As readers of The Target Report know, we view the printing, packaging, and related industries from the perspective of M&A transactional activity. Over the past ten years, we have chronicled, logged, and commented on the robust merger and acquisition activity in the print-centric business segments. We traditionally take a break at this time of the year, depart from our usual review of the prior months’ deal activity, and take a look back at the past twelve months from a high-level macro perspective. Our goal is to identify some long-term trends. Which segments have experienced more, or less, deal activity? What are the trends in rationale behind these acquisitions? Are acquirers adding facilities to their networks, or opportunistically folding acquisitions into their existing facilities?

As readers of The Target Report know, we view the printing, packaging, and related industries from the perspective of M&A transactional activity. Over the past ten years, we have chronicled, logged, and commented on the robust merger and acquisition activity in the print-centric business segments. We traditionally take a break at this time of the year, depart from our usual review of the prior months’ deal activity, and take a look back at the past twelve months from a high-level macro perspective. Our goal is to identify some long-term trends. Which segments have experienced more, or less, deal activity? What are the trends in rationale behind these acquisitions? Are acquirers adding facilities to their networks, or opportunistically folding acquisitions into their existing facilities?

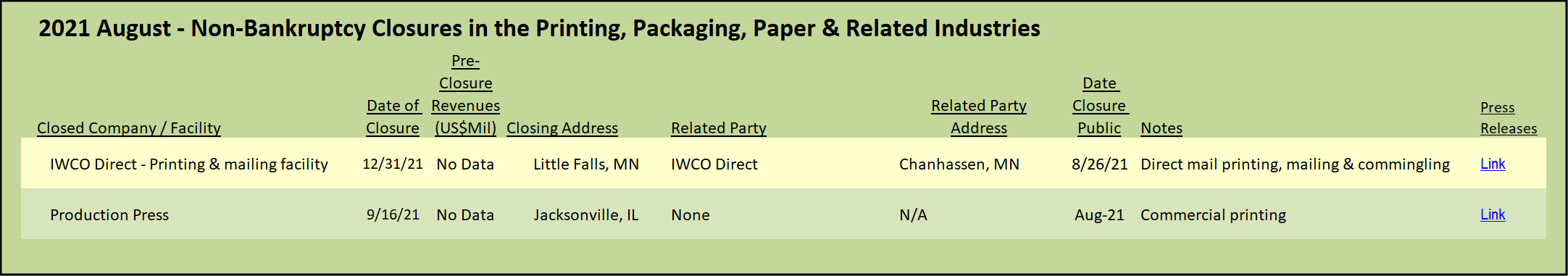

We review, categorize, sort, count and chart the data we have collected, comparing the trailing twelve months (“TTM”) ended this August to the prior twelve months. This year, we have added the prior two years in order to bridge the pandemic period and illustrate the comparison between pre-pandemic, pandemic, and the beginning of the post-pandemic business climate in the printing, packaging and related industries.

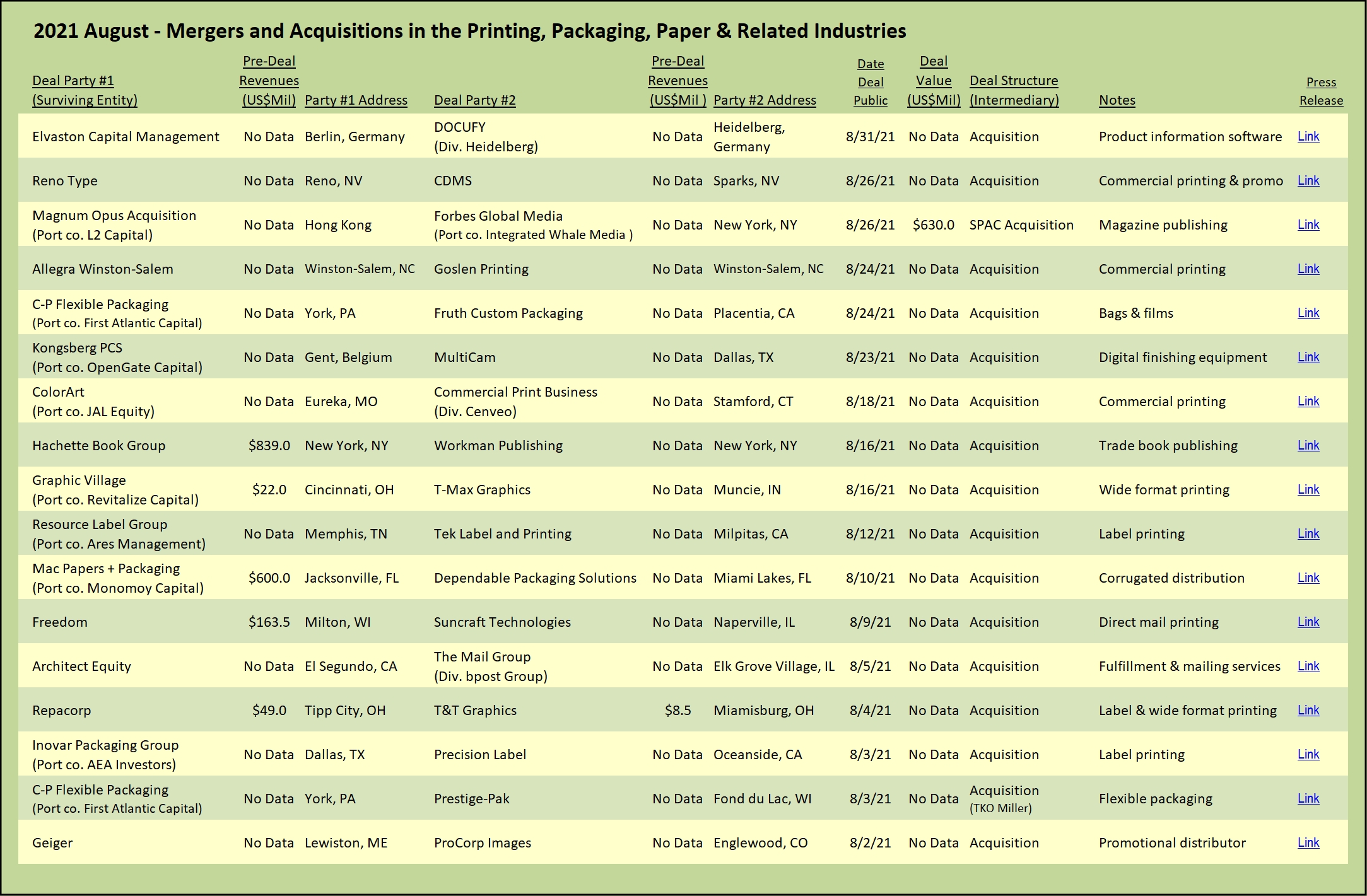

In M&A terms, the past twelve months were decidedly busier than the twelve months ended August 2020. We identified approximately 13% more transactions than last year; almost the exact match in the number of transactions during the pre-pandemic year: our data is based on 215 M&A transactions of interest for the TTM August 2021, versus 191 last year this same time, and 214 for the TTM August 2019.

As illustrated in the chart below, deal activity spiked upwards in the autumn of 2018 and again at the beginning of 2020. For reasons that were never clear, at least not to us, there was a pronounced slump in deal activity during the beginning months of 2019. Activity returned to the norm in the Spring of that year. Most dramatic and no surprise to anyone, there was a decline in transactions during March and April of 2020 when Covid-19 broke out and much business and social activity came to a screeching halt. By August of 2020, the deal activity trend had returned to the norm and has continued apace over the past twelve months.

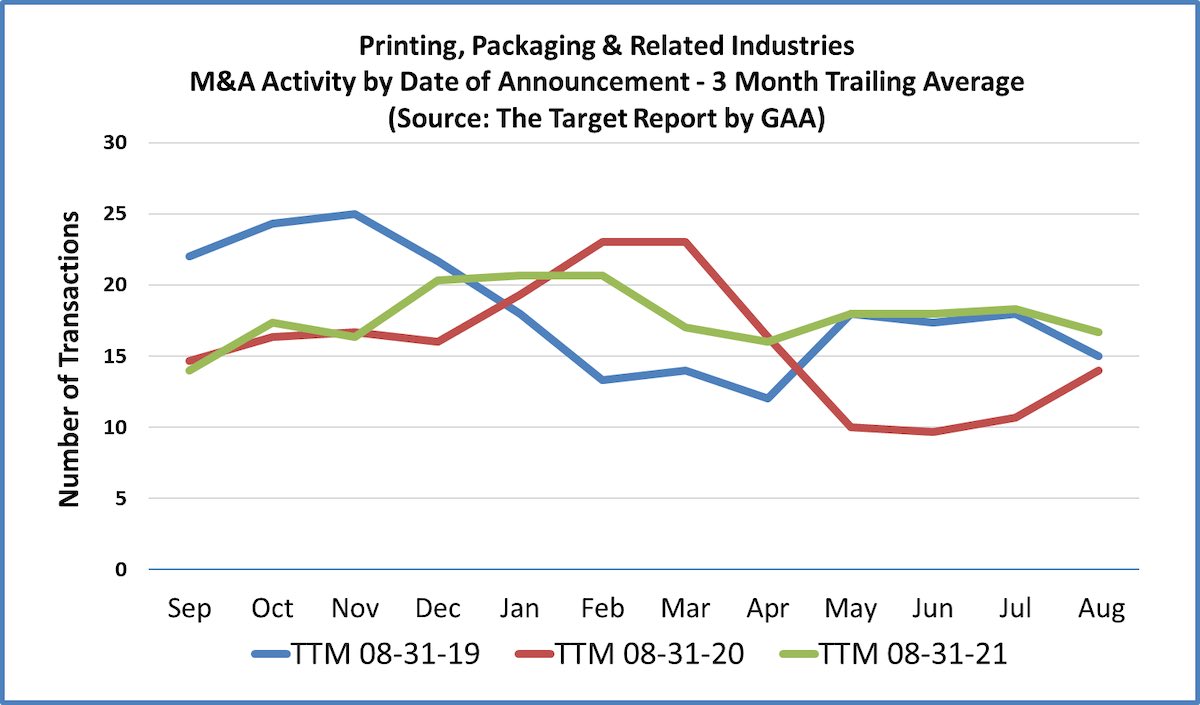

Looking at the gross numbers of M&A deals provides a view of overall transactional activity. However, as we know, the printing industry is not monolithic, rather the placement of images via ink onto a variety of substrates is comprised of a complex mix of specialties, including direct mail, wide format, industrial printing, and several forms of packaging, in addition to the more generalized commercial printing business. In our search to understand the market better, we categorize all the deals we have logged over the past year by segment. We then dig deeper into the packaging, commercial printing, direct mail and wide-format printing businesses, illustrating the rationale behind all this deal activity, by segment. We also seek to understand where the challenges are most pronounced by studying bankruptcy filings and non-bankruptcy plant closings.

The next chart breaks down the transactions over the past three years into all the segments we track in The Target Report.

Commercial Printing

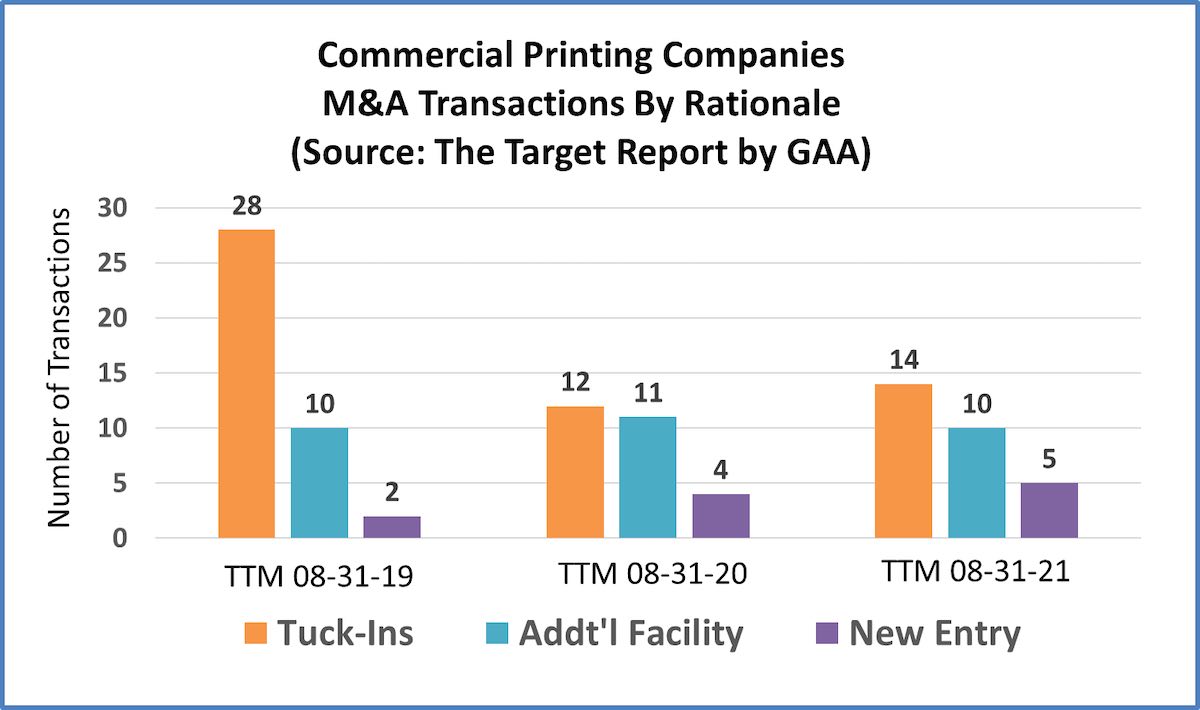

Our annual deep dive into the rationale behind the transactions in the commercial printing segment reveals once again that deals structured as a tuck-in represent a significant portion of the total. In these tuck-in transactions, the customers of the acquired company are transitioned to the buyer’s production facility. Buyers will often leave the disposition of the plant and equipment to the seller, or to the seller’s agent, avoiding responsibility for trade and other debt, and possibly cherry-picking certain equipment that is needed or desirable for the smooth continued servicing of the acquired customers. In three instances out of the fourteen tuck-ins during the past year, the transaction was a reverse tuck-in in which the buyer acquired the assets and facility of the seller and moved their business into the purchased company. As a percentage of total deals announced in commercial printing, tuck-ins represented 48% this past year, compared to 44% last year. This compares to the 70% of the commercial printing deals that were tuck-ins during the twelve months ended August 2019. This drop off from two years ago indicates to us that some of the excess capacity in the market, as evidenced by tuck-in transactional activity, has been wrung out. However, at close to 50%, the number of tuck-ins tells us that the market signals are still flashing red in the commercial printing segment and there will be much more consolidation to come.

There were fifteen acquisitions in the commercial printing segment where the acquired facility was important to the buyer and will remain in operation, as-is-where-is. Five of these were sold to new owners that were not previously invested in the commercial printing industry, while ten represented an additional facility for an existing company seeking to expand operations. The following chart shows how the past three years compare, showing tuck-ins, existing businesses adding facilities, and new entries into the commercial printing business.

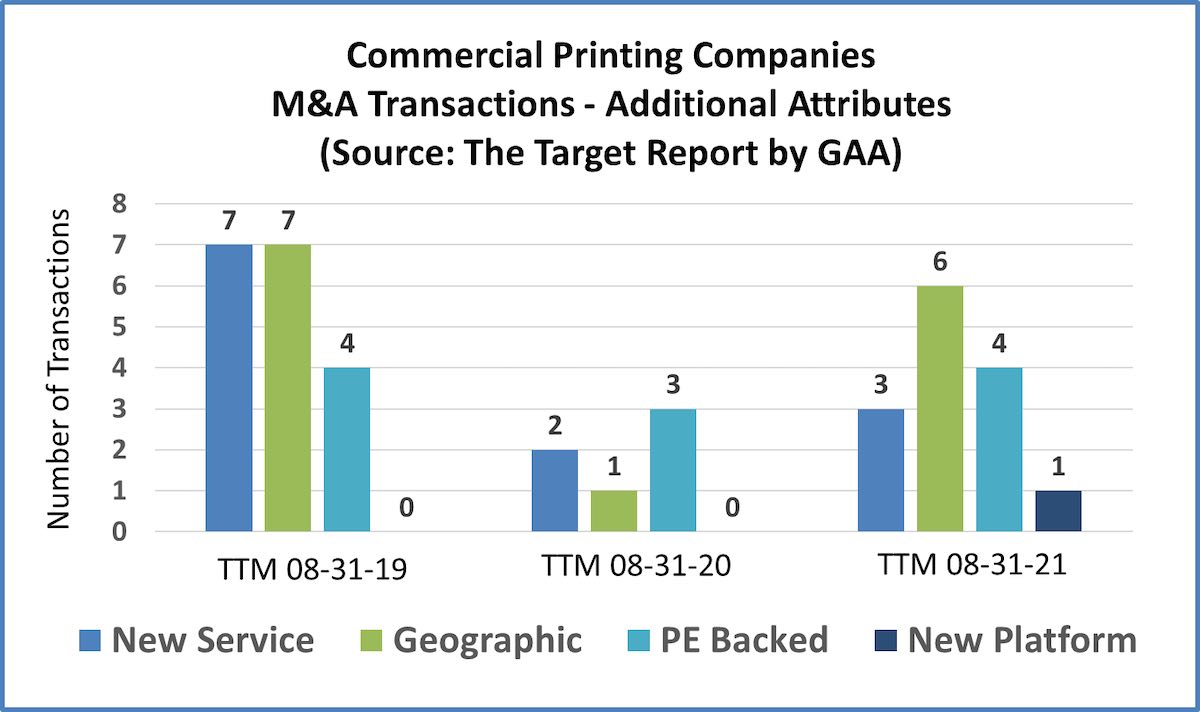

Digging a little deeper, we looked for instances in which buyers cited geographic expansion and/or added services as the rationale behind their acquisitions, as well as whether a private equity sponsor was involved. Expanding service territory was the reason most often mentioned, two-to-one over adding a new service, clearly a departure from the trend of the past two years. Notably, many of the transactions were part of a clearly expressed strategy to grow regionally in a hub-and-spoke fashion with a core financially strong commercial printing company at the center (see The Target Report: Commercial Printing: Consolidation or Regional Expansion? – November 2019). This regional consolidation trend has been in contrast to the national roll-up strategy from the now acquired and absorbed (CGX) and disintegrated (Cenveo) roll-ups from years past.

Many owners we talk with in the commercial segment are experiencing a steady, albeit modest, improvement, as the impact of the pandemic recedes. Owners that put their exit plans on hold are beginning to come back into the market, not waiting until they recover completely to pre-pandemic levels. Weaker players have begun to falter and seek shelter in a sale to a stronger company. We believe that M&A activity will increase in the commercial segment over the next several years. Consolidation will pick up steam as the impact of government subsidies fades and the demographic imperative of an aging population of owners prevails over holding out for better days.

Private equity continues to have lukewarm interest in the commercial printing segment. We noted four commercial print transactions in which private equity played a part during the past year, a similar count to past years. We suspect that at least one of the PE-backed transactions is more of a turnaround play rather than a platform-and-build-out-via-acquisition strategy.

We make special mention this year of a notable transaction in the commercial printing segment, backed by JAL Equity, representing the first new PE-backed platform in commercial printing in several years. Having quietly assembled a network of commercial printing and related businesses over the past couple years, JAL Equity announced a blockbuster deal this past month to acquire the remaining commercial printing business of Cenveo, forming ColorArt, a new national consolidator. With the other national buyer, Mittera, still actively acquiring commercial printing companies across the US, the industry once again has two national consolidators. Both appear to be more disciplined and selectively opportunistic than their predecessors.

Packaging

For the second year in a row, packaging has now surpassed commercial printing as the most active segment. There does not appear to be any let up in buyer appetite for packaging companies. As we noted recently, packaging deal activity is red hot, with a slew of private equity investment funds driving transaction multiples up as they compete to consolidate what has been a highly fragmented business, often family-owned and spanning two or more generations.

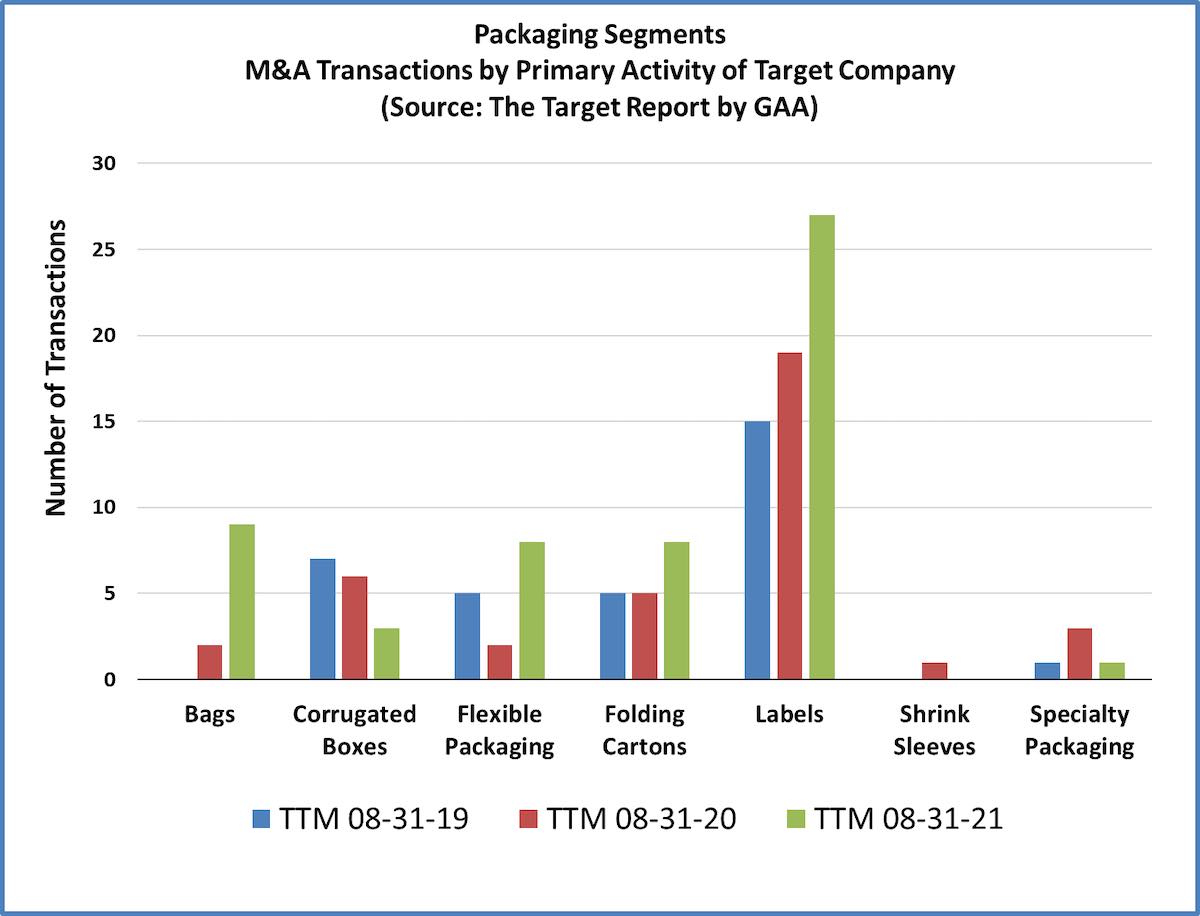

The following chart is illustrative of buyer activity in the packaging business, broken down by primary product produced at the target company. Label manufacturing again leads the pack, shooting way up this past year. The number of transactions in the corrugated box segment has been trending down; we suspect because the low-hanging fruit has already been picked, not because there are any fewer boxes showing up on our front porches. Similarly, we regularly hear from buyers that are eagerly seeking target companies in the flexible packaging segment, but fewer deals are getting done involving flexible packaging as the supply of target companies is limited compared to other packaging segments. Also worth noting is the uptick in transactions in which folding cartons are the primary product of the target company. We expect that trend to continue as private equity funds seek alternatives to the higher multiples in the label and flexible packaging businesses, as well as in response to social trends extolling the use of more sustainable fiber-based packaging.

Our candidate for the most notable and influential singular transaction in the packaging segment during the past twelve months has to be the recently announced deal in which PE firm Clayton, Dubilier & Rice announced the simultaneous purchase and combination of label manufacturing companies Fort Dearborn and Multi-Color Corporation (see The Target Report: Packaging Industry Consolidation in Every Direction – July 2021). The result is a vast network, a roll-up of roll-ups, comprised of the remnants of many formerly independent, and often family-owned, label manufacturing companies.

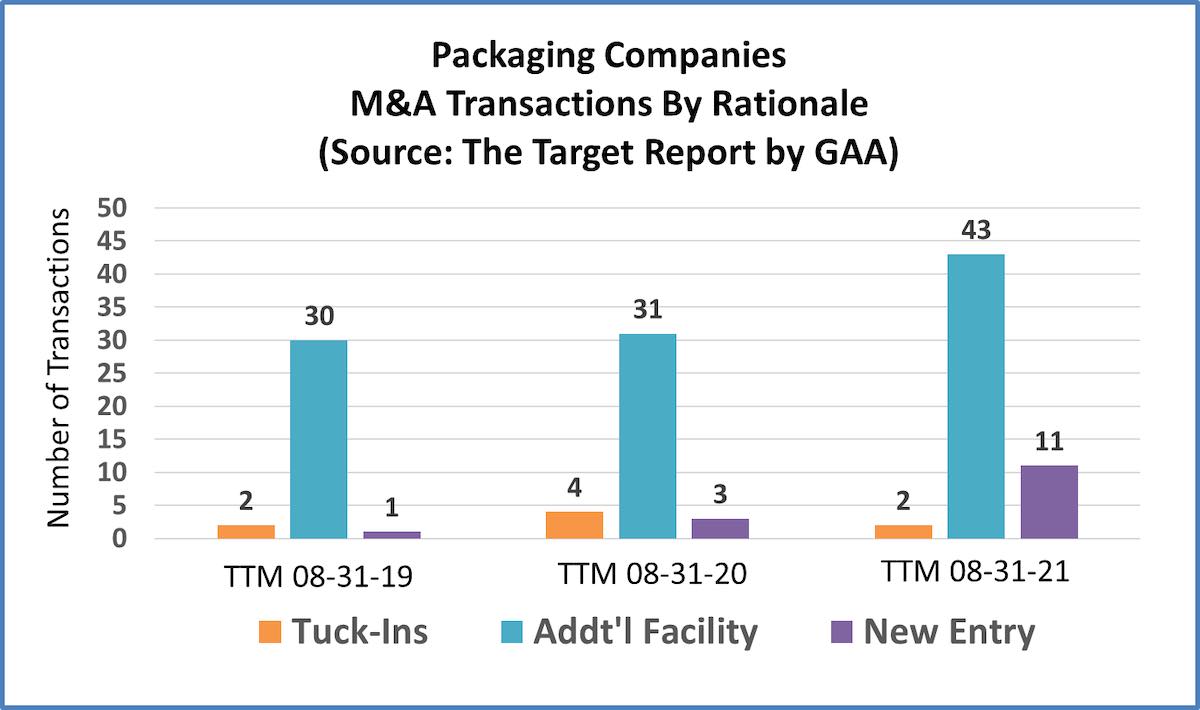

When we dig into the rationale behind transactions in the packaging segment, a very different picture emerges as compared to commercial printing. Of the fifty-six transactions that we recorded over the past twelve months in the packaging segment, only two were reported to be tuck-ins; both were small and produced labels. In all the other cases, the buyers noted that the acquired location was an important element of the rationale to complete the deal. In some, the acquired company had multiple locations, or was global in scope. Eleven of the packaging companies were sold to new owners that were not currently invested in this segment, a dramatic increase from past years.

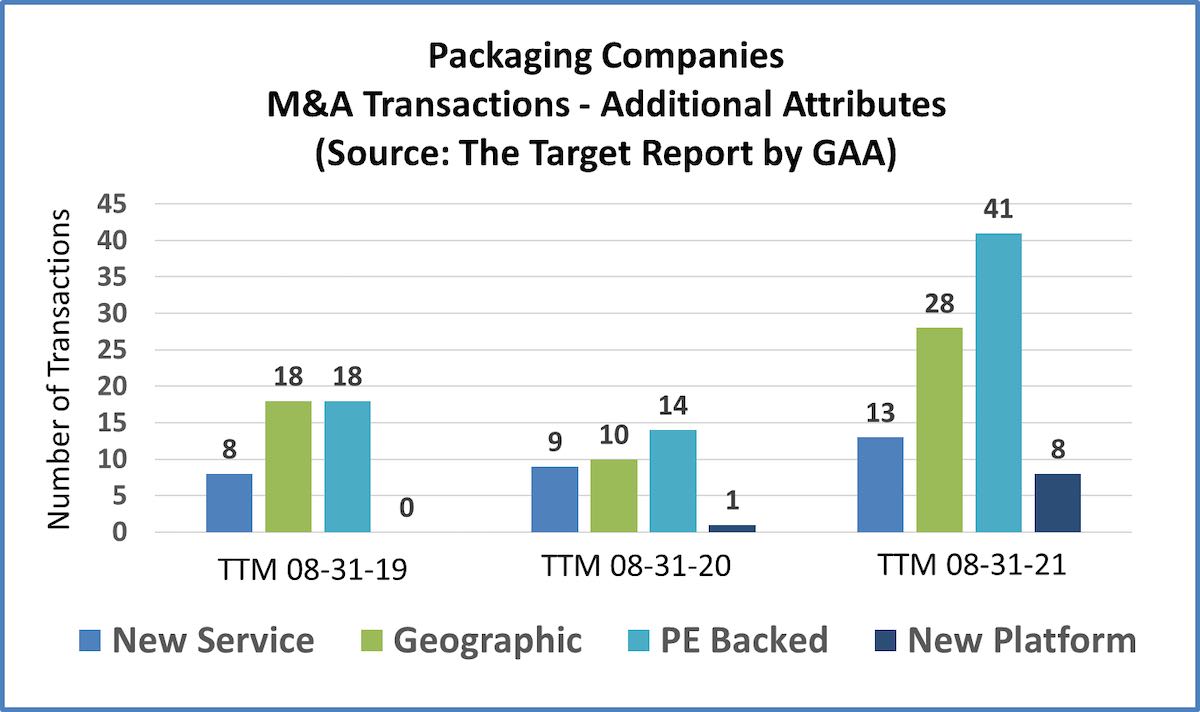

Private equity was involved in forty-one of the fifty-six transactions in packaging, a staggering 73% of the total, as compared to 37% and 55% over the past two years, respectively. The roll-up model, with financial sponsorship from private equity, is in full swing across the various packaging segments and as mentioned above, driving competition for midsize and larger label printing companies to a frenzied level of activity. Adding to the hustle, eight new PE-backed platforms were formed over the past year, as compared to only one last year and none the year before.

Thirteen of the buyers noted that the acquisition brought new services to the company, or significantly expanded on a small beachhead previously established in that service. For example, one folding carton company noted that an acquisition brought significant blister card production to their product mix, as well as adding volume to their core business, folding cartons. In twenty-eight instances, geographic expansion or diversity of the acquired locations was also noted as a key element in the buyer’s logic.

Wide Format and Related Digital Products

For our purposes in forming a picture of the various market segments that comprise the overall print-centric industries, we separate out companies that produce mostly wide-format and related products from the more generalized commercial printing segment.

The wide-format market has matured. Gone are the days of the uniqueness of digitally printed banners and wraps, the cool factor of flatbeds and the easy margins that came with being first on the block to offer large inkjet prints. Pricing on entry-level equipment has come way down, finishing technology is automated, and overall barriers to entry are low. Differentiation has moved from first-mover advantage to more complex online direct-to-customer systems, robust installation capabilities, or value-added services such as framing prints for use as home or office décor.

Our selection for most transformative transaction in the wide-format and related products segments over the past year is Shutterfly’s acquisition of Spoonflower. Backed by Apollo Global Management, the deal illustrates the investment community’s interest and confidence in custom-printed products, the aggregation of the segment (previously bolt-ons included Snapfish) and diversification of wide-format applications to include one-of-a-kind apparel, custom designed fabrics and personalized wall décor. (see The Target Report: Apollo Trades Textbooks for Wallpaper & Pillows – June 2021).

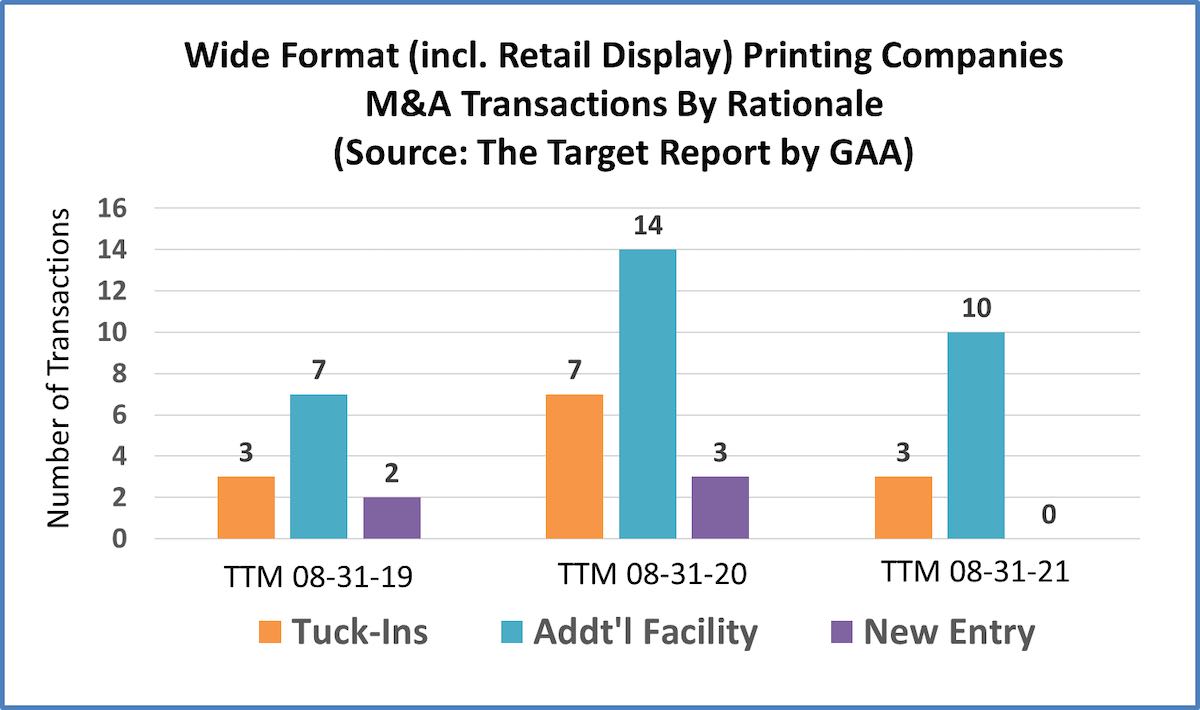

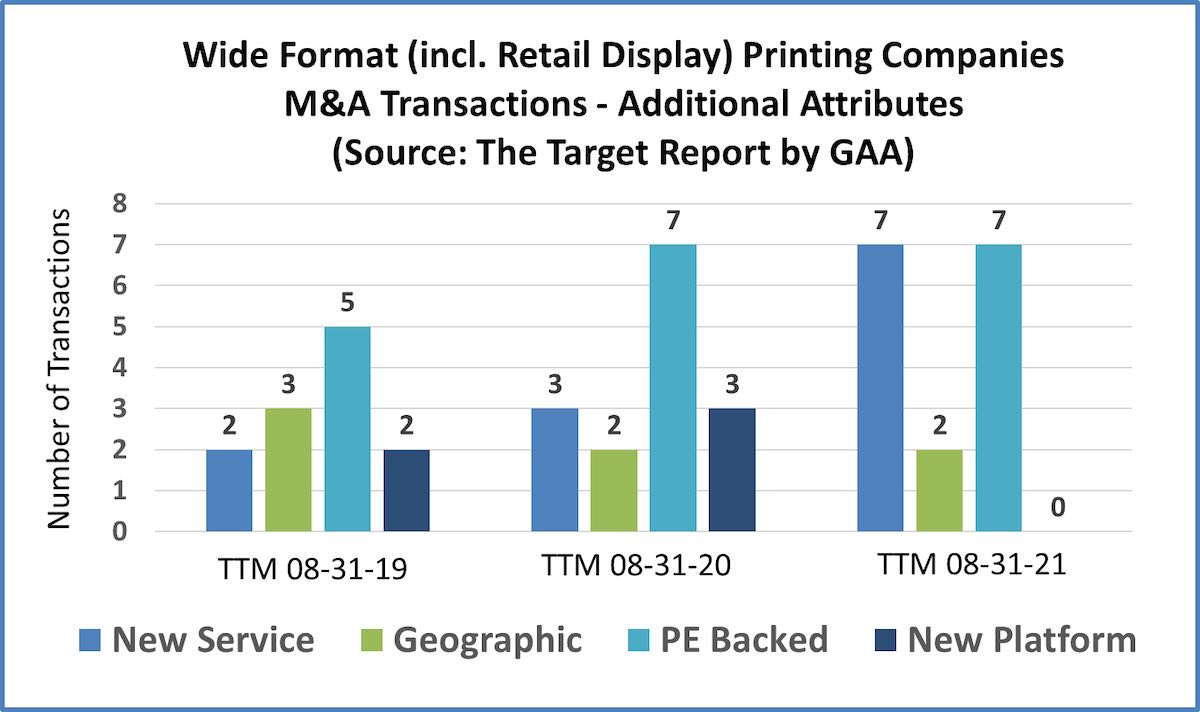

In the wide-format and related products segment, there are proportionately fewer tuck-ins than in general commercial printing, but consistent with the past two years, about a quarter of the deals were tuck-ins, with the seller’s plant shuttered and production consolidated in the buyer’s existing facility. The tuck-ins are indicative of excess capacity and the maturation of the wide-format segment; for many years there were none. Another indication of the wide-format market reaching saturation is no new entrants, all the buyers over the past year were already in the business in one form or another.

Seven buyers cited adding or greatly expanding wide format as a service offering as the logic supporting their acquisition. Same as last year, two buyers noted geographic expansion as important to their decision to move forward. Seven of the transactions involved participation by private equity in the deal, but none were new platforms for the fund. We continue to believe that the trends in wide-format and related printing, especially the involvement of financial buyers and the increase in number of distressed transactions, are predictive of more M&A activity and consolidation for wide-format printing companies.

Direct Mail

Direct mail printing companies, especially those that can manage, manipulate, store, and utilize data to drive improved results for their customers, are an exception and in a class by themselves, apart from the more generalized undifferentiated “job-shop” commercial printing companies. Therefore, we break these companies out separately.

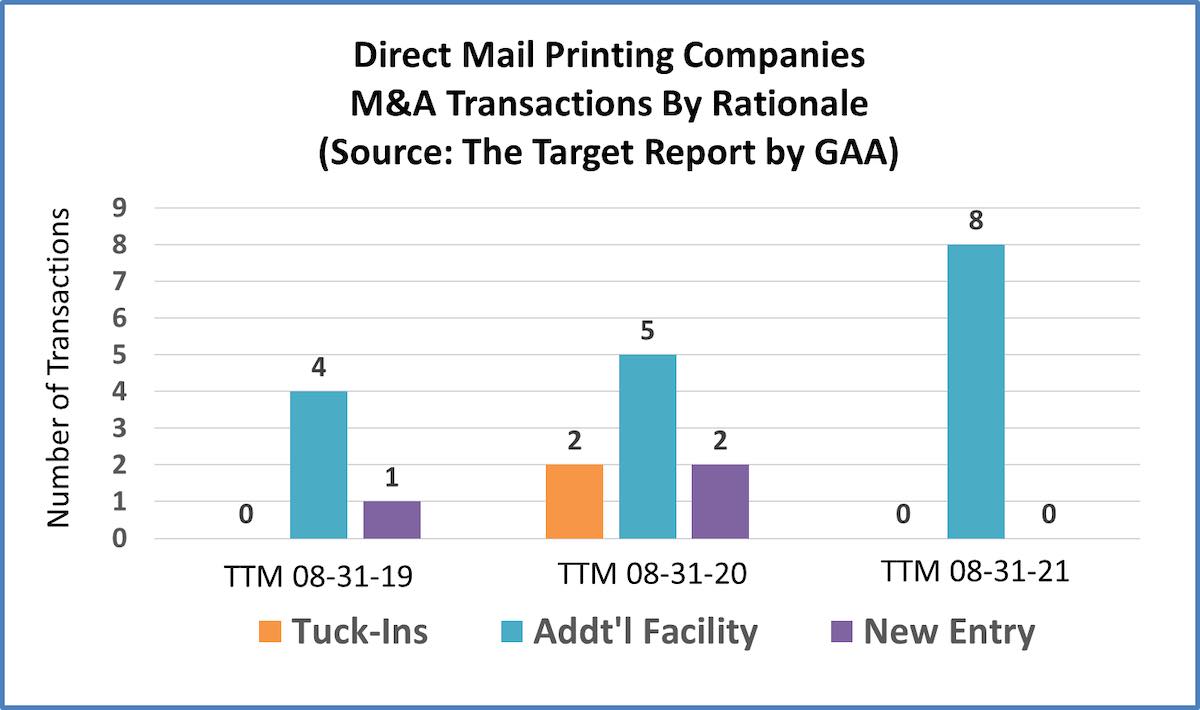

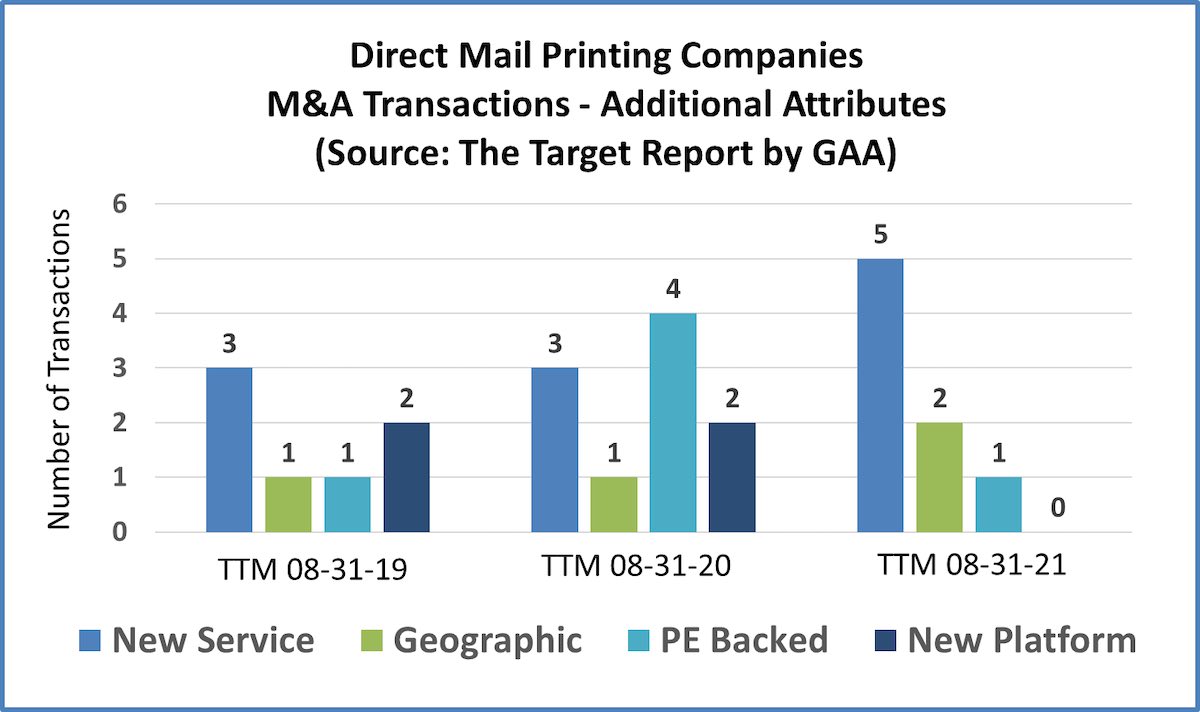

Transactional activity in the direct mail printing segment was steady over the past twelve months, with a total of eight deals announced, versus nine the prior year. Indicative of the overall health of the segment, there were no tuck-ins, and in every case the buyers cited adding a facility to increase capacity as the reason to acquire. However, there were no new entrants into the segment, a sign that current owners are confident and willing to invest in acquisitions, but outsiders are holding onto their wallets.

Our choice of the notable transaction of the year in the direct mail segment is Moore’s acquisition of Worchester Envelope in Auburn, Massachusetts. The 125-year-old acquired company operates out of a 180,000 square foot facility, offering a diverse range of converting and printing options. This follows Moore’s investment in and resurrection of the failed Colortree printing business in Richmond, Virginia which had been a major supplier of specialty envelopes to the non-profit solicitation businesses surrounding the Washington DC region. A huge user of envelopes, the move to secure its own specialized envelope production facilities provides a defensive position for Moore as envelope production consolidates.

Only one of the transactions in direct mail involved private equity backers, and there were no new PE-backed platforms. In five of the eight transactions we found, the buyers mentioned adding a service element as their rationale to move forward with the deal. At least for now, the direct mail industry appears to be plowing forward, steady-as-she-goes, not racing forward like packaging, nor lagging behind as is the case with commercial printing.

Challenged Segments

Transactional activity tells us that an industry segment is undergoing change, however the number of deals does not tell us if that activity is indicative of positive or negative change. To determine a directional indication, we track the number of bankruptcy filings and non-bankruptcy plant closures and correlate this information with the overall transactional activity. Our thesis, born out over several years and confirmed by industry stats derived from other sources, is that an industry segment with a high number of transactions that is also experiencing closures and bankruptcies is, or will be, in a contraction phase. There will be opportunities for consolidation at bargain prices for those companies that defy the downward trend. This continues to be true in the commercial printing segment.

Conversely, segments in which the number of transactions is inversely correlated to closures and bankruptcies are more likely to be expanding. Therefore, consolidation opportunities will come at much higher prices. Virtually all the packaging segments are experiencing steady transactional activity, without the corresponding bankruptcy filings and plant closures, indicating a very healthy environment for sellers as the packaging industry consolidates. As noted above, the market for label manufacturing businesses has heated up considerably over the past several years.

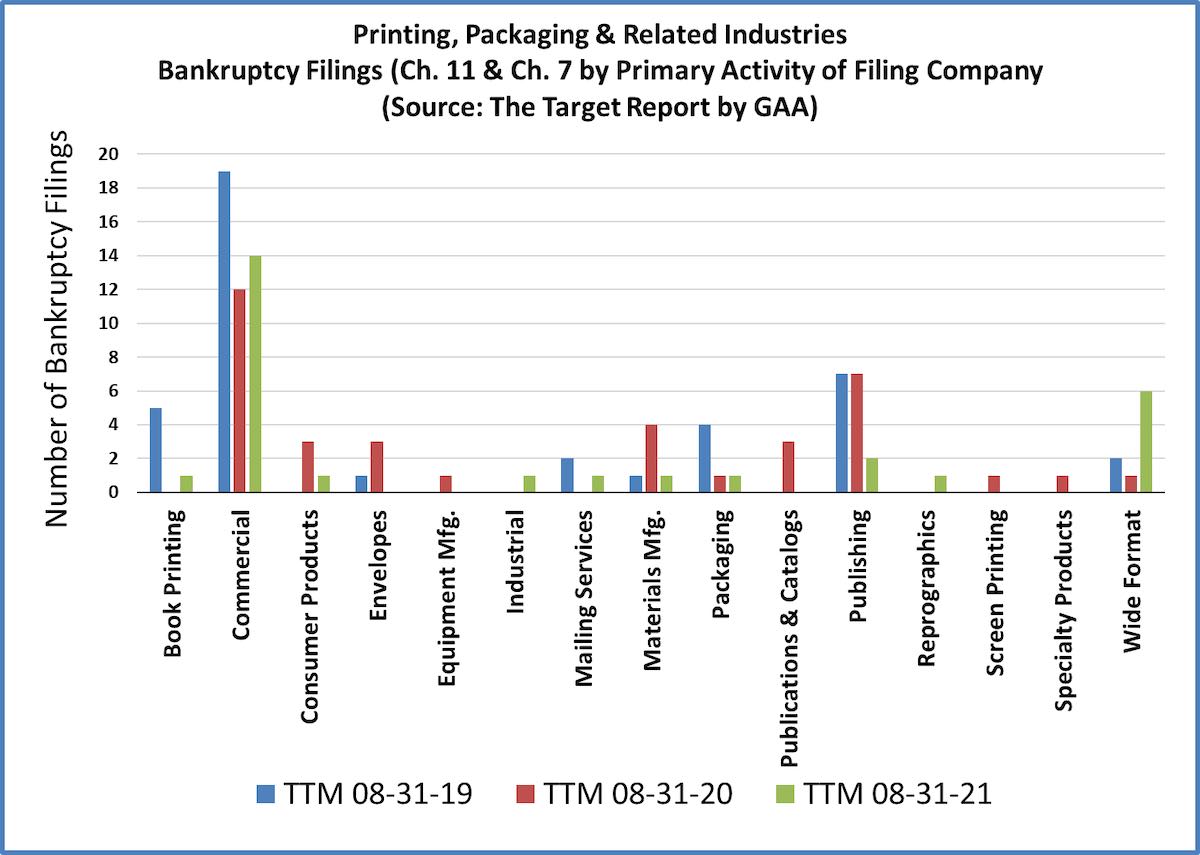

Despite the outbreak of Covid-19, the number of bankruptcies for the past twelve months across all segments decreased to 29 filings, down from 38 and 41 over the prior two years, respectively. We attribute this decrease to the huge cash infusions into businesses over the past year, structured as forgivable PPP loans and other forms of government stimulus. Another factor is likely the high cost of going through a bankruptcy proceeding versus simply winding down a business without the formal filing. As expected, even at the reduced level of bankruptcy filings, the commercial printing segment leads the pack. Of interest, bankruptcies in publishing decreased, presumably the market has been rationalized, at least for the time being. Consistent with our observations above about the wide-format segment, there was a notable uptick in bankruptcy filings.

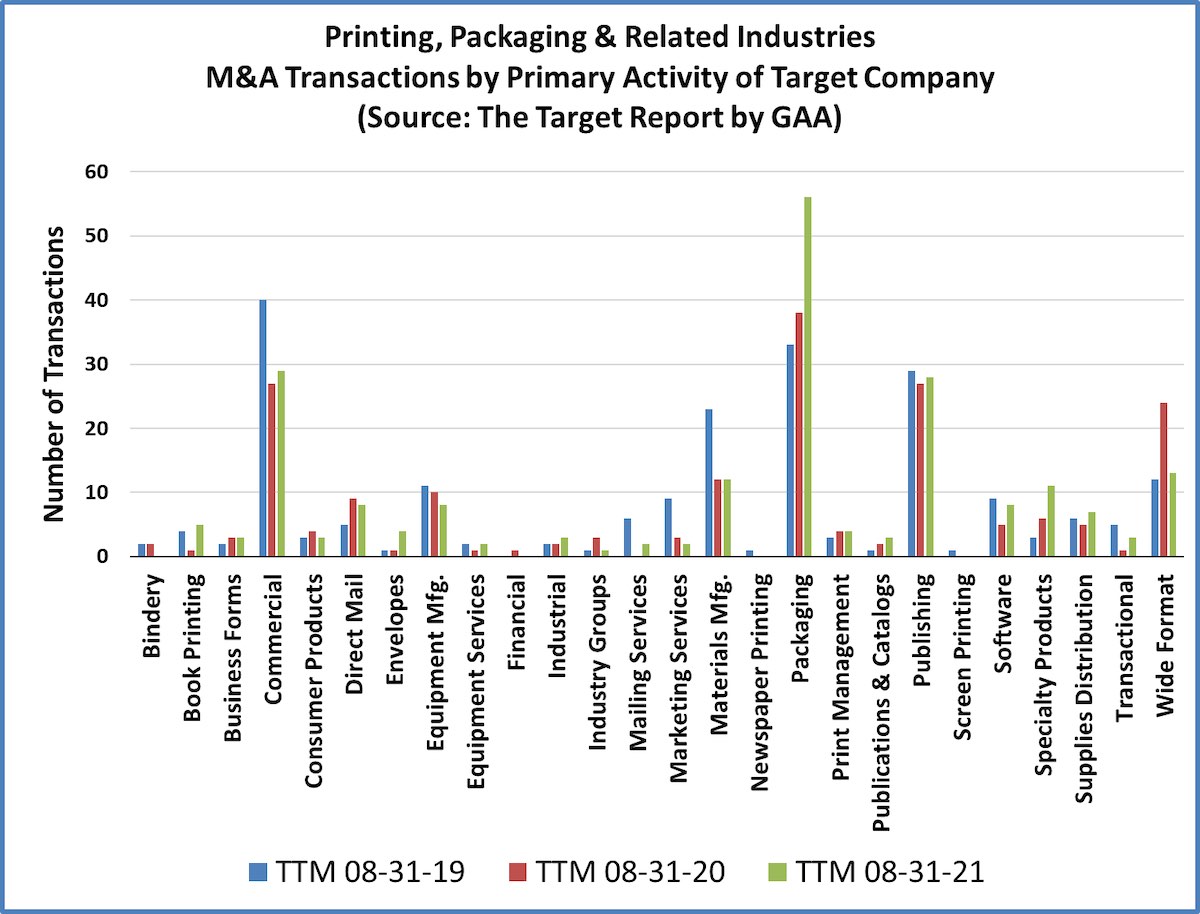

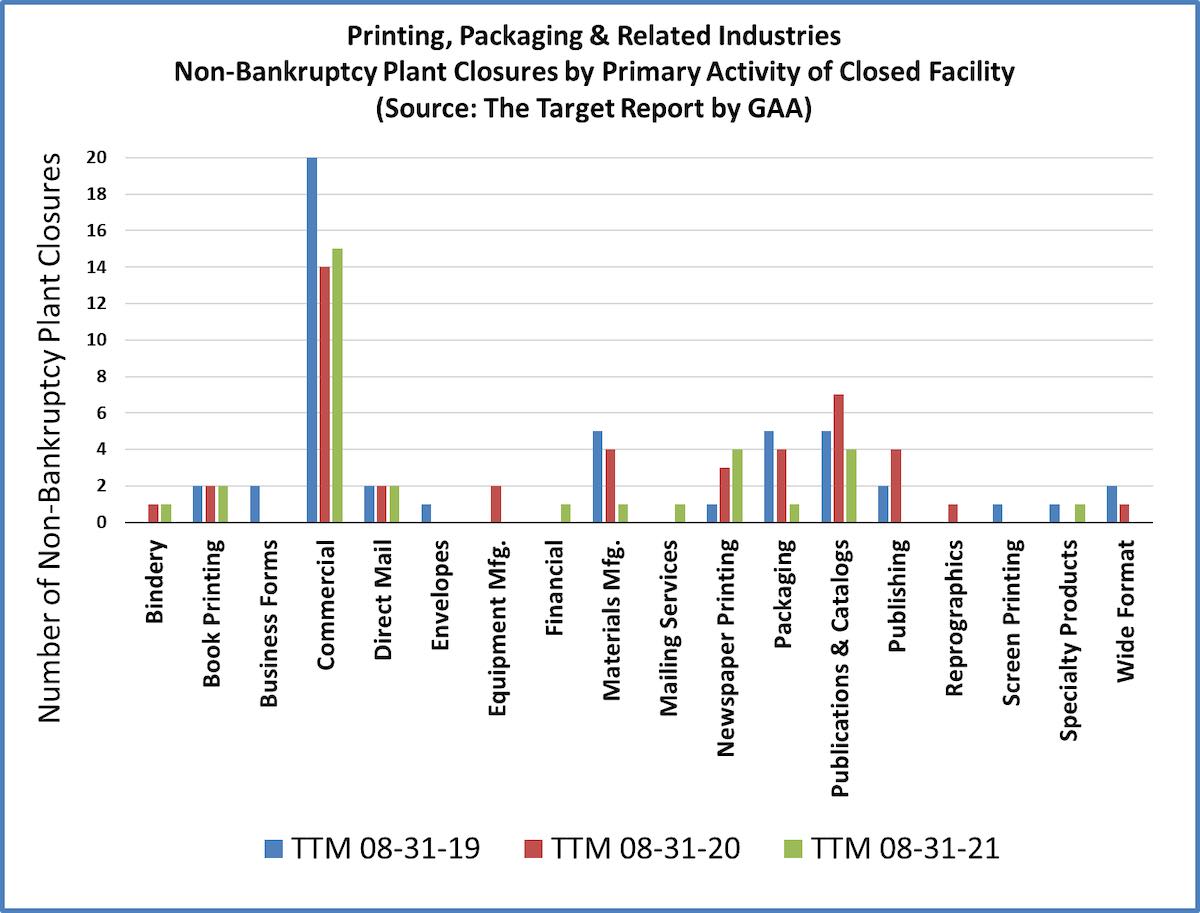

And finally, we also track activity in non-bankruptcy plant closures; some companies simply close up and just disappear while others find a buyer for the book-of-business and conduct an orderly wind-down process. A closure does not always mean that the company has ceased operating, it may simply be that one of the larger printing firms is rationalizing their production capacity. Either way, closures are indicative of change, usually resulting from downward pressure in a market segment.

Consistent with the bankruptcy filing data, the number of non-bankruptcy closures in the past twelve months declined to 33, down from 45 and 49 over the past two years, respectively. As expected, general commercial printing companies represent the majority of printing facilities closing up shop. Also not surprisingly, newspaper printing plants and publication/catalog plants also closed in greater numbers than most other segments.

View The Target Report online, complete with deal logs and source links for August 2021