By Paul Miller, ACMA

Since the COVID-19 lockdown across the country in early March, mail volumes have plunged. No category of mail has been hit harder than Marketing Mail, which saw steady weekly drops in volume vs. same period last year (SPLY) in 30 and 40 percents, peaking at a 45.4% plunge in late April, according to U.S. Postal Service figures. The USPS estimates that some 20–25% of this volume may be lost for good, even once the pandemic is over.

All along, package volumes have gone in the opposite direction, as consumers have turned to e-commerce shopping in droves. Weekly volume increases have at times nearly doubled vs. SPLY, with increases often running in the 60–80% range.

As the virus cases diminished (before the more recent uptick), Marketing Mail volume declines were easing up. For the week of June 22, for example, Marketing Mail volumes fell by 24.5%. Hope springs eternal…or does it?

Fixing an Old Problem

For much of the past decade, and with annual losses mounting, the USPS was facing a catastrophic problem long before COVID-19. In recent years, several bills have been drafted only to fail to get out of committee. There seems to be a pattern: Congress holds hearings about the future of America’s postal system; sincere passions pour out of most committee members vowing to fix the nation’s postal system. The discussions often include obvious solutions, such as repealing the mandate that USPS pre-fund health benefits for future retirees.

However, postal reform solutions typically break along party lines with Democrats generally supporting the heavily unionized postal workforce and Republicans often seeking to privatize or reduce government involvement. Postal stakeholders frequently Balkanize, adding to the confusion about what should be done. Some parties often overreach to stake out politically impractical solutions.

If there had been any momentum building for postal reform legislation, the intense focus on COVID-19 economic relief has at least temporarily put such discussions on the backburner. It’s also been further blurred by President Trump’s threat to veto any stimulus bill if it contains USPS funding, unless package rates are increased by four times—a threat he’s transparently made as a means of sticking it to Amazon and Washington Postowner Jeff Bezos.

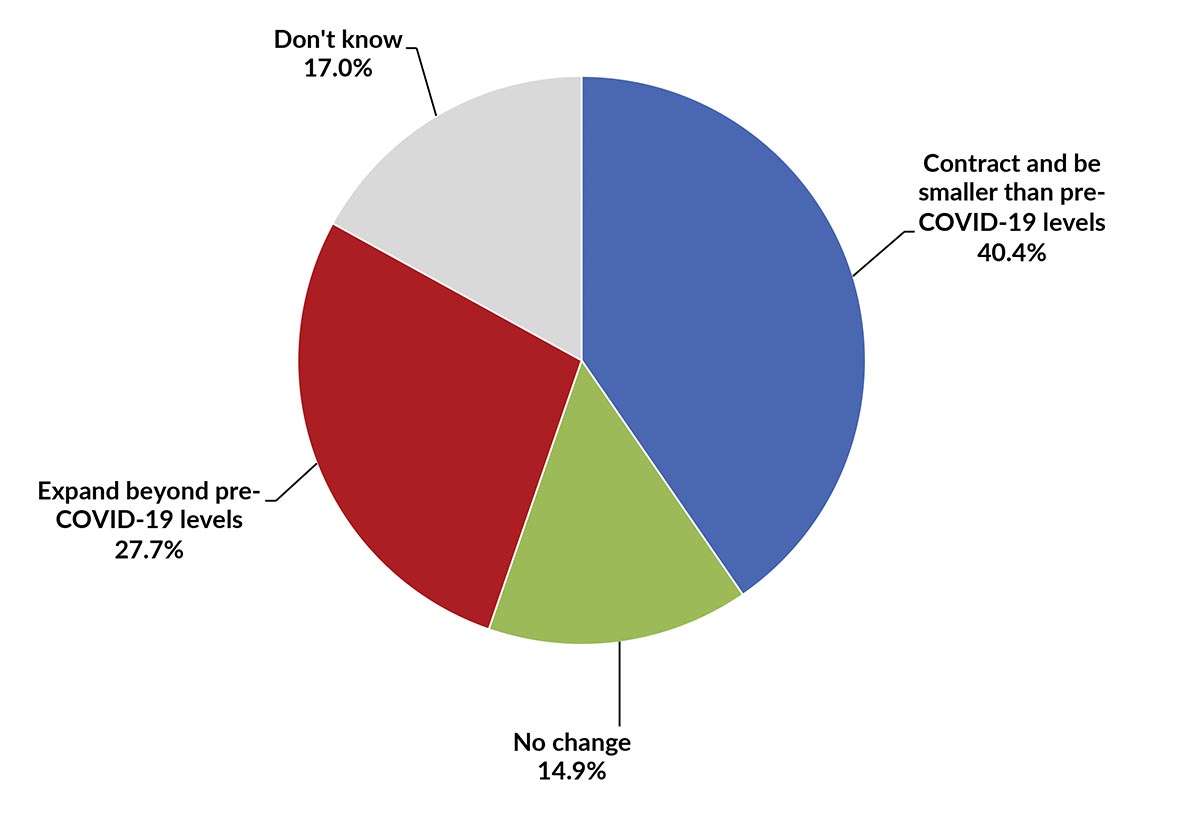

When the ACMA surveyed the catalog mailing industry about mail circulation plans during the second quarter of April 1–June 30, nearly 58% said they were decreasing their circulation. (See “COVID-19’s Economic Impact on The Catalog Mailing Industry” below.) Meanwhile, looking beyond the COVID crisis, nearly 28% anticipated expanding beyond their pre-COVID levels; 40% said they intend to contract and be smaller than their pre-COVD levels; another 15% said they don’t anticipate much difference, while 17% have no idea.

ACMA, which represents the interests of catalog mailers/online merchants and their suppliers, finds widely varying impacts from the pandemic’s impact; it’s largely based on the merchandise categories. Those who sell home goods, gardening supplies, home school supplies, and the like have experienced growth. Those selling soft goods are clinging for life right now. Specialty merchants to restaurants or dry cleaners have been hit hard. Regardless of product offerings, any marketers who also have sizable brick and mortar retail stores are suffering.

Post-COVID Adjustments

All types of merchants will face consumers with transformed buying habits once the pandemic abates. Some consumers may be completely scared off from shopping in stores and will only shop remotely, forcing merchants to adapt accordingly. Some consumers who have gotten into the habit of searching online for the lowest-priced masks, hand sanitizers and other COVID essentials may become less loyal to specific brands.

Given decades of well-above-inflation postal cost increases, many catalog executives are concerned the mail may not be viable over the long term. For more than a decade, mail-based merchants have sought alternatives, but time and again have been unable to replace the effectiveness of catalogs and other direct mail pieces. Traditional catalog and direct mail customers remain far more loyal than online-only customers. But as the USPS’s health continues to deteriorate, merchants’ confidence in mail as a reliable advertising medium will continue to diminish while their efforts (and budgets) to make non-mail marketing alternatives will keep increasing.

Resolving the financial crisis for the Postal Service is critical to restoring executive confidence in the mail. With new leadership just taking over and a nearly full board of governors with deep business and political experience, such a thing may finally be possible.

Perversely, the pandemic has acquainted many more consumers with ordering from home and this might be of long-term benefit for Postal Service revenues. While it’s too soon to determine which direction new Postmaster General Louis DeJoy will take the USPS, clearly the President’s influence is there. Depending on how the current situation resolves, it could further impact the extent to which business mailers use the Postal Service going forward.

Survey Highlights: COVID-19’S Economic Impact on The Catalog Mailing Industry

In the second half of April 2020, ndp | analytics, on behalf of the American Catalog Mailers Association (ACMA), conducted an online survey of catalog mailers and suppliers to quantify the impact of COVID-19 on employment, financial viability and business outlook. Here are some highlights from that survey.

Outlook

About 40% of catalog mailers and suppliers believe their businesses will contract and be smaller than pre-COVID-19 levels after the pandemic passes. This outlook is more prevalent among larger companies (at least $20 million annual revenues) where 46% believe their business will contract.

Company outlook after COVID-19 passes

Source: ndp | analytics on behalf of ACMA

Circulation Impact

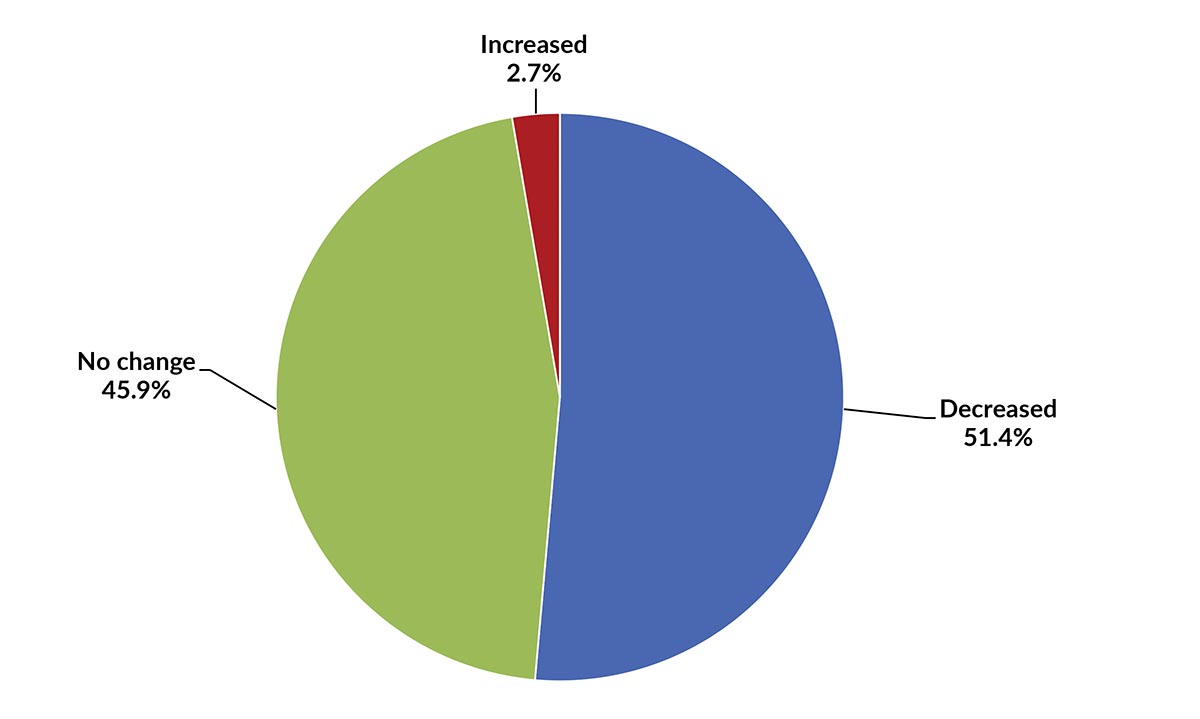

Just over half of catalog mailers decreased circulation during the first month of widespread COVID-19 lockdowns (March 9 to April 8) while 45.9% made no changes and just 2.7% of mailers increased circulation.

However, as the pandemic continued, more mailers changed circulation plans for Q2 2020: 58% decreased circulation, 11% increased circulation and 32% made no changes.

COVID-19 impact on circulation for recent mailings (from March 9-April 6, 2020)

Source: ndp | analytics on behalf of ACMA

Employment Impact

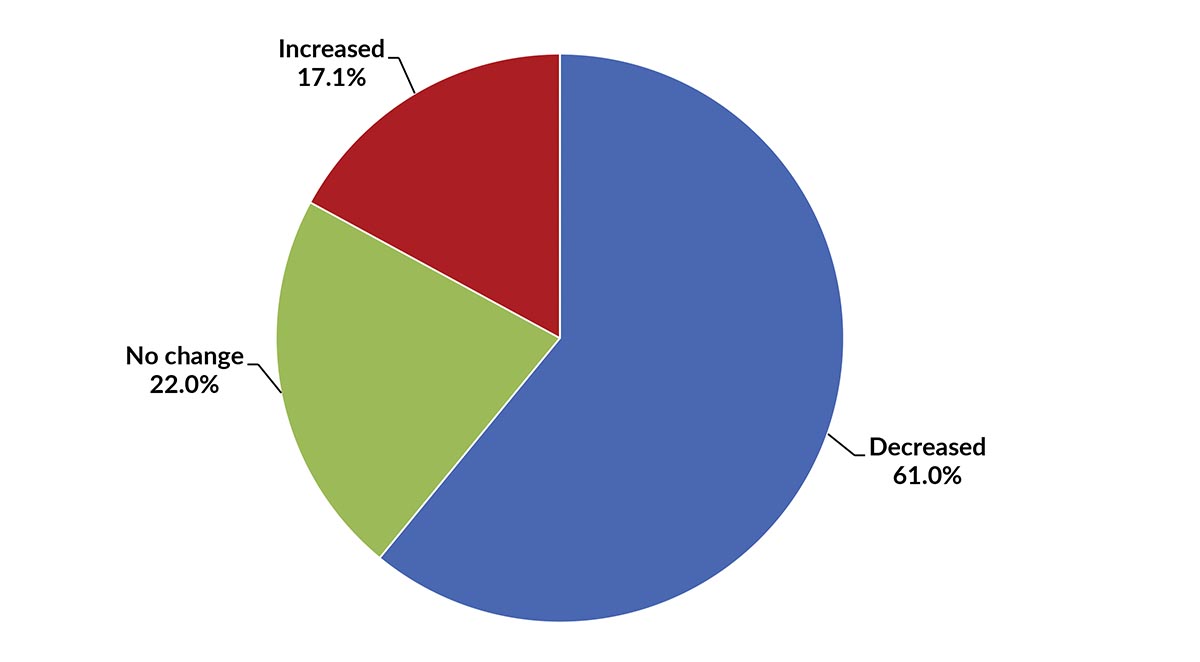

Many companies reduced their workforce as a result of COVID-19: 61% of catalog mailers and suppliers laid off or furloughed employees while 17% increased the size of their workforce. An average of workforce reduction was 25%, 39% in smaller companies (under $20 million annual revenues) and 19% in larger companies (at least $20 million annual revenues).

Change in company workforce due to COVID-19

Source: ndp | analytics on behalf of ACMA

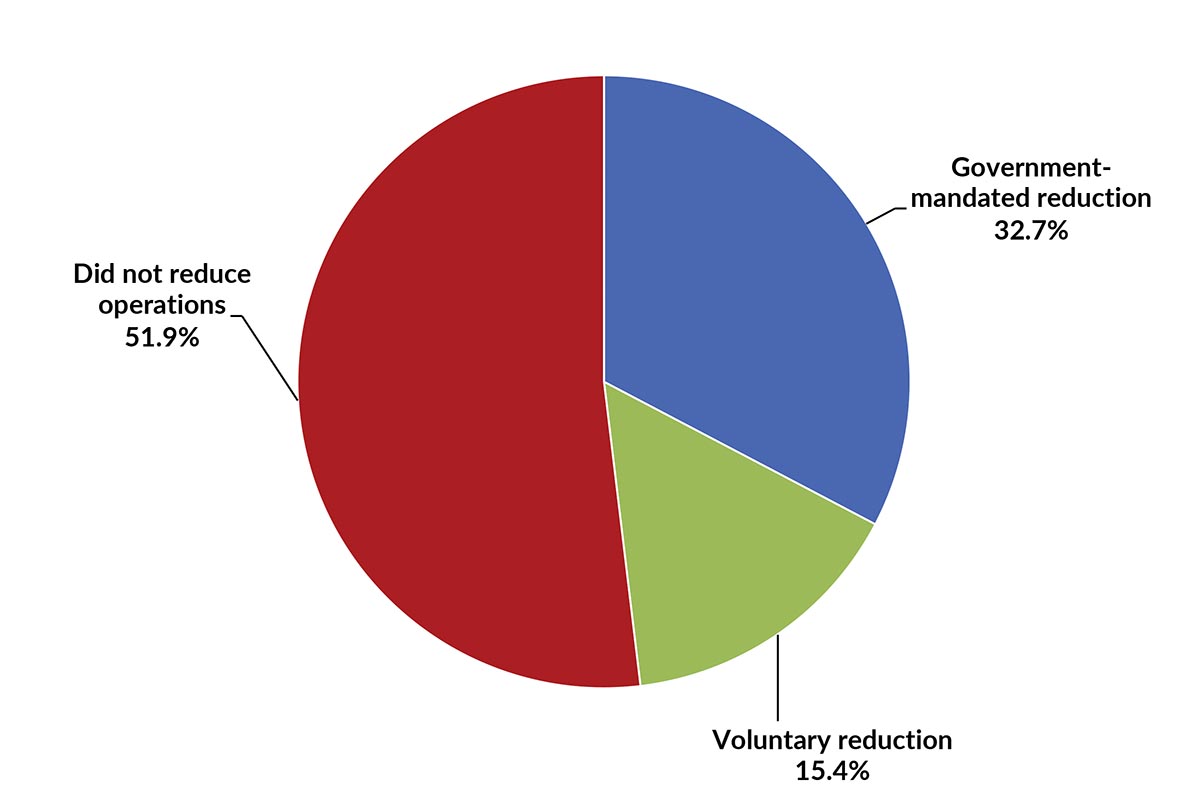

Reduced Operations

About half (52%) of catalog mailers and suppliers remained fully open while the other half (48%) have reduced their operating capacity. Among those who have reduced their operations, the majority reduced their operations due to government mandates while the remainder voluntarily scaled back. Six out of 10 (61%) larger companies (at least $20 million annual revenues) reduced their operations, compared to 33% of smaller companies (under $20 million annual revenues).

Catalog mailers that did or did not reduce their operations due to COVID-19

Source: ndp | analytics on behalf of ACMA

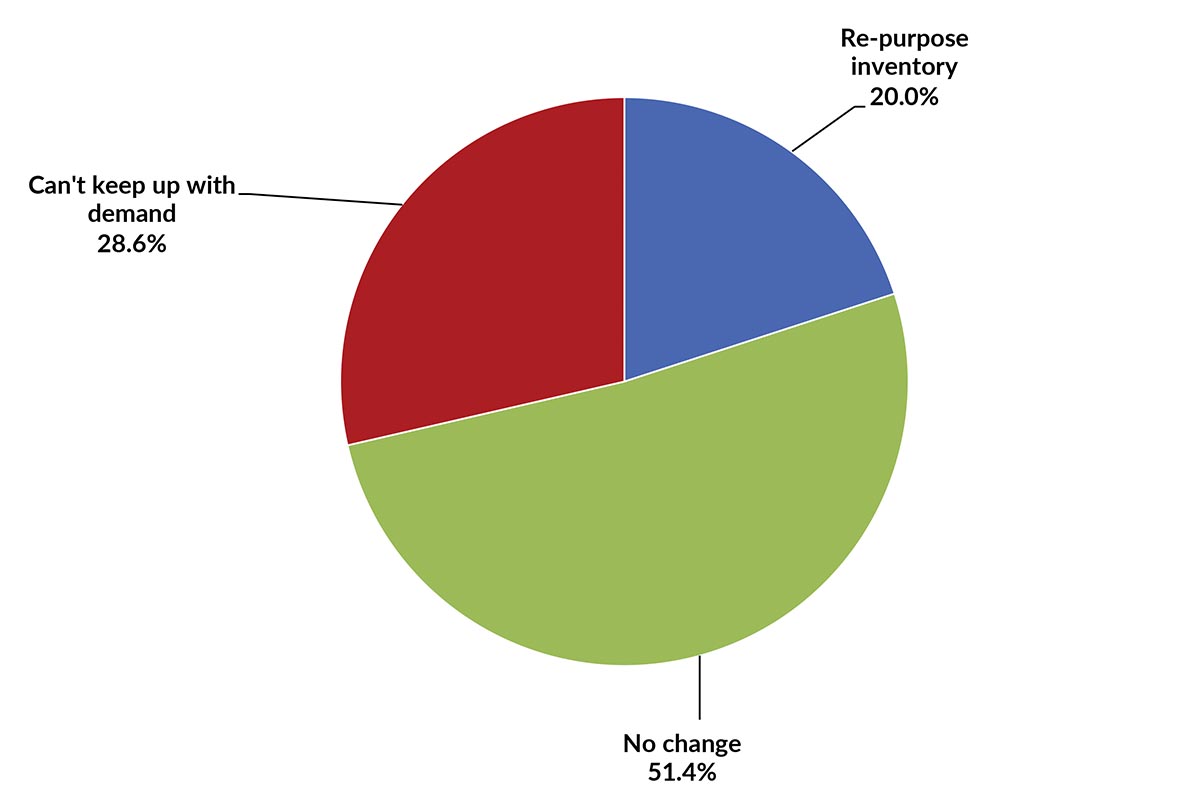

Inventory Impact

COVID-19 has had an impact on catalog mailers’ inventory—and in some cases, significantly. While 51.4% of mailers have made no changes to their inventory, 20% have repurposed inventory, and 28.6% have not been able to keep up with demand. Thirty-seven percent of larger mailers (at least $20 million annual revenues) have not been able to keep up with demand compared to 19% of smaller mailers (under $20 million annual revenues).

COVID-19 impact on catalog mailers’ inventory

Source: ndp | analytics on behalf of ACMA

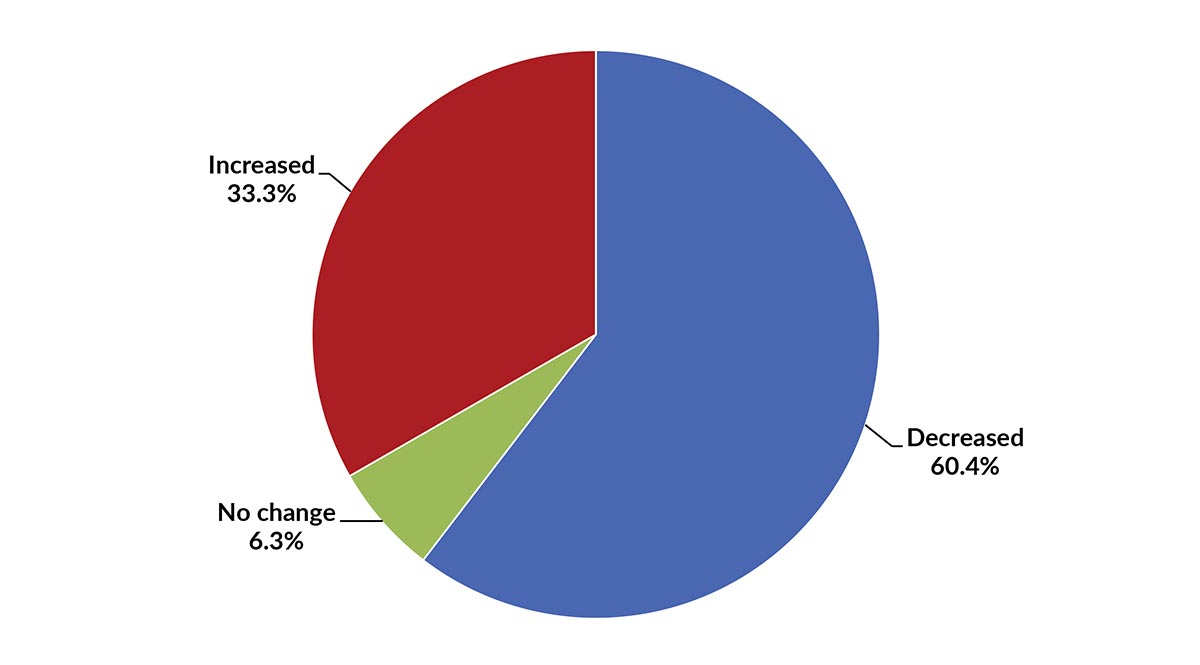

Revenue Impact

The majority of respondents saw a decline in revenue as a result of COVID-19: 60.4% of catalog mailers and suppliers realized a decrease in Q1 2020 revenue compared to Q1 2019, while 33.3% realized an increase in revenue, while 6.3% reported no change. As COVID-19 crisis escalated, more companies realized revenue losses. The survey also found that, from March 9 to April 8—the first full month under lockdown—76% of companies saw a decrease in revenue compared to SLPY while 22% realized revenue increases.

Revenue change in Q1 2020 vs. Q1 2019

Source: ndp | analytics on behalf of ACMA

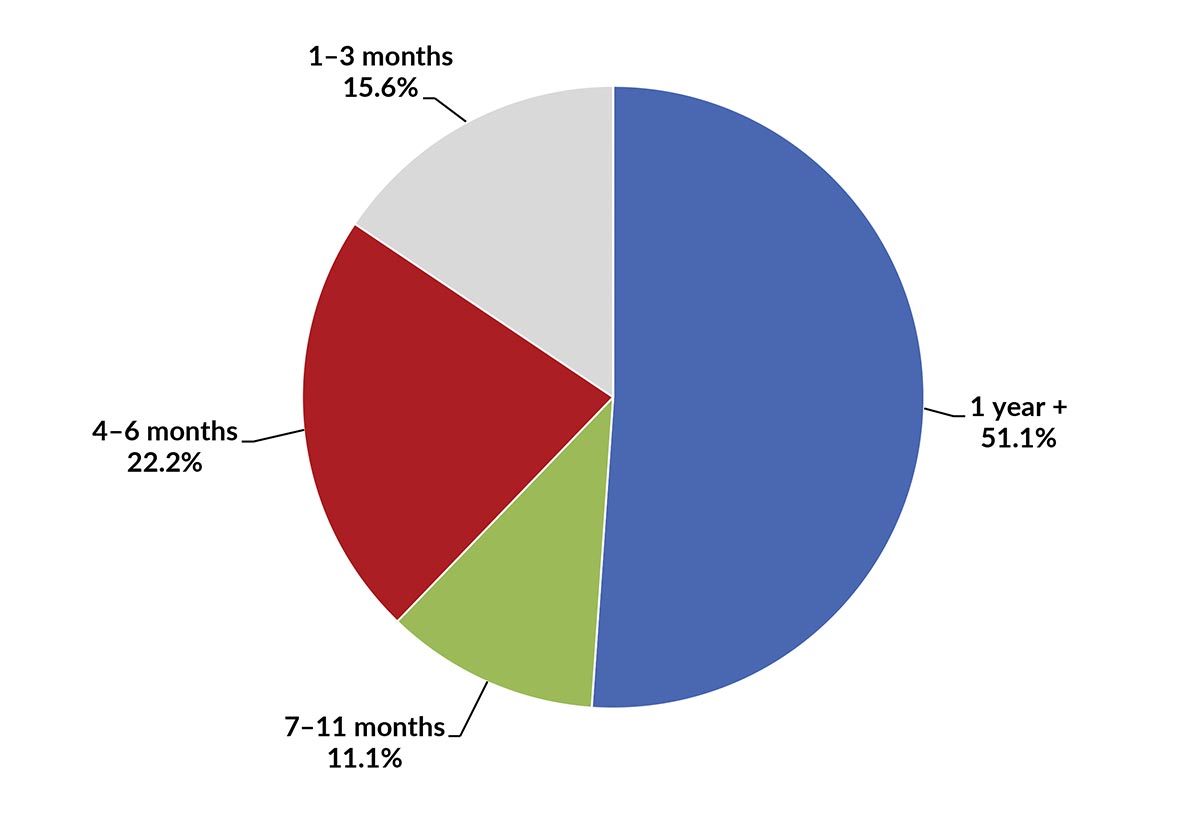

Survival and Recovery Plans

Over half (51.1%) of catalog mailers and suppliers believe that they can survive financially for at least one year under the current COVID-19 conditions, while 37.8% believe they could survive 6 months or less (22.2% believe they could survive 4-6 months and 15.6% believe they could survive less than 3 months). A larger share of smaller companies (under $20 million annual revenues) believe they can survive 6 months or less compared to larger companies (at least $20 million annual revenues).

Number of months companies believe they could survive financially under current COVID-19 conditions

Source: ndp | analytics on behalf of ACMA

Survey Respondent Comments

The ACMA survey also asked an open-ended question, “Where do you see your business once the COVID-19 pandemic has passed and life returns to normal? What do you need right now?”

Here is a sampling of some notable responses:

- Our strong online growth over this period to cover shuttered brick and mortar presence has created the need to re-evaluate marketing approaches and strategies. This could lead to a very different methodology to our mailed portion of the marketing spend. Mobile and social efforts driven by influencers continues to drive increased revenue during this time.

- The longer we are at home the longer the impact on my clients. Some will go away completely. The uncertainty around USPS viability is working against a return to the mail and a move toward electronic marketing. Most of our clients do best with a mix of postal (more expensive, but higher value) and electronic (less expensive and lower value) marketing.

- Some of our clients may not be in business. Some clients have cancelled their services with us. We would have to re-establish those relationships and the need may not be there.

- We pivoted and added new products related to COVID-19 to replace revenue drop from products not selling as well as result of the virus.

About the ACMA

The ACMA (American Catalog Mailers Association) is a Washington-based nonprofit organization that advocates for the unique collective interests of catalog, direct and e-commerce merchants in regulatory, public and administrative matters where the shared impact transcends individual company interests. ACMA participates in rulemaking and other proceedings of significance where a single collective voice increases influence and effectiveness. More information can be found at www.catalogmailers.org.

Paul Miller is vice president and deputy director of ACMA. Paul oversees all marketing and communications, membership development, association administration and organizes and oversees ACMA’s conferences and webinars.