Paper-Based industries are in Flux

As a result of the changes occurring in the paper industry, many printing and packaging companies are struggling to procure the paper they need, the grades they require, at the time they would like, and in a sufficient quantity necessary to fulfill customer orders. This is an abrupt turnabout for many companies that have striven for years to increase customer orders, always completely confident that the required paper substrates would be available on a just-in-time basis. Distributors gladly stocked and warehoused multiple grades at their own expense, ready to ship immediately, and often delivered paper on demand with extended credit terms. Some printers even enjoyed paper stocked on their premises on a consignment basis, ensuring sufficient supply without tying up excess working capital.

At least for the foreseeable future, those days of paper plenty are over. Printing and packaging company owners report that they are spending considerable time every day just procuring needed paper stock. The efficiency inherent in longer run lengths is lost when orders are filled with multiple shorter runs requiring repetitive press makereadies. Fussy buyers have lowered their paper standards, accepting lesser grades in order to meet deadlines. Shortages are being filled in with substitute grades, sometimes several different papers used within the same print run. Distributors are enforcing paper allocation schemes based on prior years usage, hindering the growth of their printing industry customers. Credit terms have tightened considerably, with slow payers cut off or required to adhere to self-liquidating payment policies. Price increases have become routine, which must be passed on to customers who have and will consider other alternative (electronic) communication choices.

Exacerbating the problem, printing companies have been buying whatever paper they can get whenever it becomes available and stocking up. This is completely understandable as each company seeks to defend its own position and viability, but clearly this makes the problem worse for the industry as a whole. Building up inventory has its cost, occupying valuable space and increasing net working capital requirements. Eventually this will run its course, as the hoarded paper reaches an equilibrium with available space and capital. However, during the buildup phase of increased inventory levels, the hoarding tendency just makes the situation worse. Just like that other paper shortage, that of toilet paper when the pandemic broke out.

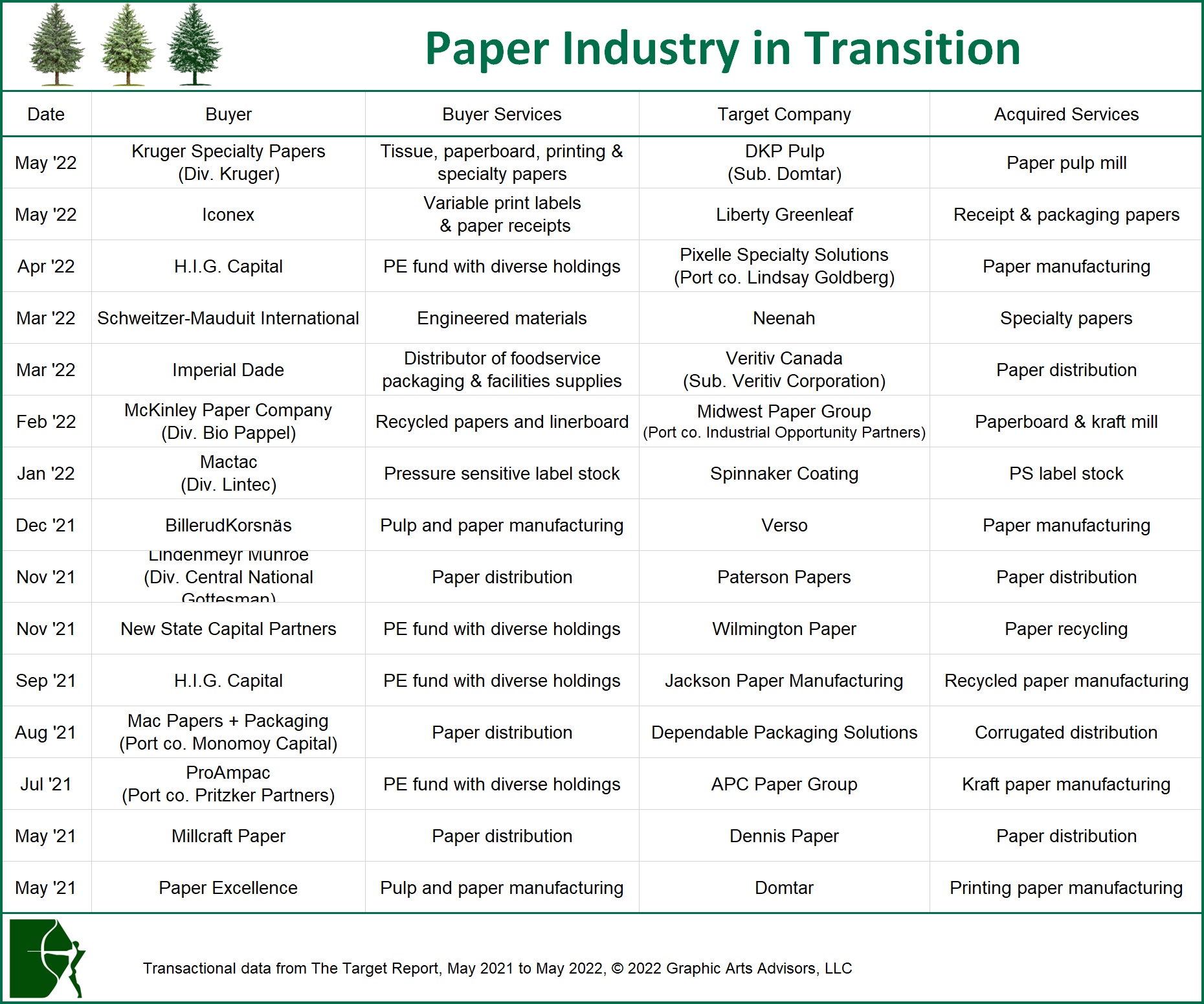

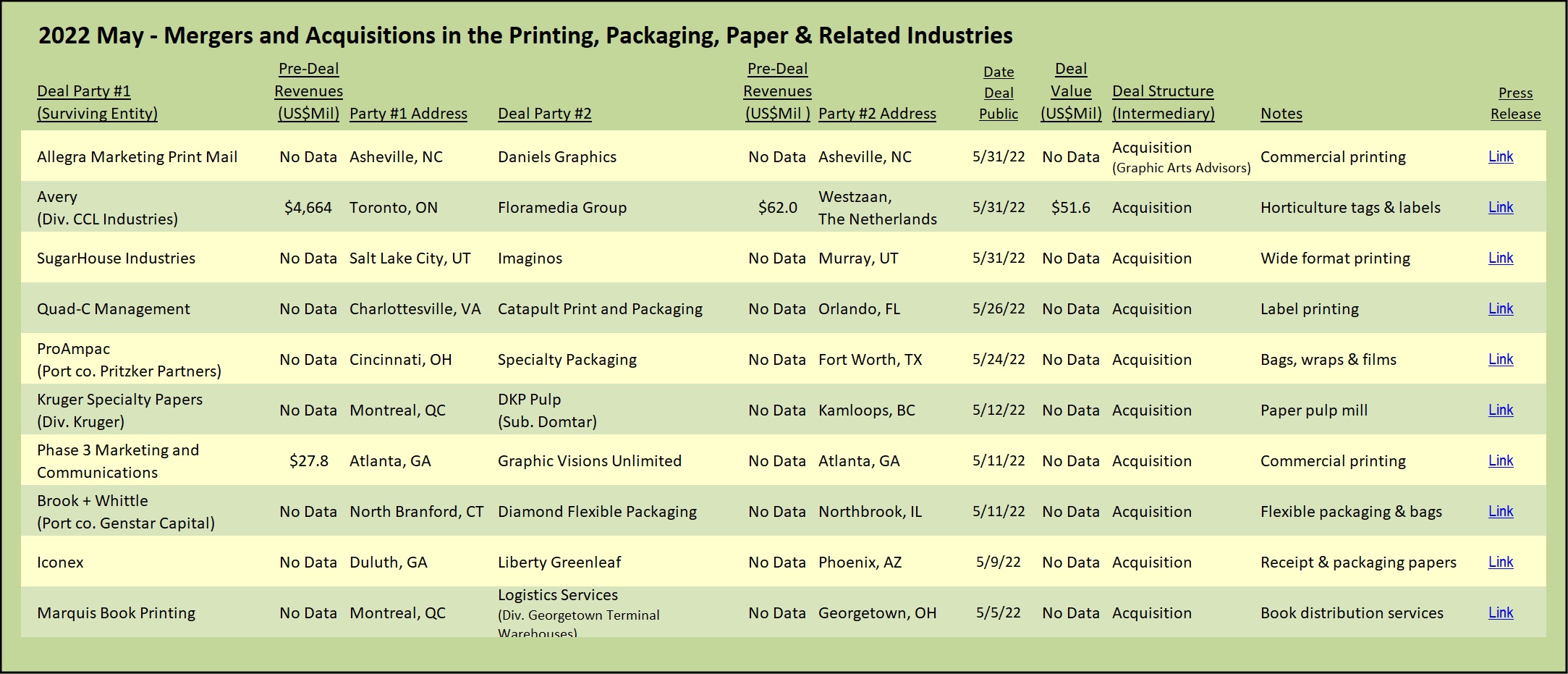

M&A Activity Hits All Levels of Paper Industry

The paper industry has been in flux over the past year, with transactions impacting all levels of the supply chain, from pulp to distribution.

Paper Making Consolidates, Specializes & Converts

Canadian-based Kruger acquired the DKP Pulp subsidiary of Domtar in a transaction that was a derivative forced sale by Domtar. The Canadian Commissioner of Competition required Domtar to divest the mill as a condition to approve its acquisition by Paper Excellence. DKP Pulp owns and operates the Kamloops Mill in British Columbia which produces softwood bleached pulp and unbleached softwood kraft pulp. Kruger announced that the acquisition will secure the supply of pulp for some of its paper mills, including in Quebec where the company is constructing two state-of-the-art tissue plants. Not limited to tissue papers, Kruger also makes coated publication printing grades, newsprint, and paper designed specifically for inkjet web presses.

In a transaction announced in May 2021, and closed late last year, 175-year-old publicly listed Domtar was acquired in an all-cash deal for $3 billion by the relative newcomer privately-owned Paper Excellence Group. Domtar, much larger and with 21 manufacturing facilities and customers in 50 countries, is now private and controlled by the much smaller British Columbia-based Paper Excellence company which operates seven mills in Canada. However, despite protestations to the contrary, Paper Excellence appears to have connections to and the backing of the billionaire Widjaja family of Indonesia, owners of Asia Pulp & Paper, among other corporate holdings. This relationship matters to those concerned with the environmental impact of deforestation and destruction of wildlife habitat, accusations that have plagued the AP&P’s operations in Indonesia and Brazil.

Domtar is currently well on its way to complete the process of converting a printing and writing paper mill in Kingsport, Tennessee, into a containerboard mill. The mill was shut down in early 2020 in an effort to balance supply with demand for printing papers which had steadily declined. When the pandemic hit and the demand for printing papers temporarily plummeted, Domtar moved forward with tentative plans to convert the mill which was in the works before its acquisition by Paper Excellence. The conversion will be complete in late 2022 and the mill re?configured to supply regional corrugators with products made from 100% recycled fiber. As a result, there will not be any more printing grade papers emanating from this mill. The general manager of the Kingsport mill recently confirmed Domtar’s long-term goal to convert additional mills to produce recycled containerboard products, including mills in Arkansas, Kentucky, and South Carolina. These are expensive capital projects, each conversion costing several hundreds of millions of dollars. Now with the backing of Paper Excellence, and the apparent family money supporting the North American investments, the handwriting is on the wall that funding will be in place to complete more conversions, further tightening supply in the market for printing grade papers.

Likely to be the most significant transaction impacting the printing industry is the sale of what’s left of Versoto Swedish paper company BillerudKorsnäs, announced in December 2021 and completed in March. The impact of this transaction will be keenly felt by the printing industry over the next seven years as BillerudKorsnäs executes its plan to convert approximately three-quarters of the acquired paper making capacity to paperboard grades designed for packaging applications. Longtime print industry veterans will recognize the name Escanaba as a production grade paper used in publications, catalogs, and commercial applications. The mill which gave its name to the paper grade, in Escanaba, Michigan, the largest in the Verso portfolio, is scheduled to be completely converted over to packaging grades. The resultant loss of capacity to produce printing grade papers will further tighten supplies to the commercial, book, direct mail, catalog, label, and publication segments of the industry.

In April, H.I.G. Capital, which has significant holdings in printing, packaging, and related companies, acquired Pixelle Specialty Solutions. Pixelle was formed in 2018 by PE firm Lindsay Goldberg with the express intent of building out a profile of specialty paper mills that eventually included four mill sites with twelve paper machines. Specialized papers produced by Pixelle include release papers, casting liners, book papers, carbonless form stock, security paper, and various other niche products. Two of the mills came from Verso Corporation, itself recently acquired. Notably, Pixelle assiduously describes its products as specialty grades and strives to find niches within the larger market for commodity printing grades.

For more detail about the transactions that have impacted the conversion to brown paper, as well as the move to specialty niches within the larger paper industry context, see Printing Papers Get Squeezed Out – February 2022).

Paper Distributors Move into Jan-San; Jan-San Moves into Paper

As the demand for printing papers declined over the past several years, the major paper distributors kept up a steady drumbeat of acquisitions, purchasing many of the formerly independent family-owned paper distribution companies. Lindenmeyr Monroe, subsidiary of industry giant Central National-Gottesman, recently acquired the much smaller New Jersey-based Paterson Papers, in a move indicative that the major pickings have already been plucked. Mac Papers & Packaging, a portfolio company of Monomoy Capital, acquired Dependable Packaging Solutions, a south-Florida based distributor of corrugated products, point?of?purchase displays and packaging supplies.

In another concurrent trend, paper distributors began to branch out and distribute other graphic supplies and, in some cases, acting as sales representatives for graphic production equipment including wide format machines. Further declines in demand precipitated the move by some into more generalized supplies related to the janitorial and sanitary needs of their customers’ facilities, otherwise known as the jan?san business. Mac Paper & Packaging, Lindenmeyr Monroe, and Veritiv, all have jan-san offerings on their websites. In a transaction that portends possible moves in the other direction, Imperial Dade, a family-owned operation headquartered in Jersey City, New Jersey, acquired the Canadian business of Veritiv. Imperial Dade’s operations focus on supplies for food service, janitorial, other facility-related needs, and now print. The company has grown via acquisitions; Vertiv’s Canadian operations is Imperial Dade’s 47th purchase. Expect further blurring of the lines between jan-san and printing paper distributors, as printing paper distribution becomes less of a specialty and is subsumed under more broadly-based distribution companies.

View The Target Report online, complete with deal logs and source links for May 2022

Discussion

By Wade Link on Jun 08, 2022

It's almost like someone in the back ground is pulling the strings to force a Green Initiative. Eliminate printing grade paper and force a move to web alternatives.