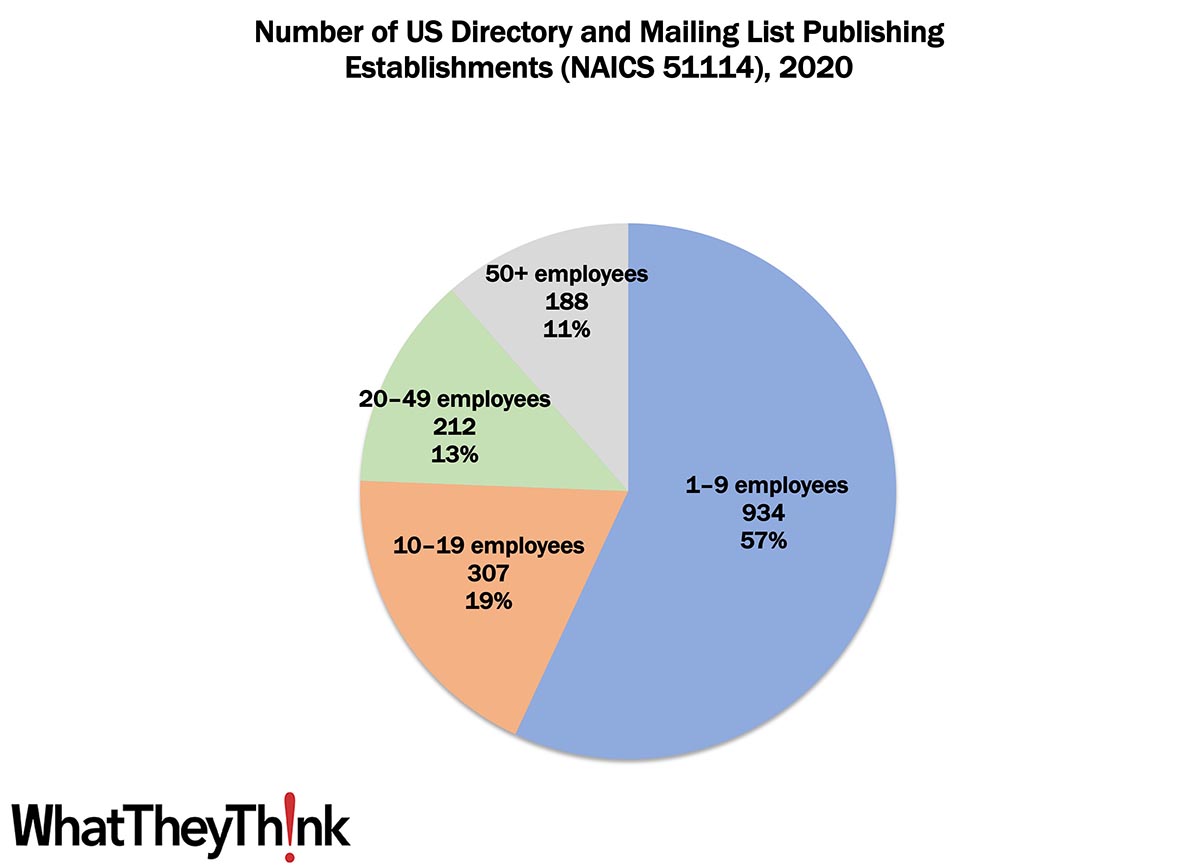

Our Friday data slice’n’dice look at the latest edition of County Business Patterns has been detailing the publishing industries. As 2020 began, there were 594 establishments in NAICS 51114 (Directory and Mailing List Publishing), a decrease of 64% since 2010.

There is no mystery to what is happening with these businesses: directories and mailing lists, when they haven’t been replaced by Google, are distributed almost entirely electronically. The USPS’s woefully underutilized Every Door Direct Mail (EDDM) bypasses traditional directory publishers (when it’s used at all), although some commercial printers—such as 4Over—offer and promote their EDDM services.

To clarify what is included in the 2020 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2020 CBP. Thus, businesses lost during the COVID pandemic won’t be accounted for until the 2021 CBP.

Directory and mailing list publishing establishments—such as they are—are concentrated at the lower end of the employee-count spectrum. Small publishers (1 to 9 employees) comprise the bulk of the establishments, accounting for 71% of all establishments, with the other three size classifications just about equal.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 51119 Other Publishers

- 511191 Greeting Card Publishers

- 511199 All Other Publishers

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

Calculated Risk rounds up some estimates of Q4 GDP, ranging from Bank of America and Goldman both forecasting +1.4% q/q saar, while the Atlanta Fed’s GDPNow is very bullish in estimating +3.4% Q4 GDP growth. Recall that Q3 GDP came in at +2.6%. The official Q4 GDP estimate from the BEA will be released January 26.