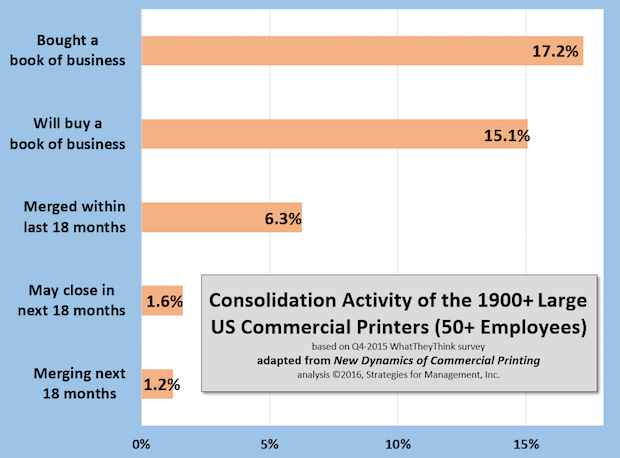

Here are data from our survey at the end of 2015 where we asked respondents to identify the status of their companies in terms of consolidation. Generally, formal consolidations are executed by the largest print businesses, and small businesses close their respective shops and reopen a new business with new partners.

Multiple consolidations by one host business, are common, especially in the purchase of “books of business.” It's not about capacity, it's about smarter use of all cost centers and access to a base of customers that can be taken to higher and more sophisticated levels in the sales and product cycle rather than starting a relationship from scratch. Sometimes that “book of business,” otherwise known as a “tuck-in” can be from a smaller company who has knowledge and experience in a part of the market that the larger company would like to enter. It's not always the purchase of a distressed competitor. With the industry moving to be a collection of niches and specialties and no longer a “mainstream printing” business, this makes sense.

The most interesting activity is in the largest establishments, those with 50 or more employees. Those 1900+ establishments represent about 8% of the industry and about 70% of industry shipments and capital expenditures. The survey data show that over the last 18 months, 17% bought a book of business, and 15% expect to buy at least one in the next 18 months. About 6% had merged with another company in the last 18 months.

There are more details in our report New Dynamics of Commercial Printing.