One Month Does Not Make a Trend

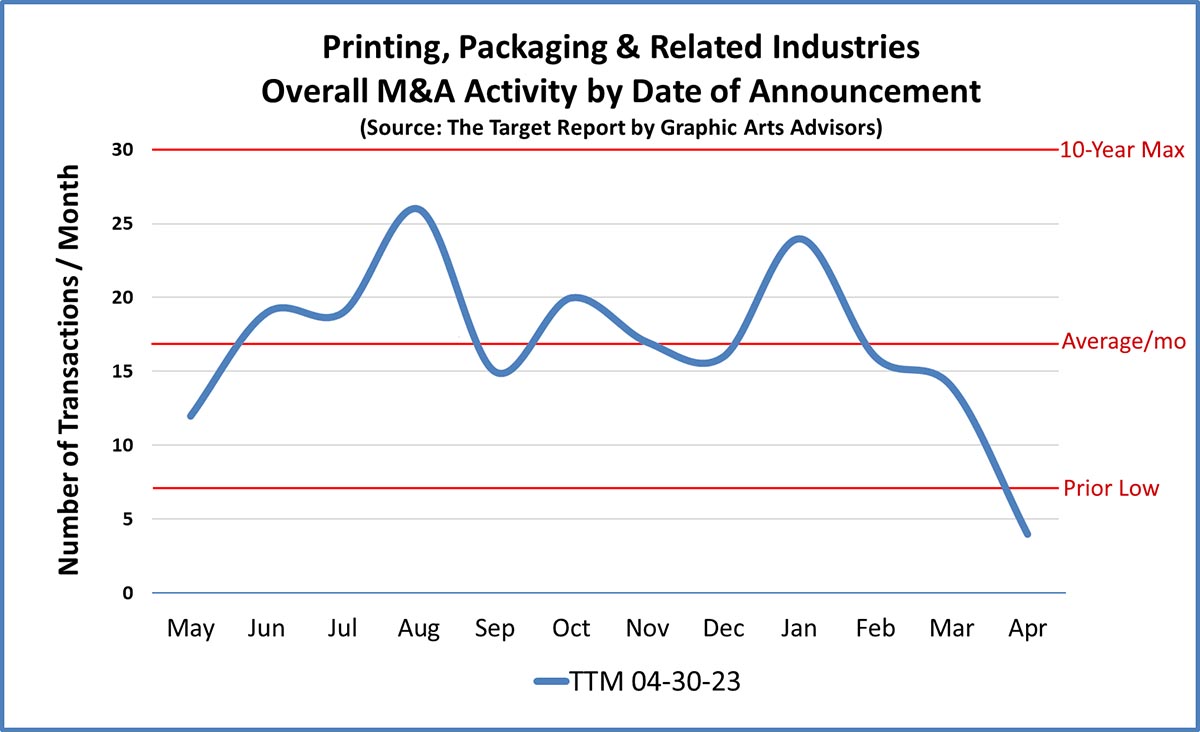

Deal activity fell off a cliff in April. The sudden drop off begs the question: are we heading into deeper turbulent waters? Is the dramatic decrease indicative of a declining M&A market in the printing, packaging, and related industries? Are recessionary times ahead? Does the increase in calls we have received from owners whose companies are at best treading water foretell more trouble to come? Or does the positive economic news about job creation, record low unemployment, and steady wage growth, among other factors, portend the way forward?

While it is too soon to tell, we do know for a fact that deal activity in April was the lowest we have logged in more than ten years of tracking the market. Incredibly, there were almost twice as many deals even in the worst months following the outbreak of Covid and the resultant business shutdown.

Over the past eleven and a half years, we have reported on the very healthy level of merger and acquisition activity in the printing, packaging, and related industries. In some segments, that activity tells us that opportunities are excellent and financial buyers are seeking to put their capital to work and invest in growing markets. Sellers that have built successful companies in these segments take advantage of the positive market conditions and enjoy a comfortable exit from ownership.

Conversely, significant transactional activity in a particular printing industry segment, especially when correlated with data on tuck-ins, bankruptcy filings, and plant closures, is a very good indicator that business in that segment is getting tougher. Owners decide, or are forced, to sell or consolidate the business in a less advantageous transaction. In the worst situations, a company simply shuts its doors and liquidates.

The Analysis of Deal Trends Informs Us

We know that the commercial printing segment has stabilized over the past couple of years and some owners are reporting record revenues and profits. Financial buyers have returned to commercial printing, albeit with a keener interest in companies that have differentiated services or are specialized in serving specific market verticals. (See Commercial Print Awakes from M&A Slumber – June 2022).

As a percentage of the total number of deals in the commercial printing segment, tuck-ins have declined in each of the past four years, another indication that prospects in the commercial printing business have improved. Bankruptcies of commercial printing companies have declined both in number and impact. Another trend we have observed is a phenomenon we have not seen for years; private individuals are entering the commercial printing business. Buyers with no prior printing experience have acquired small to medium-size non-franchised general commercial printing companies, convinced that the printing industry is a sound investment of their time and money. The message is out; commercial printing is not dead, rather it has evolved and is still a vital component of the larger mix of available communication channels.

In the label manufacturing segment, transactional activity over the past several years paints a clear picture that the M&A market for label manufacturing companies has been on fire. The record shows that consolidation in the label business has been primarily driven by keen interest from a multitude of private equity firms. (See Duking it Out in the Label Business – February 2023). A corollary indication told us that the market for folding carton companies would be picking up, and indeed it has. Similar to labels, private equity sees opportunity in folding cartons. (See The Box is Back – January 2023).

From an M&A standpoint, the wide-format printing segment has been relatively quiet. In our discussions with owners of wide format companies, we hear that times are good again. With the end of the Covid pandemic shutdown, sporting and entertainment events are back. Retailers are open again and graphic signage of all sorts is booming.

However, we are finding that buyers are very skeptical of the sharp improvement in revenue and profits. Buyers are concerned that the recent positive numbers are the result of an unsustainable surge of pent-up demand that is a result of the Covid shutdown. We expect that M&A activity in wide-format will pick up as the dust settles. Owners of wide-format printing companies that can show that the good times are sustainable and not just a boomerang effect of Covid will find willing buyers.

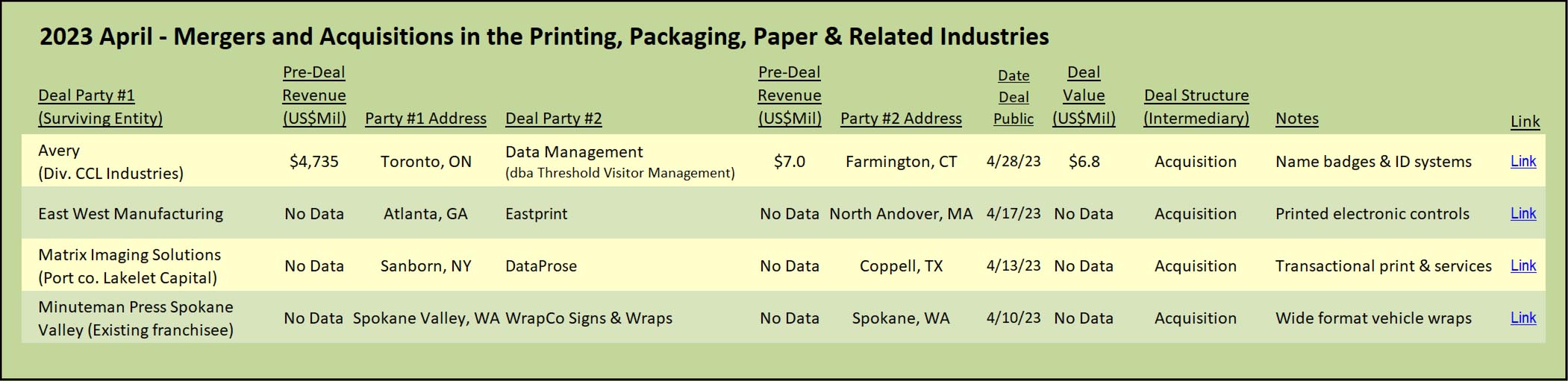

In the industrial printing segment, a bastion of the screen printing process, we believe that there will be an increase in M&A activity and growth. The production of durable labels, nameplates, membrane switches, and graphic overlays will be of interest to buyers, driven in part by the impact of US industrial policy to bring manufacturing back to America. No longer just a slogan, the made-in-America policy is supported by massive federal funding of infrastructure and technology, with strict requirements for US-based manufacturing. One of the limited number of transactions in April was indeed in the industrial printing segment, the purchase of Massachusetts-based Eastprint by East West Manufacturing.

In addition to the response to government policy, increased stateside industrial printing will be fueled by fear. Supply-chain disruptions, such as experienced during the Covid pandemic, changed thinking about reliance on just-in-time global suppliers. The threat of an attack by China on Taiwan, and concern about China’s use of trade policy to gain political leverage by limiting supply of critical components, will also drive bring-it-back-to-America strategies.

Another transaction of note in April was the acquisition of DataProse, located in Coppell, Texas, by Matrix Imaging Solutions. Based in Sanborn, New York and with financial backing from Lakelet Capital, Matrix had previously acquired a direct mail company in Frederick, Maryland. Focused on direct mail and transactional printing services, Matrix is clearly executing on the trend we have noted towards multi-region acquisitions in direct mail and transactional customer communications. The larger firms in these related print segments have been increasingly going bi-coastal in an effort to mitigate degraded postal delivery time standards, as well as provide enterprise level customers with disaster recovery capabilities within one corporate structure. (See Direct Mail Providers Stretch Out – October 2022).

Stay Tuned…

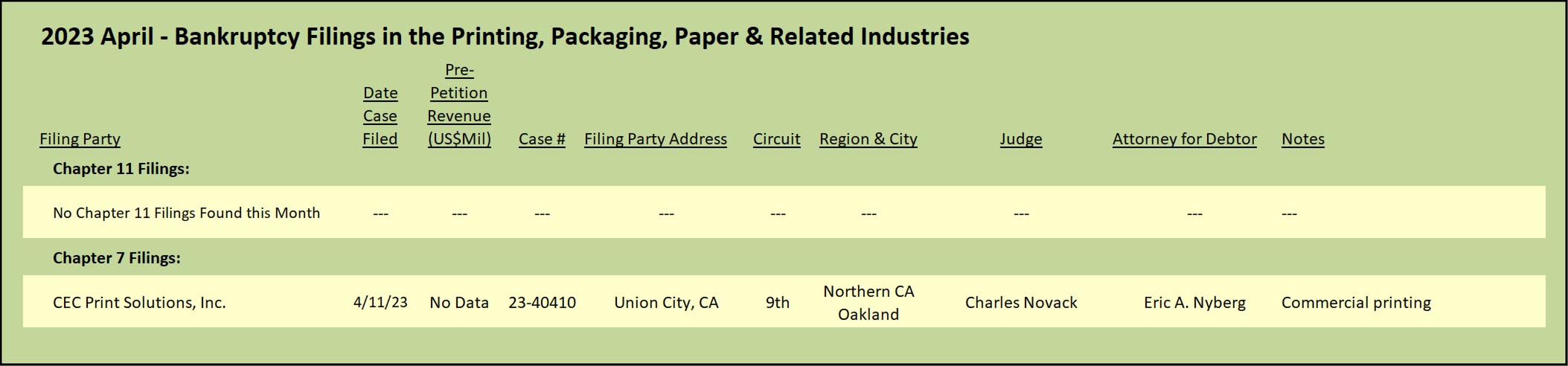

What does it mean when M&A activity in our industry suddenly grinds almost to a halt? The current evidence is mixed, and it is too soon to draw a definitive conclusion. If the economy, and consequently, the printing, packaging, and related industries, are in for a rough patch, we would expect to find increasing bankruptcy filings and non-bankruptcy plant closures, which we do not. For better or worse, one thing we do know is that deal activity will continue in our industry, and there will be peaks and valleys. The reason for the current fall off remains below the surface, yet to be revealed.

View The Target Report online, complete with deal logs and source links for April 2023