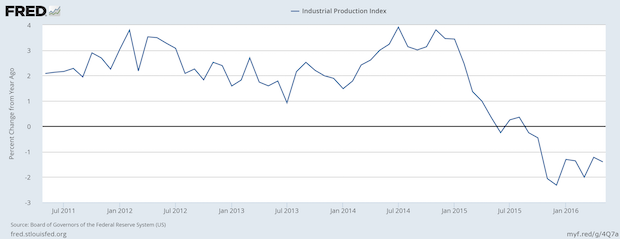

The Fed’s own data probably caused them to have a more dour outlook about the economy. The chart shows that US industrial production started slowing at the end of 2014 and has been in outright contraction since Fall 2015. MarketWatch mentioned the skinflint ways of corporations as they have decreased investment. The amount of investment is a function of the future outlook, based on sales and cost forecasts, inflation adjustments, financing costs, and after-tax returns. For many projects those future assessments look murky. The financial engineering emphasis on stock buybacks might have some corrupt undertones, but it is often the last choice for what to do with “excess cash” when capital investments are not attractive. Industrial production is one of the key economic data series that did not make it back to pre-recession levels, and its current performance is often considered recessionary. Yet, the Atlanta Fed’s GDPNow estimate of Q2-2016 GDP is at the unattractive but much better than last quarter +2.5% level. That turnaround has yet to appear in any manufacturing data.