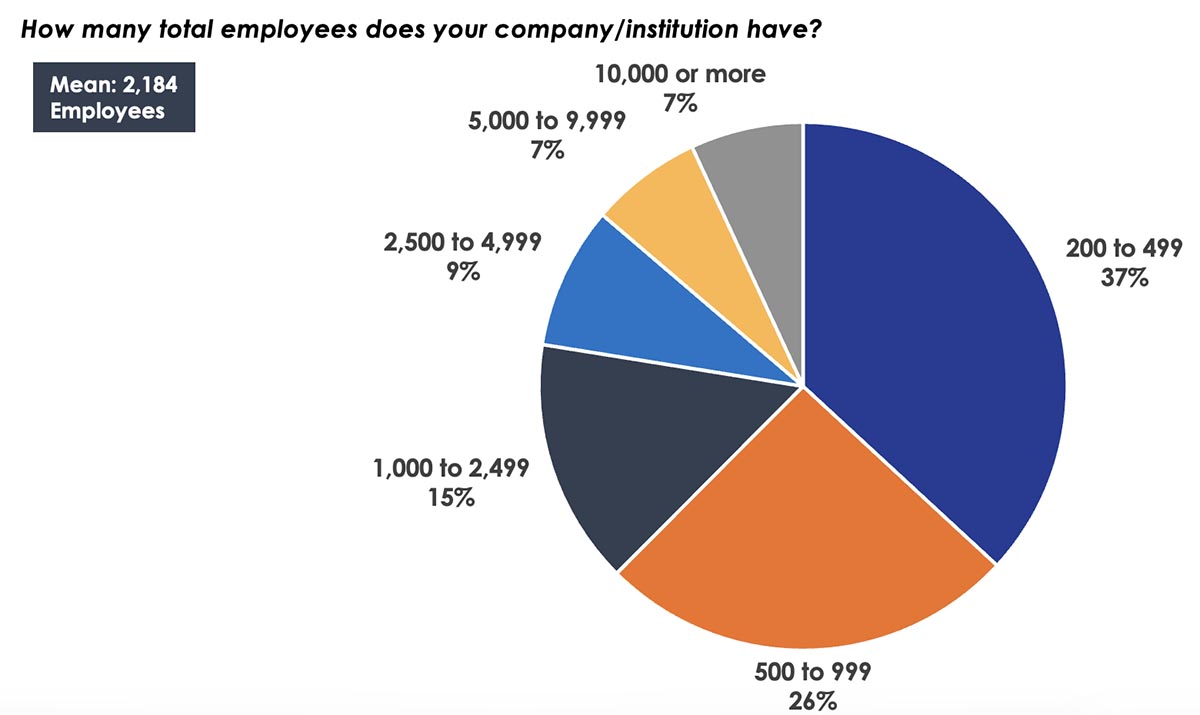

Over 1,200 respondents from businesses with 200+ employees participated in this study. On average, survey respondents reported having over 2,000 employees each. At the same time, however, well over a third of our surveyed businesses had fewer than 500 employees.

Figure 1: Number of Employees

N = 1,215 Total Respondents

Source: United States Vertical Visions Multi-Client Study; Keypoint Intelligence 2023

The Shift to Digital Continues, But Print is Still Important

When survey respondents were asked to estimate the split for digital, print, and other media in 2022, digital media accounted for roughly 44% of marketing advertising spend. In terms of vertical industry, it is interesting to note that insurance (47%) and retail (45%) respondents allocated the highest share to digital media, while the finance/banking and education sectors (42% each) allocated the least.

Figure 2: Split Between Digital/Print/Other Media

N = 1,109 Respondents in Sr. Leadership, Marketing, or Sales Roles

Source: United States Vertical Visions Multi-Client Study; Keypoint Intelligence 2023

Between 2021 and 2022, respondents indicated that the share of spending allocated to digital media increased by an average of 4.1%.

There is no question that the digital transformation continues, but the previous Figure shows that a considerable share of marketing advertising spend—37%—is still dedicated to traditional print media. In addition, nearly three-quarters of respondents (73%) agreed that they were increasing the use of print marketing because digital marketing alone does not always produce sufficient response rates.

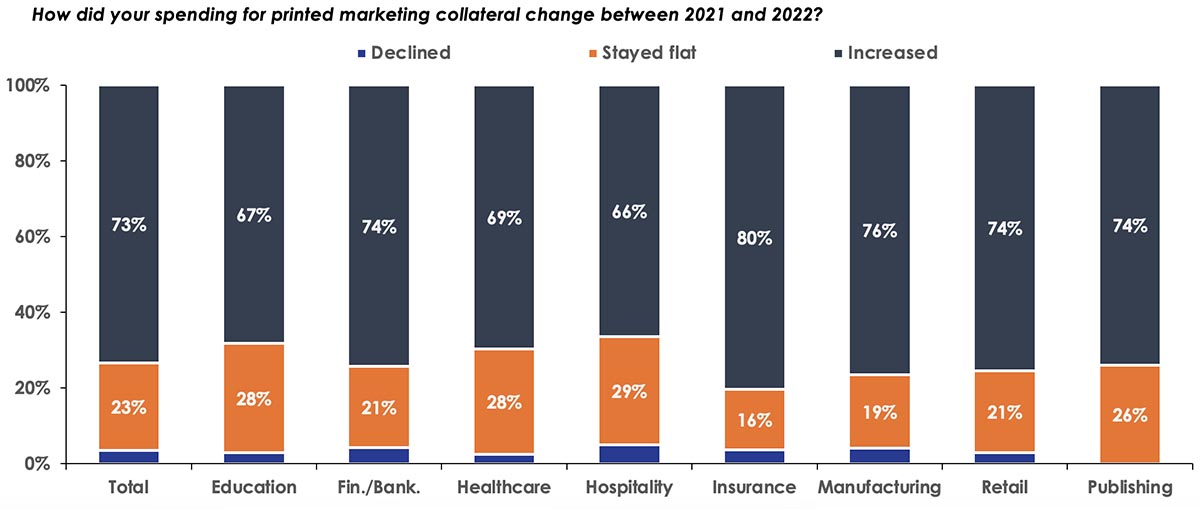

Along these same lines, 73% of respondents reported that their spending for printed marketing collateral had increased between 2021 and 2022. Respondents in the insurance industry were the most likely to report a year-over-year increase, while those in hospitality were the least likely.

Figure 3: Change in Print Spend—2021 vs. 2022

N = Varies; Base: Respondents able to answer questions about their company’s printing services

Source: United States Vertical Visions Multi-Client Study; Keypoint Intelligence 2023

Those respondents who did see an increase in print spend between 2021 and 2022 reported an average increase of 11% year-over-year.

Finally, respondents who were able to answer questions about their company’s printing services were optimistic about the importance of print. In fact, 90% of businesses considered printing marketing collateral to be very or somewhat important to their sales and marketing efforts. Meanwhile, only 2% of respondents considered print to be very or somewhat unimportant.

The Bottom Line

This article provides just a glimpse of the information that is available in our 2023 vertical visions research. Each of the 100+ questions that were posed to respondents are broken down by primary vertical industry in our Excel data tabs so readers can understand how print demand is changing among the different verticals. Today’s simple message is that print remains an important component of the media mix even as the digital transformation continues. For more information on our in-depth and comprehensive vertical visions multi-client study, please click here.

Eve Padula is a Senior Consulting Editor for Keypoint Intelligence's Production Services with a focus on Business Development Strategies, Customer Communications, and Wide Format. She is responsible for creating, analyzing, and formatting many types of content, including forecasts, blogs, industry analyses, and research/multi-client studies. She also manages editing and client distribution for many types of deliverables.