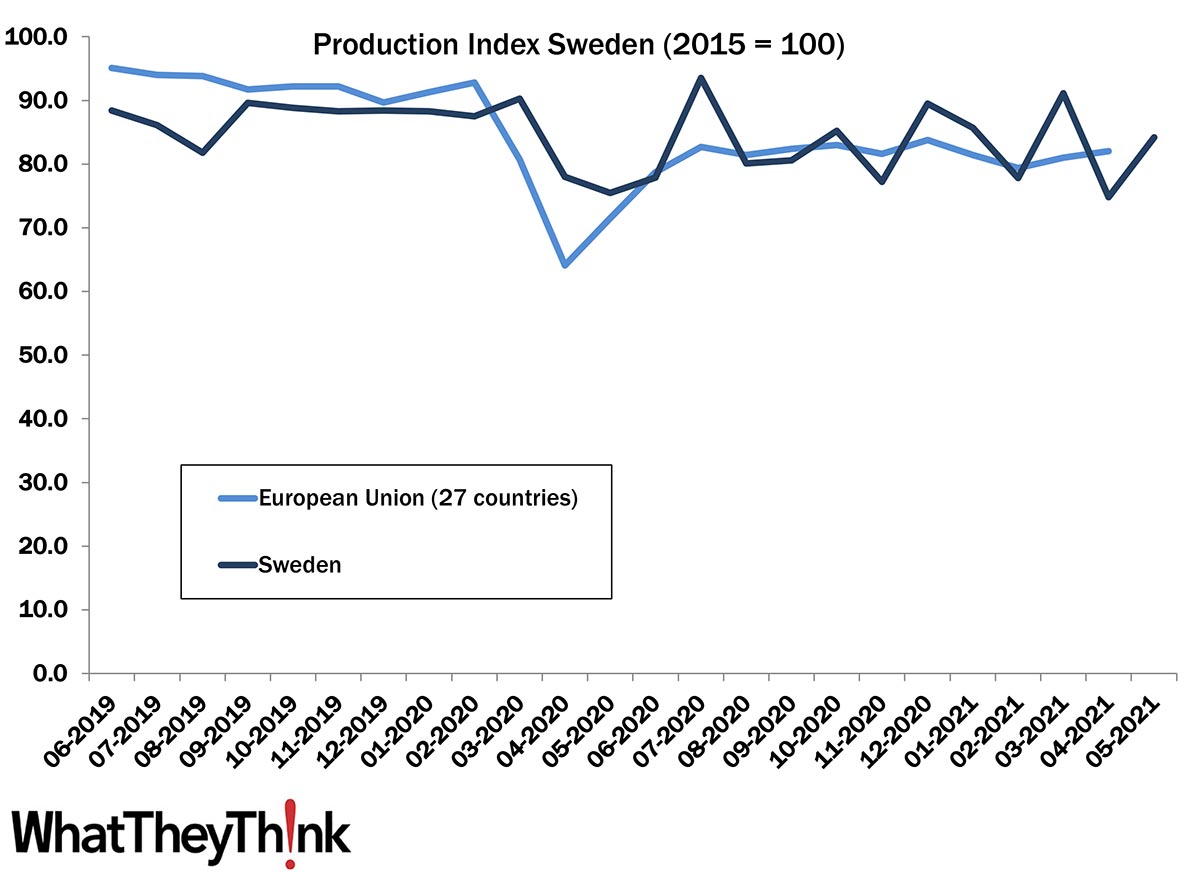

Sweden has the largest printing industry in the Nordic region. However, revenues have been under pressure in recent years. There is no doubt that the COVID-19 pandemic did impact the printing industry (like other industry sectors) heavily as well. Still, it is difficult to quantify the impact as the most recent revenue data Eurostat publishes still only dates from 2018. Eurostat publishes a more timely production index for printing and recorded media, which gives an indication on how production volumes developed based on 2015 averages. The most recent data point for Sweden dates from May 2021.

During the height of the COVID-19 Crisis in May 2020, the production volume index dropped to 76% of the 2015 production average. As volumes were down compared to 2015 before the pandemic, the drop amounts to 17% below the pre-coronavirus average. In contrast, the EU output (which excludes the UK production) dropped by 31% compared to the pre-pandemic average—although that low point had already been reached in April. The relatively low decrease is a sign of Sweden having less restrictions in the first wave of the pandemic compared to other European countries.

The steep drop led to a strong recovery from May to July, with July values even surpassing pre-pandemic levels. However, then the recovery stalled as the second and third wave of COVID-19 made more economic restrictions necessary. The output remained generally at a lower level since then, but monthly numbers fluctuate heavily. On average, the production index stayed about 9% below the pre-COVID values, which is in line with the European recovery averages. As numbers continue to fluctuate (a good May followed a weak April), it is impossible to judge right now whether the industry is on the way of recovery already, whether this will take more time, or whether numbers will remain that low.

Taking into account the decline and recovery, 2020 print industry production is down by about 8% compared to 2019. Assuming a slight increase in prices the revenue decline for 2020 over 2019 could be in the 6% to 7% range.

Source: Eurostat

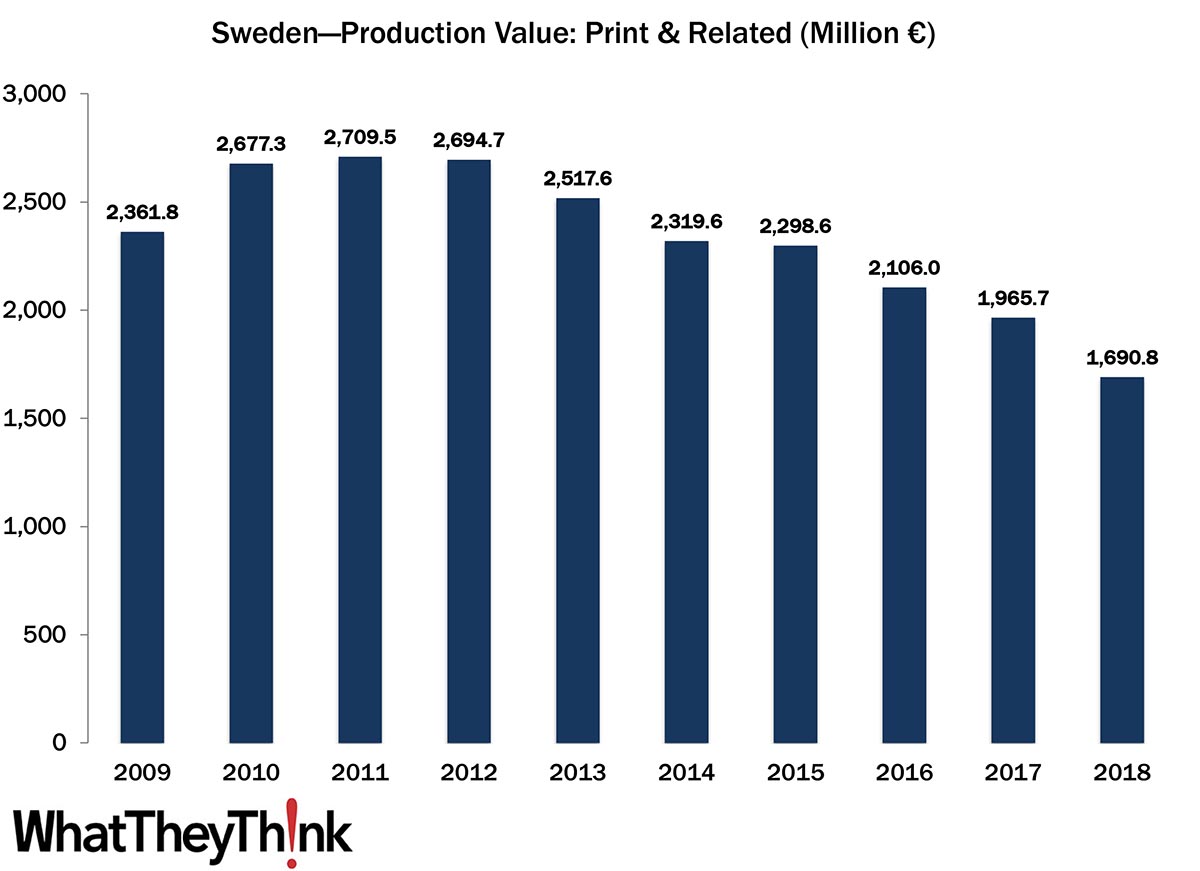

The index data gives a timely reference on how well industry sectors are doing. Less timely is the reporting of revenues, although it does show the total industry size.

After several good years from 2010 to 2012, revenues in the Swedish printing industry declined heavily. In the period from 2009 to 2018, this amounts to an average decline of 3.6% annually. Given the rapid drop in revenue in 2018, it is likely that the decline will soften. 2019 is expected to show a small decline, while 2020 can be expected to have a somewhat bigger decline, based on the 2020 production volumes during the pandemic.

Source: Eurostat, digitalprintexpert.de

This series on the impact of COVID-19 on printing industry production volumes in Europe will continue. Next time, we will have a look at the printing industry in Denmark.