- Respondents to this year’s survey reported an average annual turnover of €4.7 million for print services, which is up from €4.4 million during 2018.

- Today’s equipment suppliers are advancing quality management in their devices, improving ink formulation, and developing media that is designed for a wider range of applications.

- Despite their differences, survey respondents share a commitment to the environment. On average, respondents reported that about a third of their customers were currently demanding eco-friendly products.

By Eric Zimmerman

Introduction

The FESPA print census is an industry barometer that helps vendors and print service providers (PSPs) understand market dynamics in key industry segments, including signage and display, graphics, textile, and industrial. FESPA members around the world are exploring new applications that will help them grow their businesses and continue to innovate using a range of analog and digital printing technologies. This article provides a brief overview of the top-level findings from this year’s research.

Survey Overview

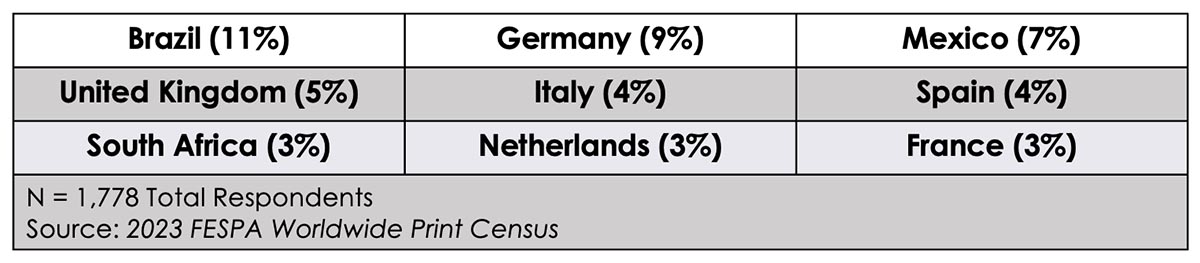

With nearly 1,800 respondents from 120 countries, this year’s survey continues a research partnership between FESPA and Keypoint Intelligence that began back in 2007. Our target audiences were FESPA members and event attendees, who are typically wide format PSPs from around the world. The survey was offered in Chinese, English, French, German, Greek, Italian, Portuguese, Slovak, Spanish, Thai, and Turkish. The respondents from the top 9 countries represent nearly half of our total respondent pool. Although the greatest share of respondents were from Brazil, the European countries dominated the remaining top contributors.

Table 1: FESPA Print Census Respondents (Top Countries)

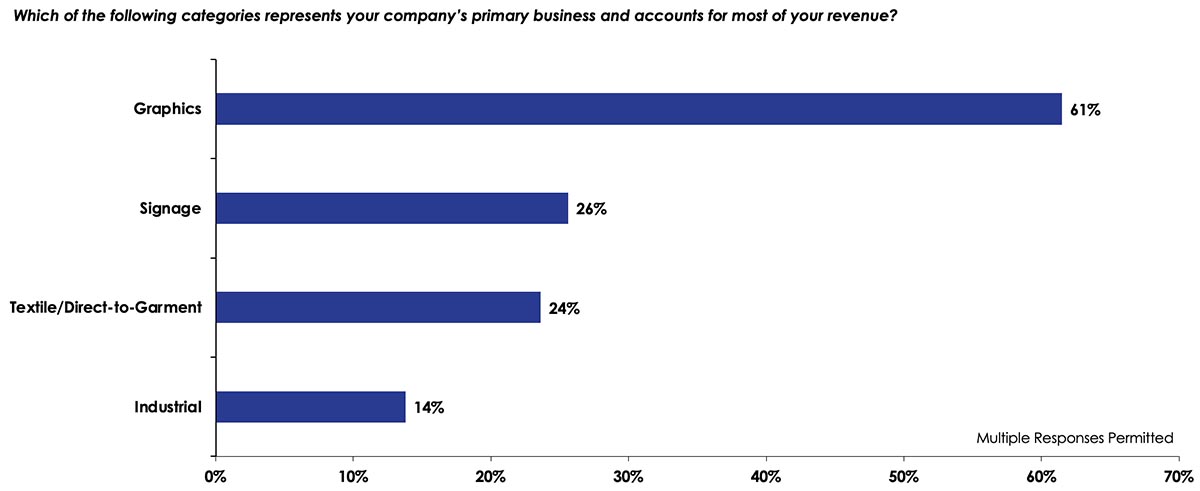

Survey respondents represented a broad range of graphic arts and industrial segments whose primary business revolves around printing. The FESPA community is diverse and growing, and this study was designed to explore service providers in these segments.

The greatest percentage of survey participants were digital printing specialists within the graphics industry, but other types of businesses, were well-represented, too. It should be noted that respondents were allowed to select more than one response when asked about their primary business, so there is some overlap between the groups.

Figure 1: Primary Business

N = 1,778 Total Respondents

Source: 2023 FESPA Worldwide Print Census

Total survey respondents worked for firms with an average of about 43 people, but this mean was drawn upward by the very large companies in the mix. In fact, 65% of respondents worked for companies with fewer than 20 employees.

Respondents to this year’s survey reported an average annual turnover of €4.7 million for print services, which is up from €4.4 million during 2018. This represents an overall increase of about 7%, which is encouraging news for the overall print industry.

There is no question that customer demand for mass customization continues to drive the adoption of digital printing technologies. Core customer requirements include fast turnaround, short-run printing, increased use of versioning and personalization, and just-in-time manufacturing. These requirements have been quite important for several years now.

Correlating their need for fast turnaround and just-in-time manufacturing, respondents reported that their top reasons for investing in new technologies were to enter new markets and to enhance print quality. Today’s equipment suppliers are advancing quality management in their devices, improving ink formulation, and developing media that is designed for a wider range of applications.

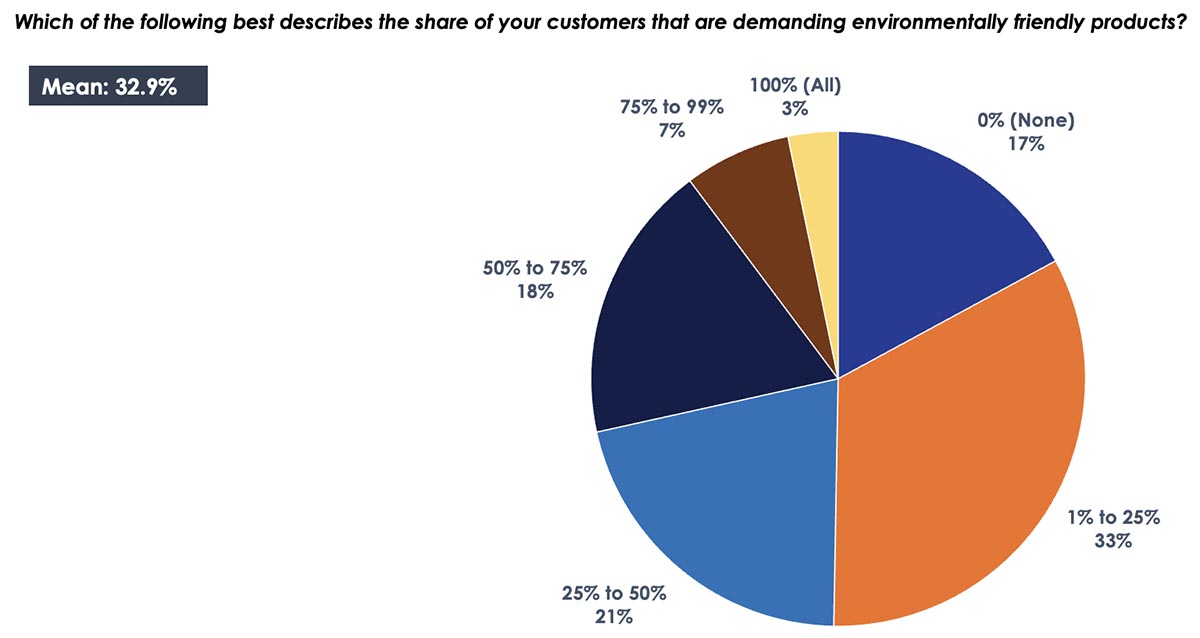

Our respondents represent a diverse range of producers from a variety of industries. Despite their differences, they all share a commitment to the environment. On average, total respondents reported that about a third of their customers were currently demanding eco-friendly products.

Figure 2: Demand for Environmentally Friendly Products

N = 1,778 Total Respondents

Source: 2023 FESPA Worldwide Print Census

As we considered the activities that PSPs are taking to meet today’s increasingly stringent environmental standards, we also asked how the investment in more sustainable products affected our respondents’ bottom lines. Fortunately, most PSPs reported that this investment had no negative impact on business and that they were able to maintain their current pricing. About 8% of total respondents needed to raise their prices, but soon expected to recoup the expenses from the investment.

The 2023 FESPA survey revealed that despite economic instability caused by the global pandemic, PSPs remain optimistic about the future. Revenue and investment levels have increased, and technology will be driven by customers' demand for faster turnaround times and customized, short-run production. For years to come, the trend will be to purchase finishing equipment and production step-saving devices. Additionally, customer demand for eco-friendly solutions will encourage PSPs to provide sustainable products with a reduced carbon footprint at an efficient rate.

The Bottom Line

Despite the ever-changing marketplace, most printers have the advantage of serving customers across all verticals. If one vertical slows down, another may be growing, and having the ability to produce a wide variety of applications in-house from start to finish provides stability.

The path forward will surely have its own share of difficulties, but the print market has proven to be resilient. PSPs have the opportunity to advance their positions, offerings, and technological efficiency in the years to come to maintain high levels of production and profitability.

This article is an excerpt of a much more detailed research report written by Keypoint Intelligence via its ongoing partnership with the FESPA community. If you are interested in accessing the full in-depth report, send us an e-mail at [email protected] for more information.

Eric Zimmerman is the Principal Analyst of Keypoint Intelligence's Wide Format Printing Consulting Service. He is responsible for conducting multiple primary research studies annually in the wide format market on a custom basis and as part of Keypoint Intelligence's syndicated research. He has 20+ years of experience in the wide format market specializing in consultative, solution-based sales, marketing, and product development.