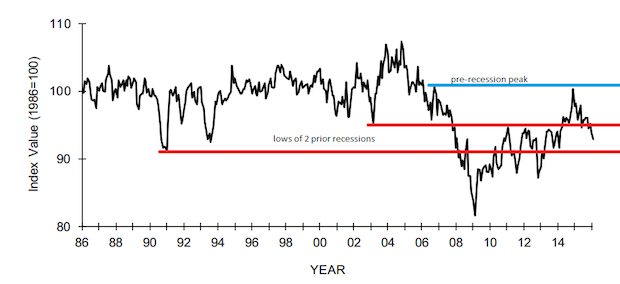

The NFIB Small Business Optimism Index took another small step to the downside. It peaked in December 2014 and it’s been on a downtrend since then. It is now back to where it has been during most of the recession and recovery, bouncing between the two recession bottoms of the early 1990s and the early 2000s.

* * *

MarketingProfs has a good presentation up on Slideshare about the effectiveness of content distribution methods. Look especially at slide 20 which shows the current rank of print among other digital media. The deck has lots of good data and comments about the practices of today’s communicators and how they view the needs of their marketplace and the actions they are taking.

Another interesting report is one offered by Adobe. That one by EConsultancy explains the importance of data-driven marketing in the plans of marketers in 2016, and the great interest in improving customer experience.

* * *

Harvey Levenson’s article about patents might be the most important article about our industry this year. If you don’t think this can affect your business, you’re making a mistake.

* * *

The student loan burden seems to get a lot of news coverage, but there is not enough written about the monetary and economic factors at work. A report from Economics21 is an excellent summary of the forces that keep driving up college tuition and fees.

Not part of their discussion is that the college loan/tuition “crisis” is and how it is not like the housing crisis. There is no underlying asset, which means that nonpayment is the only reason to go after those who have received loans. There is a sentiment is that many of these loans will be forgiven over time, and also there is a great desire to release the responsibility for loans if the recipient spends years in “public service.” That is, if you start a business and hire employees, that is not considered a “public service” in common language.

When the housing bubble burst, many homeowners had to leave their newly purchased homes. I'm not sure how a tuition bubble bursts, but no one will have to give back their knowledge. If the economy remains sluggish, the financial benefits of college education less loan payments may reduce interest in college education for marginal students or for those not ready from a maturity standpoint for higher learning.

My favorite students in those years when I was teaching at night were those who had delayed college. They were serious in their studies and had great appreciation for the reason they were there. They were wise to their interests and to their financial opportunities. Many would comment that they were glad they had some real-world experiences that allowed them greater discernment about their studies. It will be interesting to see if the college “bubble” bursts.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free