(Watch Cary Sherburne’s interview with Michael McDonald here.)

SPESA, the Sewn Products Equipment and Suppliers of the Americas, is an industry association that represents suppliers to the industry, and plays a key role in the ability to streamline supply chains, bring textiles work back to the Americas, and find more ways to automate the sewing process, which has been the bottleneck to reshoring due to lack of sewing talent, among other things. The association is also focused on attracting new talent to the sewn products industry and finding innovative ways to train sewists, sewing machine mechanics and more.

WhatTheyThink: When you say you represent the suppliers to the sewn products industry, what does that encompass?

Michael McDonald: That means anything that goes from taking a piece of fabric and turning it into a T-shirt, a car seat, a couch, an airplane wing, whatever it might be. We represent the suppliers of equipment and software and services that go into doing that. And so the bulk of our members manufacture cutting machines, sewing machines and printing machines. But we also get into the software realm with PLM (product lifecycle management) solutions, CAD, 3D design, as well as services, logistics, consulting, and more. We exclusively represent the suppliers to the industry. And we don't have textile manufacturers, brands or retailers in our member base. We are a very niche association, but we represent a very dynamic and interesting segment of the industry.

WTT: When we think about sewn products, we usually think about needles. But it’s more than that, right?

MM: Of course. There is seam sealing and bonding, as well as all sorts of new 3D printing and knitting, new technologies that don’t necessarily involve traditional sewing. It often baffles people. Airplane wings are usually sewn on because it is one of the strongest bonds you can create. It’s not just apparel; it’s car seats, boat awnings and a lot more. It’s a very diverse group of manufacturing, and we are still struggling a bit to find the name that describes our entire industry.

WTT: So you have had a busy season with your Executive Conference in Puerto Rico, the TexProcess Americas show that took place in May, and now planning for a major event in Philadelphia in the fall. Let’s talk about the first two, and what the key outcomes of those events were.

MM: We are an in-person industry. There’s a lot you can do virtually, but there’s nothing like shaking a hand, seeing a face, and if you are looking at equipment, there are just some things that you can’t get across online. That’s why we are so glad to be getting back to in-person meetings and events. We chose Puerto Rico as the venue for our Executive Conference. People might not realize the breadth of the industry there. And, of course, it’s part of the United States, so fits in with the Made in America trend, especially for military uniforms and other government contract work.

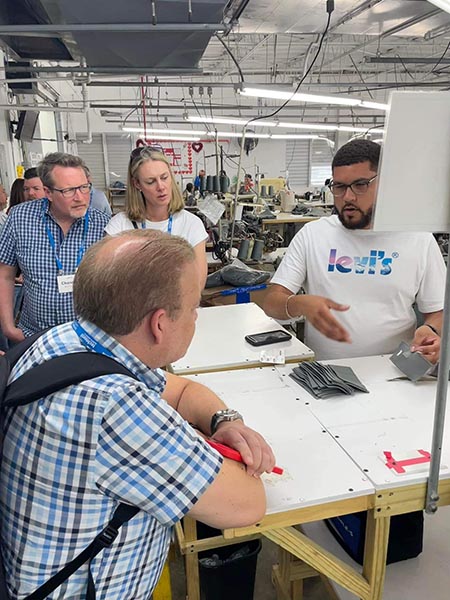

Attendees from the 2023 SPESA Executive Conference in San Juan, Puerto Rico, visit the factory floor at Bluewater Defense, Inc., one of the leading manufacturers of uniforms for the U.S. Department of Defense.

An important part of the conference were the visits to three very different factories; a uniform manufacturer; a co-op up in the mountains making artisan handbags; and a very automated footwear manufacturer.

At TexProcess, we saw a lot of enthusiasm among attendees. I think people realize that now is the time to look at your processes and rethink a lot of the way we have always done things. Our exhibitors had a tremendous amount of innovation on display, giving visitors a lot to think about as they returned to their businesses. This included things like dyeing thread on demand, automated sewing and an increased amount of automated material handling that we hadn’t really seen before.

Attendees at TexProcess Americas 2023 speak with an exhibitor in the SEAMS Made in America pavilion.

WTT: Normally this show is every other year; but because of the pandemic, you had shows in both 2022 and 2023.

MM: Yes, and some exhibitors and attendees were a little concerned that we might not have enough new to show in 2023. But that concern was completely unfounded. There was a tremendous amount of innovation on display, and that gives us a good foundation to build on as we move toward the next TexProcess in 2025.

WTT: For those who attended either or both events, both exhibitors and attendees, what would you say are the two or three outcomes? What might they do differently as they go back home?

MM: That’s a really good question. It’s hard to narrow it down. The greatest challenge in manufacturing in any industry is sewing automation. We’ve privatized space travel, but we haven’t figured out how to automate sewing a T-shirt. And the issue is really self-inflicted. Back in the 80s and 90s, instead of investing in automation, we invested in cheaper labor. But inevitably, we will run out of cheaper labor. We were just kicking the can down the road instead of addressing the real issue. But now I think the industry realizes that the solution is automation, but that automation isn’t quite there yet. So the challenge our industry has is how do we train a workforce and invest in automation to meet at the exact same place, so we have a trained workforce available when the automation gets there? The two really have to go hand in hand.

WTT: And really, if we are talking about reshoring or near-shoring, that has to happen, right?

MM: Absolutely. At the show, we had a training pavilion to showcase how you train mechanics and engineers. In addition to sewists, that’s a dire need for today’s workforce. Another important outcome is increased focus on building a regional supply chain. We have to work with Mexico, Central and South America and the Caribbean. They have the drive and the skill sets we need today, and they are excited about the opportunity to move those skills into the future.

The Chicago Pattern Maker, Xochil Herrera Scheer, speaks with two attendees during TexProcess Americas 2023. Xochil oversaw the show’s Tech Talks educational sessions.

WTT: In the United States, we do have some pockets where those skills exist. I was startled to learn that in L.A. there are 45,000 garment workers. There’s a pocket in Arizona, and in your state, North Carolina. St. Louis is starting to come back. But it is a big country, and pockets aren’t going to get the job done.

MM: One of the things we have been trying to do is map where the factories are. For example, we did a project in San Diego. At first glance, there were about 60 or 70 factories; but 40 of them were Etsy shops in a garage or something, with one sewing machine. And 10 of them hadn’t existed for years. It took us a month to sort all that out. So mapping the entire country is quite an overwhelming challenge. But we will keep at it. We have to know where we are to be able to better plan how to get to where we need to be. Plus, people need to understand that these factories are not what they used to be in the early 1900s, for example. They are typically clean, well-lit places to work. And of course, wages are an issue.

WTT: But the truth is, not much will change unless consumers drive that change. As long as they are buying that $5 T-shirt, wearing it once and throwing it away, the fashion industry will continue to fill that need. Sort of like the drug trade, you could say.

MM: True. But although it can be a heartbreaking challenge, the opportunities are exciting. There is a tremendous amount of research being done into circularity, and how you use and reuse materials throughout a circular life cycle. There are many pilot projects happening, including how to separate out, for example, cotton from polyester in blended fabrics so the polyester can be recycled and reused. But the issue here is scalability; how fast these technologies can be proven, and then how fast they can scale.

WTT: It’s encouraging that SPESA is working hard on these issues, and we hope that progress continues. As we wrap up, anything else you want to add?

MM: One of our big issues, especially in the government and military here in the U.S., is the fact that they have not really been putting their money and attention in the right places. One example is we do not have surge capacity if, God forbid, we needed to mobilize our military. We couldn’t even provide uniforms to everyone. And as you said, we need to do more to influence consumers, who will be the ones to drive change. All of that being said, I remain optimistic about the future of the industry. I think as we continue to build a workforce and develop more automation, we can reach that baseline where we get more cost and price efficiency.

One exciting thing coming up in October—we are co-hosting the International Apparel Federation’s World Fashion Convention. That conference has not been held in the U.S. for 25 years. And they are interested in seeing what the Western Hemisphere is capable of, from a manufacturing, innovation and fashion perspective. So we hope to see some encouraging outcomes from that conference as well.