(This week, WhatTheyThink is “reprinting” some key articles from 2023. This article originally appeared on September 14. Look for our regular publishing schedule to resume on Monday.)

- Marketers expect certain applications like direct mail, catalogs, and training materials to grow at single-digit rates over the next two years, while brochures and newsletters are expected to remain flat.

- PSPs must convince marketers about print’s power as a robust and relevant communication channel, and they must also position themselves as excellent partners for complementing digital communication campaigns with print.

- In addition to customized or variable data printing, specialty printing can also help improve communications.

By German Sacristan

Introduction

Print buyers are the primary customers of print service providers (PSPs), so understanding their print communication needs is imperative. In late 2022, Keypoint Intelligence surveyed over 200 marketers to better understand print buyers’ needs and uncover purchasing trends.

Although the primary printing applications are still strong, run lengths keep shrinking—which is driving digital printing investments. The technologies that enable variable data printing have been around for decades, but customization is included in only a small share of total communications. This indicates that the challenges associated with customization are more related to the communication strategy than the actual technologies that drive it. While print is not used to its full potential with omni-channel campaigns, there is still a strong opportunity to change that. Price is always a very strong buying criteria in any industry, but print buyers are also interested in purchasing higher-cost printing products that help them communicate more effectively.

Application Trends

Marketers expect certain applications like direct mail, catalogs, and training materials to grow at single-digit rates over the next two years, while brochures and newsletters are expected to remain flat. The expectations for growth are interesting since these same respondents largely expect the overall print market to remain flat. This suggests that general perceptions about the future of print may be worse than reality.

The substantial, tactile value of direct mail and the physical connection to the mailbox offers a less cluttered channel for marketers to communicate with their customers. Most consumers receive only a few pieces of direct mail each day versus hundreds of digital media communications. In addition, recent changes to digital content (e.g., increased requirements for first-party data use, website cookie policies, and Apple iPhone privacy changes) have driven a renewed interest in print. According to Keypoint Intelligence’s 2023 direct marketing communications survey, nearly three-quarters of businesses believe that the recent changes to digital content have contributed to an increased use of printed direct mail.

Digital vs. Offset Printing

The print buyers that we surveyed had strong opinions regarding the most common run lengths for some primary printing applications in terms of the potential transition from offset to digital. Most run lengths in this study could be in the crossover point between offset and digital. Crossover points for various applications included:

- Direct mail: 6,000 pieces

- Brochures: 4,000 pieces

- 40-Page Catalogs: 1,300 pieces

Survey respondents also expected the number of print jobs to grow by 3% between 2022 and 2025. For the most part, marketers are anticipating an increase in smaller print jobs, which favors the transition to digital print.

Opportunities for Print

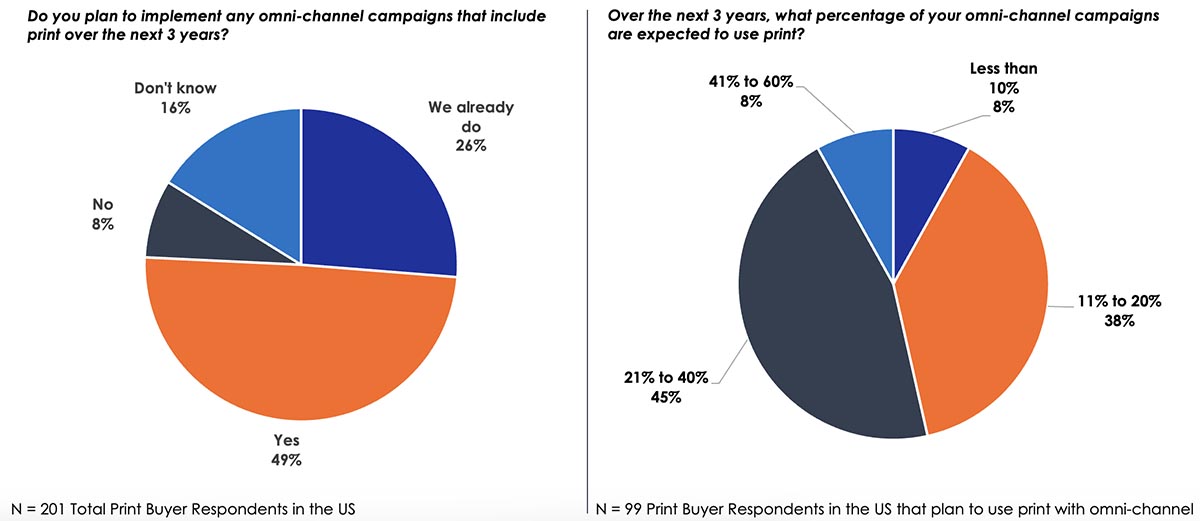

One opportunity for print could be omni-channel campaigns. Unfortunately, even though most brands plan to include a print component to their omni-channel campaigns, the total share of print is only expected to be about 25% on average. PSPs must convince marketers about print’s power as a robust and relevant communication channel, and they must also position themselves as excellent partners for complementing digital communication campaigns with print.

Figure 1: Omni-Channel Campaigns that Include Print

Source: US Print Buyer Marketing Survey; Keypoint Intelligence 2022

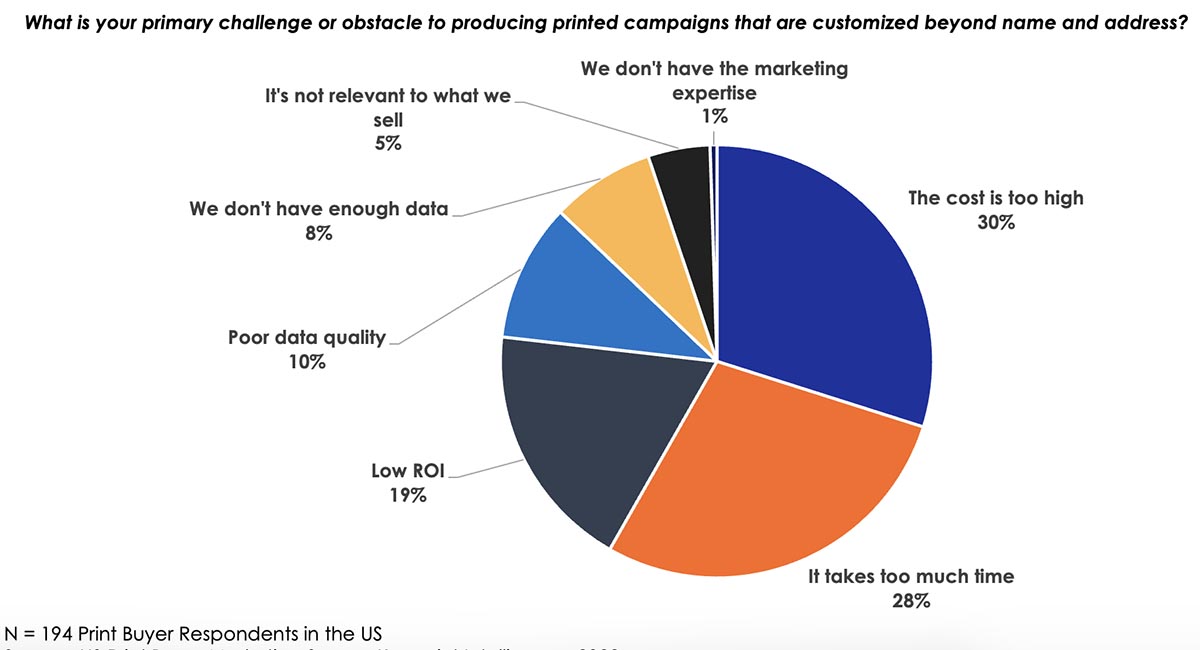

Customization—which is one of the most effective and natural ways of communicating—has been used with printed applications for decades. Even so, print buyers only customize about 25% of their printed communications beyond name and address. In theory, convincing marketers to use more customization should not be difficult because consumers actually want to receive communications that seem relevant to them. In practice, though, customization can be complicated. Print buyers’ top obstacles to increased customization are provided in the chart below.

Figure 2: Obstacles to Producing Customized Printed Campaigns

Source: US Print Buyer Marketing Survey; Keypoint Intelligence 2022

The challenge of customization does not relate to print or its technologies—it is 100% strategic. Marketers must have the right consumer data appropriately organized to increase their chances of being more relevant and achieving the best ROI.

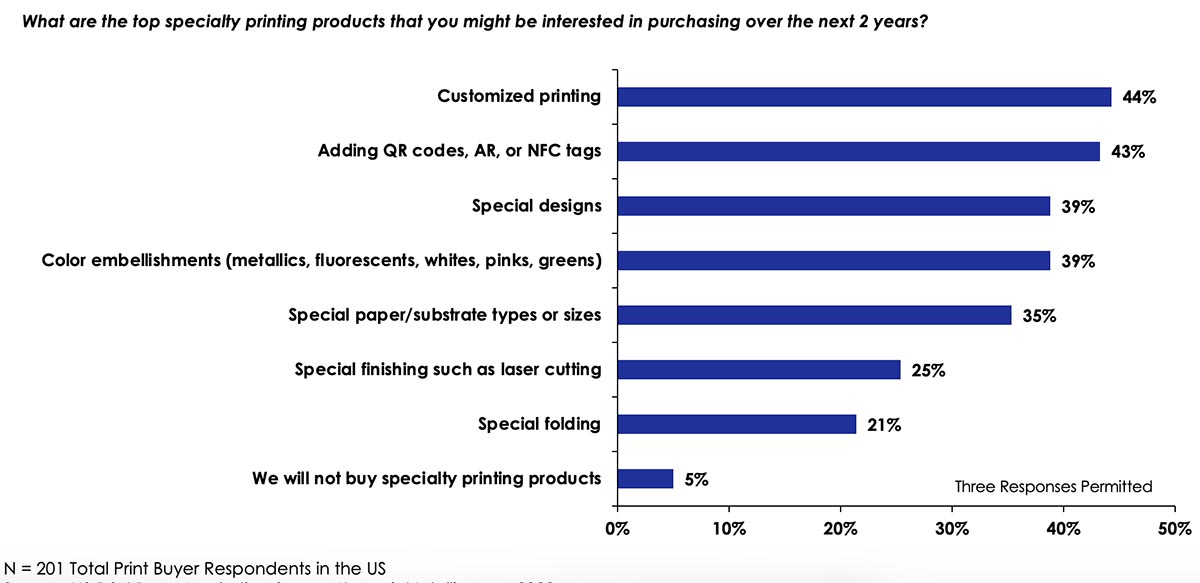

In addition to customized or variable-data printing, specialty printing can also help improve communications. The vast majority of marketers (95%) are already embracing the value of specialty printing products such as quick response (QR) codes, augmented reality (AR), near-field communication (NFC) tags, and color embellishments.

Figure 3: Top Specialty Printing Products

Source: US Print Buyer Marketing Survey; Keypoint Intelligence 2022

Although print is often perceived as a commodity, our print buyer research confirms that price is not everything. As shown in the previous chart, 95% of marketers are interested in specialty printing and will therefore need products that cost more than basic prints.

The Bottom Line

Print buyers often take print quality and delivery for granted and tend to focus on price as the most relevant buying criteria. PSPs must identify the types of campaigns and programs that call for specialty printing and value-added products to achieve the best possible ROI. The importance of price will likely depend on an individual marketer’s target audience and what needs to be communicated. All marketing decisions should be driven by objectives and goals, and marketers might need to spend more on print to achieve these objectives and goals.

Keypoint Intelligence’s research provides insights that can contribute to the growth and sustainability of the printing market. If you’re a PSP and would like to contribute to our research, we invite you to join our panel here. We offer special incentives to our panel members, including summaries of survey results.

German Sacristan is the Group Director of Keypoint Intelligence's Production Printing Group. He supports customers with strategic go-to-market advice related to production printing in graphic arts and similar industry segments. He has supported many PSPs, agencies, and brands in the transition toward and implementation of digital printing.