(Read the original press release here.)

Background

According to the Smithers Report The Future of Flexographic Printing Markets to 2027, flexible packaging is the fastest growing packaging application, and for obvious reasons. It can minimize package transport costs between the converter, packer/filler, retailer, and end user. It not only takes up less space when empty than rigid packaging but can also be constructed on the spot from roll materials at the filling location, thereby minimizing transportation of ready-formed, but empty, packaging.

Flexographic flexible packaging is projected to grow at a CAGR of 3.4% to a total output value of $40.86 million in 2027, and during this same period digital printing of flexible packaging is projected to increase a whopping 53+%, as adoption of new digital technology begins to compete with flexographic printing. Putting that growth in perspective, digital label production was introduced in 2008 and projected digital label output volume (physical amount of production) by 2027 still only translates into about 12% of the total volume of label production. When you are starting from a smaller base, even modest growth will be comparably higher. The same growth trajectory holds for the transition of flexible packaging from flexo to digital.

Importantly though, the value of a digital label or flexible packaging is comparably higher to the analog methods, and that is to be expected with all of the other digital packaging applications as well. More importantly, digital production makes short runs and on-demand production much more feasible, and better suited to the shifting consumer purchasing trends in many cases.

To address those demand shifts in flexible packaging, HP has been marketing their 25K Digital Press for flexible packaging since 2020 and has already placed over 300 presses with 200 customers in 50 countries. According to Keren Yakolev, VP Head of Product & Business Development, HP Indigo, “At the end of the day, we see that we are driving the change. Change in our market is never easy and it’s never fast, but we do see the market adoption.”

VIP Event

In order to bring those insights and experience, HP Indigo held a VIP event for over 126 customers from around the globe in Israel March 20–23, 2023. The program included visits to Indigo sites at the Ness Ziona and Kiryat Gat campuses to get a better look at the inside of HP Indigo and where the equipment and supplies are designed and manufactured. In addition, there were educational sessions, panels, and partner exhibits. One of the highlights of the VIP event was the introduction of a new HP Indigo Flexible Packaging press.

Enter HP Indigo 200K

Now that the market for digital production of flexible packaging is starting to take hold, HP has developed the next generation of product that builds on the expertise gained with the 25K as well as their other products and technologies.

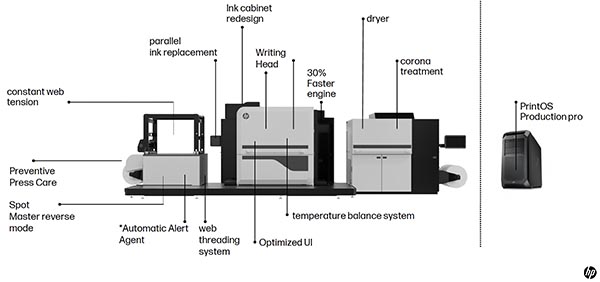

This new series 5 press is built on the backbone of the very successful 100K B2+ press. It can print up to 56 mpm (184 fpm) in EPM mode, is 30% faster, and is projected to be up to 45% more productive over the 25K. This increase in productivity is attributed to the new platform, which includes instant web tension recovery and increased automation and the new innovations under the hood.

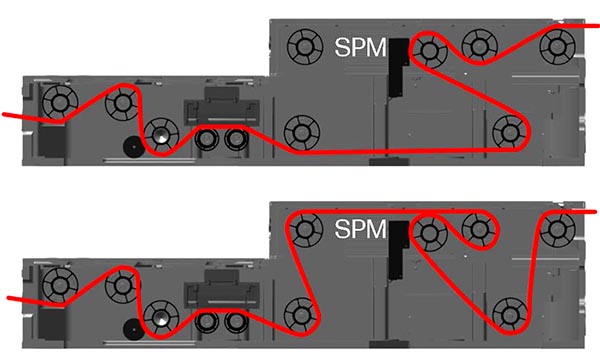

They have increased the internal machine and process control to ensure higher quality and consistency. These changes include a priming unwinder that provides on-demand treatment of virtually any substrate, and a new temperature balancing system that maintains consistent image scale throughout the print run. The new inline spectrophotometer measures both the surface and reverse side printing on the fly, and the new Spot Master performs continuous calibration and spot color refinement against the LAB values from the file or package master.

Borrowing concepts from the Indigo V12, the 200K has five dual revolver ink stations (WCMYK) that provide fast and automatic ink tube replacement, as well as two single ink stations for OGV. This is in addition to a new solid ink system for reliable ink control to support high coverage printing with increased reliability and cleaner operation.

The amount of new innovations in this press is impressive. It goes without saying that it produces food packaging compliant with EU and FDA regulations, and is compatible with available sustainable media. To date, there are more than eight 200K machines in various stages of beta prior to the VIP introduction event in Israel this week. The first one was placed with Sirane Group, and for the first time to a new HP customer, who shared their experiences at the event.

Is Digital Only for Short Runs?

When digital printing was introduced into the commercial market, there was an assumption that variable-data capabilities were going to be the primary use case. As we have seen, while transactional and some direct mail applications benefit from those capabilities, especially in mass customization, the real benefit is in production flexibility. Some of that does translate into shorter run, but for many, the addition of digital print to a company’s equipment profile provides a higher OEE for the entire production equipment base. Furthermore, it brings many previously unseen opportunities.

That doesn’t change the fact that the analog/digital cost crossover values still exist, albeit at increasingly higher run volumes with the newer inkjet equipment models. As a result, many converters just see that creating a balance of analog and digital equipment provides them with many advantages.

Increasing Digital Market Penetration

At the event, Eli Mahal, Head of Label & Packaging Marketing for HP Indigo, spoke to the experiences of their current flexible packaging market customers and took a look at future growth opportunities.

Of their current “packaging” customer base, about 20% are pure label makers who are using the series 4 presses for label and shrink film. Around 40% are conventional flexo players that have flexo presses of one meter width running 200 to 600 meter per minute. They bought an Indigo series 4 to meet the need for a short-run fast delivery. In essence, all of them are looking to expand their digital offering opportunities. Each of these are anxiously awaiting the new series 5 press.

Those players that have been reluctant to step into digital because of the productivity gap between what was offered in series 4 and what they have on flexo is essentially huge. Realistically, when you think high-volume production, with a minimum quantity of five kilometers and beyond with three week deliveries, digital is not that interesting. Although HP has seen the press penetrating a few of those who they call “innovators,” the ones that truly understand that something is happening, they need to go through a couple of years’ learning curve to prepare for when the market is ready.

In the last year or so, there has also been some shift in the market, and as a result they have also seen more conventional players following the success of ePac and others making their first step into digital flexible packaging. This is also fueled by recognition of the increased investment in ePac by Amcor and other similar scenarios. So they expect that this group of conventional flexo players will be more attracted by a press that might not run at the speed of flexo but is getting closer and offers other opportunities including quick-turn short runs, etc. This new 200K press should push the breakeven point to a point that makes more sense to them. Now they could print 3, 4, 5 kilometer jobs on this press and feel comfortable with the economics. That is one target market that they plan to focus on. It is a very big market that comprises about 98% of the flexible packaging market.

The second target market is what they call the disruptors. These are label makers moving into flex packaging or complete entrepreneurs like ePac starting from scratch, and they have only digital. To better understand this group, you need to think about their operations. They have a site, let’s say 600 to 1,000 square meters with one or two Indigo presses, a laminator, mostly solventless, two pouch makers, and a slitter. Overall, they may invest $2.5 million in this facility, and will have certain fixed costs for energy, labor, and sales and marketing. This operation with a single press today would generate $3 to 4 million per year, according to numbers that they are getting from their customers. With this new 200K, they should now be able to generate $4 to 5+ million and grow their revenues by 30 or 40%. They can nearly double the bottom line in terms of gross margin and they can simply scale and be more competitive.

More to Come …

I would like to address your interests and concerns in future articles as it relates to the manufacturing of Print, Packaging, and Labels, and how, if at all, it drives future workflows including “Industry 4.0.” If you have any interesting examples of hybrid and bespoke manufacturing, I am very anxious to hear about them as well. Please feel free to contact me at [email protected] with any questions, suggestions, or examples of interesting applications.

Discussion

By Cliff Hollingsworth on Mar 21, 2023

David -- Can this press print on "plastics", i.e. extruded resins (petro based)

Discussion

Only verified members can comment.