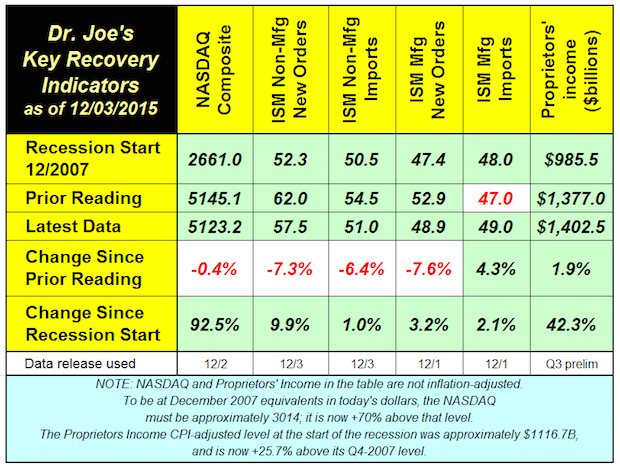

The recovery indicators turned in a mixed performance that warrants some caution, concern but not worry, yet. Some outside economic analysts starting to raise concerns about the economy in 2016. Citibank analysts peg the chances of recession in 2016 at 65%, the first such prognostication of a major investment firm that we have seen.

The NASDAQ barely budged from last month, down -0.4%.

The Q3 report of proprietors' income, a measure of the health of small business, was revised up from $1,400.9 million to $1,402.5 million. The measure is now calculated as being up +1.9% on an annual basis from Q2.

The concerns are for the ISM indexes. The manufacturing new orders index fell below 50, indicating a contraction. The 48.9 reading is still above the level when the recession started in December 2007, but this should be a concern at this point and not a worry. The manufacturing new orders index has been negative at other times and rebounded. If we get a string of numbers below 50, that would be a sign of recession. The manufacturing imports (mainly for raw materials) is still above the December 2007 level.

On the non-manufacturing side, the new orders index fell, as did non-manufacturing imports. That import index is barely above where it was at the start of the recession. Fed watchers are thinking the keepers of the monetary system will raise the interest rate by a quarter point. They may do that just to finally get it out of the way, but deterioration of economic conditions mean that a second increase may be delayed for a long period of time. The Fed may yet again have to enter into quantitative easing to prop up the economy and the banks sometime in 2016. While the Fed ended its quantitative easing actions a while ago, they have been buying new financial obligations as any of the holdings they have had reached maturity. Keep your seat belts fastened: there might be turbulence ahead.