Following the printing industry through national statistical offices could be a quite arduous task. Fortunately, data for the European Union is collected by Eurostat, the statistical body of the European Union. Eurostat data on manufacturing industries is now available through 2020. Eurostat always has a considerable time lag until data is published, but it seems that the COVID-19 pandemic prolonged the release of the data. Possibly the upheavals of the pandemic made it more complex to harmonize data and update time series.

In a series of articles on WhatTheyThink, I covered the immediate effects on print production volumes during and in the immediate aftermath of the pandemic. As this was indexed production volume data, the exact effects on revenues were difficult to predict and the numbers did not show other consequences as the number of companies or on employment.

Turnover Down, Number of Enterprises Flat

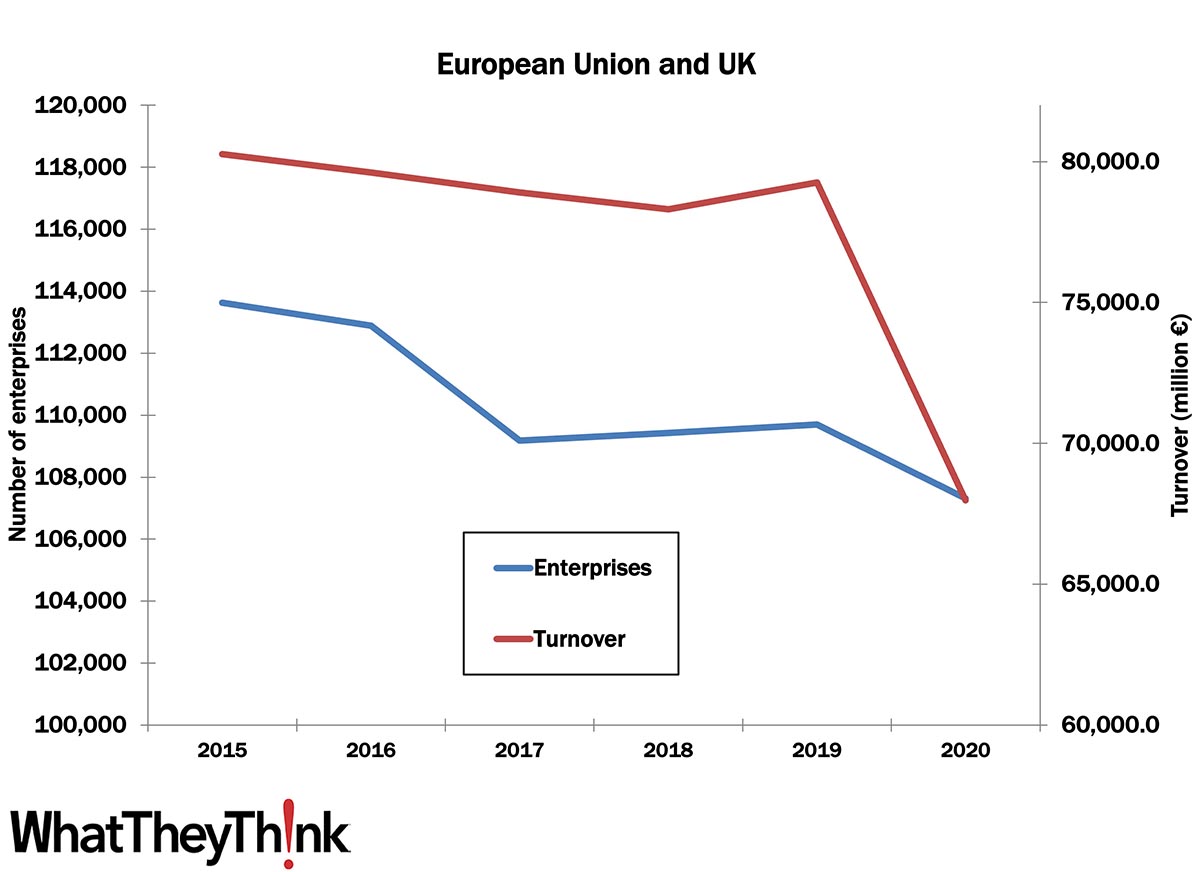

There are two noticeable findings in the 2020 data set for the printing industry in Europe: at the end of 2020 the number of print shops hardly changed, while turnover numbers took a deep hit.

Enterprises and Turnover Printing Industry in Europe 2015 to 2020

Source: Eurostat, digitalprintexpert.de, 2022

In 2020, the number of enterprises in the printing industry in the European Union and the UK declined moderately from about 109,590 to 107,311 (according to unadjusted Eurostat data). This represents a decline of 2.1%. Compared to an average decline in the previous five years of 0.7%, this is hardly any acceleration.

Turnover (that is, revenues) in the industry went into a tailspin, however, as numbers declined from €79.3 billion in 2019 to €68 billion in 2020. This is a whopping 14.2% drop, especially considering that turnover was mostly flat in the years since 2015. In 2019, the printing industry in the EU (plus the UK) even showed a slight increase in turnover. The 2020 decline even surpasses the turnover drop of 2009, caused by the euro crisis. In hindsight, the 14% drop might even look moderate considering the wide-ranging shutdowns during the pandemic and a sudden, steep drop in demand. Detailed country data reveals that some countries suffered far more, although eastern European countries fared better—even some posting revenue growth.

The very moderate decline in establishments is mainly an effect of the industry subsidies introduced by the national governments during the pandemic. Obviously, companies would not go out of business immediately at the onset of a major crisis, but without the aid provided, a much larger number of businesses would have closed on a bleak outlook and without support. Still, the number of businesses hardly changed in 2020. However, the danger is that some companies were kept alive that would have failed otherwise. It is likely, and anecdotal data already confirms this, that the numbers of companies will start to drop more quickly now.

The Current State

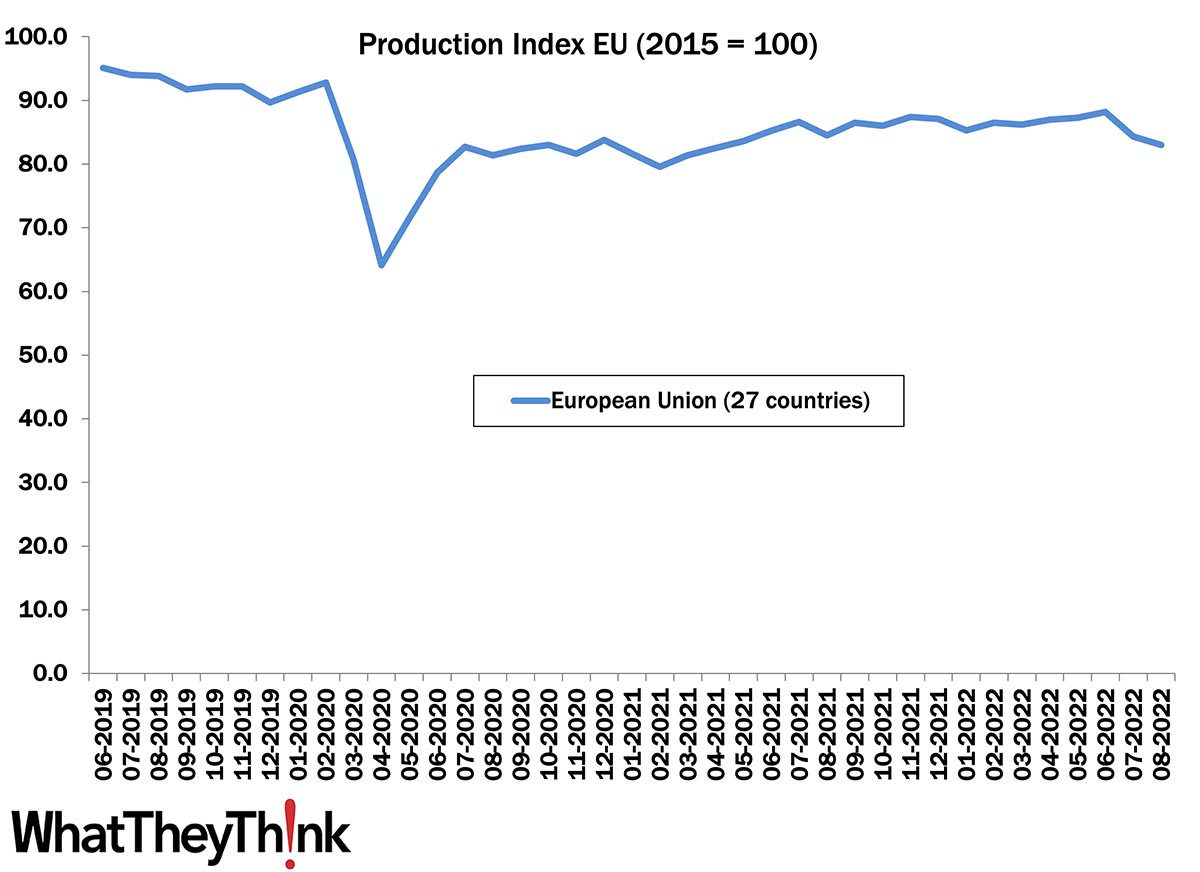

Unfortunately, the full data series ends in 2020. As a more up-to-date data series, Eurostat publishes a production index for printing and recorded media, which gives an indication on how production volumes developed based on 2015 averages. The most recent data point dates from August 2022. This data set covers the EU countries only, without the UK.

After the big dip at the height of the COVID-19 pandemic volumes recovered quickly to some extent. Production volumes took a slight dip again early in 2021 as a second wave of lockdowns followed in many EU countries. Another phase of recovery followed in the second half of 2021 until mid-2022. However, even then the index remained six to seven percentage points below the pre-pandemic average, indicating that production has not reached pre-pandemic levels. The last two months show a noticeable decline—possibly a result of the ongoing paper supply crisis. It is likely however that the latest data is revised up to some extent, as is frequently happening with the production index data.

Source: Eurostat, digitalprintexpert.de, 2022

Interestingly, the aggregated production volume index data for 2020 would result in a decline of 13% compared to the 2019 aggregated data. This is very close to a turnover decline of 12.6% for the EU countries in 2020. The difference could account for a slight price increase in 2020. Given the fact that many printers were able to raise prices in 2022, the turnover outlook for 2020 could be a bit better than the production index data is implying for now.

Eurostat 2020 data is still marked as provisional; accordingly, we will see some changes in the future. Although this should have only minor implications for the full European data set, single country results could be subject to more noticeable revisions. This article will kick off a series of short country snap-shots on the size of the printing industry in Europe and how it fared in 2020.

Unfortunately, statistical data points can sometimes be confusing, incomplete, or difficult to compare. If you have questions or need clarification, please contact me at ralf@digitalprintexpert.de.