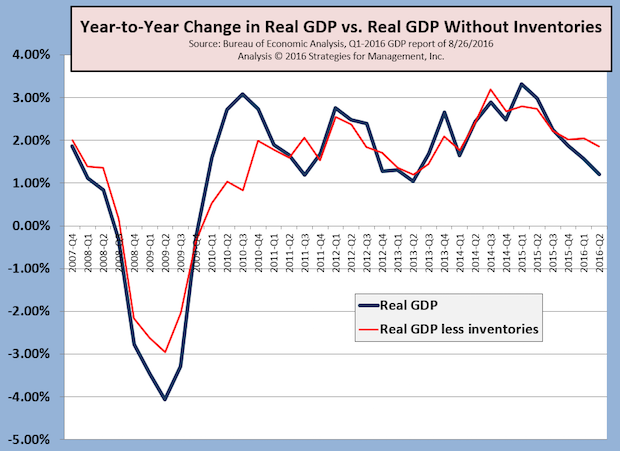

The latest revision of real US GDP for Q2-2016 dropped from +1.2% to +1.1%. The estimate for Q3 from the Atlanta Fed is above +3%. That may be the case, because it appears that the economy finally had its inventory adjustment (-$12.4 billion) in Q2. The blue line in the chart shows Real GDP on a year-to-year basis. We prefer to look at GDP in this manner because it shows the longer-term underlying trend of the data series. The red line removed the distortion of inventories, which shows that final underlying trend is still in the +2% range, well below the post-WW2 average of +3.3%.

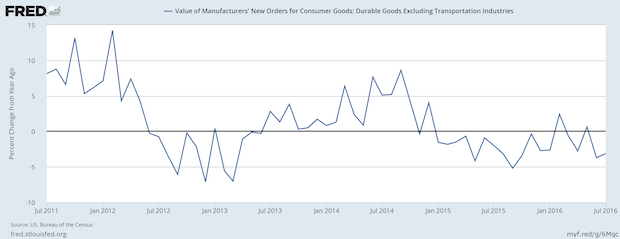

GDP has been increasing minimally lately, and that's due to consumer spending growing but business spending decreasing. New orders for durable goods excluding transportation equipment (planes and cars) have been decreasing compared to the prior year even before inflation adjustment. The year-to-year comparison has been down 17 of the last 19 months.

This remains a concern in coming months and new durable goods, much of which are for business use, are more efficient and productive. That productivity is important for supporting future wage increases of workers. The recent slight gains in wages might be short-lived for this reason.