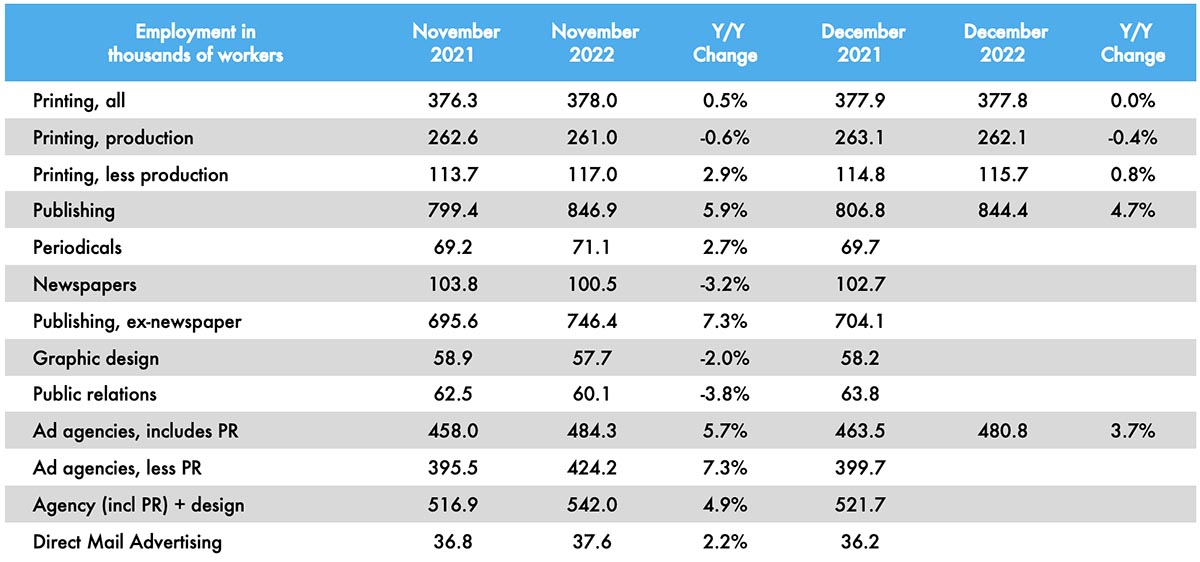

As summer turned to fall, printing employment started to drop, and by November had started to flatten, which continued into December. Overall printing employment was essentially flat, being down -0.1% from November, and essentially unchanged from December 2021 (this is on a net basis, as we have seen employment numbers rise and fall over the past year). Production employment was up +0.4% (but down -0.4% from December 2021) while non-production employment was down -1.1% from November (and down -0.8% from December 2021).

Publishing in general had had a generally strong summer, but ebbed as the summer came to a close. Overall publishing employment had been up from October to November 2022, but dropped -0.3% in December (still, it’s up +4.7% from December 2021).

Digging into the specific publishing segments (the reporting of which lags a month), employment is also fairly flat: from October to November 2022, periodical publishing employment was down -0.3%, while newspaper publishing employment was up +1.6%.

The creative markets took a hit in December. Graphic design employment was down -1.2% from October to November 2022, ad agencies (less PR) were down -0.5%, and public relations—the bright spot in October—was down -10.2% in November. Direct mail advertising employment was down -1.6% in November.

As for November employment in general, said the BLS in their January 6 report:

Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance.

Although:

The change in total nonfarm payroll employment for October was revised down by 21,000, from +284,000 to +263,000, and the change for November was revised down by 7,000, from +263,000 to +256,000. With these revisions, employment gains in October and November combined were 28,000 lower than previously reported.

The unemployment rate dropped back to 3.5% from 3.7% in November. The U-6 rate (the so-called “real” unemployment rate which includes not just those currently unemployed but also those who are underemployed, marginally attached to the workforce, and have given up looking for work) dropped to a record low of 6.5%.

The labor force participation rate ticked up from 62.2% in November to 62.3%, and the employment-to-population ratio increased from 59.9% to 60.1%. The labor force participation rate for 24–54-year-olds also ticked up from 82.3% to 82.4%.

Calculated Risk points out that “With 4.50 million jobs added, 2022 was the 2nd best year for job growth in US history behind only 2021 with 6.74 million.”

The January 2023 employment report comes out later this morning so we’ll see how we kick off 2023.