Global M&A activity in 2023 fell approximately 20% compared to 2022, according to Bain & Co, a global business consulting firm. Within that larger context, deals completed in 2023 by private equity firms were off a whopping 35% from the level reached in 2022. Strategic deals, in which one operating company buys another operating company, were down 14%. The general consensus is that the primary culprit was higher interest rates which made deals more expensive to finance. Layer that higher funding cost on top of sellers’ expectations of a higher enterprise value driven by the past decade of low interest rates, and a value perception mismatch developed. That mismatch drove down the number of successfully completed M&A deals.

How Did Our Industry Measure Up?

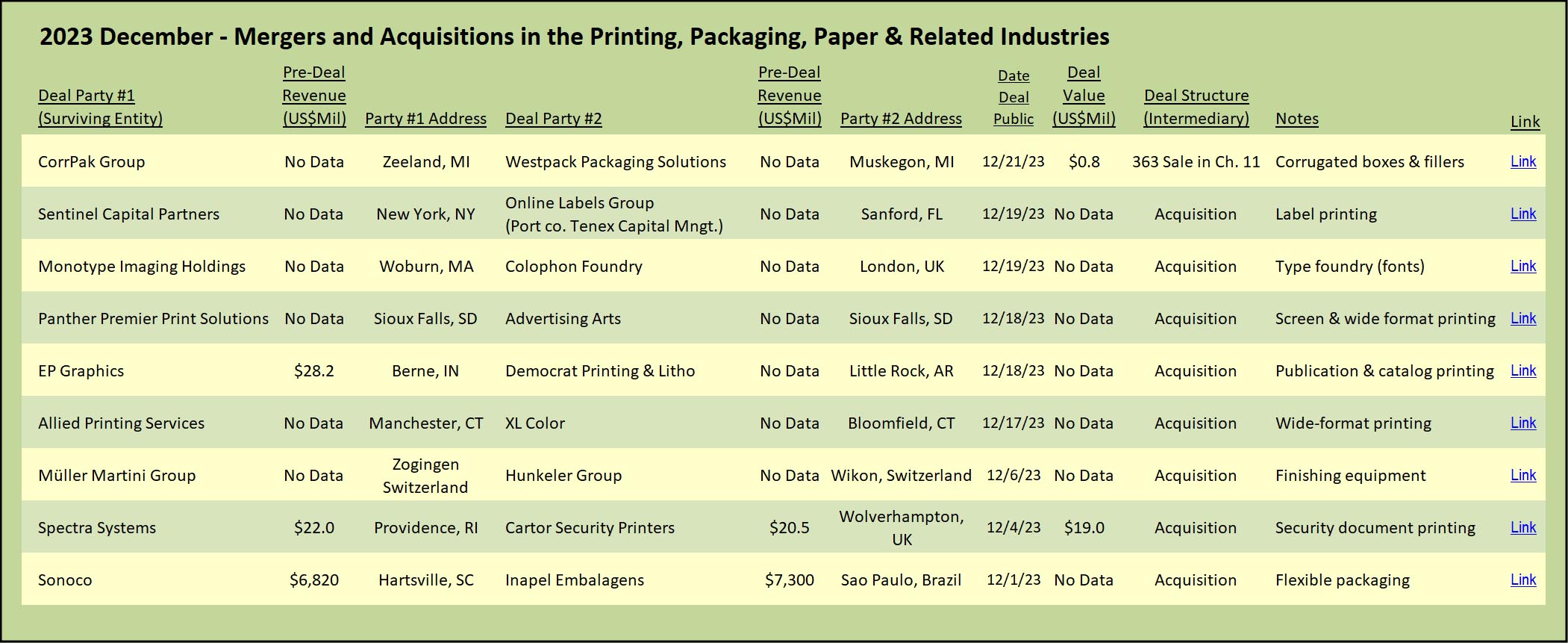

To find out how the printing, packaging, and related industries fared in M&A terms for the 2023 calendar year, we updated our stats from our annual review which we publish each September that covers the trailing twelve months ended in August each year (see The Target Report Annual Review: 2023 M&A Activity). Our analysis revealed that the trend in deals in the printing, packaging, and related industries, measured by the number of transactions announced in 2023, very closely tracked the decline in overall global strategic transactional activity. M&A deals in our corner of the business world declined 14.3% from 2022, an almost spot-on match to global trends. Maybe we should not be surprised, as the same mismatch between buyer’s higher funding costs and sellers’ expansive value expectations was evident in the industries we follow and work in.

Several distinct, but closely related, trends became apparent to us at Graphic Arts Advisors as summer progressed into autumn. The following are our observations on the M&A market in the lower middle market for printing and packaging companies as we close out 2023.

What Happened #1: The End of Post-Covid Demand

The pent-up demand from the Covid shutdown was unleashed in 2022. The increase in demand impacted many sectors of the economy including printing, packaging, and related graphic communication companies. During the past year, we had the privilege to speak candidly with many owners who reported that their companies had enjoyed significant boosts to revenue in 2022, as compared to the prior year. Reported increases were often in the 20% to 25% range, and some even higher. When the disciplined expense management and reduced headcount that Covid made necessary met those higher revenues, profits at many companies soared.

As 2023 unfolded, the pent-up demand was satiated. Demand and production capacity are reasonably back in balance. With the benefits from the post-Covid demand bubble behind them, many companies struggled to repeat their 2022 financial performance. Nonetheless, after the heady days of 2022, some sellers had expectations of an unending upward growth curve. For many, as 2023 progressed, it became clear that the curve was flattening or turning downward. Unable to support an ongoing 20% growth story, some owners became disenchanted with their exit prospects and withdrew from the market.

What Happened #2: Supply Chain Equilibrium

The severe paper and substrate shortage of 2022 required intense management attention. Companies that were able to buy available stock did so and built up excessive levels of inventory. A label printing company we know leased an entire additional building to house the massive amount of additional pressure sensitive roll stock they had purchased. It got to the point in 2022 that companies in the US West and Southwest had purchased so much paper that skids were being stored outside. On visits to several companies, I saw parking lots full of paper, lightly covered with plastic wrap, an unthinkable practice on the rainy and snowy east coast that I call home.

Companies that managed to maintain sufficient inventory to keep the presses running enjoyed sudden pricing power that had been absent from the industry for decades. For a few months last year, I heard stories that reminded me of the good times I experienced as an owner of a commercial printing company in the 1990s when customers without hesitation paid big premiums to rush preparation of proofs or extend press time availability. For some buyers last year, negotiating pricing was not their goal; if you had paper, you got your price.

As the supply of paper and other substrates normalized in 2023, market pricing discipline has returned, putting pressure on the top and bottom lines. For some companies that built up large inventories of paper at the peak of the shortage, the cost of working off high-priced inventory puts more downward pressure on margins. As a result, some owners decided it was better to withdraw from the market until revenue, profits, and inventory levels normalize.

What Happened #3: The Landing is Not Soft for Everyone

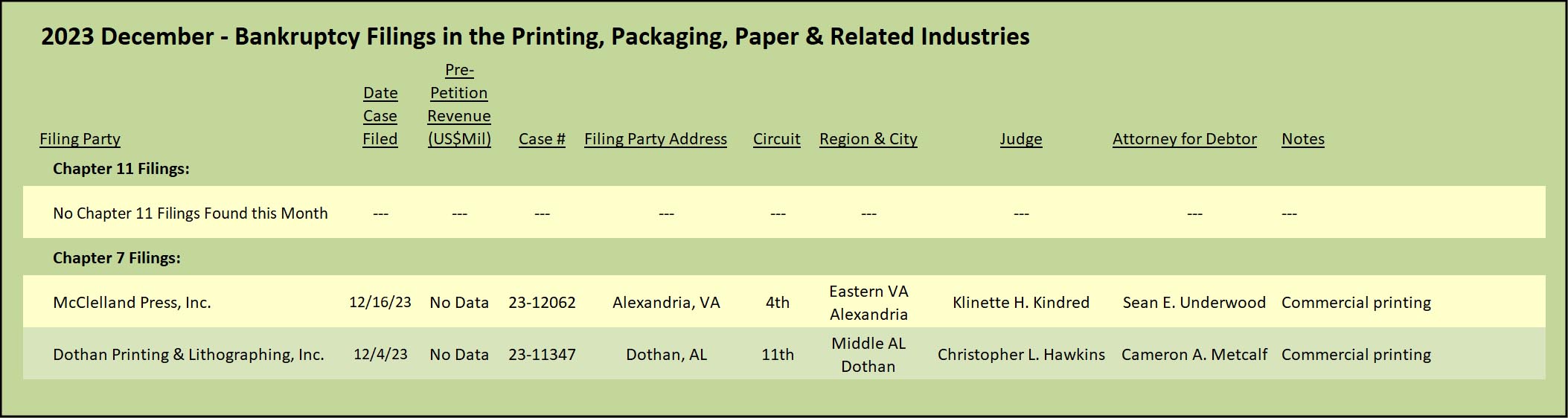

Over the past eight months, we have seen a noticeable uptick in companies that are experiencing financial challenges. Beginning in May 2023, the number of bankruptcies filed in our industry has notably increased, mostly in the commercial printing segment. The majority of those that declared bankruptcy filed for immediate liquidation under Chapter 7, rather than attempt to resurrect the company under a Chapter 11 proceeding.

In the packaging segment, some minor cracks have appeared. Although the segment remains very attractive to investors, there were several bankruptcy filings by companies in the corrugated carton and display business, indicative of some stress occurring in the fringes. One bankruptcy filed in 2023 was by a flexible packaging company, the first that we have noted in this segment for several years.

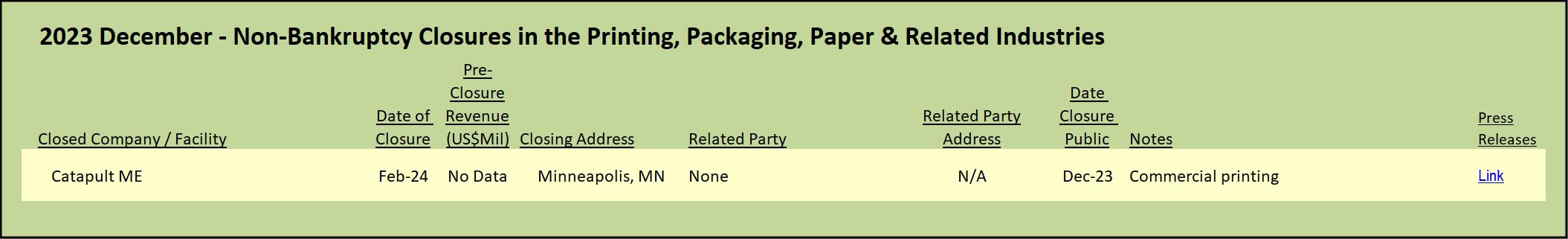

In addition, there has been an increase in the number of non-bankruptcy plant and company closures. The percentage of transactions that result in a tuck-in has also increased, which we believe is clearly indicative of overcapacity and softer market conditions. While not at the level to ring alarm bells, the trend is clear, an increasing number of companies are struggling.

It had to happen, and it is. Companies that survived due to the Covid stimulus payments are now running on empty. It is not a torrent, but our work assisting owners of companies experiencing financial challenges has increased significantly, and it appears that there will be more to come. (See The Target Report: Is a Soft Landing in Sight? – September 2023.) If opportunities to acquire and tuck-in the business from challenged companies becomes more prevalent, that will negatively color buyers’ expectations of value.

What Happened #4: Climb Another Mountain

Add up all of the above and it makes perfect sense. Company owners that had reached peak performance, maybe their best ever, had a high number firmly planted in their mind. If they are subject to the trends enumerated above, a sinking feeling has set in that a sale of the company will not produce the number they were counting on, at least not now.

As with all endeavors, there is always another peak in the distance. Forced by market conditions to climb down from the euphoria of the top, there is another summit to conquer. Even at advanced age when retirement beckons, the lure of that higher number summons. Reinvestment ensues, another capex and debt cycle begin, and ultimately a new higher exit goal is set. Some will try to climb that next mountain without a refresh of the production equipment. Like the mountain climber who does not have the right gear for the mission, trouble looms. In the meantime, as some owners set their sights on that next peak, they decided to withdraw from the market.

Reset Expectations for 2024

The unique trends that impacted the market for M&A transactions in 2023 all led to a value perception mismatch between sellers and buyers, depressing the number of completed transactions.

In addition to the trends of the moment, some trends are timeless and inexorable. Owners will age out and some will not have a next generation family member eager to take over. Technology will progress and equipment will become obsolete. Presses will wear out. Content will continue to be digitized and delivered electronically. Macro-economic conditions will bear down on or push up all businesses, but not evenly.

Sellers will continue to perceive the value of their companies at the top end of what is possible within their particular segment of the industry, and buyers will maintain their disciplined approach to valuation. Nonetheless, enough owners will decide that they have climbed their last hill and are ready to exit ownership. Even in a slower market that was down 14.3% year over year, 85.7% completed a transaction.

View The Target Report online, complete with deal logs and source links for December 2023

www.graphicartsadvisors.com