If there is an industry that is bullish about its growth, it’s labels and packaging. According to Label & Narrow Web’s “2024 Labels and Packaging State of the Industry Report,” 63% of converters and suppliers say they are “very confident” about industry growth, up from 47% saying they were “very confident” this time last year. If you add those who are “somewhat confident,” the confidence level jumps to 95%.

While these numbers come from manufacturers producing both labels and packaging, we’re really talking primarily about labels here. More than 8 in 10 (83%) of respondents have labels as their primary business activity.

This level of optimism is not surprising, since you can’t pack an iPad or a makeup pallet into a digital box. Labels and packaging remain the printed products you can’t replace with digital versions.

Staffing Remains a Stubborn Problem

But this doesn’t mean that running the business is breeze. As in the printing industry, staffing remains a stubborn problem—50% of respondents say that they have issues hiring and retaining staff.

On a positive note, the supply chain is moving along since the pandemic. Just over one-third (36%) of respondents say they are still experiencing “some” issues in their supply chains, but the plurality (43%) say they had experienced issues during the pandemic, but those issues have now been resolved.

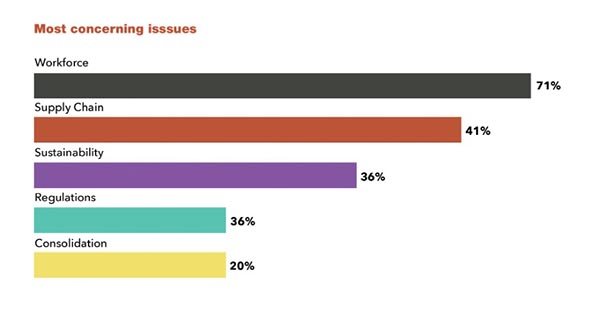

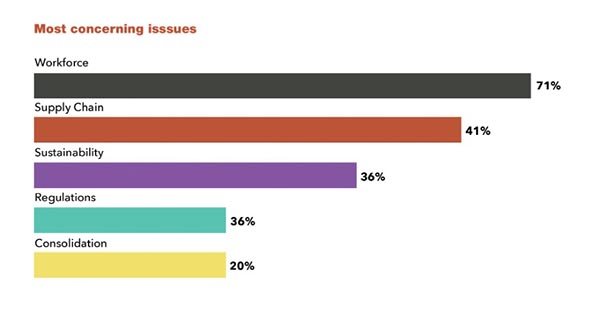

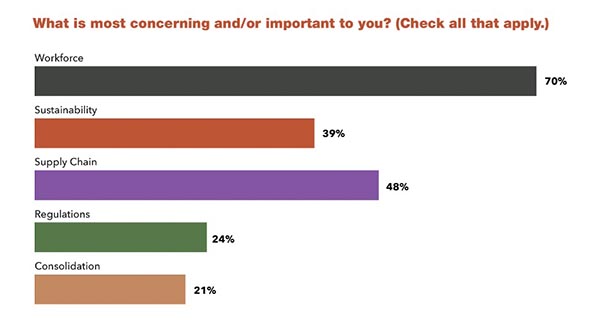

So what are the top issues faced by label and packaging converters and suppliers today? When asked to cite the issues that most concern them, respondents cite the workforce as by far and away number one — 71% giving this answer. This is followed by the supply chain (41%), then sustainability tied with regulations (36%).

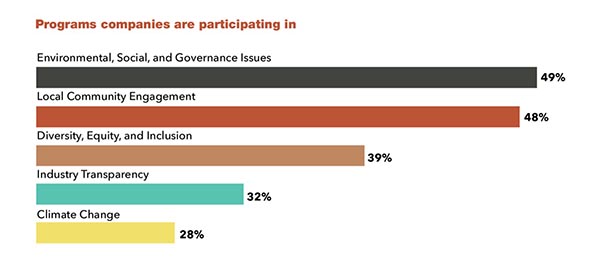

With more than one-third of survey respondents concerned about sustainability, and with so many ways to address the issue, what programs are they participating in? Nearly half are involved in ESG and local community engagements (49% and 48%, respectively). Coming in third is diversity, equity, and inclusion (39%).

Manufacturers Say…

Looking at the issues cited by manufacturers specifically, we see a slightly higher level of concern about the supply chain (48% vs. 41% overall) and sustainability (39% vs. 36%). Among manufacturers, concern about regulations drops significantly (24% vs. 36% overall).

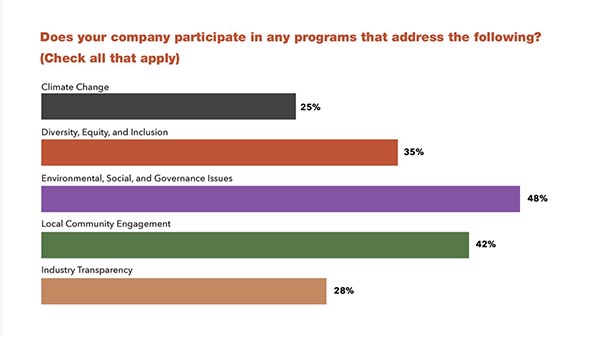

When it comes to participating in programs to address sustainability issues, manufacturers are less likely to be involved than suppliers. The highest level of participation is in ESG, followed by local community engagement (among suppliers, this is reversed).

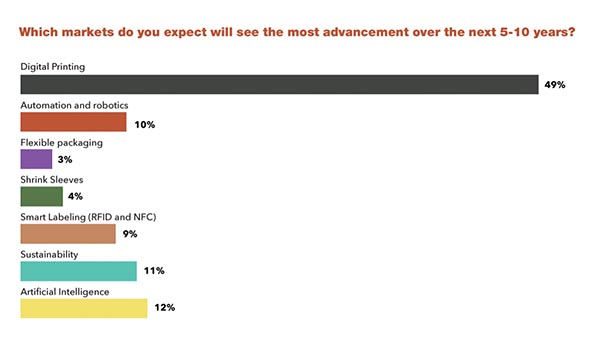

In which markets do label manufacturers expect to see the most advancement over the next 5-10 years? At 49%, digital printing dwarfs all others. Automation and robotics and smart labeling (RFID and NFC) come in at a paltry 10% and 9%, respectively.

Suppliers Say…

Where are label and packaging industry suppliers in all this?

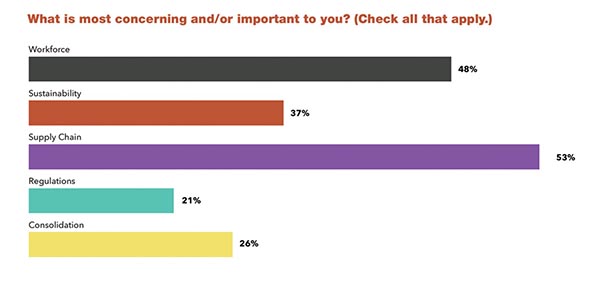

Unlike manufacturers, which are most concerned about the workforce, suppliers struggle most with the supply chain. Fifty-three percent say this is the most concerning and/or important issue to them. The workforce is, however, still a major issue, with 48% citing this concern.

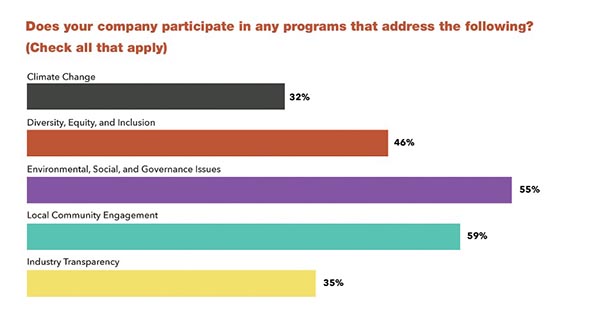

What programs are suppliers participating in that address sustainability? Number one is local community engagement, with 59% giving this answer. (Compare this to manufacturers at 48%.) More than half of suppliers are involved in ESG (55%), followed by diversity, equity, and inclusion (46%).

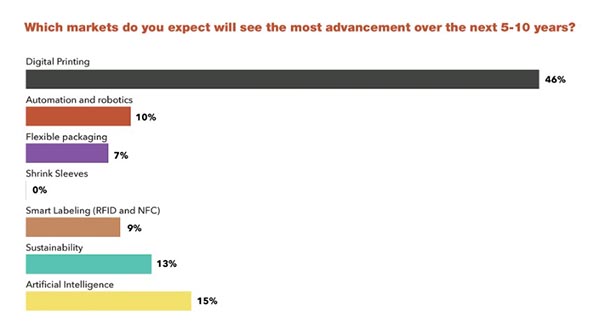

Suppliers, too, see digital printing as the market that will see the most advancement in the next 5-10 years. Most of their other answers are similar to manufacturers, although they are slightly more bullish on AI (15% vs. 12% for manufacturers).

Who Loves Associations?

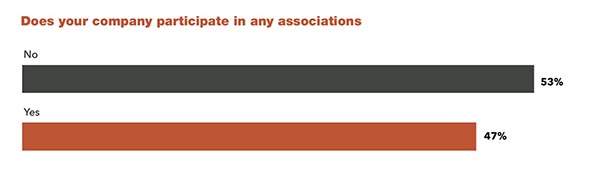

Another set of very interesting numbers is whether or not respondents belong to associations. Among converters, more don’t belong to associations than that do — 53% do not participating, compared to 47% who do. Among converters, this is inverted.

With fewer and fewer manufacturers in attendance, each manufacturer has the opportunity to be lavished with more attention.

CONVERTERS

SUPPLIERS

This does not exhaust all of the interesting insights in the annual report. Want to download your own copy and see for yourself? Click here.