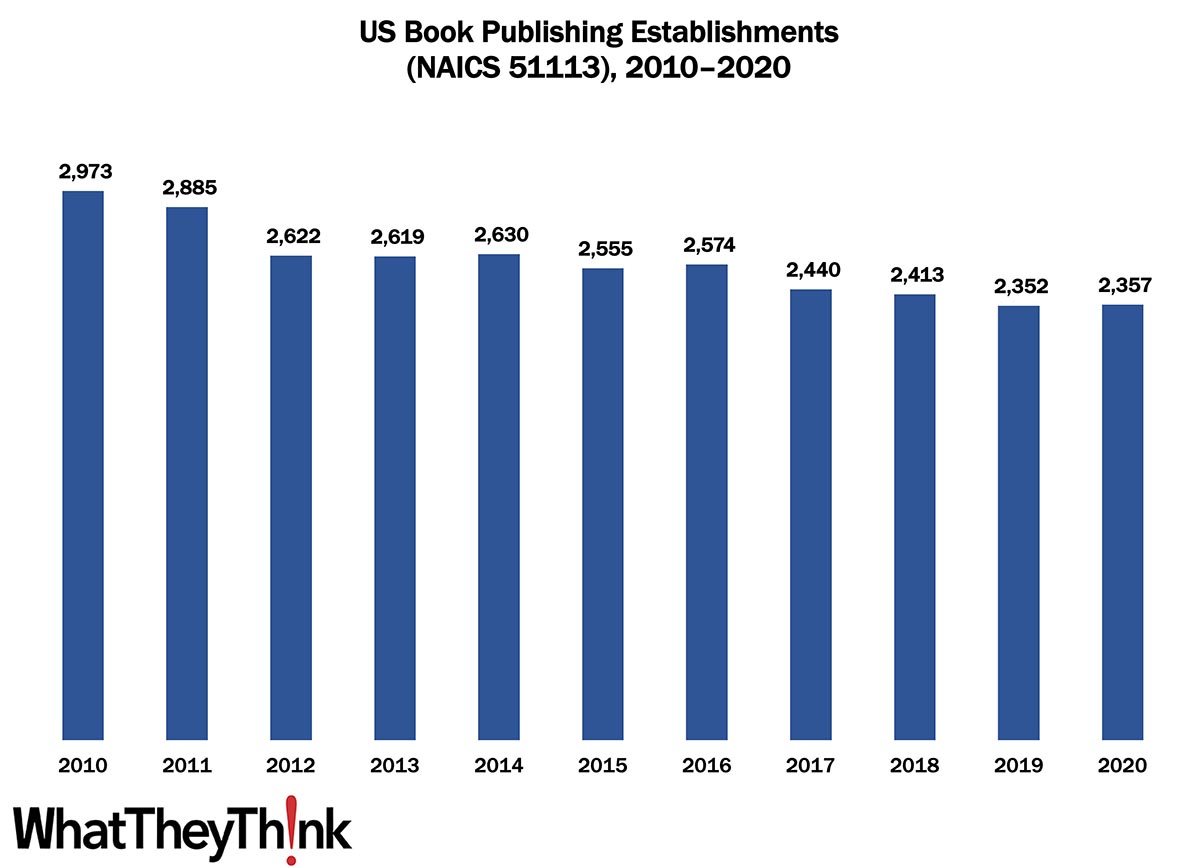

Our Friday data slice’n’dice look at the latest edition of County Business Patterns has been detailing the publishing industries. As 2020 began, there were 2,357 establishments in NAICS 51113 (Book Publishing), a decrease of 20% since 2010.

We’ll look at Non-Employer Statistics* at another time, but it’s worth noting that at least as recently as 2016 there were an estimated 7,977 small or self-publishers in this category. Technology enablers such as electronic publishing, on-demand book production, and e-commerce through companies like Amazon (Createspace) have led to a growing specialty publishing market. When you factor in the ease of creating and publishing ebooks (which are often given away or sold for only a token amount as more of a self/business promotion strategy or tie-in to a speaking gig), some, perhaps many, “book publishers” may not classify themselves as such.

To clarify what is included in the 2020 CBP, establishment counts represent the number of locations with paid employees at any time during the year. If an establishment existed at any point during the year, it would be included in the CBP count of the number of establishments for 2020 CBP. Thus, businesses lost during the COVID pandemic won’t be accounted for until the 2021 CBP.

Book publishing establishments are concentrated at the lower end of the employee-count spectrum. Small publishers (1 to 9 employees) comprise the bulk of the establishments, accounting for 71% of all establishments, with the other three size classifications just about equal.

These counts are based on data from the Census Bureau’s County Business Patterns. Throughout this year, we will be updating these data series with the latest CBP figures. County Business Patterns includes other data, such as number of employees, payroll, etc. These counts are broken down by commercial printing business classification (based on NAICS, the North American Industrial Classification System). Up next:

- 51114 Directory and Mailing List Publishers

- 51119 Other Publishers

- 511191 Greeting Card Publishers

- 511199 All Other Publishers

These data, and the overarching year-to-year trends, like other demographic data, can be used not only for business planning and forecasting, but also sales and marketing resource allocation.

This Macro Moment…

According to the Census Bureau, retail sales in October were up:

Advance estimates of U.S. retail and food services sales for October 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $694.5 billion, up 1.3 percent from the previous month, and 8.3 percent above October 2021. ... The August 2022 to September 2022 percent change was unrevised from virtually unchanged.

If you back gasoline out, retail sales were up 1.0%. October retail sales were above expectations, and sales in August and September were revised up.

* “Non-Employer Statistics” is where the Census Bureau tracks freelancers, sole proprietorships, and other small businesses or individuals. For our purposes, these include graphic designers, small agencies, and small or self-publishers.