During the On Demand Conference in Tokyo last year, Kasper Roos, Director of Production Workflow Software Services at InfoTrends, presented a slide that showed a dramatic increase in interest for color management software. This slide was based on InfoTrends’ study entitled U.S. Production Software Investment Outlook 2014, which surveyed 150 commercial printing companies and 50 in-plant printers.

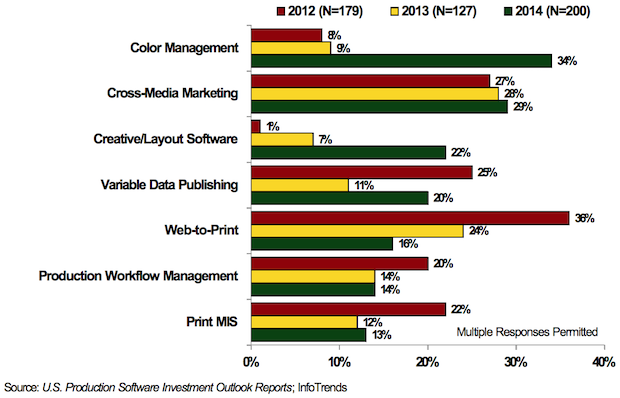

Software Products Considered for Purchase (2012-2014)

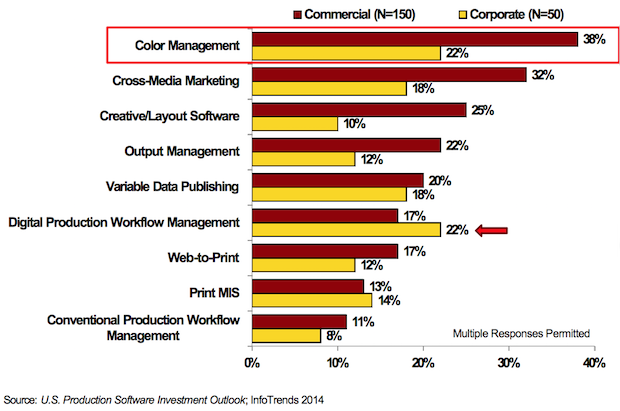

When the responses from the commercial printers in this survey were compared to those of in-plant printers, some interesting trends emerged.

Color Management is a Top Purchasing Intention

When survey participants were questioned about their purchasing intentions, 38% of commercial printers and 22% of corporate (in-plant) printers cited color management. This was the top choice for commercial printers, and it tied for first place (along with digital production workflow) among corporate respondents. Color management’s popularity is somewhat unusual—according to InfoTrends’ survey data, the top investment is typically a completely new software tool or a software tool that helps companies offer new services (e.g., cross-media marketing). Color management is not a new software tool, nor does it help in offering a new service. This begs the question—why is color management considered the number one investment?

Buying Intentions

One way to understand more about purchasing intentions is to question our consulting clients. According to our clients, the ability to match colors across a variety of devices is becoming more important to customers. This isn’t really a new idea—many of today’s companies try to match colors from their offset presses to their digital presses. It is, however, becoming more important as companies adopt inkjet presses and buy large format devices. Customers want all colors to match across their toner, offset, and inkjet devices. Many companies are also buying large format signage devices, and they want colors to match across those as well.

For commercial printers, digital production workflow software is another term for PDF prepress software solutions. For some in-plants, though, it also refers to the datastream transformation software required by companies that are involved with mainframe or transactional printing. This may be contributing to the high score that in-plant printers assigned to Digital Production Workflow Management Software. According to InfoTrends’ consulting work, a number of transactional printers want to migrate from their toner-based cut-sheet devices to more modern toner and inkjet devices.

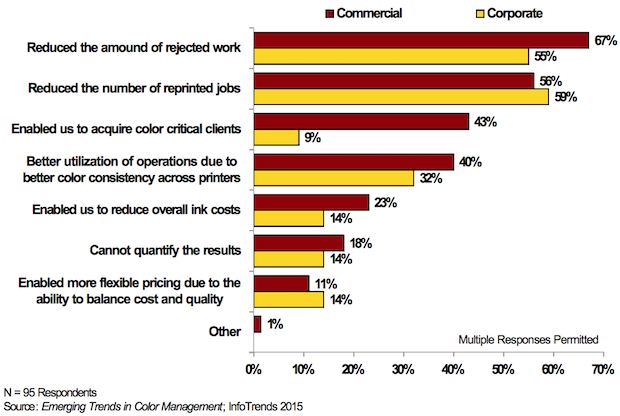

The Benefits of Color Management

Due to the sudden interest in color management, InfoTrends recently published a report entitled Emerging Trends in Color Management. The report summarizes the results from a survey that was conducted as part of InfoTrends’ ongoing relationship with the North American Publishing Company (NAPCO) to monitor emerging market trends. Readers were asked about their management practices, and the results focused on commercial printers’ color management initiatives, investments in software and services, and use of technology.

Over three-quarters (78%) of the printers that were surveyed reported managing color. These respondents agreed that color management greatly contributed to operational efficiencies that positively affected the bottom line. The majority of commercial and corporate printers cited a reduction in the amount of rejected customer work, as well as a reduction in the need to reprint work due to color issues. In addition, many respondents also reported reduced ink consumption, greater flexibility to shift work from one printing device to another, and the ability to successfully sell printing to more demanding customers.

Benefits of Implementing a Color Management Program

InfoTrends believes that there are 6 important facts driving the sudden interest in color management:

- The ability to match color across all devices has become a strategy for differentiation.

- Companies are using color management to reduce or eliminate complaints about color consistency.

- Print service providers expect color-critical work to account for nearly half of their work by 2017.

- Software investments are no longer excessive; companies are spending an average of $4,000 for color management software.

- About one-third of companies lack the technical skills and infrastructure requirements to support color management. Furthermore, 58% of companies report that they are not utilizing professional color management services.

- GRACoL and its derivative G7 are the most prevalent specifications implemented.

The Bottom Line

It’s very natural to see peaks and valleys when exploring respondents purchasing intentions for various software categories. These trends can be cyclical in nature because opportunities can suddenly appear and then be quickly fulfilled. At the same time, however, the increased demand that we are seeing for color management software is somewhat unusual. InfoTrends believes that this interest is being driven by a number of industry factors, and its research confirms that more and more companies are recognizing the benefits that color management can bring.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free