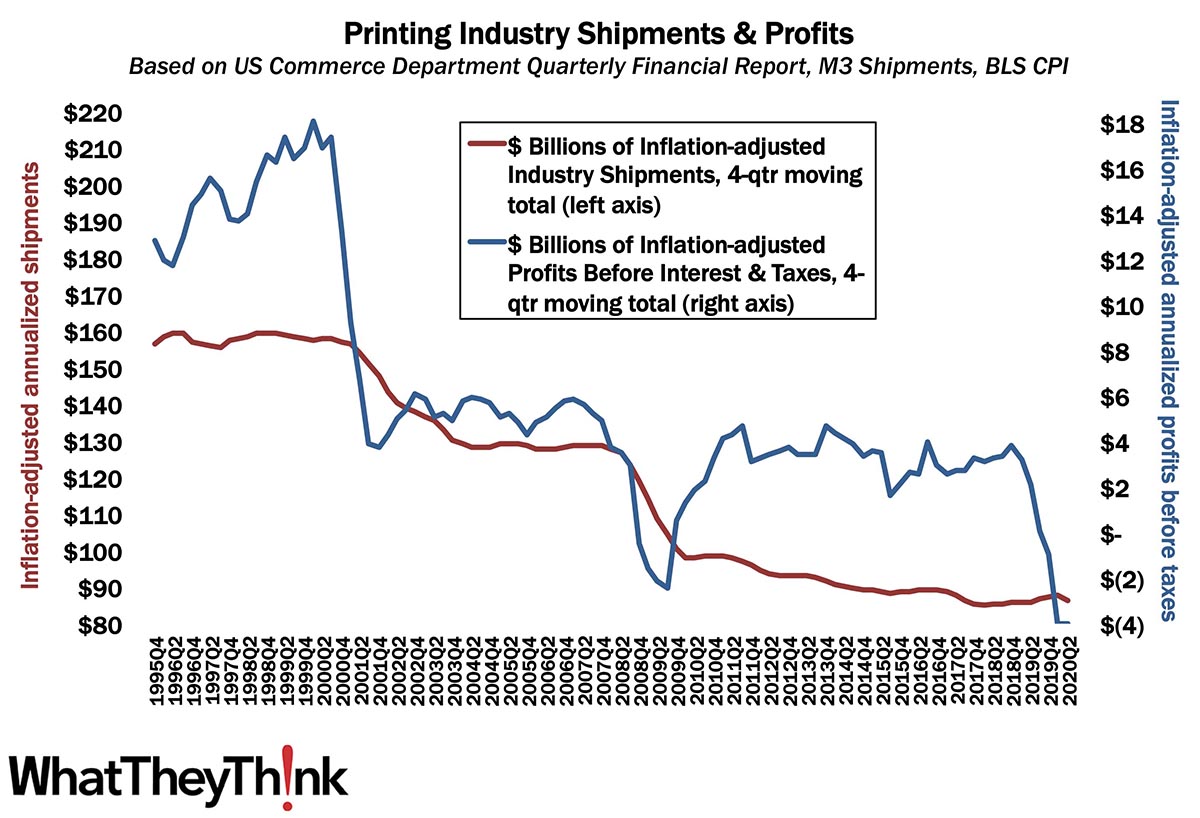

As we saw two weeks ago, shipments-wise, the industry has been having a pretty OK third quarter. However, given the lag time in the release of quarterly profits, we have to time travel back to Q2, much as it pains us to do so, where we see that annualized profits for Q2 2020 stayed steady at -$4 billion. That’s still really low, but at least it’s no lower than Q1 profits had been (these are four-quarter moving totals). As we remarked back in June, Q4 2019 profits had plunged from Q3, and this was before the pandemic. To repeat what has become a common phrase in industry analysis, “the pandemic only accentuated trends that were already well-established,” and there is some comfort (cold though it may be) in seeing that there was no plunge from Q1 to Q2 2020. Of somewhat bigger concern is our ongoing “tale of two cities” saga, although it’s more of a short story this quarter.

In Q1 2020, for large printers (those with more than $25 million in assets), profits before taxes had been -7.96% of revenues. In Q2, this rose slightly to -6.95% of revenues. But for small printers, profits before taxes in Q1 were +5.11% of revenues, but in Q2, this dropped to -2.09% of revenues. That would be the pandemic effect. Q2 interrupted our narrative a little—big printers did a little better profitwise, while small printers did a lot worse. For the industry on average, profits before taxes were -5.31% of revenues, and for the last six quarters, they’ve averaged -1.50% of revenues.

We can’t really blame the large printers for driving down overall industry profitability—this time. As with shipments, the impact of the pandemic on profits hasn’t been insignificant, but has been a little muted; we were expecting the Q2 report to be a lot worse. We are expecting a little bit of a turnaround in Q3, the report for which we’ll see in January.

But, as with everything else, whether we rebound or relapse will all depend on what happens with the virus.