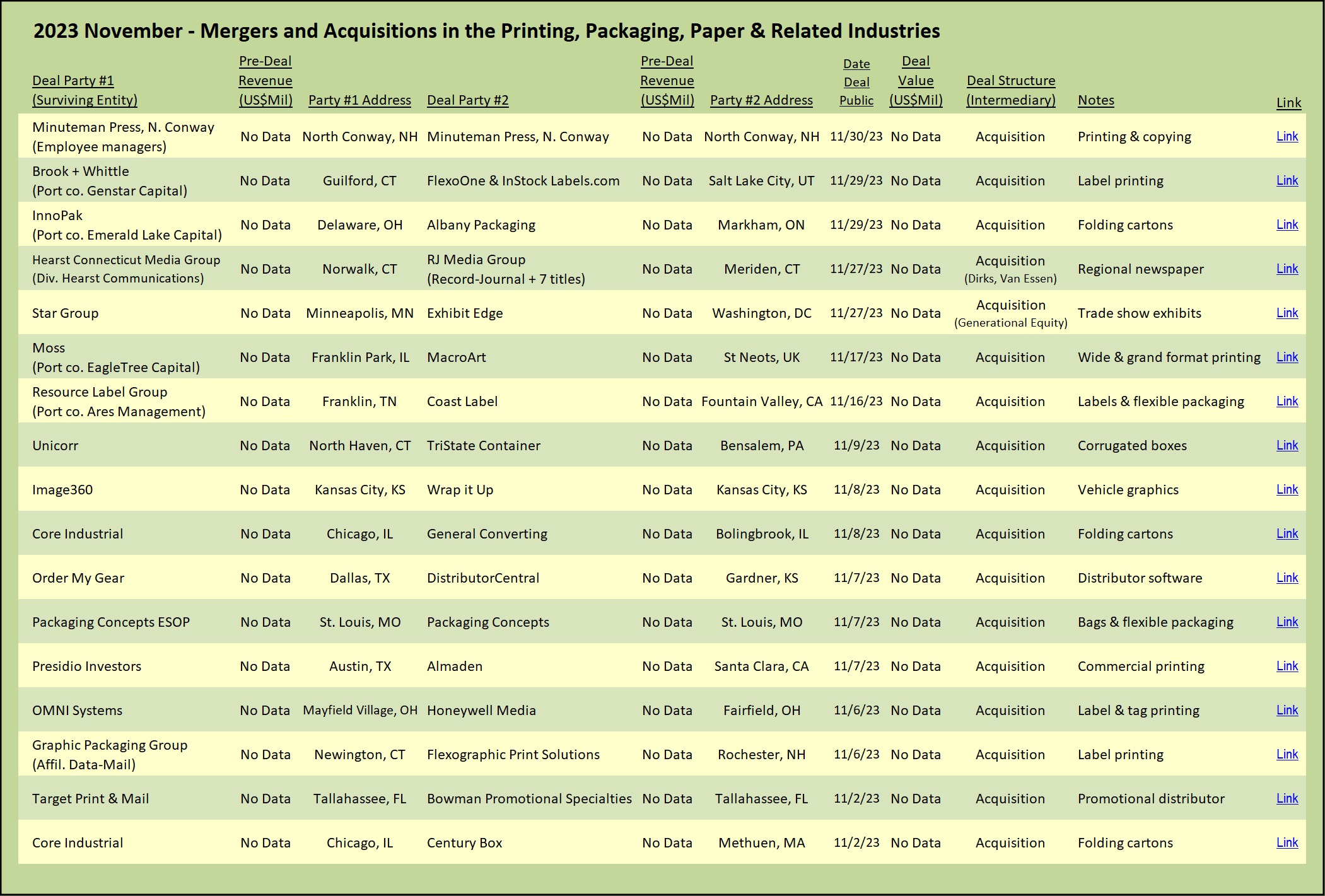

Core Industrial Partners is back in the ring, re-entering the packaging market as a contender in the emerging roll-up of the folding carton business. In 2020, the Chicago-based private equity fund had acquired TCG Legacy, a commercial printing and packaging company in Raleigh, North Carolina. Intended as Core’s platform entry into the print and packaging business, TCG Legacy soon added-on MedLit Graphics, a packaging and labeling company based in Windsor, New Jersey. Rather than continue to build out the TCG Legacy platform, Core soon thereafter exited the investment, in 2022, selling the renamed MedLit Solutions to Resource Label Group.

At the opening bell of its return to folding carton business, Core Industrial announced its investment in Century Box, a folding carton manufacturer based in Methuen, Massachusetts. As is often the case with private equity deals, partnering with Core Industrial represents the first institutional equity investment for Century Box, a family-owned company. The second generation owners of Century Box stated that they had specifically sought out a financial partner with packaging industry experience and expertise to fund and expedite the company’s next phase of growth. Core Industrial fit the bill.

Century Box, which was founded in 1978, operates from two facilities that together are over 200,000 square feet dedicated to folding carton production. The company utilizes a large format offset press and two narrow web presses to produce folding cartons for private-label store-brand food and consumer products. A complement of large format die?cutters and folder?gluers enable complete in-house production capability. Automated windowing is a specialty of the company, which supports the company’s focus on supplying food product cartons.

In its announcement of the deal, Core Industrial Partners clearly articulated that Century Box was only the first round in its re?entry to the packaging industry. Strategic initiatives and complementary acquisitions were planned. Less than a week later, the fund made good on its promise and announced round two, the acquisition of General Converting, a folding carton manufacturer in Bolingbrook, Illinois.

General Converting brings geographic and customer diversity to Core’s new platform company. Operating from a 122,000 square foot facility, the acquired company also serves the food industry, with added penetration into the confectionery segment. Additional markets served include pharmaceuticals, cosmetics, and fragrance, as well as other consumer products. Printing is accomplished on sheetfed offset presses. Die-cutting and finishing are completed in?house.

Core Industrial Partners is not alone. In the past two years, private equity has moved aggressively into the highly fragmented business of manufacturing folding cartons. As we noted a couple years ago, the market for folding carton manufacturing had begun to heat up. In recent months, the purchase of box printing companies outpaced the number of deals that involved label printing companies. That had not occurred before in our eleven?plus years of tracking and commenting on M&A activity in the printing, packaging, and related industries. (See Label Roll-Ups are Red Hot; Are Folding Cartons Next? – March 2022). We expect that the keen interest from private equity firms in the folding carton business will continue unabated for the next several years.*

The Easy Pickings are Gone

The label business has been positively picked over. The most desirable fruit has been gathered.

The owners of the diminishing number of label companies that remain independent are not ready to harvest the fruits of their labor. The valuations of desirable label printing companies, especially those with solid earnings and positive growth prospects, were sky-high relative to other segments in the printing and packaging industries. Many owners took advantage of the very favorable market conditions and sold out to one of the numerous PE-backed aggregators. As a result of the extensive consolidation, fewer highly desirable independent target label printing companies remain available for purchase.

Resource Label Group, now funded by its third PE backer, Ares Management, announced its 30th acquisition with the purchase of Coast Label in Fountain Valley, California. The acquired company produces specialized labels, such as durable industrial labels, sequential bar code labels, numbered machine identification labels, electrical system labels, inventory tracking stickers, traceability labels, and tamper evident labels. Notably, these are not the high-volume prime labels that characterized many of the earlier acquisitions completed by Resource Label Group. (See Private Equity Fuel$ Consolidation of Label Industry – September 2021.)

Brook + Whittle, now funded by its third PE backer, Genstar Capital, announced the purchase of FlexoOne, a label printing company in Salt Lake City, Utah. The company specializes in small clear stickers and pressure sensitive labels that are used to indicate apparel sizes in retail environments. Other products include tamper evident labels, as well as some prime product labels. The acquisition of FlexoOne included the purchase of InStockLabels.com, an associated online sales channel. InStockLabels stocks over 4,000 label products that are sold via its website. The products include standard safety labels, color coding stickers, for-sale labels, as well as a complete range of clothing size stickers. Remarkably, the products are not the high-volume prime labels that distinguished the manufacturers that Brook + Whittle acquired in its initial roll-up deals.

Eschewing the lure of private equity funding, OMNI Systems prides itself as being the largest privately owned label converter in the US. Headquartered near Cleveland, Ohio, the company announced the acquisition of Honeywell’s Media Business. The acquired business provides barcode labels, media tags, thermal label stock, RFID labels, and patient wristbands. OMNI Systems specializes in direct thermal stock, anti-theft tags, and preprinted barcode labels. It is worth noting that prime labels, while offered, are not front and center in the company’s offerings.

Compared to the past several years, the number of deals announced in the label segment has declined markedly over the past year. Nonetheless, the PE?backed label platforms continue to find some select, but potentially less juicy pickings.

* Graphic Arts Advisors, publisher of The Target Report, currently represents a private equity fund seeking to acquire manufacturers of high-value folding cartons.

View The Target Report online, complete with deal logs and source links for November 2023