A refrain is now heard throughout the printing industry: paper supplies are very tight, allocations limit the ability to take on new customers, discounts and rebates are a thing of the past, shipments are delayed until price increases take effect, and printing and packaging companies increase paper inventories at every opportunity. The supply and demand curves have crossed, and the mills are in charge.

There are several reasons pricing leverage has shifted to the mills, including a labor strike at Finnish papermaker UPM, COVID-related supply chain disruptions, shortages of drivers, all in addition to the numerous closures of paper mills over the past several years.

The Finns will eventually go back to work, shipping containers will get sorted out, truck drivers will be hired, and pricing will eventually settle down. However, one trend that is not likely to reverse is the conversion of papermaking machines from printing paper grades to packaging grades.

Conversion to Brown Paper

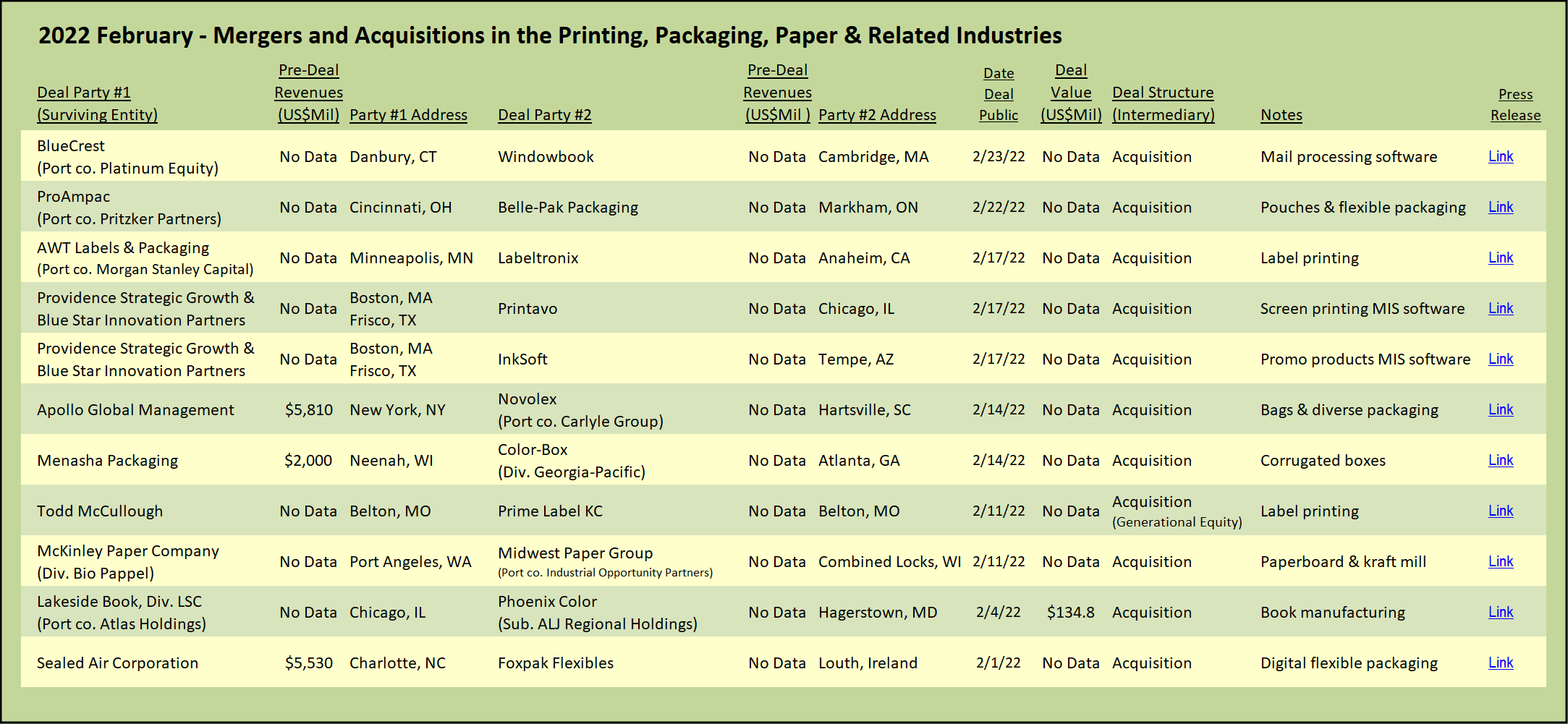

McKinley Paper Company, a subsidiary of Mexico-based paper producer Bio Pappel, acquired Midwest Paper Group located in Combined Locks, Wisconsin. The Midwest Paper Group mill is the former Appleton Paper mill, which for many years produced fine printing papers. The switch to packaging grades has taken several years to complete, with the mill’s loyal employees traversing a painful path through several owners, receivership, a complete shutdown of the mill, the resurrection and restarting of the machines, and finally the rebuilding of the paper machines to make lower-quality, but in-demand, packaging grades.

At one time, the Appleton Papers company, which operated the mill, made some of the finest coated printing paper grades. As the former owner of a commercial printing company, I remember that some of the papers that Appleton Papers made were so fine that they were rated above number one and earned the approbation as premium and super-premium grades. Sold under the tradename Utopia One, these were beautiful papers.

Appleton Paper was capable of making these fine grades because the company had a long history of technical proficiency in paper coating technology. Notably, in the 1950s, when the inventor of microencapsulated inks developed the technology that enabled carbonless papers, he went to Appleton to commercialize his invention. Appvion, the successor to the original Appleton Papers company, has retained much of that coating expertise, now applied to direct thermal labels and other highly specialized coated substrates.

As Appleton transitioned to become specialty coating company Appvion, the mills were sold off and acquired by an investment group. That group foresaw the increased demand for packaging grades and began the transformation of the mill’s product lines. However, the company was overleveraged, and the Combined Locks facility eventually was forced to shut down when the company’s lender forced it into receivership in September 2017. Two used machine dealers picked up the 55-acre mill complex in the receivership proceedings, apparently intending to sell off the pieces. Fortuitously, the buyers stopped, looked at what they had bought, and listened to the investment group that had failed to complete the conversion.

The new buyers decided to give it a go and restarted the mill’s papermaking machines in 2018, recalling many of the laid off highly-skilled papermakers. Commenting on the continuation of the conversion plans, the president of Midwest was quoted at the time, “White paper is in a declining market and you’re fighting to sell every ton. When you move to brown paper, we’re making both the inside and the outside of the boxes. It may not be sexy, but that market is growing tremendously, and we’re excited about it. We’re using our ability to make high-quality white paper and it put us in a position to make brown paper very, very well.”

McKinley Paper has other papermaking assets in the US, including U.S. Corrugated in Pennsylvania which it acquired in 2019. It’s parent company, Bio Pappel, is focusing its efforts on the production of packaging grades. The purchase by McKinley Paper firmly cements the conversion of the Combined Locks mill site to the production of brown Kraft paper and containerboard products.

More Conversions on the Horizon

In December 2021, Swedish paper company BillerudKorsnäs announced the acquisition of US-based Verso Corporation. Verso is the successor to the coated business of two major paper companies, International Paper and NewPage Holdings. Before being rolled into Verso, NewPage had itself acquired MeadWestvaco’s printing and writing paper business, as well as the North American assets of Stora Enso (formerly Consolidated Papers). Both Verso and NewPage declared bankruptcy and were restructured, shedding billions of dollars of debt in the process. During their relatively short lifespans, Verso and NewPage each separately closed numerous paper mills that produced printing paper grades as the market for these grades contracted.

BillerudKorsnäs stated goal in its acquisition of Verso is to build one of the most cost-efficient and sustainable paperboard platforms in North America by converting some of Verso’s assets into paperboard machines. Verso’s largest mill in Escanaba, Michigan, which currently produces printing and specialty grades for printing magazines, books, direct mail, and labels will be converted into a fully integrated pulp and paperboard production site. The plans call for one machine to be converted by 2025 and a second machine by 2029. BillerudKorsnäs will produce paper at Escanaba during the conversion. At the other mill included in the Verso deal, at Quinnesec, Michigan, the company will continue to produce coated woodfree and specialty printing papers. Despite the buyer’s assertion that it is committed to serve Verso’s existing customers, it appears that almost 75% of the acquired capacity will be converted from printing grades to paperboard grades.

The McKinley Paper mill and Verso conversions follow transitions at other paper mills, including ND Paper’s reworking of its Rumford, Maine paper mill to shift production further into packaging grades. ND Paper is a wholly-owned subsidiary of China-based Nine Dragons Paper Holdings, the largest producer of containerboard in Asia. Similar to Mexico’s Bio Pappel, the Chinese company’s focus is on the production of packaging, not printing, paper grades.

No Going Back

The paper industry has been chasing falling demand across the printing grades for a couple decades, closing mills, seeking to regain pricing leverage. With the uptick in online purchasing and increased consumer spending across the board during the rebound from the Covid shutdowns, the stage was set for the significant shift in paper manufacturing now well underway. The result is that shuttered mills have reopened, and in the process, transitioned to packaging grades. Underperforming mills are purchased, and the new owners reconfigure the paper machines away from printing paper grades and to containerboard or kraft papers. Paper making operations are large and capital-intensive; the moves are major sea changes and will not be easily reversed. The result will be tight supplies of printing grade papers for the foreseeable future.

View The Target Report online, complete with deal logs and source links for February 2022