Many industry pundits spoke of drupa 2008 as “The Inkjet drupa,” and in many ways, it was. Following drupa 2008, a number of vendors brought to market four-color high-speed inkjet solutions that were shown at drupa in product or concept form, and those products are still coming to market.

As we approach drupa 2012, what are the technologies we can expect to see that will drive change in the printing and publishing markets? Once again, we can expect to see a significant position for inkjet in the array of new technologies exhibitors have on display. This time, however, while there will still be a large presence in the production sector, we can also look forward to a “big” presence in the large format market as digital offerings in that sector continue to mature, improve in price/performance, and displace conventional analog sign and display graphics technologies, such as screen printing, for many applications.

The Large Format Market

Digital large format printers are not new to the sign and display graphics market. What is new is the rate at which the technology has advanced in terms of quality, speed and the range of applications that can be addressed using digital—rather than analog—manufacturing processes. Just as the offset printing market has seen demand from buyers for shorter runs, faster turnaround times and more relevant content that drives production to digital processes, the same transformation is occurring in the large format market. And the technology is there to deliver against those demands.

Innovation continues as well. For example, EFI claims its new LED “Cool Cure” curing for its VUTEk line operates at the same speed as UV lamps but with decreased power consumption, ability to print on thinner, less expensive substrates due to reduced heat, and less cost due to no bulb replacements. Scott Schinlever, EFI’s Senior Vice President and General Manager of EFI’s Inkjet Solutions, expects to see other suppliers come to market with LED by drupa, saying, “There is not a lot of downside to LED curing if done without compromising core functionality.”

Fujifilm Graphic Systems has introduced a product that could be viewed as a cross-over between commercial printing and the signs and display graphics market. The Fujifilm J Press 720, a half-size (29”) sheet-fed inkjet press is designed for commercial print applications, but its sheet size and quality also make it suitable for smaller signs and display graphics, especially point of purchase (POP) materials. This type of approach may be an easier way for commercial printers to enter the signs and display graphics market, since the press can also be used to produce traditional short run commercial print products as well. In addition, Fujifilm is the exclusive distributor of Inca Onset printers in the U.S., and offers its own Acuity Series flatbed/roll-fed UV printers and UVISTAR Series roll-fed printers worldwide.

Much of this technology advance is driven by market requirements. In June 2011, research firm InfoTrends completed a study designed to collect more information about the buyers of large format products.(1 )The study was designed to both gain an understanding of wide format graphics buyer requirements and to track changes in those buying patterns since the previous study conducted in 2009. Although this is a North American study, it highlights buyer requirements that are likely to be similar around the globe. More than 300 buyers responded to the survey that was the basis for the study.

Applications and Buying Patterns

The study revealed that banners, posters and signs remain the leading large format applications, with photography gaining an increasing share as compared to 2009 (in 2011, 42.6 per cent of respondents reported purchasing photography applications, compared to 30 per cent in 2009). Drawings, proofs, flags and textiles showed sharper declines, with other applications remaining relatively stable. On average, respondents reported purchasing large format applications 5.4 times per year, a slight increase in frequency over 2009. In the 2011 study, the average number of prints per order reported was 36.5, a number that favours digital production over legacy analogue processes.

Quality, price and speed are the three key drivers for selection of a signage and display graphics print provider. In 2009, price was the top selection criterion. This shift was also noted by Linda Bell, CEO of Inca Digital Printers, who said, “There has been a definite shift. Customers are more familiar with the technology, and more demanding about what they want the technology to do. They are interested in having different types of print and finish and a higher quality output than we have seen in the past. Because they already have a certain expectation about speed, it is now less about speed and more about quality.” To that end, Inca has recently introduced higher quality printers with slower throughput; the S20 and S40 models also offer a choice of gloss, satin and matte finishes. Bell adds, “If you can push quality up to offset levels, it will open an even wider market for large format.”

Speed is still important, however, and most suppliers to the market continue to increase the equipment throughput with wider print beds and faster speeds. EFI’s Schinlever said, “For print heads and the printing systems themselves, price/performance is increasing exponentially. For printer vendors such as EFI, Durst, Inca and others, it is not far-fetched to say that we will ultimately have something as fast or faster than a full-blown screen press–which will make integrated workflow solutions beyond the printer all the more important.”

Enhancing Signage with QR Codes

One of the more interesting findings in the InfoTrends buyer research was the fact that 20 per cent of large format signage and graphics buyers have used QR codes and other interactive media elements in their large format graphics, and of those, more than 90 per cent plan to continue the use of interactive elements. Seventy percent of buyers would consider using QR codes or other interactive elements in their large format graphics. This presents a huge opportunity for print providers in the large format graphics market to both educate buyers on the value of interactive elements as well as add this service to generate more value for the buyers and new revenue streams for themselves.

Digital Displays Not a Threat

One perceived threat to the sign and display graphics market has been the emergence of digital (electronic) signage that many feared would displace printed signage. That transition, however, has not occurred, according to the InfoTrends study. Only 11 per cent of respondents have purchased digital displays, although 38 per cent indicated they plan to. These purchases, however, appear to have little impact on printed large format graphics, with 76 per cent of respondents indicating that they use digital displays along with printed large format graphics.

The Digital Technology Mix

These digital dynamics are driving a wedge into the traditional screen printing market at an escalating rate, and many screen printers are adding digital technology to their production portfolios. Just as in offset, there will be applications suitable for screen printing for the foreseeable future that are just not practical to produce with digital technologies. But the range of applications that can now be produced digitally is increasing exponentially. Many believe that the only applications screen printing does that can’t be done digitally revolve around use of niche specialty inks such as metallic and fluorescents, which are not likely to be available for digital for some time. In terms of specific applications, apparel will be the last big one to fall in terms of transitioning to long-run digital.

Ink Types

One way to segment the large format market is to examine the various types of inks used. InfoTrends segments inks into three major categories:

- Aqueous, which includes durable aqueous as a subsegment, such as HP’s Latex inks

- Solvent/Eco-Solvent, once owning the largest share of the market but being eroded by durable aqueous and the third category, UV curable inks.

- UV Curable has captured the market and UV printers represent the lion’s share of shipments of new equipment in the large format market as print providers migrate from solvent.

UV is gaining ground faster in Europe than in North America, but less quickly in emerging markets such as China and Latin America where regulatory control is less strict. InfoTrends’ Tim Greene says, “In North America, digital large format is still a fairly high margin business as compared to China, where solvent is the technology of choice and printers are paying one-tenth the price for a liter of ink than a North American printer would pay. The Chinese have driven price down, selling large format for as little as 35 cents per square foot, where it used to be as much as US$3 to US$4 per square foot.”

Greene also points out that printers in highly regulated markets such as Western Europe and North America are using what he calls cross-shoring to meet certain customer requirements, perhaps ordering printing produced in a less environmentally sustainable manner in Poland with the end product being shipped to the UK. In this case, the printer meets both the customer requirements and regulatory requirements, since the print is not being produced in the UK.

“China started with solvent inks, while North America and Western Europe started with aqueous inks,” Greene adds. “Solvent looks to remain the primary technology in China and other emerging markets due to lower ink costs, while developed markets are moving away from aqueous and solvent to UV and—as the technologies mature—we expect to see durable aqueous making significant inroads as well.”

One technology to watch is durable aqueous. While HP has a leading position in that segment with its Latex inks, Greene reports that similar formulations are being developed by companies such as Sun Chemical and Sepiax, adding, “These inks are good for use with some Epson piezo-based printers, and that includes many Roland DG, Mutoh, Mimaki and Epson devices in the market. Many of these devices could be moved to durable water-based ink, replacing eco-solvent, simply by flushing the system and changing the print heads.” Durable aqueous inks could be a game changer that could slow the growth of UV, while accelerating the decline of solvent inks. It will bear watching to see whether leading service providers ultimately find value in migrating their systems to durable aqueous as this technology matures.

Interestingly, in a joint FESPA / InfoTrends study conducted in 2011, (2) the most common type of equipment in use by printers surveyed was still solvent, and only a third of respondents reported having aqueous technology. This is despite the fact that the trend worldwide has been a move to UV curable inks. According to Roland DG’s Andrew Oransky, Director of Marketing and Product Management, “While UV technology promises to eventually replace solvent for many applications, it will be some time before the price points of UV printers match the levels we are seeing currently for solvent inkjet printers. For this reason, solvent inkjet printers will continue to be in demand, especially from small to mid-sized shops where an investment in UV technology is too cost prohibitive.”

Prints Aren’t Finished Till They Are Finished!

Finishing is also an important aspect of large format production and can add both margin and value to an otherwise mundane project. For example, adding grommets to vinyl banners can add US$1 per square foot to the value of the project. Savvy large format providers are doing installation including backlit applications, and using laser die cutting to finish point of purchase materials, vehicle wraps and more. They are also applying different finishes to the piece, either through lamination or using technology such as offered by Inca Digital that allows a choice between matte, satin or gloss finish. Although these more complex operations can be harder to manage from a cost and profit standpoint than a “print, stack and ship” approach, a print provider who can offer this full range of services stands to grow both revenues and profits as well as build market differentiation and customer loyalty.

For most operations, printing and cutting are two distinct processes. Roland DG offers a unique patented print/cut platform that combines digital printing capabilities with a contour cutting mechanism to streamline the production process, allowing graphics to be produced from design to finished print in an automated manner, eliminating several otherwise manual steps. Its new VersaStudio 20-inch desktop printer/cutter allows graphics professionals to access the technology for less than US$10,000 and is ideal for producing fully finished one-off samples or mock-ups.

Market Share

Global market share ranking for vendors by ink type showed:

- The global market leaders in water-based or aqueous inkjet are HP, Canon and Epson. HP is the only big brand in the latex market and has sold more than 5,000 latex-based printers, according to InfoTrends.

- In eco-solvent, Roland DG is number one, with 2X the market share of everyone else in North America. Mimaki and Mutoh hold global market share positions 2 and 3, respectively. Roland DG’s Oransky reports that Roland DG’s global market share in eco-solvent is 41.9 per cent, with a global UV market share of 5.6 per cent.(3)

- UV finds Océ with the lead in global market share, followed by Mimaki, HP and EFI. One advantage of UV printing using a flatbed printer is the ability to print directly to rigid substrates up to 2 inches thick, eliminating the need to later mount and laminate output. UV printers are available in flatbed, roll-to-roll, or hybrid models that easily convert from one to the other.

These suppliers will be well-represented at drupa 2012, but visitors should also take the opportunity to visit smaller manufacturers, such as Czech-based Grapo Technologies, as well as look for innovative new products and technologies on display in larger vendor stands.

Evolving Markets Driving Change

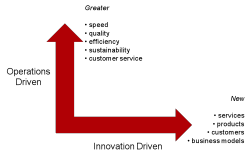

One thing is clear: the large format market is evolving and successful players are driving that evolutionary change on two planes, according to the FESPA / InfoTrends study.

The study reflects that service providers can develop strategies to evolve in two directions: “On one side is the ability to improve their operational effectiveness, to develop greater speed, improve image quality, gain efficiencies, reduce the environmental impact, and improve their customer service standards. On the other side, strategies could be developed to help create new services, build new products, engage new customers, and set up new business models.”

Evolutionary Strategic Directions

The strategic decisions these companies make will impact the types of equipment, customers and applications they will choose to pursue. In addition to the quantitative data acquired by surveying large format service providers, this study also presented case study examples of companies that have chosen these evolutionary paths. Three of these, representing market entry from three different starting points, are summarized here as examples of the evolution the industry is undergoing in terms of both technology and the competitive playing field.

Devising New Revenue Streams

UK company Alderson Print Group is an example of a non-traditional competitor in the signs and display graphics industry, an increasingly common phenomenon. In the case of this commercial printer in business since 1963, large format was perceived as a growth strategy to compensate for declining offset revenues. In 2009, the company established a dedicated point-of-sale division utilizing a combination of a KBA sheetfed offset technology and a range of HP roll-fed wide format digital inkjet equipment.

Alderson used this new division to garner more revenues from existing customers, becoming more of a one-stop supplier, as well as an entree to gaining new business with new customers. Since the division was established, it has doubled year-over-year sales and now accounts for 20 per cent of the firm’s £30 million in sales. This 20 per cent of revenues is generated by a headcount of 30 out of a total staff of 236. A key challenge for Alderson, as for many commercial printers who choose to take the large format path, is the need for significant additional space to accommodate production and finishing, as well as for fulfillment and distribution services these new customers demand.

Massive Graphics

Located in New Brunswick, Canada, Massive Graphics is a digital shop with seven employees driven by an innovative leader. The company uses three large format printers, two Mimaki eco-solvent printers and one Agfa flatbed printer, and does work in the exhibition and retail markets. In 2010, Massive Graphics saw an opportunity to integrate QR codes into its offerings. Although the company does not sell QR codes at an extra charge, its customers recognize that using QR codes in their signage and graphics campaigns is more effective. QR code expertise also positions Massive Graphics as a consultant to its customers, frequently helping clients on the design side to make effective use of QR codes on large format printed signage. QR Codes also make it easier to provide a link to information on the Internet in multiple languages—a requirement and often a challenge in French- and English-speaking Canada.

QR codes also deliver metrics. Companies want to know they are getting a direct response and QR codes are a great way to deliver that intelligence since accesses to the codes are tracked.

In a very short timeframe since this large format company began offering QR codes, it has come to be seen by its customers as capable of producing much more comprehensive and effective campaigns, elevating its value, and with little risk, since the addition of QR codes requires little additional investment on the part of the printing firm.

BIG Opportunities for Making a Big Impression

Large format inkjet printing is an exciting segment of the printing business. It is growing, it can offer higher margins than many other segments, and the technology continues to evolve to allow even more innovative customer solutions.

drupa 2012 will be an important venue for print service providers of all types to investigate the full range of options for entering this lucrative market space. Visitors should take full advantage of the opportunity to educate themselves about equipment, inks, finishing solutions, applications and more as they seek the best path to profit for a new business opportunity, or look for ways to enhance their existing large format services.

Visitors should also look “beyond the box” at tools and solutions that will help streamline their operations. Most, if not all, suppliers to the large format market offer a wide range of prepress, workflow and finishing solutions that make the large format printing process more efficient and cost-effective.

1. Who Buys Wide Format 2011, by Tim Greene, Director, InfoTrends, June 7, 2011

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free