- A 2020 study conducted by Keypoint Intelligence found that over half of consumers across all age groups spent more time looking at direct mail that was personalized and relevant to them.

- Although VDP commands higher profit margins, VDP printing is marginal in relation to overall print volumes.

- According to Keypoint Intelligence’s 2020 Customer Communications research, PSPs report an average profit margin increase of 10.5% for VDP jobs in relation to static printing.

By Ryan McAbee

Introduction

Since the pandemic became a part of our everyday lives, we’ve all been craving a little more human connection. Although many of us visited an office to do our jobs at the start of 2020, the onset of COVID-19 forced us to work from home virtually overnight. Similarly, in-person shows and events switched to an online format, albeit (hopefully) temporarily. This lack of normal in-person routines has created an opportunity for variable data printing (VDP). Ironically, print means more in this age of virtual everything—it is tangible and can be personalized to replicate that human connection that we all crave.

A 2020 study conducted by Keypoint Intelligence found that over half of consumers across all age groups spent more time looking at direct mail that was personalized and relevant to them. We all understand the concept of customer appreciation, but it seems that many print service providers (PSPs) are not fully capitalizing on the opportunity by selling the value of VDP to businesses and brands.

Variable Data Printing in North America

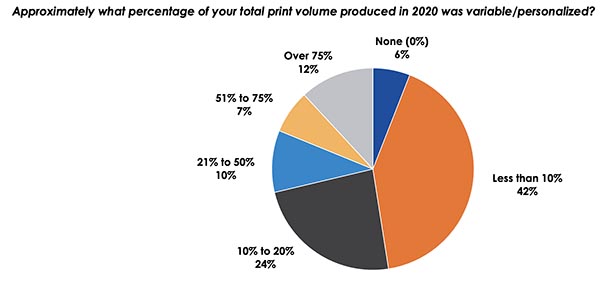

In response to the shifts brought about by the pandemic, businesses have also changed their marketing messages (particularly in the early stages) to make them more empathetic, emotional, reaffirming, and personalized. VDP has been a key medium for all these applications, but far too few PSPs take full advantage of the opportunity by delivering customization, personalization, and localization. In fact, VDP printing is marginal compared to overall print volumes. In 2020, VDP represented only 24% of total print jobs on average. In addition, about 48% of PSPs reported that under 10% of their total print volumes were variable.

Figure 1. VDP as a Share of Total Print Volumes

N = 106 Total Respondents

Source: North American Software Investment Outlook, Keypoint Intelligence 2021

Higher Profit Margins

During 2020, revenue declines ranged from approximately 30% to over 50% across the globe. As a result, many PSPs recognized the need to right-size their operations. These PSPs typically took a multi-pronged approach that involved reducing costs, pivoting to COVID-related applications, and optimizing operations and staffing. Focusing on the marketing needs of businesses during the pandemic and beyond is another way to positively impact financials. According to Keypoint Intelligence’s 2020 Customer Communications research, PSPs report an average profit margin increase of 10.5% for VDP jobs in relation to static printing. At these levels, the profit from roughly nine VDP jobs is equivalent to ten regular print jobs.

The Bottom Line

PSPs with the technical ability to produce VDP can focus on expanding horizontally into new applications that they can offer their customers as part of their overall marketing campaigns. There is an opportunity to build an embedded relationship where the value lies in the creative, execution, and data analytics. PSPs that can move beyond a focus on pricing and a print-as-a-commodity approach can find success. After all, PSPs can command markedly higher profit margins for VDP than they can for static printing. These PSPs have figured out the value proposition for VDP, and you can too!

Ryan McAbee is the Director of Keypoint Intelligence’s Production Workflow Consulting Service, which focuses on providing technology, business, and market insights to clients in the Digital Marketing & Media and Production Workflow markets. In this role, he is responsible for conducting market research, market analysis and forecasting, content development, industry training, and consulting with print service providers.